Benefits Of Investing In Government Bonds

-

Sovereign Guarantee

-

Government bonds enjoy a privileged status in terms of having stabilised funds and assuring promised returns. As government securities constitute a formal declaration of a debt obligation of the Government, it means the government body has to repay it according to the specified terms.

Inflation-adjusted

Inflation-indexed bonds balances are adjusted against the increasing level of the average price. Also, the principal invested in capital indexed bonds is adjusted keeping in view of the inflation. This characteristic gives the power to the investors who are financially undermined to invest in such funds for getting the actual value of the deposited funds.

Regular source of income

According to the RBI directives, interest earnings accrued on Government bonds are expected to be allocated every six months to such debt holders. It gives investors the avenue to earn regular income by parking their idle funds.

Types of Government Bonds in India

-

Fixed Rate Bonds –The interest rates are fixed for fixed rate bonds which remain consistent across the investment tenure irrespective of the market rates fluctuations.

Fixed Rate Bonds – The interest rates are fixed for fixed rate bonds which remain consistent across the investment tenure irrespective of the market rates fluctuations.

7.75% GOI Savings Bond- As per the RBI directive, these bonds can be held by:

An individual or individuals who are not NRIs

A Hindu Undivided Family

Is Now The Right Time To Buy Bonds

Once a bonds interest rate is set and made available to investors, the bond trades in whats called the debt market. Then the moves of prevailing interest rates dictate how the bonds price fluctuates.

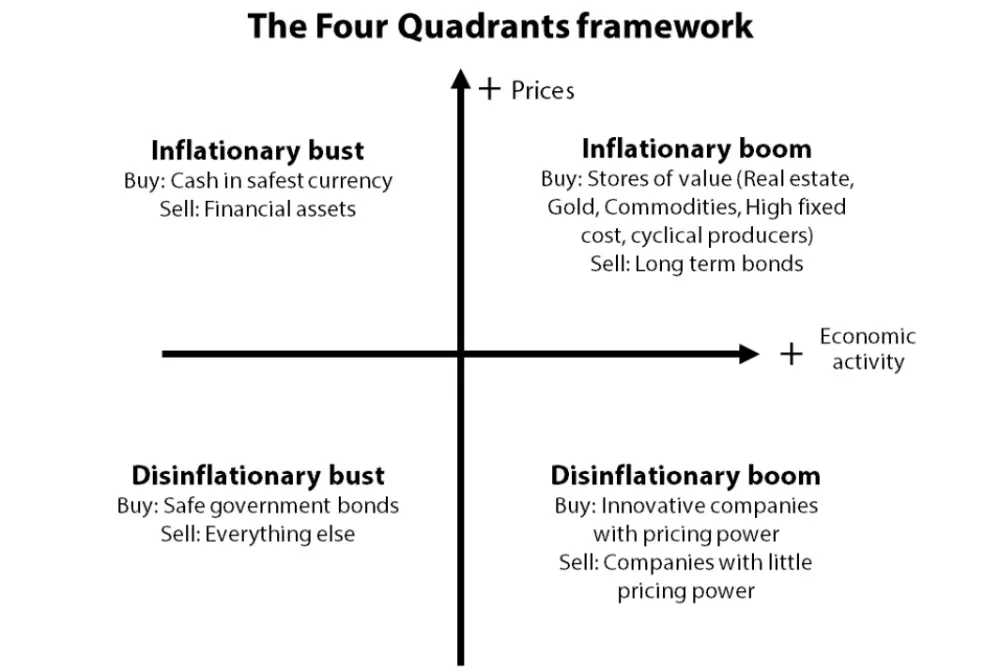

Bond prices tend to move countercyclically. As the economy heats up, interest rates rise, depressing bond prices. As the economy cools, interest rates fall, lifting bond prices. You might think that bonds are a great buy during boom times and a sell when the economy starts to recover. But its not that simple.

Investors try to predict whether rates will go higher or lower. But waiting to buy bonds can amount to trying to time the market, which is not considered a good idea.

To manage this uncertainty, many bond investors ladder their bond exposure. Investors buy numerous bonds that mature across a period of years. As bonds mature, the principal is reinvested and the ladder grows. Laddering effectively diversifies interest-rate risk, though it may come at the cost of lower yield.

Savings Accounts & Term Deposits

You might think that bonds are essentially the same product as savings accounts and term deposits given their similarities, but they’re really quite different. The latter serves a primary purpose as savings vehicles more so than investments. Due to the present low cash-rate environment, you’re not going to see any spectacular returns on either savings accounts or term deposits – the infographic below shows what you can expect. By contrast, bonds can produce higher returns in exchange for slightly higher risk. Both of them offer near-certainty of returns, but bonds give you the flexibility of a greater range of choice.

If you’re looking to save for a short-term goal, then either a savings account or a term deposit is probably your best bet. These two options also come with a government guarantee of $250,000, meaning that under the financial claims scheme up to $250,000 of your savings will be returned to you in the extremely unlikely event your institution collapses.

