Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

What To Do About Inaccurate Information

- Clearly identify the inaccurate information on your credit report and dispute it, in writing, to both the credit reporting agency that issued the report with inaccurate information and any creditors associated with the information.

- For more information, review the FTCs online Disputing Errors on Credit Reports article.

- If an investigation doesnt resolve your dispute with the credit reporting company, you can ask that a statement of the dispute be included in your file and future reports. If inaccurate information is not removed or reappears, you may wish to consult with a private attorney regarding possible legal actions.

Here is contact information for the three credit reporting agencies and links to their web pages informing consumers how to dispute inaccurate information:

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Read Also: Car Insurance Government Employee Discount

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Freescoreonlinecom Helps You Keep An Eye On Your Credit Scores With:

Immediate access to your Experian, TransUnion and Equifax scores and reports, and updates so you can quickly spot unauthorized credit accounts opened in your name.

Daily credit monitoring for suspicious activity and alerts notifying you of changes.

Our online Dispute Center to learn how to dispute any inaccurate information on your reports.

$1 million in Identity Theft Insurance* to help you recover your good name should identity thieves strike.

The Scores To Go® app, which lets you check your current scores and reports from TransUnion, Equifax and Experian anytime on your mobile devices.

FreeScoreOnline® and ScoreSense® are registered trademarks of One Technologies, LLC.

One Technologies, LLC is the proud owner of this website. For a complete list of our properties,

*Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group, Inc. The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described. Please refer to the actual policies for terms, conditions and exclusions of coverage. Coverage may not be available in all jurisdictions.

After verification of your identity, your scores are available for secure online delivery in seconds.

Recommended Reading: Government Requirements For Electronic Medical Records

How To View Your Free Credit Reports Every Year

Reviewing your credit reports is a crucial part of avoiding errors and preventing identity theft. Those reports contain the raw information that goes into your credit scores, and bad information can lead to lower .

Fortunately, its free to see whats in your credit reports. The federal Fair Credit Reporting Act requires that U.S. consumers be entitled to a free credit report each year.

In the past, it was harder to get that information for free. You had to purchase reports or qualify based on certain activities based on the credit report . Some states required that residents periodically be entitled to a free report, but federal law makes it official nationwide.

Helps You Keep An Eye On Your Credit Scores With:

Immediate access to your Experian, TransUnion and Equifax scores and reports, and updates so you can quickly spot unauthorized credit accounts opened in your name.

Daily credit monitoring for suspicious activity and alerts notifying you of changes.

Our online Dispute Center to learn how to dispute any inaccurate information on your reports.

$1 million in Identity Theft Insurance* to help you recover your good name should identity thieves strike.

The Scores To Go® app, which lets you check your current scores and reports from TransUnion, Equifax and Experian anytime on your mobile devices.

You May Like: Government Assistance For College Students

How To Access Your Free Credit Reports

To access your free credit reports, visit AnnualCreditReport.com. Youll need to answer some questions to prove your identity to see your reports. If you have difficulty accessing your report online, you can also request it . You can choose to access your report for any of the three credit bureaus or all three simultaneously.

These reports dont show a credit score, but provide a thorough history of your financial activities, including payment history and balances for credit cards, mortgages, and car, personal, or student loans.

When you access your report, make sure all the information is correct. If youve paid at least the minimum on time each month, your accounts should be listed as being in good standing. If you have past-due payments or an account in collections, this will also be noted on your report.

Read more: How to Deal with Mistakes on Your Credit Report

If you see an error on your report, dont wait to dispute it with the credit bureau. Start the process as soon as you can to verify the accounts in question. The FTC has a guide and sample letters for doing this. Youll also need to contact the creditor in question to correct your account status.

If you suspect youre a victim of fraud or identity theft after reviewing your reports, report it at identitytheft.gov.

Remember: Each credit bureau may have different information about your financial history, so be sure to check each of them for accuracy.

Order Your Free Credit Report

Consumers can get free copies of their credit report each year. The Fair Credit Reporting Act requires each of the three nationwide consumer reporting agencies Equifax, Experian, and TransUnion to provide you with a free copy of your credit report, at your request, once every 12 months.

