Ace Flare: Best Nontraditional Bank Account

Provided through MetaBank, ACE Flare provides many of the same services you can receive at a traditional bank, such as check cashing, ATM access, a Visa debit card, and direct deposit. However, this is 100% a check-cashing app.

ACE uses First Century Bank, N.A. the same provider as Brink’s and Ingo. With an optional ACE savings account, you can even earn an absurd 6.0% APY on balances under $2,000.

- 3.9 stars on | 2.7 stars on App Store

- Fee-free cash withdrawals at 950 ACE locations in 23 U.S. states

- No charge for standard check cashing

- 2-5% expedited check cashing fee

How Long Does It Take For A Third

A third party check clearance duration is similar to a two party check. Funds might not be available for another five days if the check doesnt clear in two days. Regulation CC allows for up to two business days for on-us checks and five additional business days for local checks, which is seven days of time for a deposit.

Changes To Your Financial Institution’s Cheque Hold Policy

Your financial institution may change its policy on holding funds deposited by cheque. It must let you know what these changes are before applying them to your account.

If you get a regular statement in the mail, your financial institution must send you a written notice explaining any change in its policy on holding funds deposited by cheque. It must do so at least 30 days before applying the change to your account.

If you carry a passbook that you present to the financial institution when you make a transaction, your financial institution must display, in your branch, a notice explaining the change in its policy. It must do so for at least 60 days before applying this change to your account.

You May Like: Government Funding Programs For Low Income Families

How Do I Deposit A Third Party Check

When it comes to deposits, how do you do it on Cash App? There are many different options. You can deposit checks with a tap of your phone or take a picture with it. Using a camera, you can take a picture of the check, and the app will deposit it for you. You can even deposit a check directly to your wallet. To get started, download the Cash App and follow the instructions.

When you need to cash a third-party check, you have to ensure that the check was signed by the depositor or endorser. Typically, this means that you must endorse the check on the back so that the depositor can cash it. Once youve endorsed the check, the next step is to take it to your bank. Youll need to provide identification to cash the check, and the cashing company will need the check in order to process it.

After youve signed the check, you can cash it at a bank or other check cashing institution. Most banks will refuse to accept third party checks via mobile. However, you can cash them at your local credit union or bank. Its less convenient than going to a third-party check cashing service, and its free for members. And if you cant find a bank near you, there are many other places that will cash third party checks.

Access To The First $100

Financial institutions must make the first $100 of all funds you deposit by a cheque available to you right away. If the cheque is for $100 or less, the financial institution must make the entire amount of the cheque available to you.

The first $100 must be available to you:

- immediately if you deposit the cheque in person with a teller, or bank employee, at one of the financial institution’s branches or other locations where you can open an account

- on the business day after the day of the deposit if you deposit the cheque in any other way, such as at an automated teller machine , using a mobile device

Read Also: How Can I Apply For A Free Government Phone

What Is The Difference Between Cashing A Third

You put funds directly towards your available checking account balance when you deposit third-party checks. Alternatively, you can also deposit a third-party check into a savings account. When you cash a third-party check, the money never enters your bank accounts and comes directly back to you in the form of cash.

When should you deposit a check vs. cash a check? If you need funds and have an adequate amount of money in your checking account, you shouldnt have a problem cashing your check. But, if you are low on funds in your bank account or have upcoming automatic payments, it may be wise to deposit that check instead of cashing it.

How To Cash A Third Party Check

Endorsing a check for a third party is easy cashing a third party check is where things get more complicated. Thanks to the increased risk of fraud associated with third party checks, some banks may refuse to follow the instructions endorsing a third party to receive the check. Before you cash a third party check, be sure to call the bank or financial institution where you intend to cash it. Ask them about requirements for cashing third party checks or if they allow these checks at all. Finally, when you go to cash your third party check, make sure that you bring a valid photo ID! This will add an extra layer of security and accountability that will make the bank more comfortable when cashing your third party check.

Recommended Reading: Federal Government Home Care And Family Support Grant Program

Your Right To Cash A Government Of Canada Cheque

You have the right to cash your Government of Canada cheque for free at a bank and at an authorized foreign bank .

You can cash your Government of Canada cheque at any branch of a bank in Canada that has tellers and that offers disburse cash services. You can do so even if youre not a customer of that bank.

Find out more about your rights when cashing a Government of Canada cheque.

