How Much More Would People Use The Health Care System

Estimated increase in use of health care

| friedman | |

|---|---|

| 8% |

Medicare for all would give insurance to around 28 million Americans who dont have it now. And evidence shows that people use more health services when theyre insured. That change alone would increase the bill for the program.

Other changes to Medicare for all would also tend to increase health care spending. Some proposals would eliminate nearly all co-payments and deductibles. Evidence shows that people tend to go to the doctor more when theres no such cost sharing. The proposed plans would also add medical benefits not typically covered by health insurance, such as dental care, hearing aids and optometry services, which would increase their use.

The economists differ somewhat in how much they think people would increase their use of medical services.

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

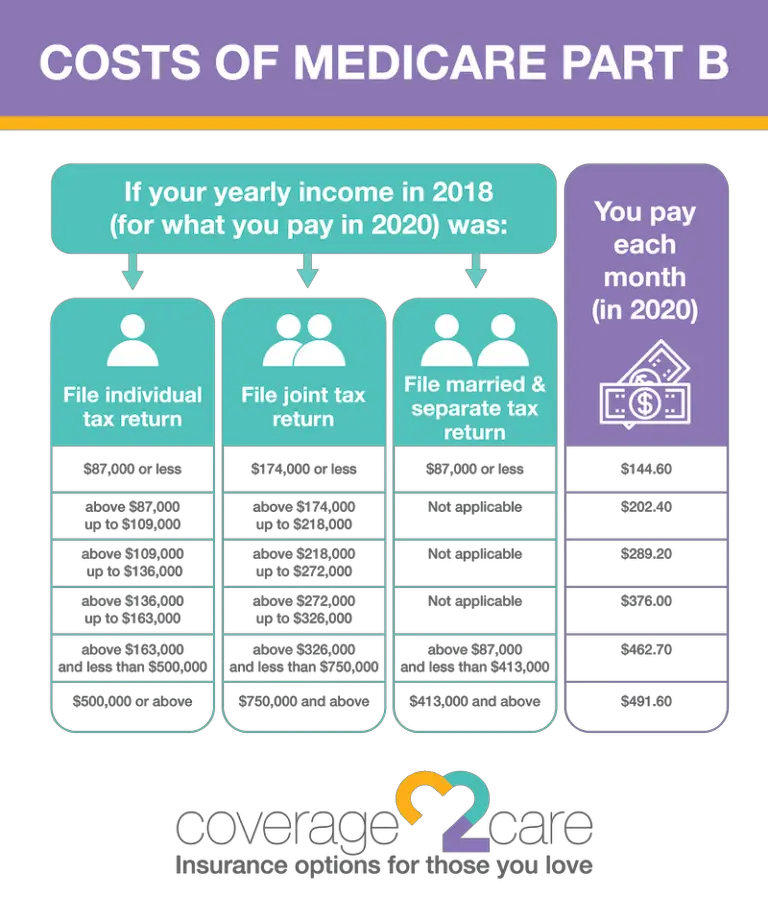

Premium Surcharge Is Based On 2020 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2020 tax returns were filed in 2021, so those were the most current returns available when income-related premium adjustments are determined for 2022.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

You May Like: Some Of The Laws Governing Medicare Parts C And D

Is Social Security Government Funded

Social Security is funded with income from four sources. Social Security is primarily funded by payroll taxes assessed on wages in the United States. The employer pays 6.2% of income, and the employee chips in another 6.2%. The self-employed, being both employer and employee, pay 12.4% of income into the program.

How Is Medicare Financed

Medicare is funded primarily from general revenues , payroll taxes , and beneficiary premiums .

Figure 7: Sources of Medicare Revenue, 2018

- Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees . Higher-income taxpayers pay a higher payroll tax on earnings .

- Part B is financed through general revenues , beneficiary premiums , and interest and other sources . Beneficiaries with annual incomes over $85,000/individual or $170,000/couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35 percent to 85 percent.

- Part D is financed by general revenues , beneficiary premiums , and state payments for beneficiaries dually eligible for Medicare and Medicaid . Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

- The Medicare Advantage program is not separately financed. Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan about half of Medicare Advantage enrollees pay no additional premium.

