How To Cash A Check Online

If you want to cash a check online, you can simply do so by having your mobile phone ready along with a set of mobile applications. Make sure your mobile phone has a usable camera because that will be important to scan your checks on the go.

There plenty of online check cashing services to consider that are either large institutions or independents. Some of these online check cashing services offer free check cashing both in-person and online.

Here is how the check cashing process works with routing numbers. Here is a list of routing numbers for several large banks:

Enrol In Direct Deposit

The Government of Canada is switching to direct deposit for all its payments. If you currently receive your federal payment such as your income tax refund, GST/HST credits, Canada child benefit or Canada Pension Plan payments by cheque, enrol in direct deposit.

You have the right to cash your Government of Canada cheque at any bank for free, even if youre not a customer.

You can cash your Government of Canada cheque at any branch of a bank in Canada that has tellers.

Use Your Smartphone To Cash Your Stimulus Check

With your smartphones camera you have a number of services at your disposal to cash your stimulus check. Each service varies in the fee that they charge and the amount that you can cash. If you are willing to wait to have the check cashed most services waive the fee. However, always make sure you understand the fees and other requirements before you sign up.

This option can be useful for other transactions as well, giving you the ability to make purchases, withdraw money from ATMs or stores and cash other checks.

Also Check: Colt 45 Series 80 Government Model

What Type Of Checks Can Be Cashed Without Bank Account

You can cash almost any type of check without a bank account.

At Money Services, you can cash the following checks:

- payroll

- business

- Western Union® or MoneyGram® issued Money orders.

You can also unload or get cash off your debit card at Money Services up to $5,000 or get cash off your card when buying groceries for up to $300. We dont accept starter or personal checks, or third party checks at this time.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Do Nonprofits Receive Government Funding

Open A Checking Account

If you do not have a bank account, using your stimulus check to open one could be an option as well. With the possibility of a second stimulus package bill being regularly discussed, now might be a good time to set up a check account for any future payouts that could be sent. This way, you could potentially have your next payment sent via direct deposit.

Cashing A Check At Walmart And Other Stores

The following national stores and major grocery stores will cash payroll checks along with government-issued checks like Social Security checks and tax refund checks. Theyll usually also accept cashiers checks, insurance settlement checks and retirement plan disbursement checks. Kmart and Publix are the only retailers listed below that accept personal checks. Some regional or local grocery stores not listed below may also cash checks. Visit the customer service counter of your local supermarket to find out if they cash checks and what types they accept.

| Store | ||

|---|---|---|

|

|

|

| Kmart |

|

|

| Kroger |

|

|

|

Recommended Reading: Can I Sue The United States Government

Where To Cash A Check Without A Bank Account

Most consumers with a bank account can cash any check at their own bank for free. But if youre one of the millions of Americans with no bank account, youll probably have to cash your check at a big-box store, supermarket, bank or check-cashing center. You typically pay a fee ranging from $3 to a percentage of the check amount and will be required to present a valid ID.

Load Funds Onto A Prepaid Debit Card

People who dont have bank accounts sometimes use prepaid cards to deposit checks and access their cash. Prepaid cards are similar to checking account debit cards. Your spending is limited by how much money you have loaded onto the card.

Prepaid cards have different options for check cashing. Some prepaid cards let you set up direct deposit so that checks are automatically loaded onto the card. Other cards come with an app that lets you snap a picture of your check to load it onto your card. Or, you might be able to deposit your check at an ATM to load the money onto the card.

Fees are a big drawback of prepaid cards. The Walmart MoneyCard charges $2.50 to withdraw money at an ATM or a bank teller window, and 50 cents to check your card balance at an ATM. There is a monthly fee of $5.94 unless you load $1,000 a month onto the card.

Reload fees can be steep. It can cost you up to $5.95 to add money to a Green Dot Prepaid Visa card. Green Dot also charges a $3 ATM fee. Sometimes, prepaid card fees are scaled according to how quickly you want your money, and you can get dinged for expedited availability.

Recommended Reading: Free Government Watch List Search

Can You Cash A Check At Any Bank

Can you cash a check at any bank? Some of the best banks will do it for you even if youre not a customer. But your options dont end their. You can also cash checks at several retailers, grocery stores and even through mobile apps linked to prepaid cards. Read on to learn all about cashing a check at a bank where you dont have an account and elsewhere.

Easy Access To Money In The Account

Most banks now allow you to deposit checks remotely online and then tap into those funds through a debit card. Another advantage of a bank account is gaining access to services like Venmo, which allows you to receive funds from other parties and have them transferred to your bank account or associated debit card. If you transfer from Venmo to a debit card, you should be able to access the funds within an hour.

You May Like: Government Policies To Reduce Greenhouse Gas Emissions

Where Can I Cash A Check Without A Bank Account

There are a number of places and ways you can cash a check, including:

- At Money Services. You can cash a range of different checks at your local Money Services, including payroll or government-issued checks. Find your local Money Services using the store locator.

- At the issuing bank. If youve received a check from the bank, you can usually cash it there, too. Remember to take your ID.

