Is It Possible To Reduce The National Debt

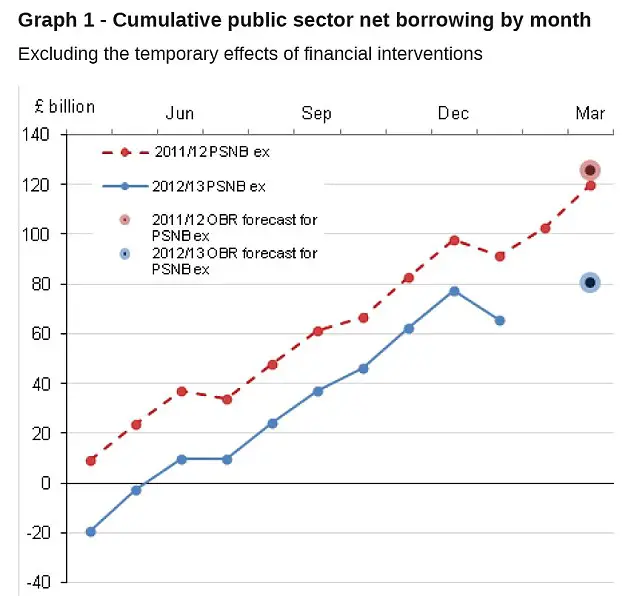

The debt is currently higher than its ever been before. While the government talks about reducing the deficit, the reality is that the total national debt will keep growing. Even if it stops the debt growing, taxpayers will continue paying around £120 million a day in interest on the national debt.

It is very unlikely that the government will be able to reduce debt in the current system. To understand why, consider what would need to happen for the debt to be paid down. First, the government would need to start paying the annual interest on the national debt each year out of tax revenue, rather than simply borrowing the money to pay it. Interest payments totalled £43bn for 2012, so if the government wanted to reduce the debt it would have to find an additional £43bn in taxes, which would require, for example, raising VAT to roughly 30% .

In addition, in the five years before the banking crisis the government spent an average of 10.6% more than it received in taxes every year. So even after the £43bn interest on the national debt is paid, to run a balanced budget right now, it would need to raise an extra £22bn in taxes , or cut public services by £22bn equivalent to shutting down a fifth of the National Health Service.

