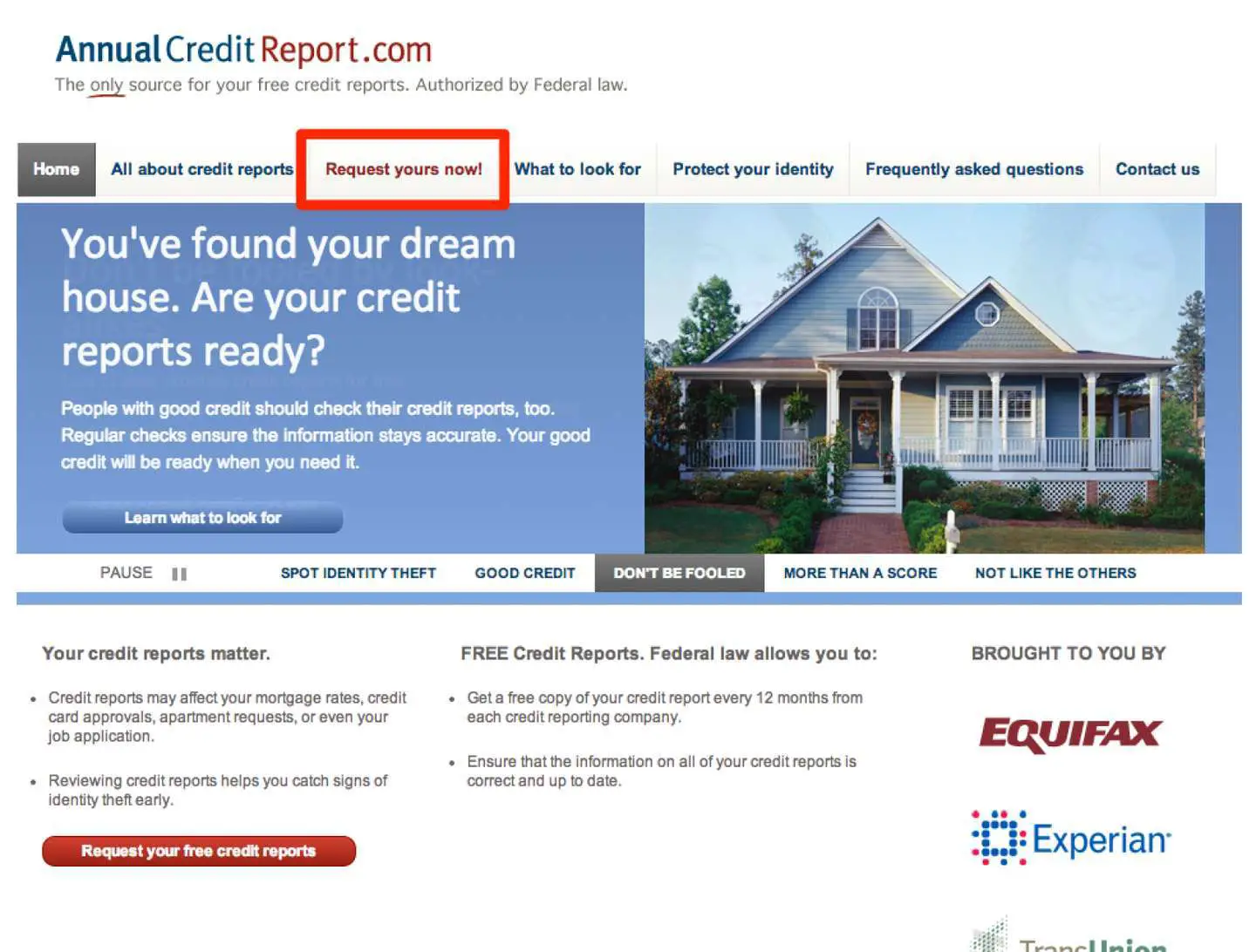

Annualcreditreportcom For Free Credit Reports

AnnualCreditReport.com is the only authorized source for the free annual credit report that is yours by law. The FCRA guarantees access to your credit report for free from each of the three nationwide credit reporting agencies every 12 months.

This website is jointly operated by Experian, Equifax, and TransUnion and was created in order to comply with their obligations under the Fair and Accurate Credit Transactions Act to provide a method for American consumers to receive a free annual credit report. The goal was to allow consumers a way to ensure their credit information is correct and to guard against identity theft. The three major credit reporting agencies created the joint venture company, Central Source, LLC, to oversee their compliance with the FACTA. This service does not lower the consumers score nor does it count as a .