- Using Prepaid Cards. You can load the value of your check onto a prepaid card at Money Services, to be spent at your local grocery store or to withdraw in cash at an ATM.

Cashing Your Emergency Benefits

The Government of Canada has temporarily increased the cheque-cashing limit to $2,000 for emergency benefits-related cheques to individuals.

A bank can refuse to cash a Government of Canada cheque for you if:

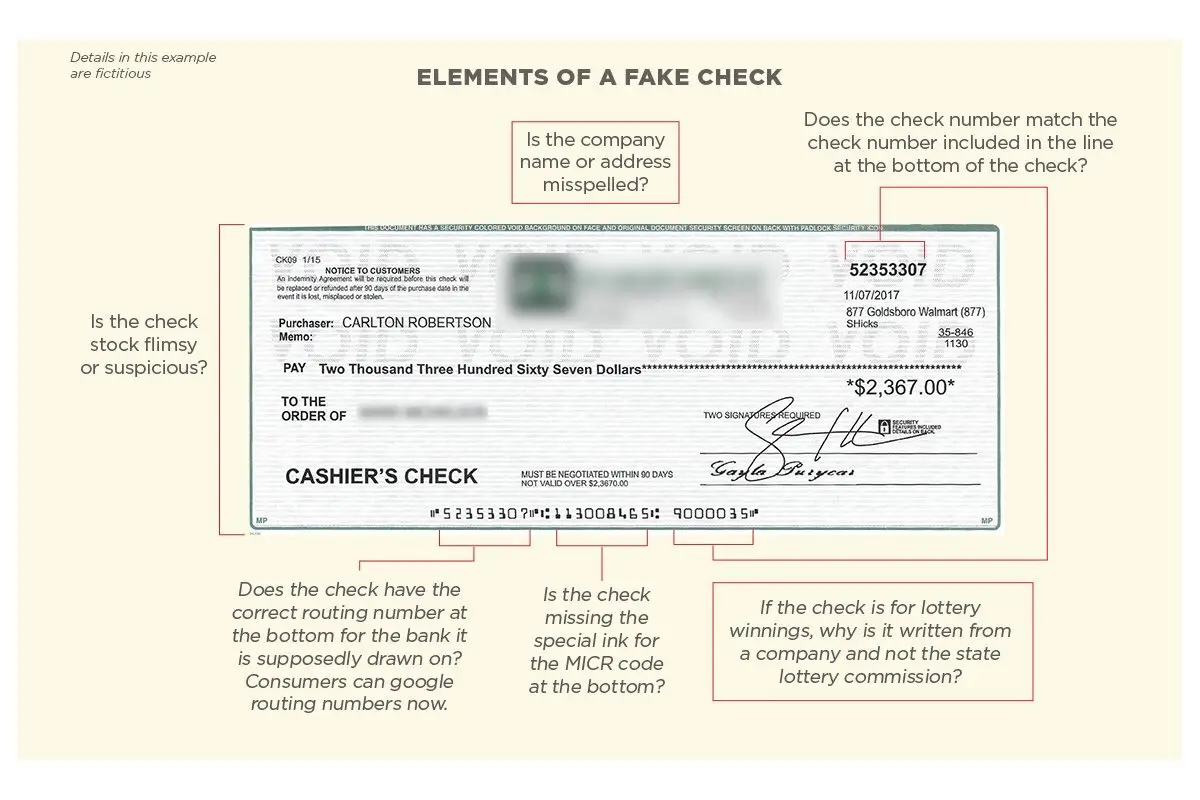

- the bank suspects that it’s counterfeit

- the cheque is for more than $1,500

- the cheque has been endorsed or signed by a third-party

- the cheque has been altered in some way

- the cheque is connected with a crime or fraud

If the bank wont cash your cheque, it must give you a letter saying it wont do so. It must also tell you how to contact the Financial Consumer Agency of Canada if you have a complaint.

Don’t Miss: Government Benefits For Legally Blind

Others Ways To Cash A Government Check

If you rely on services other than a bank for your check cashing needs, you have probably heard of several options for how to get your money in hand. We believe EZ Money Check Cashing provides a better service for our customers than some of the alternatives. One such alternative is to endorse your check to a friend. You would have to be able to have complete trust in your friend to even consider this, and individual banks will each have their own policies on whether or not they will honor a check in this manner. So for many individuals, this is simply not an option. Stores like Walmart will often provide cash checking services, however, they do have limits on the amount the check can be and the types of checks they cash. Like all check cashing services, they do also charge fees. One way of potentially avoiding fees is to load the money onto a prepaid debit card. But again, not all banks will do this and sometimes you just need cash, not a card.

Things To Consider Before Cashing Your Stimulus Check

Before heading off to cash your stimulus check you should consider which option would be best for you based on your needs, the fees that you may be charged and how much you will receive from the EIP. This will be the largest payment of the three so far, and some options may limit the amount you are able to cash.

It is always wise to read the fine print before signing up to any service and inquire ahead of time. Also is cash the best option or would you want to have the money put onto a debit card or use some electronic payment system to be able to use the money.