How Does The Us Government Borrow Money

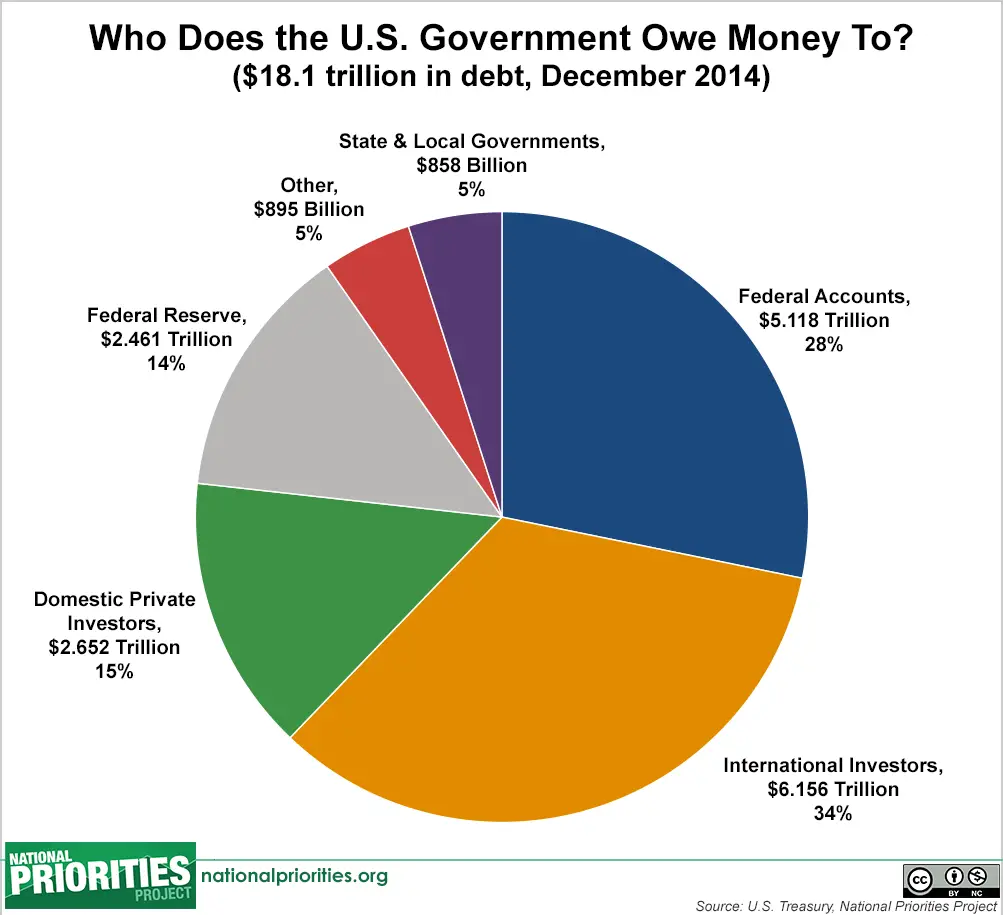

Heres where the Government is different from individual people and businesses. When the Government borrows money, it doesnt go to the bank and apply for a loan. It “issues debt.” This means the Government sells Treasury marketable securities such as Treasury bills, notes, bonds and Treasury inflation-protected securities to other federal government agencies, individuals, businesses, state and local governments, as well as people, businesses and governments from other countries. Savings bonds are sold to individuals, corporations, associations, public and private organizations, fiduciaries, and other entities.

Here is how Treasury securities – such as savings bonds – generally work. People lend money to the Government so it can pay its bills. Over time, the Government gives that money, plus a bit extra, back to those people as payment for using the borrowed money. That extra money is “interest.”

This is how the U.S. system of debt works:

Private Vs Government Loans

Private loans, made by a private lender like a bank or credit union, are different than government loan programs. It may be more difficult for certain borrowers to qualify for loans through private lenders.

For example, a private mortgage lender may require good credit scores and a large down payment. But you might be able to qualify for an FHA mortgage with a lower down payment and flexible credit qualification.

Don’t Miss: Government Jobs For 18 Year Olds

How Does The Government Borrow Money

The government borrows money by selling financial products called bonds.

A bond is a promise to pay money in the future. Most require the borrower to make regular interest payments in the meantime.

UK government bonds – known as “gilts” – are normally seen as very safe, with little risk the money won’t be repaid.

Gilts are mainly bought by financial institutions in the UK and abroad, such as pension funds, investment funds, banks and insurance companies.

The Bank of England also bought trillions of pounds’ worth of government bonds to support the economy, though recently it has started selling them again.

What Happens If You Hit Federal Loan Limits

If your cost of attendance exceeds what you can borrow in federal student loans, you may not have enough cash on hand to cover the extra costs. If youre worried about not having enough money to pay for school, you have a few options, including:

Working part-time. Find a job that lets you work non-traditional hours so you can pay for school. You can look on- or off-campus, depending on your living situation and transportation options. Consider a side-hustlelike delivering groceries, tutoring or freelancingto cover your extra schooling costs.

Requesting payment assistance. Many schools require payment in full, whether that comes from your lender or you. If you cant pay your outstanding bill, talk to your schools financial aid office about a payment plan, like making monthly payments instead of one lump-sum payment. Also inquire about emergency grants or interest-free loans, which vary by school but might be available based on your need.

Switching schools. Cost of attendance varies by each school. Since every institution has different service fees, you might pay more at a private or big-name school compared to community colleges, which tend to have fewer fees. If you can, consider attending local colleges for the first couple years and then transferring to your school of choice to complete your bachelors degree.

Don’t Miss: How To Find Out If The Government Owes You Money

Direct Vs Guaranteed Government Loans

Government loans are either direct loans or guaranteed loans.

With a direct loan, youre borrowing money directly from a government agency. All loan payments will be made to pay back the government.

With a guaranteed loan, youre borrowing money from a private government-approved lender. The government makes a guarantee to the lender that it will cover a certain amount of losses if you dont repay the loan. This guarantee helps reduce the risk for the lender so that its able to extend credit to borrowers who might not qualify for a loan from a private lender.

What Is Congresss Power To Borrow Money

the credit of the United StatesArticle I, Section 8 of the Constitution gives Congress the power To borrow Money on the credit of the United States. At first, Congress authorized each debt issuance, often for a specific purpose.

What is the purpose of borrowing power?

Meaning of borrowing power in English the amount of money that a person, company, or government can borrow at a particular time, based on their financial situation: Additional borrowing power should enable the company to continue operating.

You May Like: Federal Government Jobs No Experience

What Is The Government’s Plan For Managing The Debt

Governments often increase borrowing when they face unusually difficult situations, such as the coronavirus pandemic, or the current cost-of-living crisis.

This can fund extra services needed to support people during the crisis, such as help with higher energy bills or paying some of the wages of people who couldn’t work during Covid.

But most economists and politicians agree that debt can’t keep growing for ever, because at some point it will become impossible to keep paying the interest.

