How Do I Know If I Am Subject To Backup Withholding

The IRS may send you a letter regarding backup withholding. This might have happened if you didn’t report all your interest and dividends on a previous tax return. If you haven’t received this letter, and if you provide your tax identification number to the requester of Form W-9, then you are not subject to backup withholding. If you are subject to backup withholding, cross out item two in part two of Form W-9 before submitting it.

Company Or Business Partnership

Follow the steps below if the LLC is a company or a partnership:

The W-9 form must be filled out for each client a freelancer or contractor has worked for. Keep a copy of the W-9 form for your archives to be on the safe side. When tax time comes around, you can use it to get in touch with a client if you dont have a 1099-MISC.

For independent contractors, freelancers, and self-employed individuals, a W-9 form is an essential document. W-9s serve as agreements that you are responsible for paying these taxes independently, not withheld by the companies you work for.

This form should not be sent to the Internal Revenue Service. The document is sent to employers upon request. You should always double-check your information when filling out an IRS W-9, even though it is relatively straightforward.

Failure To Remit Form W

If someone asks for a completed Form W-9, its usually for a good cause. Be skeptical for requests where youre not sure why your information is needed or who is making the request. It is expected that requests as part of normal business operating activities will be fulfilled.

There are some repercussions if you do not remit Form W-9. First, the payor is required to begin withholding taxes from future payments. As of 2022, the current withholding rate is 24%. In addition, there are the following penalties for non-compliance:

- $50 penalty for every failure to furnish a correct TIN to a requestor unless you are able to provide errors that were not willful neglect.

- $500 penalty if you make a false statement with no reasonable basis that results in no backup withholding.

- Other fines and/or imprisonment for willfully falsifying certifications or affirmations.

- Civil and/or criminal penalties for disclosing or misusing another partys W-9 information in violation of Federal law.

Recommended Reading: Government Seized Land For Sale

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Who Has To Fill Out A W

There are four common situations in which you might be required to fill out and send someone a W-9 form:

Youâre a contractor, freelancer, or consultant and plan on getting paid more than $600 by one particular client in a tax year. Theyâll need you to send them a completed W-9 before they can send you a Form 1099-MISC form. Youâll need that to report your income to the IRS.

Banks sometimes also need a W-9 when you open a new account with them.

Your bank or the financial institution you invest with might also need a completed W-9 from you in order to submit one of the other types of 1099 forms, which theyâll use to report things like interest income, distributions, and proceeds from real estate transactions .

If someone forgives or cancels a debt you owe them, theyâll need to file Form 1099-C with the IRS. Theyâll need you to send them a completed W-9 to complete the process.

If someone other than a client, bank, or other financial institution asks you for a W-9 form, you might want to think twice about sending one. This type of information can lead to identity theft and should be protected as such.

Also Check: What Kind Of Government Is The Us

Recommended Reading: How To Unlock A Government Phone

Who Must Complete A W

A Form W-9 must be completed by one party and furnished to a second party if the second party is going to furnish specific types of payments in the future. Most broadly, Form W-9 must be filled out by independent contractors that perform work for another party in which they are not employed with. This includes freelance workers or gig employees under non-employment structures.

A W-9 is also required from people in specific circumstances. A bank or lending institution may ask for a W-9 as part of the process of setting up a new account, as interest and dividend payments are furnished through Form 1099-INT. Participants in a contest that may win prizes may also be required to fill out a W-9, as the prize value may be taxable income and require IRS reporting.

Form 1099 is also used to furnish mortgage interest payments, student loan payments, real estate transaction proceeds, and discharge of certain types of debt. For these forms, the opposing party may request Form W-9 to ensure they have appropriate information on file.

Completing a Form W-9 is required whether you are subject to withholding or not. If you are exempt, this form is your means of communicating that exception to the paying party.

Adobe Acrobat Sign Makes Collecting W

For business owners, time-saving digital processes for W-9s and employment contracts are a must. Merck KGaA wanted to alleviate administrative headaches so employees could spend more time on issues than paperwork. By implementing an electronic signature process with Adobe Acrobat Sign, they saw a 1,400% increase in faster time to signature.

When it comes to collecting and securely storing important documents like W-9 forms, Adobe Acrobat Sign removes the steps of printing out and filing physical paperwork, resulting in faster turnarounds. Plus, you can store completed forms securely in Adobe Document Cloud for easier access to critical information.