Read Also: Federal Government Jobs No Experience

What Is Medicare Advantage

Roughly one-third of all Medicare beneficiaries are enrolled in the Medicare Advantage program under which private health insurers assume the responsibility for, and the financial risk of, providing Medicare benefits. Almost all other Medicare beneficiaries receive care in the traditional fee-for-service program, which pays providers a separate amount for each service or related set of services covered by Part A or Part B . Payments to Medicare Advantage plans depend in part on bids that the plans submitindicating the per capita payment they will accept for providing the benefits covered by Parts A and Band in part on how those bids compare with predetermined benchmarks. Plans that bid below the benchmark receive a portion of the difference between the benchmark and their bid in the form of a rebate, which must be primarily devoted to the following: decreasing premiums for Medicare Part B or Part D reducing beneficiary cost sharing or providing additional covered benefits, such as vision or dental coverage. Those additional benefits and reduced cost sharing can make Medicare Advantage plans more attractive to beneficiaries than FFS Medicare. Plans that bid above the benchmark must collect an additional premium from enrollees that reflects the difference between the bid and the benchmark. Payments are further adjusted to reflect differences in expected health care spending that are associated with beneficiaries health conditions and other characteristics.

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRGs, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

Also Check: Governmentjobs Com Las Vegas

You May Like: Government Use Of Technology To Control Society

How Much Does The Government Pay Medicare Advantage Plans Per Person

How Much Does the Government Pay Medicare Advantage Plans? The federal government pays out over $1,000 each month for each enrollment for every individual. $1,000 is a substantial amount when considering the number of enrollees they see, and bonus payments received through the bonus system.

How Do Medicare Costs Fluctuate

The number of people enrolled in Medicare increases every year. Most years, this increase exceeds the number of people entering the workforce .

Although the Medicare population grows fairly quickly, with over 61 million enrollees in 2020, the percentage of the federal budget that goes to the Medicare program has remained fairly constant. It literally takes an act of Congress for more funds to be allocated to Medicare. This is one reason that deductibles and monthly premiums go up a little every year.

The rising cost of healthcare also causes prices to fluctuate. This may lead to increases in other out-of-pocket costs, like co-payments and co-insurance.

Read Also: Do I Qualify For A Government Grant

Do Medicare Advantage Plans Cost Government And Taxpayers Less Or More

Traditional Medicare and Medicare Advantage can be compared in many ways, including benefits provided, quality of care, patient outcomes, and costs. Policymakers have focused mainly on comparing costs in traditional Medicare with those in Medicare Advantage, largely because the original impetus for allowing private insurers to provide Medicare benefits was to reduce costs while maintaining or improving quality of care.

Older and more recent studies alike have largely found that Medicare Advantage plans cost the government and taxpayers more than traditional Medicare on a per beneficiary basis.10 In 2022, that additional cost was about 4 percent, down from a peak of 17 percent in 2009.11

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicares use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of upcoding, when a physician makes a more severe diagnosis to hedge against accidental costs.

Read Also: Standard Government Headstones And Markers

Medicaid Expansion In 2021

President Joseph Bidens American Rescue Plan provided incentives for states to expand their Medicaid programs to cover adults up to age 65 who have incomes at or below 138% of the federal poverty level . Fourteen statesAlabama, Florida, Georgia, Kansas, Mississippi, Missouri, North Carolina, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Wisconsin, and Wyominghad income limits well below that as of May 2021.

Under the plan, the states were offered additional federal funding if they expanded Medicaid for adults with eligible low-income adults. They could also earn an additional five-percentage-point federal match on their regular Medicaid expenditures for two yearsnot including costs for those newly eligible, disproportionate share hospital payments, and some other expensesto help defray state matching costs. More valuable, they would also gain the ACAs 90% federal matching funds to pay for the costs of covering newly eligible adults.

Little Evidence Those Higher Payments Are Justified

Legal or not, the rise in Medicare Advantage coding means taxpayers pay much more for similar patients who join the health plans than for those in original Medicare, according to Kronick. He says there is little evidence that higher payments to Medicare Advantage are justified â theres no evidence their enrollees are sicker than the average senior.

Kronick, who has studied the coding issue for years, both inside government and out, says that risk scores in 2019 were 19% higher across Medicare Advantage plans than in original Medicare. The Medicare Advantage scores rose by 4 percentage points between 2017 and 2019, he says â faster than the average in past years..

Kronick says that if CMS keeps the current coding adjustment in place, spending on Medicare Advantage will increase by $600 billion from 2023 through 2031. While some of that money would provide patients with extra health benefits, Kronick estimates that as much as two-thirds of it could be going toward profits for insurance companies.

AHIP, the industry trade group, did not respond to questions about the coding controversy. But a report prepared for AHIP warned in September that payments tied to risk scores are a key component in how health plans calculate benefits they provide and that even a slight increase in the coding adjustment would prompt plans to cut benefits or charge patients more.