Recommended Reading: Government Grant For Dental Implants

Ishares Gbp Ultrashort Bond Etf

The iShares GBP Ultrashort Bond ETF invests directly in corporate bonds across sectors, such as industrials, utilities and financial companies. It also invests in quasi-government bonds, which arent secured by collateral.

Unlike the bonds in our other chosen ETFs, those in this one are ultrashort typically maturing in a year or less. Investors might consider an ETF of this kind if interest rates appear likely to rise in the future, providing the opportunity to make the most out of a decent yield over a short period of time.

As of 30 August 2021, this ETFs distribution yield was 0.47% and the WAC was 1.32%, with dividends paid twice annually. The fund has a rating of AAA, which is the best ESG rating according to MSCI criteria. Further, Barclays Bank, Imperial Tobacco and Santander make up a sizeable portion of the funds top holdings.

Best Bond Funds Right Now

Bond funds can create a sustainable and stable source of income for beginners and seasoned investors. There are tons of bond mutual funds and ETFs that you can choose to invest in for short-term and long-term benefits.

You can buy and sell shares of bond funds at your convenience. The inherent liquidity and frequent market swings can provide plenty of opportunities to earn a regular income from your investments.

Before investing in bond funds, be sure to evaluate certain factors that can impact your earnings. These factors can include expense ratios, price-to-earnings ratios, liquidity, assets under management and return rate.

You can consider investing in these top bond funds to grow your wealth.

Recommended Reading: Federal Jobs Las Vegas

Are Bonds A Good Investment

The only person who can answer that question is you. Here are some scenarios to consider as you decide:

If you’re the risk-averse type who truly can’t bear the thought of losing money, bonds might be a more suitable investment for you than stocks.

If you’re heavily invested in stocks, bonds are a good way to diversify your portfolio and protect yourself from .

If you’re near retirement or already retired, you may not have the time to ride out stock market downturns, in which case bonds are a safer place for your money. In fact, most people are advised to shift away from stocks and into bonds as they get older, and it’s not terrible advice, provided you don’t make the mistake of dumping your stocks completely in retirement.

Pradhan Mantri Jeevan Jyoti Bima

Pradhan Mantri Jeevan Jyoti Bima is a term insurance plan launched by the Government of India. This plan aims to secure your family’s future with a life cover. This insurance scheme offers life insurance cover for death due to any reason.

Benefits of Pradhan Mantri Jeevan Jyoti Bima

- The premium charged in the scheme is liable for tax benefits as provided for in Section 80C of the Income Tax Act.

- This provides a death coverage of Rs 2,00,000 to the beneficiary in the case of a sudden demise.

- Other Important Government schemes

Don’t Miss: Government Contracting Certificate Programs

Ishares Us Treasury Bond Etf

You can trade this ETF now.

GOVT

- NAV as of Jan 07, 2022$26.0452 WK: 26.04 – 27.20

- 1 Day NAV Change as of Jan 07, 2022-0.06

- NAV Total Return as of Jan 06, 2022YTD: -1.25%

- Fees as stated in the prospectus Expense Ratio: 0.05%

1. Exposure to U.S. Treasuries ranging from 1-30 year maturities

2. Low cost access to the broad U.S. Treasury market in a single fund

3. Use at the core of your portfolio to seek stability in your portfolio and pursue income

Discover The Potential Advantages Of Fixed

Fixed-income investments may be right for you if you want to experience these benefits as part of a diversified portfolio.

- Preserve wealth – while fixed-income prices may fluctuate, you can rely on receiving the full-face amount when your investment matures, subject to credit risk

- Diversify your portfolio – diversifying your investments across asset classes may result in less risk exposure for your overall portfolio

- Generate income – fixed-income investments may provide a steady stream of monthly, quarterly, or semi-annual income to help supplement your income or help fund your retirement

- Manage interest rate risk – creating a ladder through staggered maturities can potentially help you manage interest rate risk in both rising and falling environments and experience less exposure to interest rate volatility

Recommended Reading: Government Dental Grants For Seniors

Rule #: Buy Bonds According To Your Age

You shouldn’t shun bonds all together. Instead, use the “Method of 100,” to determine how much of your portfolio should be composed of bonds.

Your base of assets should represent a lower risk as you age. To determine the best time to buy bonds, simply subtract your age from 100 to figure out how much exposure you should have to the riskiest asset class: stocks.

For example, if you’re 25 years old, you should have 75% of your assets in stocks. If you’re 60 years old, then the percentage devoted to stocks should fall to 40%. The remainder should be tied up in bonds, along with your homeowner’s equity.

The 11 Best Treasury Bond Etfs

Last Updated: 4min. read

Treasury bonds are the best tool for downside protection and volatility reduction in a diversified investment portfolio. Here well look at the best treasury bond ETFs.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Contents

Recommended Reading: Grants For Owner Operators

Best Online Brokers For Bond Funds

An online broker enables you to browse through thousands of bond mutual funds and ETFs. These platforms let you buy and sell shares hassle-free. Most online brokers also let you trade bond funds free of commission.

You can access historical financial information on stocks and bond funds on these platforms. It also lets you manage your portfolio and provides insights for making the right investment decisions.

