Can You Combine Calhfa Loans With Financial Assistance Programs

Finding it hard to pick among these many financial aid options? You may not have to choose.

Sometimes, California Housing Finance Agency loans can be combined with other assistance offers, while others cant, says Tony Mariotti, a licensed real estate agent and the CEO of RubyHome in Los Angeles.

The trade-off, however, is that you might need to pick a loan with a slightly higher interest ratebut it may pay off, so its worth crunching the numbers. For instance, while the CalPLUS FHA Program comes with a slightly higher 30-year fixed rate than the CalHFA, a CalPLUS loan can be combined with the CalHFA ZIP, which can assist with closing costs and prepaid items, including the FHAs mandatory mortgage insurance premium.

In some cases, you can even combine a CalPLUS loan with two financial assistance programs, offering home buyers three ways to save money. For instance, while the CalPLUS Conventional Program comes with a slightly higher 30-year fixed rate than the CalPLUS FHA loan, you can combine it with the MyHome Assistance Program and the CalHFA ZIP.

Just know that some loans, however, cant be combined. When in doubt, ask your loan officer or real estate agent for guidance.

First Home Buyer Assistance Scheme: 1 July 2017 31 July 2020 And Continuing From 1 August 2021

New homes |

Existing homes |

Vacant land |

|---|---|---|

|

|

|

Downpayment Toward Equity Act Of 2021

- Status: Introduced to the House, awaiting a vote

- Originally Introduced: April 14, 2021

- Latest Action Taken: July 16, 2021 Referred to the House Committee on Financial Services

The Downpayment Toward Equity Act, also known as the $25,000 First-Time Home Buyer Downpayment Grant, will help give first-time home buyers up to $25,000 in cash towards the purchase of their new house. This can be used for closing costs, down payment, mortgage interest rate reductions, and other home purchase expenses.

The current criteria* is as follows:

- Must be a first-time home buyer

- Must meet income and purchase price limitations

- Must be purchasing a primary residence no second homes or investments

- Must use a government-backed mortgage

- Must have parents or legal guardians who have not owned a home in your lifetime or lost their home to foreclosure or short sale, or lived in foster care during your lifetime

*Note that these may change by the time this becomes a law.

Also Check: Dental Grants For Low Income Adults

Read Also: Government Grants For Minority Women

Avoid These Common Pitfalls

-

One of the biggest misconceptions that can hurt new homebuyers is the belief they dont need to bring money to closing. There are times when people think theyll simply apply for a loan and be handed the keys without any other steps involved. Unfortunately, this is not the case. More often than not, you’ll have to meet a requirement. So it is highly recommended that homebuyers bring at least $1,000 to closingand if possible, a bit extra to be safe. Access to saved money is essential when coming to the table. If the buyer is not aware of this fact, whoever assisted them failed to do their job.

-

It’s important to remember that expenses continue even after you receive the keys. Buyers may get themselves into trouble when they neglect to consider the additional costs that homeownership entails. This may include landscaping, window coverings, and necessary repairs they didnt previously notice.

-

There is nothing more embarrassing than putting in an offer, then arriving at the mortgage company and finding out you dont qualify after all. As a result, mortgage pre-approval is crucial. Dont forget to stay within your price range and consider added expenses.

What Is The First Home Owners Grant

As mentioned above, you can use the new HomeBuilder scheme in combination with some of the existing home buyer financial support programs, this includes the First Home Owner Grant scheme.

The FHOG was originally introduced in July 2000. Eligibility criteria and the size of the grant differs in each state and territory, but it is primarily available to first-time buyers purchasing a new residential property, or building their own new home.

As part of the FHOG, you may also be eligible for exemption or discounts on stamp duty or other related fees.

For example, the State Revenue Office Victoria outlines,

A $10,000 First Home Owner Grant is available when you buy or build your first new home.

The FHOG is $20,000 for new homes built in regional Victoria, for contracts signed from 1 July 2017 to 30 June 2021.