At least once a year, review each one of your three credit reports to:

- ensure that the information is accurate and up-to-date before you apply for a loan, lease a car, get a credit card, buy insurance, or apply for a job.

- help guard against identity theft. If identity thieves use your information to open new account in your name, those unpaid accounts get reported on your credit.

To order your FREE reports:

Don’t Miss: What Is Lobbying In Government

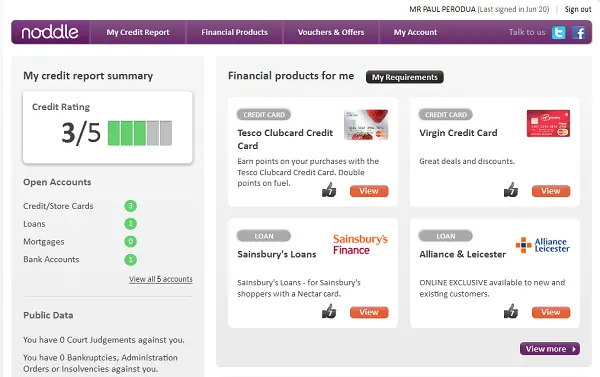

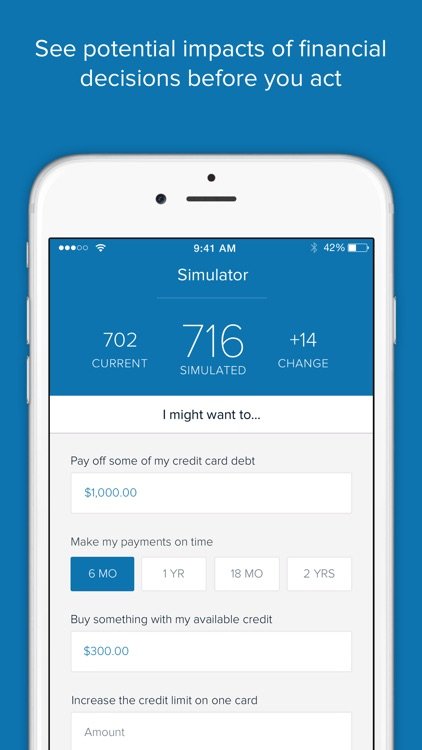

Best For Improving Credit: Creditwise

-

Timely notifications about credit report changes

-

Only offers TransUnion report access

-

Sign-up required

You can check your TransUnion credit report and credit score through CreditWise, a credit report and credit score tool from Capital One. Credit Wise is available for free, even for those who arent Capital One customers. Signing up is simple and easy. You wont have to enter any credit card information, theres no trial subscription to cancel, and your credit information is updated weekly. You can access Credit Wise online or use the mobile app to keep up with your credit score.

How To Order Your Free Annual Reports From Equifax Experian And Transunion

You can order your free annual credit reports through a toll-free phone number, online, or by mailing the Order Form at the end of this Information Sheet.

1-877-322-8228Annual Credit Report Request ServiceP. O. Box 105281Atlanta, GA 30348-5281

You have the option of requesting all three reports at once or staggering them. You could create a no-cost version of a credit-monitoring service. Just order a free report from one credit bureau, then four months later from another, and four months after that from the third bureau. That approach won’t give you a complete picture at any one time. Not all creditors provide information to all the bureaus. Monitoring services from the credit bureaus cost from about $40 to over $100 per year.

Also Check: Government Assistance For Nursing Home Care

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Also Check: Where Do I Get A Government Phone

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online throughout 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

*warnings When Ordering Online:

Misspelling the annualcreditreport.com site or using another site with similar words will take you to a site that will try to sell you something or collect your personal information. Even one mistyped letter could take you to a fraudulent website that looks and feels like a place to order credit reports but in fact has been set up by ID thieves to steal your information. Other sites with similar names exist and may try to sell you credit monitoring services.

Remember, only one website is authorized to fill orders for the free annual credit report you are entitled to under lawannualcreditreport.com. Other websites that claim to offer free credit report,, free credit scores, or free credit monitoring are not part of the legally mandated free annual credit report program.