Can I Cash A Third

While there are a few ways to cash a third-party check, many retailers require identification from the payee. Without the proper identification, third-party checks may be used to create a fraudulent identity. Most banks will refuse to cash third-party checks unless the payee presents a government-issued photo ID. Fortunately, some banks will waive this requirement if the payee has an established account with them.

If the check youre trying to cash is from a bank account that is closed or compromised, it may not be accepted. Other reasons that checks may be declined include the fact that they dont have an endorsed photo, or the image is blurry. In addition, if the check doesnt have an endorsement, it may not be processed through Venmo. Fortunately, there are some ways to cash a third-party check using Venmo.

Whether or not the check was signed by the original owner is up to the new recipient. You should take the check to a bank where the check holder has an account. Alternatively, you can cash the third-party check without the other persons presence. You can also make a cashiers check or money order out to the new check recipient. You may need to show the persons ID and bank account number to cash the third-party check.

Recommended Reading: Government Bonds With Highest Interest Rate

Exceptions To The Maximum Cheque Hold Periods

The maximum cheque hold periods may not apply to:

- an account that has been open for less than 90 days

- a cheque that has been endorsed more than once

- a cheque that is deposited six months or more after it was dated

- a cheque that isn’t issued in Canadian dollars

- a cheque issued from an account at a bank branch outside of Canada

- a deposit that a financial institution has reasonable grounds to suspect is being made for illegal or fraudulent reasons

- a cheque that isn’t encoded with magnetic ink to allow character recognition

- a cheque that is damaged

Where To Cash A Check Online Now

We all know that trying to actually get to the bank during open business hours is so hard often by the time weve finished work the bank is closed. So you have to trudge on down there at the weekend and who wants to do that?

Thats why cashing a check online is such a good option.

Thankfully, there are lots of places where you can get a check cashed online. Some of these places also let you cash other forms of payments. You can even cash a money order. Its pretty easy to do as well.

Here are the best places where you can deposit a check online.

Also Check: Government Loan To Start New Business

The Disadvantages Of Third Party Checks

Businesses that cash third-party checks may end up with a lot more paperwork because it needs to be entered into QuickBooks or other accounting software. The process also adds time when cashing out at night since all transactions need to be reconciled before going home if needed.

On top of that, bank tellers usually get paid hourly, so each transaction can take longer, which means lower productivity overall for them and an increased chance for mistakes due to fatigue over time.

Waleteros: Best For People With Family In Central America

If you have relatives in Central America, Waleteros is the optimal pick for you. Waleteros offers one-time $0.99 transfers to various locations in Mexico, Cuba, El Salvador, Guatemala, and Nicaragua at the beginning of each month.

This app allows you to cash checks, receive your direct deposit, and send money with very few fees. There are no minimum account balances, no overdraft fees, and customers can enjoy over 20,000 nationwide fee-free ATM locations.

- 1.75% check cashing fee

- $0.75 charge for sending money to family and friends

Don’t Miss: Government Economics High School Course

Places That Dont Cash Third

Some institutions, such as Bank of America, Chase, Citibank, M& T, and HSBC, permit third-party checks. Check-cashing stores such as ACE Cash Express, Check N Go, and The Check Cashing Store permit third-party checks.

Expect to produce evidence of identity, and both payees may be required to be available in some circumstances. There may be additional charges. Third-party cheque are rarely cashed in grocery and convenience stores.

In the United States and overseas, endorsed third-party checks have been used to conduct fraud, money laundering, tax evasion, and other criminal activities. For example, in the Middle East, Africa, and the Americas, such checks are extensively used in the black market peso exchange and other currency black markets. Such tactics are frequently used in situations involving a variety of illegal activities.

Depositing And Withdrawing Without An Id

If you do not have the ID form that the bank requires, there is something else you can do with your check. You can deposit it into your account. The only thing to keep in mind is that this may take a while, so you need to wait until the check clears to gain access to your money. This entire procedure can take about 3-5 business days.

When you are depositing a cashiers check, youre in luck because the very next business day, you will gain access to the funds. Also, banks like TD Bank, for example, will allow you to access the first $100 as soon as you deposit the check.

Then, when the full amount becomes available, you have the chance to withdraw the money. What makes this even better is that no ID is required in order to make the withdrawal. The only thing the bank will pay attention to is whether the signature on your check is the same as the one on file when you withdraw the money.