The Chancellor Jeremy Hunt has said that he plans to get debt falling relative to the size of the economy “over the medium term”.

What Does The Power To Borrow Money Allow The Congress To Do

bills on the credit ofThe original draft of the Constitution reported to the convention by its Committee of Detail empowered Congress To borrow money and emit bills on the credit of the United States. 659 When this section was reached in the debates, Gouverneur Morris moved to strike out the clause and emit bills on the credit of the

Which is an example of the power to borrow money?

The loans are debt obligations and must be repaid. An example of the governments power to borrow is the sale of U.S. Treasury Bonds. The power to borrow money is not the same as the power to issue money, to create money, or to loan money.

What kind of power does Congress have to borrow money?

Other powers granted to Congress include the authority to borrow money on the credit of the United States, regulate commerce with foreign nations and among the states, and coin money. People also ask, which branch of the federal government has the power to borrow money?

Don’t Miss: Government Contract Jobs In Georgia

Is There A Way To Borrow Money From The Government

Yes, there are ways to borrow money from the government. The government offers a vast array of loans to individuals, communities, and businesses. These loans are usually a direct loan, where you borrow money from the government directly, or a guaranteed loan, where you borrow money from a lender that has been approved by the government.

What Happens When The United States Borrows Money

Borrowing Power. When it borrows money on the credit of the United States, Congress creates a binding obligation to pay the debt as stipulated and cannot thereafter vary the terms of its agreement. A law purporting to abrogate a clause in government bonds calling for payment in gold coin was held to contravene this clause,

What does Clause 2 of the constitution say about borrowing?

Clause 2. The Congress shall have Power * * * To borrow Money on the credit of the United States.

Don’t Miss: Does The Government Give Free Cell Phones

Isnt It Currently Cheap For The Government To Borrow

Going into the coronavirus outbreak, markets were willing to lend to the Government at historically low rates. The Government was set to take advantage of the low rates and borrow for investment spending.

There was speculation and some signs that the coronavirus crisis might lead to markets increasing the price at which they would lend to the Government. However, this fear seems to have subsided. Markets continue to invest in gilts which are seen as some of the safest assets around. The Bank of Englands purchases have helped to increase demand for gilts.

This article was updated on 09.03.21 to amend the chart The majority of Government bonds have a medium or long maturity clarifying that the chart only shows the maturity of Government gilts and bills.

Who Does The Government Borrow From

Rather than borrowing from banks, the government typically borrows from the market primarily pension funds and insurance companies. These companies lend money to the government by buying the bonds that the government issues for this purpose. Many companies favour investing money in government bonds due to the lack of risk involved: the UK government has never defaulted on its debt obligations and is unlikely to in the future, primarily because it is able to collect money from the public via taxation. The market in government debt also tends to be stable and liquid, and offers an interest rate in excess of that which is available on other riskless investments .

Recommended Reading: How To Find If Government Owes You Money

Tans Bans Rans And Gans

TANs , BANs , RANs , and GANs are four short-term borrowing alternatives that are available to Washington local governments. These short-term obligations are repaid out of money derived from the source or sources in anticipation of which they were issued or from any money otherwise legally available for this purpose.

TANs must be paid off no later than June 30 following the year in which they are issued. RANs are similar to TANs except that they are backed by non-tax revenue. TANs, BANs, and GANs are general obligation debt and are subject to the debt limit provisions. Notes issued in anticipation of non-tax revenue bond receipts are not subject to any debt limit.

Iv Empirical Evidence Focusing On Africa

In Chapter 8, Kidanemariam Gebregziabher Gebrehiwot and Daniel Makina examine the macroeconomic determinants of financial inclusion across 27 African countries. Their results show that financial inclusion is significantly and positively related to its lagged value, GDP per capita and mobile infrastructure, and negatively related to government borrowing. The negative relationship between financial inclusion and government borrowing has important policy implications for African countries, which have a low ratio of private sector credit to GDP.

In Chapter 9, Daniel Makina and Yabibal Walle investigate the relationship between financial inclusion and macroeconomic growth in selected African countries against the odds of non-availability of long-dated time series data on indicators of financial inclusion. Despite data constraints, they find that financial inclusion as measured by the dimension of access has a significantly positive effect on economic growth in Africa.

In Chapter 10, Ashenafi Beyene Fanta and Daniel Makina investigate the relationship between financial inclusion and technology using cross-sectional data of 168 countries, of which 48 are African. They report a significant positive relationship between financial inclusion and technology proxied by internet and ATM access.