Read Also: Government Assistance For Roof Repairs

Per Enrollee Spending Growth Has Slowed In The Past Decade For All Major Payers

On a per enrollee basis, the average annual growth of Medicare spending was similar to that of private insurance over the course of the 1990s and 2000s. Average annual spending growth per enrollee in Medicaid was similar to growth for Medicare and private insurance in the 1990s, but slowed in the 2000s while spending growth accelerated for the other major payers. More recently, per enrollee spending in Medicare and Medicaid has grown somewhat slower than per enrollee spending in private insurance.

Growth In Health Spending From 2019 To 2020 Was Driven In Part By An Increase In Public Health Spending

Total national health expenditures grew by nearly $365 billion in 2020 compared to 2019. About one-third of that growth in spending can be attributed to the increase in spending on public health, which includes federal spending to develop COVID-19 vaccines under Operation Warp Speed, strategic stockpiles of drugs and vaccines, and health facility preparedness. An increase in hospital expenditures contributed 20.9% of the growth, which reflects increased federal payments and loans to hospitals for COVID-19 relief , as well as increased Medicaid spending. Meanwhile, health spending on dental services and research, structures, and equipment declined from the prior year.

Spending on public health activities and federal programs including the Provider Relief Fund and Paycheck Protection Program drove the 9.7% increase in overall health spending from 2019 to 2020 when these spending categories are excluded, overall health spending increased only 1.9% from 2019 to 2020. Health services spending plunged early in the pandemic as care was delayed or cancelled.

Read Also: Government Grants For 1st Time Home Buyers

What Services Does Medicaid Cover

Medicaid covers more than 60 percent of all nursing home residents and roughly 50 percent of costs for long-term care services and supports.

Federal rules require state Medicaid programs to cover certain mandatory services, such as hospital and physician care, laboratory and X-ray services, home health services, and nursing facility services for adults. States are also required to provide a more comprehensive set of services, known as the Early and Periodic Screening, Diagnostic, and Treatment benefit, for children under age 21.

States can and all do cover certain additional services as well. All states cover prescription drugs, and most cover other common optional benefits include dental care, vision services, hearing aids, and personal care services for frail seniors and people with disabilities. These services, though considered optional because states are not required to provide them, are critical to meeting the health needs of Medicaid beneficiaries.

About three-quarters of all Medicaid spending on services pays for acute-care services such as hospital care, physician services, and prescription drugs the rest pays for nursing home and other long-term care services and supports. Medicaid covers more than 60 percent of all nursing home residents and roughly 50 percent of costs for long-term care services and supports.

How Much Does Medicaid Cost? How Is It Financed?

How Much Does Medicaid Cost The Government

How much does the federal government spend on health care?

The federal government spent nearly $1.2 trillion in fiscal year 2019. In addition, income tax expenditures for health care totaled $234 billion.

The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 . Of that, Medicare claimed roughly $644 billion, Medicaid and the Childrens Health Insurance Pro-gram about $427 billion, and veterans medical care about $80 billion. In addition to these direct outlays, various tax provisions for health care reduced income tax revenue by about $234 billion. Over $152 billion of that figure comes from the exclusion from taxable income of employers contributions for medical insurance premiums and medical care. The exclusion of employer contributions to medical care also substantially reduced payroll taxes, though that impact is not included in official tax expenditure estimates. Including its impact on both income and payroll taxes, the exclusion reduced government revenue by $273 billion in 2019.

Read Also: Best Places To Work In The Federal Government

Nhe By State Of Provider 1980

- Between 2014 and 2020, U.S. personal health care spending grew, on average, 4.8 percent per year, with spending in Arizona growing the fastest and spending in Vermont growing the slowest .

- In 2020, Californias personal health care spending was highest in the nation , representing 12.2 percent of total U.S. personal health care spending. Comparing historical state rankings through 2020, California consistently had the highest level of total personal health care spending, together with the highest total population in the nation. Other large states, New York, Texas, Florida, and Pennsylvania, also were among the states with the highest total personal health care spending.

- Wyomings personal health care spending was lowest in the nation , representing just 0.1 percent of total U.S. personal health care spending in 2020. Vermont, North Dakota, Alaska, and Montana were also among the states with the lowest personal health care spending in both 2020 and historically. All these states have smaller populations.

- Gross Domestic Product by state measures the value of goods and services produced in each state. Health spending as a share of a states GDP shows the importance of the health care sector in a states economy. As a share of GDP, West Virginia ranked the highest and Washington state the lowest in 2020.

For further detail, see health expenditures by state of provider in downloads below.