Pros And Cons Of Refinancing Your Federal Loans

After all of this, you may be wondering whether its actually smart to refinance your student loans. This is an especially important question if you have federal loans in the mix.

The answer lies in not only your own personal debt situation, but also how likely you are to take advantage of those benefits offered by the government. Refinancing your federal student loan debt can have its perks, but once youve completed the process, theres no going back.

Lets take a look at the pros and cons of refinancing your federal student loans, or simply leaving them alone.

Student Loan Refinancing Vs Consolidation

Although people tend to use the terms refinancing and consolidation interchangeably, they are actually two different things. Refinancing is only done through private lenders, and it could change all of your loan details your interest rate, repayment term and even lender. However, because of this, you can often get a lower rate or a lower monthly payment.

Student loan consolidation, on the other hand, is offered through the federal government. With this program, you can combine multiple federal student loans into one Direct Consolidation Loan and potentially change your repayment timeline. Consolidating loans may provide access to more repayment and loan forgiveness options, but it wont necessarily save you money, since your interest rate will be the weighted average of all the loans youre consolidating. If you choose a longer repayment term after consolidating, you may end up paying more in total interest over the life of the loan.

Should You Refinance Your College Loans Prior To Government Payments Restart

Should you Refinance Your College loans Prior to Government Payments Restart?

Web page Url

So you can re-finance today or to re-finance later on? This is the question for the majority of federal student loan consumers strategizing over how exactly to conserve the essential money.

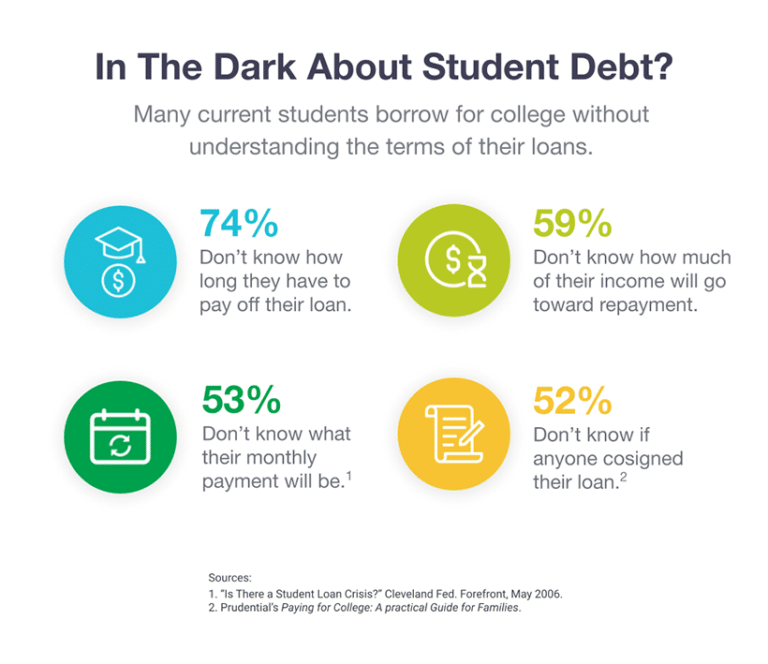

Almost 43 billion federal education loan individuals has actually enjoyed some slack using their payments, and 0% appeal to their current stability, for more than a year and a half today. For borrowers having safe salaries who have been able to keep and also make repayments during this pandemic-time forbearance, the past 20 months has been an alternative possible opportunity to create headway paying off dominant.

However, which have payments and you will attention set-to go back immediately following , a harvest of high-earning, high-loans consumers presently has to determine whether or not to trip out the pandemic save till the most end, or work ahead of typically lower rates to have refinancing inevitably start ascending.

The clear answer? It all depends, definitely. But most consumers are most likely safer to wait to refinance up to very early next year.

Travis Hornsby, originator and President away from economic classes company Education loan Planner, said their cluster receives several texts a week out of consumers wondering if now could be ideal time for you re-finance.