Take a look at these online brokers to get started.

How To Invest In Bonds In Canada

Bonds are essential to a diverse investment portfolio. They help protect your portfolio against stock market volatility while providing a regular and reliable source of passive income. Best of all, its now easier than ever to buy bonds in Canada!

I personally keep 20% to 25% of my entire investment portfolio in bond ETFs. These funds are some of my favorite holdings in my portfolio because they pay dividends monthly, which provides a reliable cashflow I can use to buy other investments. I even keep my core bond funds set on DRIPs , so Im always increasing my position in these ETFs. As a result, my passive income grows every single month. I think bonds are a must-have for any portfolio, and anyone who wants to start investing should allocate a percentage of their investment portfolio to this asset class.

In This Article:

Recommended Reading: Government Grants For Dental Implants

Total Bond Market Funds

A total bond market fund can form the core of a fixed-income portfolio. These funds track the progress of the entire bond market. This allows you to have a broad investment with a single fund.

If you are looking for just one bond fund to invest in, total bond market funds are a wise choice. Let’s unpack two good choices to consider.

Should I Buy A Government Bond

Government bonds can be a great option for the low-risk portion of an investorâs portfolio. They can also be a great way to begin investing in the bond market overall with little risk. Yields on government bonds range from approximately 2.20% to 3.00%. Many investors look to government bonds as options for consideration along with money market accounts, certificates of deposit, and high yield savings accounts. Ultimately the investment in a government bond is generally based on investment goals, risk tolerance, and return.

Recommended Reading: Entry Level Government Jobs Las Vegas

Can You Lose Money Investing In Bonds

Yes, you can lose money when selling a bond before its maturity date since the selling price could be lower than the purchase price. Also, if an investor buys a corporate bond and the company goes into financial difficulty, the company may not repay all or part of the initial investment to bondholders. This default risk can increase when investors buy bonds from companies that are not financially sound or have little-to-no financial history. Although these bonds might offer higher yields, investors should be aware that higher yields typically translate to a higher degree of risk since investors demand a higher return to compensate for the added risk of default.

Four Channels For Investment In Municipal Bonds

Buying municipal bonds follows more traditionally with the standards in the bond market overall. Thus, most investors buy municipal bonds through brokerage accounts. However, in the municipal bond world, investors have a few choices. The MSRB suggests the following four channels for individual investors looking to buy municipal bonds:

These four categories can overlap slightly in their offerings. Serious investors looking to go deep in the municipals market may want to work with a full-service broker dealer or RIA that specializes in municipal bond investing which can allow for the potential opportunity to take part in primary issuance of municipal bonds. Generally, institutional investors comprise the majority of primary municipal market buyers. Most investors however will be happy with trading municipal bonds on the secondary market which can be done through full service brokers, RIAs, and self-managed accounts.

Don’t Miss: Rtc Jobs Las Vegas

Tips Before You Invest In Bonds

Here are 10 tips to consider before you invest in bonds or bond funds:

Ishares Core Corp Bond Ucits Etf

The iShares Core Corp tracks the Bloomberg Barclays Euro Corporate Bond Index, with holdings including Rabobank, Orange, Anheuser-Busch, Volkswagen and Total. Unlike the US bonds on this list, it’s UCITS-approved and its currency is GBP meaning UK investors can buy it without paying a currency conversion fee.

Read Also: Government Jobs In Las Vegas Nevada

Benefits Of Investing In Bonds

Why Do People Buy Bonds

Investors buy bonds because:

- They provide a predictable income stream. Typically, bonds pay interest twice a year.

- If the bonds are held to maturity, bondholders get back the entire principal, so bonds are a way to preserve capital while investing.

- Bonds can help offset exposure to more volatile stock holdings.

Companies, governments and municipalities issue bonds to get money for various things, which may include:

- Providing operating cash flow

- Funding capital investments in schools, highways, hospitals, and other projects

Read Also: Government Jobs Vegas

What Is The Meaning Of Yield On Tax

As I said above, the yield is the RETURN that you will get it by investing in the bonds. Let me simplify this concept. Because it is very much important to understand the concept of yield when you are investing in bonds.

Assume that you are buying a Bond, whose face value is Rs.1,000, tenure is 10 years and the price is also Rs.1,000 with coupon rate at 8% .

In such a case, the YIELD will be 8%. Because it means by investing Rs.1,000 , you are receiving 8% yearly income up to 10 years.

However, assume that suddenly RBI increased the interest rate. Assume that there are other options that are offering you higher returns than 8%. Hence, no one will buy such 8% yield bonds. In such a case, the price of this particular bond will fall. Hence, even though the face value remains the same i.e Rs.1,000, the price of the bond may fall. Assume it fallen to Rs.900.

Now those who buy these bonds will earn more than those who purchased it at Rs.1,000 right? Because of those who purchased by investing Rs.1,000 and those who purchased by investing Rs.900 will earn the same interest rate of 8%. However, those who purchased at Rs.900 will have lesser investment to earn the same 8% returns.