Don’t Miss: Isaca Governance Risk And Control Conference

Can I Refuse To Fill Out Form W

If you refuse in response to a legitimate request, your client will withhold taxes from your pay at a rate of 24%. Businesses have a heavy obligation from the IRS to obtain a completed Form W-9 from anyone they pay $600 or more to during the year. Failure to comply can result in fines.

If you think the person requesting the form has no business asking for it, though, refusal is probably a good idea. If you’re concerned, ask a tax professional for guidance.

Who Needs To Fill Out Form W

If you’re an employee, your employer will withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on your wages. You’ll receive a W-2 that summarizes your earnings. Instead of filling out a Form W-9, new hires are often asked to fill out a W-4 to provide their taxpayer information to their employer.

If you’re an independent contractor, it won’t. That means you’ll be responsible for the employer’s share of Social Security and Medicare taxes, and that you won’t be eligible for unemployment compensation if you are laid off. To report some of this related information to the IRS, independent contracts, freelancers, and other non-employees that received payments should fill out a Form W-9.

Financial institutions may ask a new client to fill out a W-9 as it is a useful way of collecting and recording a customer’s details. Real estate businesses may also ask tenants to complete a W-9 as a method of storing their information as well.

Form W-9 is only used if the taxpayer is a U.S. person . A U.S. person is defined as an individual, partnership, corporation, estate, or domestic trust.

Read Also: Government Grants For Solar Panels For Your Home

Government Forms Printable W 9

Government Forms Printable W 9The W-9 form is a tax return that the Irs needs from individuals who are getting payments from business. The form is utilized to verify the identity of the individual and their address in order to make sure that they are not being paid under a different name.

This form is likewise used by business to track any payments made to specialists and other people so that they can meet their tax obligations with the IRS.

The IRS W-9 form is a tax form that freelancers will be required to fill out if they are not an employee of the business they are working for. This form is used to report the income and taxes withheld from them. The W-9 form can be completed online or in hard copy.

No Matter How You File Block Has Your Back

You May Like: How Do You Work For The Government

Implementation Of The W

Information Needed On Form W

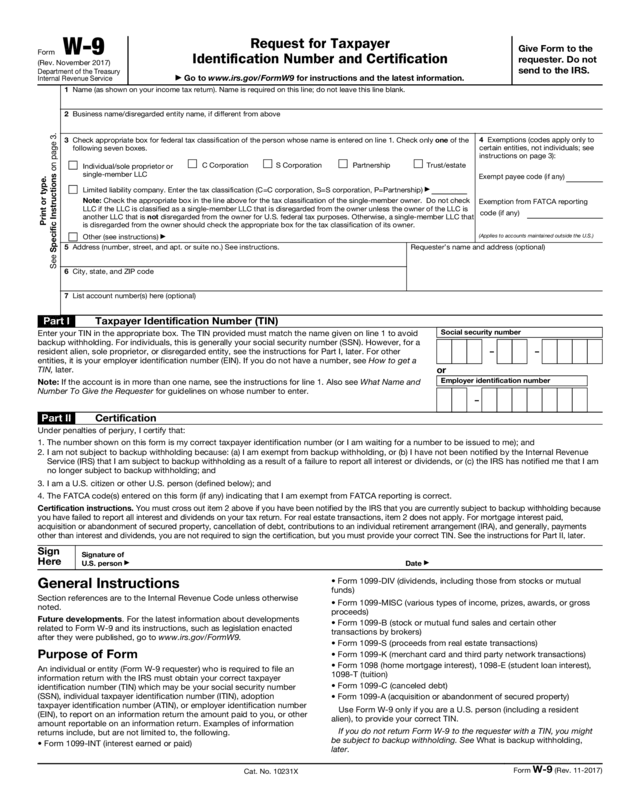

Form W-9 asks the independent contractor for eight pieces of information:

- Line 1, Name. This is the name that is shown on the individual’s tax return. This field is required. This field is either the name of an individual, although it can be the name of the owner of a sole proprietor. The taxpayer can also list the name of a partnership or other entity.

- Line 2, Other Business Name. This line is only required if the taxpayer has a business name, trade name, DBA name, or disregarded entity name.

