Damages From Floods And Hurricanes Are Expected To Increase

With the frequency of catastrophic hurricanes and their damages expected to grow, the NFIPs method for calculating premiums will likely exacerbate the programs shortfalls. The NFIP was originally designed to generate enough revenue for a historical average loss year, which is the mean of the annual losses over the life of the program. However, this method of calculating needed revenue underrepresents losses from catastrophic storms. Insurance costs spike and significant deficits accumulate after major hurricanes according to CBO, nearly three-quarters of the NFIPs insurance claims over the past 35 years have arisen from hurricane-related storm surges and inland flooding. Although the Biggert-Waters Act addressed the outdated premium-setting methodology by calling for fully risk-based rates, the NFIP has yet to implement the update. In the absence of an effective strategy to generate sufficient revenues for major losses, constraints from the limit on borrowing and increasing interest costs may inhibit the programs activities in the future.

Stirring Up The Waters66

Three months prior to Hurricane Sandy, the U.S. Congress took a significant step in addressing the need for NFIP reform: it approved a major five-year reauthorization of the National Flood Insurance Program by enacting BW12.Footnote 67 Hurricane Sandy highlighted the importance of investing in protective measures and insurance prior to a disaster to reduce future damage and facilitate the recovery process for those experiencing severe losses. But Sandy was not the cause of reforms at the NFIPit merely underlined the need for the reforms to be enacted. As we have seen, the program had gone through waves of reform before. The crisis of debt for the program caused by Hurricane Katrina showed policymakers that piecemeal fixes and reauthorizations would not stand up to the increasing urgency of hurricanes and sea-level rise resulting from climate change.

Flood disaster policy going forward must also take into account the impact that changing climate patterns might have on future damage from flooding due to sea-level rise and more intense hurricanes. There is evidence that federal agencies and other bodies have underestimated the risks of damage from extreme weather events due to climate change.Footnote 75 Enforcing building codes for all residences in Florida could reduce by nearly half the expected price of insurance under climate-change projections.Footnote 76

Code Of Federal Regulations

FEMA created a regulation that identifies the minimum flood plain management criteria for communities including the following:

- utilize base flood elevation and floodway data

- require permits for all development in Zone A

- determine whether proposed developments will be reasonably safe from flooding

- determine that all necessary permits have been received from Federal and State government agencies, including section 404 permits of the Federal Water Pollution Control Act Amendments of 1972

- require within flood-prone areas that new and replacement water supply systems to be designed to minimize or eliminate infiltration of flood waters into the systems

- require within flood-prone areas that new and replacement sanitary sewage systems to be designed to minimize or eliminate infiltration of flood waters into the systems and to minimize or eliminate discharges from the systems into flood waters

- require within flood-prone areas that onsite waste disposal systems to be located to avoid impairment to them or contamination from them during flooding

- notify adjacent communities prior to any alteration or relocation of a watercourse

- determine that the flood carrying capacity within the altered or relocated portion of any watercourse is maintained

- require that manufactured homes must be elevated and anchored to resist flotation, collapse, or lateral movement

Optional stricter standards

Don’t Miss: Apply For Money From Government

Pressure Builds On Congress To Help People Afford Pricey Flood Insurance

Premiums will rise in October, but 51 percent of homeowners in high-risk areas are low-income

Congress is under pressure to subsidize flood insurance costs for low-income households after the federal government announced last week that it would increase flood insurance premiums for millions of homeowners.

Of the 5 million properties insured by the National Flood Insurance Program, about 3.9 million soon will see a hike in premiumsand 200,000 substantially so. The new rates will go into effect in October for new policyholders and April 2022 for homeowners renewing policies .

An affordability plan is still needed, said David Maurstad, the Federal Emergency Management Agency official in charge of the program. FEMA manages the National Flood Insurance Program.

Roughly one-third of NFIPs 5 million policyholdersnearly 1.7 million householdshave an income that is less than 85% of the median income in their region, Maurstad said. He called the income levels a barrier to closing the insurance gap of people who live in flood-prone areas but do not have flood insurance.

The problem is not new to lawmakers.

Congress has failed to make flood insurance affordable in the three years since FEMA gave Congress a 111-page report listing options for premium subsidies.

FEMAs report to Congress in April 2018 found that 26% of the homeowners who have flood insurance and live inside a high-risk flood zone were low income.