Your first home can be a house, townhouse, apartment, unit or similar but it must be valued at $750,000 or less, be the first sale of the property as residential premises and the home must be less than five years old.

As the FHOG varies greatly between each state and territory, we recommend finding out more about the specific details from the First Home Owner Grant website.

Recommended Reading: Mortgage Stimulus Program For Middle Class 2021

You May Like: What Is Haiti’s Government

Down Payment Assistance : What Is It

If you qualify for our programs, TSAHC will provide you with a mortgage loan and funding to use for your down payment. You can choose to receive the assistance as a grant or a deferred forgivable second lien loan . If youre eligible, you can essentially receive free money to help you buy a home. To qualify, you must have a credit score of 620 and meet certain income requirements.

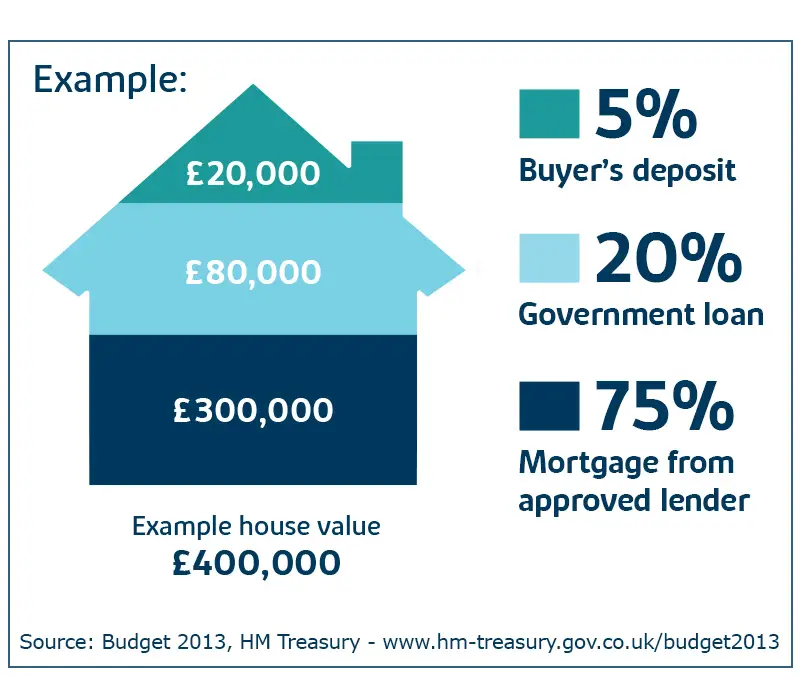

Help To Buy: Mortgage Guarantee Scheme

Announced in the 2021 Budget, the mortgage guarantee scheme offers lenders the option to purchase a guarantee on mortgages where a borrower has a deposit of only 5%.

The guarantee compensates mortgage lenders for a portion of net losses suffered in the event of repossession. The guarantee applies to 80% of the purchase value of the guaranteed property, covering 95% of these net losses. The lender therefore retains a 5% risk in the portion of losses covered by the guarantee. This ensures that the lender retains some risk in every loan they arrange.

Homebuy Wales supports households by providing an equity loan to help buy an existing property.

The scheme helps people who couldnt otherwise afford to buy a property.

Homebuy isnt available in all areas. And where it is available, the scheme will be subject to local residency and employment eligibility criteria.

Find out more about the Homebuy scheme at gov.walesOpens in a new window

Also Check: What Is Petition The Government

How To Find Down Payment Assistance Programs

Down payment assistance programs are usually very localized. There are a few national DPAs and many statewide ones, but the majority are run at a city or county level.

The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out. Theyll also know which programs the lender can accept .

If you want to do some research on your own, you can also Google down payment assistance grants in . This will help you find current programs specific to your area that you might be able to apply for.

Down Payment Assistance For First

When new buyers move into a neighborhood, the community benefits.

New homeowners make home improvements and raise local values, beautify lawns, increase curb appeal and, when homeowners spend money in local stores and businesses, they pay taxes that benefit the municipality.