You May Like: How To Tell If The Government Owes You Money

Should I Refinance My Student Loan

Last week, we published a report on student loan affordability, which discussed the low levels of activity in the student loan refinance market. Since that time, weve received a lot of questions from consumers about what to consider if they find a refinance option. Weve uploaded these questions to Ask CFPB. Take a look.

Should I refinance my private student loan into one with a lower rate?Private student loans generally feature variable interest rates based on a borrowers credit history. When borrowers first take out private student loans, many have a limited credit profile and are treated as higher credit risks by lenders. This means that, for many borrowers, private student loan interest rates can be quite high.

Some borrowers who have graduated, obtained a job, and have excellent credit may be able to qualify to refinance their existing private student loans with a new private loan at a lower rate.

Unfortunately for many borrowers in this situation, there arent very many financial institutions that offer this financial product, but if you are able to find one, here are some things to consider:

Refinancing your student loan could help you take advantage of your improved credit profile, as well as todays historically low interest rates. It can be a useful way to lower your monthly payments and build your savings, but be sure to consider the risks and benefits before signing on the dotted line.

Federal Direct Consolidation Loan

If you have federal student loans, you have the option to combine all or some of your federal student loans into a federal Direct Loan Consolidation. This option is only available to consolidate federal student loans and not private student loans.

Federal loan consolidation will not lower your interest rate. The fixed interest rate for a Direct Consolidation Loan is the weighted average of the interest rates of the loans being consolidated, rounded up to the nearest one-eighth of a percent. While consolidating your loans may slightly increase your interest rate, it will lock you into a fixed interest rate, so your new payment wont change over time.

If you have federal loans originated under the Federal Family Educational Loan program or the Perkins loan program, you may be able to consolidate those loans into a new Direct Loan to qualify for Public Service Loan Forgiveness .

Tip! On Oct. 6, 2021, the U.S. Department of Education announced a temporary period during which borrowers may receive credit for payments that previously did not qualify for PSLF or Temporary Expanded Public Service Loan Forgiveness . Get current PSLF guidance and learn more about this limited time opportunity.

Learn more about what type of loan you have and get information about your federal student loans.

Recommended Reading: Pueblo Government Agencies Federal Credit Union

Refinancing Parent Plus Loans

Parents can choose a parent PLUS Loan when filling the FASFA form. As with other federal programs, the parent must meet minimum credit requirements. Parent PLUS financing can cover up to the entire cost of attendance.

You can refinance parent PLUS Loans through a private lender. But your lender will require you to meet the minimum credit requirements. Some lenders may allow a cosigner for your loan when you dont have a good credit score.

Federal Versus Private Student Loans

Both types of loans have advantages and disadvantages depending on your situation. Federal loans are issued by U.S. Department of Education to help students with financial needs. You often do not need a credit score, but interest rates are currently higher than private loans. Federal student loan repayments are currently on pause until January 31, 2022.

Federal student loans can either be subsidized or unsubsidized. When the loan is subsidized, the federal government pays the interest on the loan while the student is in college or while the loan is in deferment. But if the loan is unsubsidized, interest begins accruing as soon as the loan is taken out. Undergraduate borrowers typically get financing at a rate of 3.73% but only can borrow a limited amount, often not enough to cover college attendance. As for graduates and professionals, the interest rate is typically 5.28%. The interest rate for federal loans remains constant for the entire term of the loan.

The federal government also issues parent PLUS Loans. The interest rate for parent loans is 6.28%, which is constant for the entire term.

Private student loans may have more options than federal programs and lower interest rates. You can decide whether to choose between a variable-rate or fixed-rate option. Private lenders also provide flexible repayments and alternatives such as adding a cosigner for your loan.