Beware of emails, banner ads, pop-up ads, and telemarketing calls that promise to obtain your free annual credit report on your behalf. In particular, beware of email messages or internet ads claiming to be from annualcreditreport.com.

Also beware of any free offers for your credit score. One wrong click on an enticing ad for a free look at your credit score may have you signed up for costly or unnecessary credit monitoring or sharing your personal information with a thief.

Annualcreditreport.com will not send you an email asking for your personal information do not reply or click on any link in the message. Its likely a scam, leading to potential ID theft. Forward scam emails to the FTC .

Also Check: How Do I Know If I Owe The Government Money

Check Your Credit Reports Regularly For Free

Accounts listed on your credit report that you do not recognize may indicate that you have become a victim of identity theft. The next section contains specific information related to credit reports, credit scores and identity theft.

What is a Credit Report and How is it Used?A credit report contains detailed information about a person’s credit history, including credit accounts and loans, bankruptcies and late payments and recent inquiries. Credit reports are compiled by three major companies known as credit reporting agencies.

Typically, when a consumer applies for credit, the prospective lender obtains the applicant’s credit report to help determine creditworthiness. The information in a credit report is one of several factors that help lenders determine whether to offer credit, and on what terms, such as interest rate, annual percentage rate, grace period and other contractual obligations of the credit card or loan. This information is also used to generate a credit score, which is explained in greater detail below.

Requesting FREE Credit ReportsConsumers are entitled to one free credit report every twelve months from each of the three major credit reporting agencies. The official website from which consumers can request their free annual credit report is www.annualcreditreport.com.

File A Complaint About A Debt Collector

Report any problems you have with a debt collection company to your State Attorney General’s Office, the Federal Trade Commission , and the Consumer Financial Protection Bureau . Many states have their own debt collection laws that are different from the federal Fair Debt Collection Practices Act. Your state Attorney Generals office can help you find out your rights under your states law.

You May Like: Government Sponsored Small Business Loans

Getting Your Credit Reports

You can get a free report once every 12 months from each of the three nationwide consumer credit reporting companies through AnnualCreditReport.com. You can request all three of your reports at once, or you can space them out over the course of the year. That means if you order a report from one of the companies on March 1, you can’t get another free annual credit report from the same company until March 2 next year.

Please note, that there may be situations where you can obtain additional copies of your credit report for free such as the application of certain state laws, when you have been denied credit or in certain situations involving fraud.

You can visit the Consumer Financial Protection Bureau’s website for more information on how you can obtain your credit report for free.

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Read Also: How To Cash A Government Check

Achieve More With Transunion

TransUnion is a global leader in credit information and information management services. For more than 45 years, we’ve worked with businesses and consumers to gather, analyze and deliver the critical information needed to build strong economies throughout the world. The result is two-fold:

- 1) Businesses can better manage risk and customer relationships

- 2) Consumers can better understand and manage credit to achieve their financial goals

Our dedicated associates provide solutions to approximately 45,000 businesses and approximately 500 million consumers worldwide.

Learn more about how we create advantages for our customers every day at www.transunion.com.

The 6 Best Free Credit Reports Of 2022

- Best for Credit Monitoring:

- Best for Single Bureau Access:

- Best for Improving Credit:

- Best for Daily Updates: WalletHub

AnnualCreditReport.com makes it simple to review your Equifax, Experian, and TransUnion credit reports all in one place.

-

Reports from three major bureaus available

-

No account requirement

-

Only accessible once a year

-

No credit score access

In 2003, a Federal law passed granting every consumer the right to a free report from all credit reporting agencies each year. AnnualCreditReport.com is the centralized site that allows every consumer to access their free credit report granted by Federal law.

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus Equifax, Experian, and TransUnion at no cost. You can obtain one free credit report every 12 months through AnnualCreditReport.com, without signing up, creating an account, or entering your credit card information. Alternatively, you can call 1-877-322-8228 to order your legally free credit report.

Also Check: Free Government Cyber Security Training