Homeownership is the centerpiece of local U.S. economies, so area governments have incentives to make their streets attractive to incoming buyers.

Thats where down payment assistance comes in.

Down payment assistance programs make it possible for first-time home buyers to stop renting and start owning without saving for large, 20% down payments.

We cover everything you need to know about down payment assistance programs and how to find one today.

Also Check: Is Harp A Real Government Program

How Do I Get A First

Start by exploring the housing finance agency in your state. You’ll likely come across a number of programs designed especially for first-time buyers such as yourself. Many programs offer grants to help turn your homeownership dream into reality.

Be aware that not all first-time homebuyer grants are the same. Fund amounts depend on various factors, including location, credit score, income, and family size. An experienced lender can also point you in the right direction as far as grants are concerned.

The Bottom Line: Help Is Available For Those Buying A Home For The First Time

First-time home buyers have access to many grants, loans and financial help that can make buying a home easier. First-time buying assistance can include help with down payments and closing costs, tax credits or education. You might be able to get help from your local, state or federal government if you meet income standards.

Charities, nonprofits and employer programs are also available. These programs vary by state, but you can easily find programs you qualify for through HUDs website. As a first-time buyer, you cannot have owned property in the last 3 years.

Ready to explore your options? Get preapproved now to start.

Get approved to see what you can afford.

Rocket Mortgage® lets you do it all online.

Read Also: Government Loans For Senior Citizens

Washington Down Payment Assistance Programs

The Washington State Housing Finance Commission has nine different down payment assistance programs. Help ranges from $10,000 or 4% of your mortgage balance, right to up to $55,000 for eligible buyers in Seattle.

All these come in the form of a second mortgage. But you dont have to repay that right away. It becomes due only upon sale, transfer, non-occupancy or refinance of the property.

View the list of DPAs on WSHFCs website and click through for details of each program. And consult HUDs list of other homeownership assistance programs in the state.

American Dream Downpayment Act Or 529

- Status: Introduced to the House

- OriginallyIntroduced: February 25, 2021

- LatestActionTaken: August 2, 2022 Introduced in the U.S. Senate

The American Dream Downpayment Act authorizes a tax-advantaged downpayment savings account. The bill is based on Internal Revenue Code Section 529, which permits tax-advantaged tuition savings accounts. The American Dream Downpayment Act would occupy section 529 of the tax code and create savings accounts for buying your first home.

Cash added to a 529 down payment savings account can be withdrawn with no taxes due on gains.

Withdrawals from a 529 are allowed anytime if buyers use the proceeds to help purchase a home. Buyers can use withdrawals to make a down payment, pay for mortgage and real estate closing costs, pay state and local taxes, and pay other home-buying expenses due at closing.

- Contributions must be cash

- Contribution total limit is $129,400

- Contribution limits adjust with inflation

Also Check: American Government Roots And Reform Online Textbook

Missouri Down Payment Assistance Programs

The Missouri Housing Development Commission provides down payment assistance for both first-time and repeat buyers. This comes in the form of a second mortgage loan of up to 4% of the homes purchase price.

- This loan will be forgiven after 10 years, provided you dont move, sell, refinance, or pay off your first mortgage during that time

- To qualify, your income must be below certain limits, which vary by location

Get more information from the MHDCs website. And check out HUDs list of other homeownership assistance programs in Missouri, including one operated by the Delta Area Economic Opportunity Corporation.

New Jersey Down Payment Assistance Programs

First-time buyers in New Jersey can get up to $10,000 in down payment assistance through a five-year, forgivable loan with no interest or monthly payments required.

The loan must be paired with a first mortgage from the New Jersey Housing and Mortgage Finance Agency which can be a 30-year FHA, USDA, or VA loan.

For more information, visit the agencys website. And consult HUDs list of other homeownership assistance programs operating in the state.

Read Also: 9000 Dollar Grant From Government

Down Payment Assistance Options

First-time homebuyers can more easily afford a home with the help of down payment assistance , which is a sum of money given as either a grant, second mortgage or matched savings.