- Line 3, Federal Tax Classification. The taxpayer must select whether they are a corporation, individual, sole proprietor, single-member LLC, limited liability company, partnership, or trust/estate. The taxpayer must only select one of the options provided.

- Line 4, Exemptions. The taxpayer must select whether they are exempt from backup withholding or FATCA reporting.

- Line 5 and Line 6, Address. The taxpayer must enter their address, city, state, and ZIP code. This is where

- Line 7, Account Numbers. This option field is where the taxpayer can enter in additional information at the requestor’s ask. For example, a bank or brokerage firm may ask the client to enter into their client information here.

- Part I, Tax Identification Number. The purpose of a W-9 is mainly to obtain this tax number from the taxpayer. This may be a Social Security number of an Employee Identification Number.

Read Also: What Is The Government Green Grant Fund

Who Might Ask Me To Fill Out Form W

A bank, a brokerage firm, a lending institution that has canceled a debt you owe, or the issuer of a prize you have won all might ask. If you’re a guest on “Ellen” during her “12 Days of Giveaways” promotion, and the talk show producers ask you to fill out a W-9 before you leave, it’s safe to assume the request is legitimate. If you receive an email saying you won a prize for a contest you don’t recall entering, you may not want to give that person a W-9.

Beware of W-9 phishing scams. If you receive an email request for a Form W-9 and you’re not sure it’s legitimate, contact the supposed sender by phone to ask if the request is valid. Attackers are sophisticated and can make a message look like it came from your bank or even your client. And if you get an email from the IRS, it’s definitely a phishing attempt, and you should forward the email to . The IRS doesn’t initiate contact with taxpayers via email.

What Is A W

A W-9 for a business entity contains information about the amounts paid to that business by another business during a calendar year. It contains the same basic information as an individuals W-9, but rather than having personal names and information, it instead lists the businesss legal name, address and Employee Identification Number number.

Don’t Miss: Government Help For New Business

How Do I Fill Out A W

As an LLC, you’ll provide the same type of information on a W-9 as individual contractors, but with two differences:

How Bench Can Help

Both senders and receivers of Form W-9 have at least one thing in common: they need to file their taxes. From small one-person operations to the biggest corporation, the end of the year signals long nights of filling out forms and reviewing numbers to keep the IRS off of their backs.

Buck the stress with Bench. Weâll handle your financial reporting for you, so when it comes time to file taxes, you have everything you need to make it a breeze. These same reports can be used every day to optimize your business and maximize your cash flow. By bringing on the support of our bookkeeping teams, you can grow your business without worrying about how to report it to the IRS. Learn more.

Don’t Miss: Local Government Federal Credit Union Routing Number

Is A W 9 Requiring Every Year

The W9 form is utilized by companies that pay freelancers or independent licensed contractors more than$600 per year. Companies need to prepare a W-9 form for each freelancer or independent licensed contractor they hire. The IRS website has actually detailed directions for submitting the form.

A W-9 form is required by the IRS to gather tax-related info from independent professionals or freelancers. The form resembles a W-8 form however serves different objectives. The IRS uses the W-9 form to obtain recognizing information from independent contractors and freelancers. Companies use these details to file the necessary types with the IRS. Many businesses that employ freelancers or independent contractors keep a copy of the W-9 form on file for each contractor. Banks sometimes use the form too.

When filing their taxes, Freelance licensed contractors and independent professionals should seek advice from a professional accounting professional. A W-9 form is a standard form companies use to gather tax information from United States residents. While it is not required for each year, it is vital to submit it on time if you are a self-employed freelancer or independent service provider.

If You Get One From Someone You Dont Know

If youâre a contractor and you receive a Form W-9 from an individual or business who is not a client, donât fill it out. Sending your Social Security number and other personal information to a stranger could be dangerous. Scammers will sometimes send W-9s to collect the SSNs of unsuspecting individuals.

If youâre suspicious about a W-9 that someone has sent you, ask them which tax forms they plan on sending you back after you fill it out. If you canât get a straight answer, talk to a tax professional. Remember that the only reason anyone would ever need a W-9 from you is because they need it to send you some kind of IRS form.

Also Check: Dfa Intermediate Government Fixed Income Portfolio Institutional Class