David P. Stowell, in, 2018

You May Like: How To Get Money For Rent From The Government

Who Owns Gilts And Bills

Insurance companies and pension funds are the biggest holders of gilts and bills with around 32% of the total value. A further 28% are held overseas.

Since 2009 the Bank of England has become a large holder of debt by September 2019 it held 23% of the value. The Bank of England has been purchasing gilts as part of its quantitative easing programme which aimed to provide a boost to the economy following the 2007-2009 financial crisis.

The Bank is returning to this approach in response to the coronavirus. Its expanding its quantitative easing programme by around £200 billion . Most of the £200 billion will be spent on Government gilts, which are being bought from investors. The Bank is not buying gilts directly from the DMO. The Bank will then hold over 30% of Government gilts and bills.

How Does The Treasury Department Borrow Money From Congress

If the Treasury Department wishes to issue more debt, then they are required to get congressional approval through a raising of the debt ceiling. Please find below an excerpt from Article 1 Section 8 of the Constitution which lays out the power of the legislative branch to borrow money on behalf of the U.S. government.

Which is the best bank for personal loans?

The best loan offerings with a price guarantee and the best interest rates. Get an online Personal Loan offer in 3 minutes. We help you manage your financial life better, so you can live better. Get the money you need to reach your goals. Tailormade with flexible options to suit your pocket and lifestyle. Personal loans tailored to your needs.

Don’t Miss: How To Get Government Subsidy For Home Loan

What Is The Power To Borrow Money

Article I, Section 8 of the Constitution gives Congress the power To borrow Money on the credit of the United States. At first, Congress authorized each debt issuance, often for a specific purpose.

What is a good borrowing power?

Borrowing Power is a score from 1-10 that gives you an indication of how eligible you are for all products listed on TotallyMoney. A score of 10 gives you the widest range of products that you are eligible for. Your borrowing power can fluctuate each month, even if there have been no changes to your own circumstances.

Repaying Your Tsp Loan

Even though youre paying your loan back to your own account, failure to repay properly could have serious financial consequences. So you need to know how TSP loan repayment works.

You cant take a new loan after you separate from service.

If we are notified that you have gone into approved nonpay status while you have an outstanding TSP loan, your loan payments will be suspended. In other words, you will not have to make loan payments. However, interest on your loan will continue to accrue while loan payments are suspended. Making payments on your own during your nonpay status will reduce the amount of interest that accrues.

Your loan payment suspension lasts until you return to pay status or until one year passes, whichever comes first. The exception is when youre in nonpay status from your civilian job to perform military service. In that case, your payments will be suspended until you return to pay status, even if its longer than one year. The maximum term of your loan will be extended by the length of your military service.

For more information, including how to notify the TSP of your nonpay status, please refer to the TSP fact sheet Effect of Nonpay Status on Your TSP Account .

You May Like: How To Get A Government Id Card Online

Agriculture Rural And Farm Service Loans

These loans provide funding to encourage farming, which can lead to food security and rural development. Several loan programs are available for agriculture and farm service. Capital allows the purchase of livestock, feed, farm machinery, equipment, and even farmland within the eligibility criteria.

Loans are also available for constructing on-farm storage, cold storage, and processing and handling facilities for selected commodities. Other available loans cover fisheries, financing for aquaculture, mariculture, and commercial fishing industries. The dedicated Rural Housing Farm Labor Housing Loans and Grants program offers capital for the development and maintenance of housing for domestic farm laborers.

Economic Contributions Of The Financial Revolution

For England itself, this Financial Revolution provided a remarkably effective and stable form of public finance. It certainly contributed to a significant reduction in the cost of government borrowing and thus in the so-called crowding-out effect, for the private sector: from 14.0% in 1693 to 3.0% in 1757. Certainly, from their very inception, rentes or annuities in European public finances were far less costly to finance than interest bearing and thus usurious loans. Furthermore, perpetual, heritable rentes were always cheaper than life rents. Perpetual annuities, contrary to the term itself, did not pose a perpetual burden on the state because the state always enjoyed the reserve power of redemption, when it deemed best to exercise it .

Second, a clear majority of the investing public found government rentes or annuities to be a very attractive form of investment, despite such seemingly low yields , because they were so readily negotiable, marketed on the London and many other international stock exchanges, while most bonds were difficult to trade , and most loans, even when assignable, were not readily negotiable. Indeed, for that very reason, Consols and other negotiable annuities provided European investors with a most valuable form of collateral for short-term borrowing, especially for merchants and industrialists during the Industrial Revolution and the subsequent nineteenth-century era of industrialization in Britain and the continent .

Daniel Makina, in, 2019

Read Also: Government Grants To Help With Bills