Recommended Reading: Nc Government Assistance Single Mothers

Cash A Check Without A Bank Account

Its possible to cash a check without a bank account, but its not as convenient and youll pay some fees.

How to cash a check without a bank account, but you have ID:

- Cash it at the issuing bank

- Cash a check at a retailer that cashes checks

- Cash the check at a check-cashing store

- Deposit at an ATM onto a pre-paid card account or checkless debit card account

All of these options will have fees and may be time-consuming. The fees might be small, but they add up. If youre earning $300 a week and paying $7 to cash your paycheck, thats 2% of your paycheck used just to convert your paycheck to cash. Thats $360 in fees per year!

Save yourself money and time and open a bank checking account. Once you have a checking account, you can probably get direct deposit or you can deposit your check through an ATM.

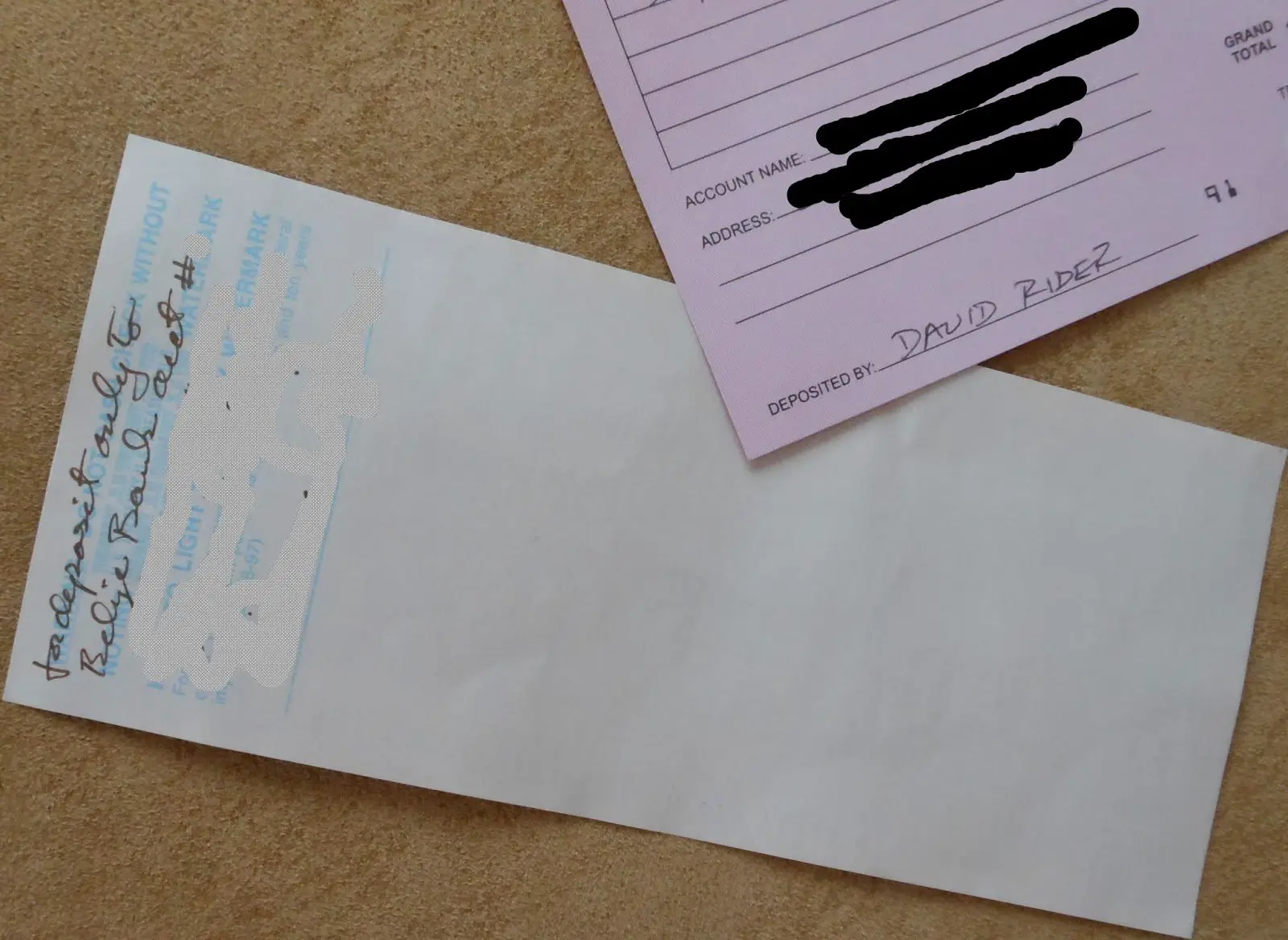

Can I Deposit A Check Signed Over To Me At An Atm

Checks signed over to you should only be deposited into an ATM as a last resort. Banks will collect the check from the ATM and make a decision to deposit funds or not. Checks which do not clear may be mailed back to your address on file with the bank.

Usually, there isnt a problem with depositing third party checks at a financial institution. However, any red flags may cause the bank to investigate potential fraud issues.

People have successfully deposited checks at ATMs. At most, youll have to try to deposit the check again later or its mailed to an old address on file.

You May Like: Government Car Trade In California

Currency Exchange To Cash Third

One way to cash a third-party check is to utilize a cash checking service at a currency exchange. Many currency exchanges throughout the United States can help you out with cashing a third-party check as well as some other financial services. For example, you may be able to cash funding you receive from payday loans at a currency exchange. Those who cannot receive payday loans online same day could go to a currency exchange to access their funding.

Some popular check cashing stores are:

- ACE Cash Express

- Check N Go

- The Check Cashing Store

If you plan to cash a third-party check at a currency exchange, it would be best if both you and the original payee were there to cash the check in person. Some financial institutions require in-person verification where two parties are both present when cashing a third-party check.

What Is The Fastest Way To Deposit A Check

Mobile Charging: Perhaps the fastest and most convenient option is to use a mobile device. Download your banking application. Make sure to use a legitimate application from your bank to avoid revealing confidential information to thieves. Find an option to deposit checks and start the process. Confirm receipt .

Read Also: Toyota Highlander Hybrid Government Rebate

Cashing A Check For Someone Else At The Bank