Down payment grants

Down payment or first-time homebuyer grants are essentially free money that help you cover your down payment or closing costs. Grants are usually awarded to low- or moderate-income borrowers, typically defined as earning no more than 80 percent of the area median income . They also come with a number of other requirements, such as limits on home purchase price and a minimum credit score. You might be able to apply for multiple grants, so dont be shy about trying to score more financial assistance.

To find grant programs in your area:

- Ask your loan officer or real estate agent for guidance they might know about special grant programs in your area.

- Explore grants from local housing authorities or nonprofit organizations.

- Consider working with a local credit union or community bank these might offer grant programs of their own.

Down payment assistance loans

Besides grants, there are a variety of down payment assistance loans a second mortgage you take out with the first mortgage youre using to buy the home:

Down payment savings match

Iowa Down Payment Assistance Programs

The Iowa Finance Authority offers grants and loans as down payment or closing cost assistance.

- FirstHome Loan: The loan could provide 5% of the homes purchase price, up to $5,000, with no monthly payments. The loan would come due when you sell or refinance the home

- FirstHome Grant: The grant could pay $2,500 toward closing costs or a down payment

First-time home buyers and veterans may qualify for either type of assistance. Others can also qualify if theyre home buying in a low-income census tract. And the Iowa Finance Authority runs a similar program for repeat home buyers.

All programs have income limits and price caps on eligible homes. Youd also need a credit score of 640 to qualify.

Learn more at the IFAs website. And take a look at HUDs list of alternative programs in Iowa.

Read Also: How To Get Land From The Government

Closing Cost Assistance Programs For Home Buyers

Closing cost assistance programs are home buyer stimulus plans that pay up to 100% of a buyers purchase closing costs, including title expenses, transfer taxes, and mortgage fees.

The National Council of State Housing Agencies website maintains an active list of closing cost assistance programs. Programs require buyers to meet minimum credit standards and income thresholds and homes to meet the minimum safety and quality standards.

Rhode Island Down Payment Assistance Programs

The Rhode Island Housing department offers a down payment assistance program for first-time buyers who use an RIHousing mortgage to buy their home.

If youre eligible, you could get 6% of your loan size or $15,000 in down payment assistance. The agency says that in most cases, the interset rate on an Extra Assistance Loan will be the same as the interest rate on your RIHousing first mortgage.

Discover more at Rhode Island Housings website. And explore HUDs list of other homeownership assistance programs in the state.

Don’t Miss: Us Government Coins For Sale

What Kind Of Grants Can I Get

New construction and existing home purchases are both included in these housing grants, as are grants that cover closing costs and renovations. You can find homeowner education for free with grants that are designed to assist homeowners in managing their homes once purchased, including training you how to set up a household budget and manage your finances.

Government housing grants can be obtained for anywhere in the U.S., and in cities, suburban areas, or rural locations.

Specific types of grants can be found for:

- Mobile homes or parks

- New construction

How Big Is The Subsidy

This depends on your income and the lower it is, the higher your subsidy. You can use the FLISP subsidy calculator to determine how much you will receive from this programme.

The subsidy ranges from R30 001 to R130 000, depending on where you fall in the income bracket. The lower your income, the higher your subsidy.

You May Like: How To Claim Free Money From Government

Down Payment/closing Cost Assistance

Financial assistance for first-time homebuyers for down payment and closing costs. The amount of assistance provided to any low-income family cannot exceed the greater of six percent of the purchase price of a single family housing unit or $10,000. The City will provide a zero interest forgivable loan that is forgiven at the rate of 20% per year, as of each anniversary of the loans execution date. At the end of the five-year loan period the loan is fully forgiven. The applicant may sell or transfer the property at any time during the monitoring time period provided the balance of the loan is repaid to the City of New Haven or the property is sold /transferred to an individual who is willing to assume the balance and the terms and conditions of the loan. The deferred loan can be used for: down payment, closing cost or the combination of both down payment and closing cost.

For program information please email .

Terms and conditions of loans are subject to change without notice.