Recommended Reading: Loss Of Governance In Cloud Computing

I Went To The Bank The Check Was Drawn On To Cash It The Bank Refused To Cash The Check Because I Do Not Have An Account With Them Is This Legal

There is no federal law or regulation that requires banks to cash checks for non-customers.

Most banks have policies that allow check cashing services only for account holders. If a bank agrees to cash a check for a non-customer, it may legally charge a fee.

These policies are intended to protect the banks and their customers from forgeries.

Once a bank cashes a check that has been forged by a non-customer, it may lose money if it cannot collect from the person who cashed the check.

Last Reviewed: April 2021

Please note: The terms “bank” and “banks” used in these answers generally refer to national banks, federal savings associations, and federal branches or agencies of foreign banking organizations that are regulated by the Office of the Comptroller of the Currency . Find out if the OCC regulates your bank. Information provided on HelpWithMyBank.gov should not be construed as legal advice or a legal opinion of the OCC.

Maximum Hold Period For Cheques Drawn On Banks Outside Of Canada

If the cheque writer or cheque writer’s financial institution is located outside Canada, the cheque can take much longer to clear.

Financial institutions often hold foreign cheques for 30 days. If the cheque does not clear, your financial institution will withdraw the money from your account.

Your financial institution may choose to return the cheque to the bank that issued it and have it replaced by a secured method of payment, such as a bank draft or a cashier’s cheque. It would then need to wait for that institution to send the bank draft or cashier’s cheque.

Read Also: Which Government Bonds Are Tax Free

Exceptions To The Maximum Cheque Hold Periods

The maximum cheque hold periods may not apply to:

- an account that has been open for less than 90 days

- a cheque that has been endorsed more than once

- a cheque that is deposited six months or more after it was dated

- a cheque that isn’t issued in Canadian dollars

- a cheque issued from an account at a bank branch outside of Canada

- a deposit that a financial institution has reasonable grounds to suspect is being made for illegal or fraudulent reasons

- a cheque that isn’t encoded with magnetic ink to allow character recognition

- a cheque that is damaged

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Recommended Reading: Government Grants For Auto Repair Shops

Sign Your Check Over To Someone You Trust

Another way to cash a check if you dont have a bank account is to sign the check over to someone you trust who does have a bank account and have that person cash the check at their bank.

Make sure the person you are signing over your check to is willing to cash the check, and that his or her bank will cash it. You should accompany your trusted friend to the bank in case the teller requires your ID or has questions about the check.

Your friend must have the proper identification and be prepared to have his or her check dinged by a check-cashing fee.

In all of the methods laid out above, there is a personal and financial safety risk. Paper checks and cash can be lost or stolen.

Cash Your Check At A Check

Check-cashing outlets are probably the most expensive places to cash checks. Some of them require customers to become members or to buy check-cashing ID cards before they will cash your checks. In addition to a membership fee, they might charge a first-time use fee.

Fees to cash a check can range from 1 percent to 12 percent of the face value of the check. That means you could pay between $10 to $120 to cash a $1,000 check. Some businesses charge a flat fee on top of the percentage.

The average face value of a check presented to a check-cashing outlet is $442.30, with the average fee to cash that check being $13.77, or about 3.1 percent, according to the FDIC. If thats your paycheck and you cash it every week, youll pay $55.08 a month, or $661 a year, in check-cashing fees.

Not only are check-cashing stores exorbitantly expensive, there is a risk of deceptive practices. The Better Business Bureau, for example, alerts consumers to a scam where customers of a check-cashing store are called by someone who claims to represent the business. The caller offers the customer a loan and requests payment to secure the loan. Of course, the loan is never received and the customer of the check-cashing store gets scammed out of their cash.

Check-cashing stores should be your last resort.

Recommended Reading: Colt 45 Automatic Government Model

Convenience Stores And Gas Stations

Convenience stores and gas stations may be willing to cash checks depending on the type. For example, at Mr. Payroll stores and some Shell gas stations, you can cash a payroll check or government-issued check, but not a personal check. Similar to grocery stores, you may have to pay a fee be asked to make a minimum purchase.

Endorse The Check Over To A Friend

If you have a friend or family member whom you trust, and who has a checking account, you may be able to cash your check by endorsing the check over to them to cash. Ask the bank first if they will honor the check this way first though, since individual bank policies vary. When you endorse the check, youll sign your name and underneath write Pay to the order of , under which theyll endorse the check. Their bank will then cash the check with no penalties.

Obviously, this only works if you completely trust your friend. Its also not a favor youll want to get in the habit of asking, as it could be a major inconvenience for them.

Also Check: What Hotels Give The Best Government Discount

Ask Friends And Family

Some individuals without bank accounts approach their highly trusted contacts who have bank accounts and ask them to cash checks on their behalf.

The information contained in this article is not legal or financial advice and is not a substitute for such advice. State and federal laws change frequently, and the information in this article may not reflect your own states laws or the most recent changes to the law.