Don’t Miss: Government Assistance For Student Loan Repayment

No Student Loan Forgiveness Take A Look At Loan Refinancing Before Rates Rise

Pallavi Kenkare

Pallavi is an editor for CNET Money, covering topics from Gen Z to student loans. She’s a graduate of Cornell University and hails from Atlanta, Georgia. When she’s not editing, you can find her practicing bookbinding skills or running at a very low speed through the streets of Charlotte.

Peter Butler

How To writer and editor

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

What’s happening

President Biden recently announced $10,000 to $20,000 in federal loan forgiveness. If you have private student debt, you’re not eligible for this forgiveness, but refinancing may help you save money.

Why it matters

Refinancing student loans can help you lock in a lower or fixed interest rate. With rates expected to continue rising, refinancing sooner may make sense.

While borrowers holding federal student loans got big news last week $10,000 to $20,000 in forgiveness for eligible recipients and an extended pause on payments and interest until 2023 those who owe money on private student loans are still faced with their same burdens of debt and payments. Private loans account for a little more than 7%, or $148 billion, of existing student loan debt.

Are You Comfortable With Assuming More Risk In Your Financial Life

Refinancing with a private loan may be a good option if you are highly motivated to repay your student debt have a secure job, emergency savings, and strong credit are unlikely to benefit from forgiveness options, and have a low fixed rate option available OR you will have access to sufficient funds in the near future. However, if you do not meet these criteria, many financial advisors suggest that trading in federal loans for private loans may expose you to additional financial risk. Therefore, before you assume possible financial risk, evaluate your current situation to determine whether you could afford repayment if something unexpected happens.

Federal loans will give you the ability to benefit from flexible terms and conditions, including access to income-driven repayment plans and possible loan forgiveness, potential interest subsidies, limits to monthly payment amounts, the availability of a death and disability discharge, and possible student loan tax deductions. Be sure the reward received in a refinance is enough to offset the potential risk.

|

Private debt and federal debt can operate very differently, especially when it comes to repayment. Know what youre giving up and what you will gain because refinancing federal loans into a private loan cannot be undone. |

|---|

Don’t Miss: Democratic Republic Of Congo Government

Private Student Loan Consolidation

What about consolidating your private student loans ? The government cant help you with that. It can only be done with a private company.

As with a federal consolidation, the lender will roll all of your loans into one new loan. But heres whats awesomewhen you go this route, they wont simply give you a weighted average interest rate, theyll give you a new interest rate! If the new rate they offer you is lower than some or all of your existing rates, you could save some significant money. Sound familiar? It should because this is called refinancing.

You Should Avoid Refinancing If:

You want to qualify for federal forgiveness programs

Federal loans offer federal forgiveness programs thatll help you pay off your student loan debt.

Refinancing your loans means paying off your old loans with a new loan, given by a private company rather than the federal government. This means that the federal repayment opportunity will disappear.

If you work in the public service sector and plan to continue to do so for a while, you could qualify for loan forgiveness after youve made 120 payments towards your loan. This also applies to teachers that work at low-income schools, some doctors in certain states, and those who are or were in the military.

Also Check: Government Grants For Group Homes

Details Of Your Current Student Loan Or Loans

In order to make an informed decision about refinancing your student loans, youâll need some information about your existing loans.

- How much do you currently owe?

- What is your current interest rate?

- When is your expected payoff date?

- What is the current payment on your loan or loans?

This information will be necessary in order to calculate and compare total interest and monthly payments on your existing loans to those of refinance loan alternatives. If you donât have this information, check with your current loan servicer. You should be able to get this information by logging in to their payment website or by referencing a recent billing statement.

Once you have this information gathered, check out our Refinance Calculator to see how a Brazos Refinance Loan can help you meet your financial goals.

Read Also: What Qualifies As A Small Business For Government Contracts

Why Do Borrowers Refinance Their Loans

Ironically, while borrowers who refinanced their loans are now missing out on loan forgiveness, many did so in the first place to relieve money stress.