Banks will allow you to cash or deposit a personal check for someone else. This is especially useful for people without a bank account, as it means a friend or family member can cash in a personal check for you.

To successfully endorse a check, follow these steps:

-

Ask the person who the check is from if their bank will allow you to sign a check over to someone else.

-

Check with the person who is depositing the check if their bank will accept a check that has been signed over.

-

If so, sign your name on the back of the check

-

Include any additional details such as whether its to be deposited or cashed

-

Check to make sure the signature and name on the front of the check are the same

-

Ensure the signature is on the line

-

If you are making a deposit to your bank account, include the account number.

Another thing to be careful of when cashing a check for someone else is the check bouncing. Should this happen, the funds will be taken from your account if it is a bad check.

Often when cashing a check, the funds will show up in your account immediately. But it can take the bank a few days to actually process the check. As this process can take a while, its recommended you dont hand over any cash until youre sure the check has been processed.

Can I Make A Check Out To Myself And Deposit It

It is not uncommon and perfectly legal to write a check in your name from one of your personal bank accounts and transfer it to another. You also have the option to write a check for cash, but this comes with additional risks if you lose it as anyone with a check can cash it at your bank or deposit it into an account.

Read Also: Government College Grants For Adults

Ingo Money: Most Versatile App

There’s a good reason Ingo is the most popular app in this category.

With Ingo, you can link your bank prepaid, credit, or debit card or PayPal account to deposit money. You can even split a check between accounts .

You can also qualify for Ingo Gold Preferred Pricing if you cash checks frequently .

- 3.9 stars on | 4.1 stars on App Store

- $5 fee for payroll or government checks $250 or less

- $5 fee for all other checks $100 or less

Don’t want to use Ingo? Here are 5 alternatives:

- Venmo

Read more

Signing The Check Over

Another way to cash your check if you dont have an ID is by signing the check over to someone else. This can be a family member or a friend that you trust. The check can be endorsed if you sign your name and then write Pay to the order of on it, then write the full name of the person you trust with this.

The check will be endorsed underneath, and after this, the person that you sign the check over to will have to show a form of identification. The ID should match the name written by you on the check. Meanwhile, your ID doesnt have to be shown. The bank will then have to decide if they cash the check or deposit the money, and then wait for the clearing of the check.

Read Also: How To Do Business With The Government