How Is The Nfip Financed

The NFIP depends predominantly on one source of income: premiums paid by policyholders. On the other side of the ledger, in addition to paying insurance claims and servicing policies, the programs expenditures include non-insurance activities such as floodplain mapping and flood risk mitigation.

Historically, payments on claims and other expenses have exceeded receipts from premiums. Because the NFIPs claim payments are mandated by law, the NFIP is authorized to borrow money from the U.S. Treasury when premium receipts do not cover its costs. While the NFIPs shortfalls cannot be attributed to any single incident, the program borrowed significantly in the aftermath of Hurricanes Katrina in 2005 and Sandy in 2012. In 2017, it reached its borrowing cap of $30.5 billion, at which point the Congress canceled $16 billion so that the NFIP could borrow in response to Hurricanes Harvey, Irma, and Maria. Currently, the NFIP has an accumulated debt of $20.5 billion.

A report by the Congressional Budget Office suggests that the trend of shortfalls will likely continue into the future. The program is projected to run a deficit of approximately $1.4 billion per year under current conditions, with the expected annual cost of $5.7 billion exceeding the $4.3 billion in expected premiums. That shortfall stems largely from two sources: policies embedded in the NFIP and expected flood damages.

Don’t Miss: Where To Get Free Money From The Government

The National Flood Insurance Program

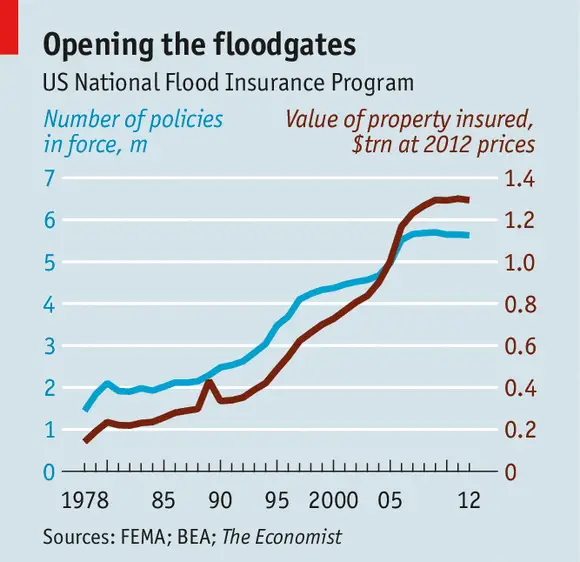

There is essentially no private insurance for flood damage in the U.S. The National Flood Insurance Program was established to aid personal and community recovery after flood events. Coverage through the NFIP is provided at substantially subsidized rates. While the original intent of the program was to assist in recovery from floods and other disasters, the net effect has been to subsidize development in hazardous areas, and thus to perversely increase the number of flood victims over the years.

The Federal Emergency Management Agency , under the Department of Homeland Security, has a direct mandate to coordinate disaster response when state and local entities are overwhelmed. As a result of this mandate and the agencys coordination of the NFIP, FEMA plays an ever increasing role in guiding state and local mitigation or prevention of loss efforts from natural disasters. FEMA has more impact on and authority over the development and execution of policies that could lead to effective adaptation to climate change on the coast than any other federal agency.

Improvements to the National Flood Insurance Act in the last few decades have required participating local governments to adopt building codes for floodproofing and the elevation of structures above the base flood elevation. In general, the focus of this law has been on floodproofing and otherwise protecting structures rather than restricting development in hazardous areas.

Flood Insurance Reform

What Does The Nfip Do

The NFIP was established in response to a lack of affordable private flood insurance, owing largely to the difficulty of predicting floods and the damage they cause. The NFIP covers up to $250,000 for residential buildings and $500,000 for non-residential buildings damaged by flooding. Coverage for certain commonly owned contents, such as furniture and electronic equipment, is also available for purchase up to $100,000 for residential properties and $500,000 for non-residential. As of September 2019, single-family homes constitute the largest portion of properties covered by the NFIP.

The NFIP calculates coverage levels and premium rates based on the geographic location of a building, the characteristics of its structure , and other statutory provisions. Currently, over 5 million homes and businesses are covered by the program. Coverage is heavily concentrated in counties in coastal areas where buildings are more vulnerable to flooding.