Refinancing federal student loans can be an attractive option for borrowers experiencing financial duress from trying to repay their debt. It allows borrowers to combine their monthly payments into one new monthly bill with just one lender, shorten or lengthen their loan repayment term, and, often most importantly, secure a lower interest rate than offered by the government.

The most common reason for refinancing student loans is to save money, says financial aid expert Mark Kantrowitz. If you borrowed your federal student loans several years ago, the interest rates were much higher than they are now, he says. Even with the Federal Reserve raising interest rates , interest rates on private student loans are still lower than the interest rates on federal loans were several years ago.

Federal student loan borrowers may have chosen to refinance via a private lender like a bank, credit union, or online lender.

Also Check: Federal Government Jobs No Experience

You May Like: Government Assistance For First Home Buyers

Your Job And Finances Are Secure

Because refinancing federal loans turns them into private debt, you lose access to federal perks like income-driven repayment plans. If you work in a volatile industry or live paycheck-to-paycheck and may need those benefits, refinancing your loans likely isnt wise.

But if you have a secure job and have a large emergency fund, you can probably refinance without those worries.

You Lose The Option For Student Loan Forgiveness

If you refinance a federal loan into a private loan, you can no longer qualify for Public Service Loan Forgiveness by working as a teacher, nurse, lawyer and more. This also includes if there is ever widespread forgiveness of federal student loans, which has been proposed. Private student loans arent eligible for student loan forgiveness through the Department of Education.

Recommended Reading: Are Student Loans Government Funded

Make Extra Loan Payments

If you have the means, start to pay your loans more frequently, such as every two weeks rather than once a month. You can also increase your minimum monthly payment to put more money toward your balance. By paying off your debt more quickly, you reduce the amount of interest you pay over time without officially refinancing loans.

Ask For Alternative Payment Plans

Since some private lenders dont have deferment or forbearance programs, youll need to talk to your lender about what it can do for your individual situation. If youve recently lost your job or youre otherwise not able to afford making payments, ask about hardship assistance. Some lenders have payment-reduction options to lower monthly payments, the interest rate or both.

Don’t Miss: Entry Level Government Jobs Charlotte Nc

What Happens If I Lose My Job Or Cant Make Loan Payments For Other Reasons

Some private lenders offer forbearance the ability to put loans on hold in cases of financial hardship. Policies vary by lender, so its best to learn what they are before you refinance. SoFi, for example, offers Unemployment Protection to qualifying borrowers who lose their jobs through no fault of their own.

In those cases, SoFi suspends monthly loan payments and provides job placement assistance during the forbearance period. This benefit is offered in three-month periods and capped at 12 months.

For policies on disability forbearance, its best to check with the lender directly, as this is often considered on a case-by-case basis.

How To Refinance Student Loans

Youve decided you want to refinance your loanshere are a few steps you should take:

Don’t Miss: Government Contractor Jobs In Tampa Fl

Lowering Your Interest Rate Can Mean Big Savings

The term âinterestâ refers to the price lenders charge to lend money. Generally, interest rates are quoted on an annual basis and represented as a percent. The annual rate is converted to a periodic rate, typically daily, and is multiplied by the amount of debt outstanding to calculate the amount of interest that accrues. Payments on your loan are generally applied first to interest that has accrued, and the remaining amount reduces the amount of principal you owe.

How Do I Know How Much Forgiveness I Am Eligible For

If you meet the income requirements of $125,000 or less per year for individuals, and $250,000 or less per year for married couples who file their taxes jointly, and you have an eligible loan type, you are eligible for $10,000 in student-loan forgiveness.

If you received a Pell Grant, you are eligible for $20,000 in student-loan forgiveness. Pell Grants are federal grants given to students with exceptional financial need. To check whether or not you received a Pell Grant, log into studentaid.gov to view your student loan details.

If you see two circles on your dashboard that look like the image below, you received a Pell Grant, and you are eligible for $20,000 in student-loan forgiveness.

Read Also: Government Programs To Help Buy A Car