Read Also: Government Grants For Auto Repair Shops

Why Gao Did This Study

FEMA, which administers NFIP, estimated that in 2012 more than 1 million of its residential flood insurance policies–about 20 percent–were sold at subsidized rates nearly all were located in high-risk flood areas. Because of their relatively high losses and lower premium rates, subsidized policies have been a financial burden on the program. Due to NFIP’s financial instability and operating and management challenges, GAO placed the program on its high-risk list in 2006. The Biggert-Waters Act eliminated subsidized rates on certain properties and mandated GAO to study the remaining subsidized properties. This report examines the number, location, and characteristics of properties that continue to receive subsidized rates compared with full-risk rate properties the information needed to estimate the historic cost of subsidies and establish rates for previously subsidized policies that reflect the risk of flooding and options to reduce the financial impact of remaining subsidized policies. GAO analyzed NFIP data on types of policies, premiums, and claims and publicly available home value and household income data. GAO also interviewed representatives from FEMA, insurance industry associations, and floodplain managers.

The Larger Budgetary Implication Of Hurricane And Flood Damages

The NFIP is just one component of federal spending related to flood and hurricane damages. During presidentially declared disasters, the federal government will partially compensate for economic losses incurred by both the private and public sectors. A report by CBO in 2019 estimates that, based on current climate conditions, federal government spending in response to hurricane and flood damages will include:

- Providing funds to households and businesses through disaster recovery programs of federal agencies such as FEMA, the Department of Housing and Urban Development, and the Small Business Administration to help repair or replace properties lost in storms. Those programs are expected to cost $4 billion annually.

- Coordinating with state and local governments to provide immediate assistance such as emergency shelters and debris removal, as well as conducting longer-term activities such as repairing public properties. The government is expected to spend $11 billion per year on such activities.

Including $1 billion of administrative costs and the $1.4 billion of subsidies to be paid to the NFIP, the expected federal outlays on hurricane and flood damages is estimated to total $17 billion annually.

Read Also: How Do I Get Government Assistance For Housing

How To Purchase Flood Insurance

To purchase flood insurance, call your insurance company or insurance agent, the same person who sells your home or auto insurance. If you need help finding a provider go to FloodSmart.gov/flood-insurance-provider or call the NFIP at 877-336-2627.

Plan ahead as there is typically a 30-day waiting period for an NFIP policy to go into effect, unless the coverage is mandated it is purchased as required by a federally backed lender or is related to a community flood map change.

Biden Admin: Stop Flood Insurance For New Risky Homes

By Thomas Frank | 06/13/2022 06:56 AM EDT

Justin Douglas stands in the doorway of a flooded house in Givhans, S.C., after record rainfalls in 2015. Joe Raedle/Getty Images

The Biden administration is proposing a massive overhaul of federal flood insurance that would prevent the government from insuring newly built homes in flood-prone areas and would drop coverage for homeowners who receive repeated claims payments.

The administration also is proposing a nationwide disclosure law that would require homebuyers and renters to be told about a propertys flood history before they buy or lease a residence. And no new federal flood insurance policy could be written for any commercial building, regardless of its location or construction date.

The proposals, contained in a 104-page legislative package sent recently to congressional leaders, are the most dramatic attempt to restructure the governments National Flood Insurance Program since its creation in 1968.

The NFIP provides most of the nations flood insurance, covering nearly 5 million properties. It also has historically charged discounted premiums that do not reflect the actual flood risk of properties. The discounted rates have been criticized for encouraging development in flood-prone areas and discouraging property owners from undertaking flood protection.

Fugate supported the proposal, saying it would result in insurance premiums that reflect flood risk more accurately.

You May Like: Care Principles For Indigenous Data Governance

Fema Shall Consult With Federal State And Local Agencies

U.S. Congress requires FEMA to consult with other departments and agencies of the Federal Government, and with interstate, State, and local agencies responsible for flood control in order to make certain that those agencies’ programs are consistent with the National Flood Insurance Program . For example, a U.S. District Court ordered FEMA to consult with the National Marine Fisheries Service on FEMA’s mapping regulations and FEMA’s revisions of flood maps to determine whether they jeopardize the continued existence of the Puget Sound chinook salmon.::1177

This “shall consult” language not only gives FEMA discretion to consult, but appears to require FEMA to consult with other agencies, such as NMFS, to ensure that the NFIP is implemented in a manner that is “mutually consistent” with NMFS’s programs.:1172â1173

Fema Offers More Equitable Flood Insurance Rates Beginning Oct 1

WASHINGTON — Beginning Oct. 1, FEMAs National Flood Insurance Program will begin to offer more equitable and risk informed rates.

The new premiums are the result of the programs new pricing methodology delivering rates that are actuarily sound, equitable, easier to understand and better reflect an individual propertys flood risk.

New policies will be sold using the new methodology, and some existing policyholders may be eligible for immediate premium decreases when their policy renews.

To date, FEMA has provided more than 2.8 million quotes and trained 20,792 agents.

Potential and existing policyholders can learn their specific rates with a call to their insurance company or agent.

The NFIPs new rating methodology is long overdue since it hasnt been updated in more than 40 years, said David Maurstad, senior executive of the National Flood Insurance Program. Now is the right time to modernize how risk is identified, priced and communicated. By doing so we empower policyholders to make informed decisions to protect their homes and businesses from life-changing flooding events that will strike in the months and years ahead due to climate change.

Also known as Risk Rating 2.0, the new methodology uses increased technological and mapping capabilities to determine and communicate a propertys full flood risk. In addition, the new rating methodology has exposed inequities in pricing whereby some policyholders have been unjustly subsidizing other policyholders.

Don’t Miss: Government Loans For Mobile Homes

Letter Of Map Revision

For multiple properties or a larger area, an application for a Letter of Map Revision can be submitted when the landscape topography is different from that shown on the floodplain boundary and/or flood heights shown on the FIRM and the Flood Insurance Study. A Letter of Map Revision based on Fill is used when landscape topography is altered by humans, usually to increase the land elevation and remove land from the floodplain. A Conditional Letter of Map Revision and Conditional Letter of Map Revision Based on Fill are strongly advised as a mechanism to obtain FEMA feedback on the project before site changes are made, especially in light of the increasing attention on the nexus between the NFIP and the Endangered Species Act. 44 C.F.R. § 65.6 says “A revision of flood plain delineations based on topographic changes must demonstrate that any topographic changes have not resulted in a floodway encroachment.”

Proposed encroachments

Outdated flood maps

Updating flood maps

The Nfip: Reaching For Sustainability 19792005

In 1979, President Carter signed an order creating the Federal Emergency Management Agency . FEMA was in part a reaction to strong pressure from the National Governors Association to streamline the acquisition of disaster relief and to assist states with hazard mitigation efforts. FEMA represents as well the final rejection of civil defense as the dominant paradigm of the postwar United StatesFEMA inherited the civil defense mission, but the agency was also thoroughly steeped in an all hazards disaster preparedness methodology. The FIA and the NFIP were moved from Housing and Urban Development right away and placed under the aegis of FEMA. Certainly the new agencys mission was more closely aligned than HUDs with the floodplain management goals of the NFIP, and almost at once FEMA took action to provide technical floodplain management assistance in the many communities across the nation that had no state or local offices equipped for such work. From around 3,000 communities in 1980 to around 8,000 communities in 1984 had received flood insurance studies from the FIA and had entered the flood insurance programs Regular Program phase. . . . More than 8,000 communities still participated in the Emergency program.Footnote 46

You May Like: Us Government Patent Office Search

Certain Policies Embedded In The Nfip Reduce Receipts And Increase Costs

As mentioned above, the NFIP offers discounted and grandfathered premium rates to provide affordable coverage and encourage widespread participation. The latest available analysis by CBO estimated that those discounts would constitute approximately 50 percent of the total expected shortfall in 2017 that is, the program was projected to annually receive $0.7 billion less than if it were to charge a fully risk-based rate to all policyholders. Likewise, the Government Accountability Office highlighted in its latest report that the NFIPs fiscal condition has been high-risk since 2017 due to premium rates that do not reflect the full risk of flood damage.

Additionally, the voluntary nature of the NFIP results in low coverage. Many properties that are at risk of flooding do not participate in the program, resulting in a potential decrease in program expenditures but also an increased likelihood of the need for federal disaster aid which ultimately costs more for the government. GAO cites several reasons for why individuals decide not to participate, including the difficulty of comprehending low-probability, high-severity risks and the false sense that non-SFHA zones are safe from flooding. Without closing the insurance gap, the cost of the NFIP will continue to shift from policyholders to taxpayers if the federal government steps in to provide emergency assistance to those without flood insurance.