The FTC has received complaints from consumers who thought they were ordering their free report from other companies but were actually forced to pay fees or buy other services. While there are many companies out there with similar sounding names the site that provides this free government mandated credit report access is AnnualCreditReport.com. Consumers who want to take advantage of this free service should type the address carefully to avoid landing on a legitimate looking page run by a scam artist.

Ask The Experts: The Best Credit Reports In Life Are Free

Fortunately, its pretty easy to get a free credit report these days. But we could all stand to make some improvements in terms of how often we check and what we do with the information. So WalletHub convened a panel of personal finance experts for some tips and insights. Below, you can see who they are, what we asked them and how they recommend getting more from your free credit reports.

Consumer Rights Under The Fair Credit Reporting Act

Consumers also have a right to see their own credit reports. By law, they are entitled to one free credit report every 12 months from each of the three major bureaus. They can request their reports at the official, government-authorized website for that purpose, AnnualCreditReport.com. Under FCRA, consumers also have a right to:

- Verify the accuracy of their report when its required for employment purposes.

- Receive notification if information in their file has been used against them in applying for credit or other transactions.

- Disputeand have the bureau correctinformation in their report that is incomplete or inaccurate, in an effort to repair their credit.

- Remove outdated, negative information .

If the credit bureau fails to respond to their request in a satisfactory manner, a consumer can file a complaint with the Federal Consumer Financial Protection Bureau .

Recommended Reading: Government Grants For Certificate Programs

As A Victim Of Fraud Or Identity Theft You Have The Right To:

- Request the credit reporting company to block information from your credit report that was the result of identity theft. You must provide an identity theft report from a law enforcement agency to request a block

- Dispute information you believe is incorrect

- Request a fraud alert be placed on your credit report

Free Annual Credit Report

Review your credit report often to make sure the information is accurate. If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.

Also Check: Car Insurance For Federal Government Employees

What To Do About Inaccurate Information

- Clearly identify the inaccurate information on your credit report and dispute it, in writing, to both the credit reporting agency that issued the report with inaccurate information and any creditors associated with the information.

- For more information, review the FTCs online Disputing Errors on Credit Reports article.

- If an investigation doesnt resolve your dispute with the credit reporting company, you can ask that a statement of the dispute be included in your file and future reports. If inaccurate information is not removed or reappears, you may wish to consult with a private attorney regarding possible legal actions.

Here is contact information for the three credit reporting agencies and links to their web pages informing consumers how to dispute inaccurate information:

Specialty Consumer Reporting Agencies

Specialty consumer reporting agencies prepare reports on consumers histories for specific purposes. The reports cover employment, insurance claims, residential rentals, check writing, and medical records. Think about ordering a specialty report if you are ready to buy homeowners or automobile insurance, open a checking account, apply for private health or life insurance, or rent a home or apartment.

Property Insurance Claim Reports: Insurance companies often check reports of this kind when you apply for homeowners or automobile insurance. One of these reports is the CLUE report .2 CLUE reports contain information on property loss claims against homeowners insurance and automobile insurance policies. A CLUE report contains personal information, such as your name, birth date, and Social Security number. It also contains a record of any auto or homeowner property loss claims you submitted to an insurance company. It includes the type of loss, date of the loss, and amount paid by the insurance company. It lists inquiries, or companies that have checked your claim history.

Another property loss report is called A-PLUS . The A-PLUS database is compiled by a smaller company and is less commonly used than the CLUE database. You may order a CLUE report and an A-PLUS for free once every 12 months.

Tenant History Reports: Landlords sometimes check your tenant history as well as your credit history. You may order a free copy of your tenant history report once every 12 months.

Read Also: Federal Government Long Term Health Insurance

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Q: How Long Does It Take To Get My Report After I Order It

A: If you request your report online at annualcreditreport.com, you should be able to access it immediately. If you order your report by calling toll-free 1-877-322-8228, your report will be processed and mailed to you within 15 days. If you order your report by mail using the Annual Credit Report Request Form, your request will be processed and mailed to you within 15 days of receipt.

Whether you order your report online, by phone, or by mail, it may take longer to receive your report if the nationwide credit reporting company needs more information to verify your identity.

You May Like: What Is A Government Issued Birth Certificate

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

How To View Your Free Credit Reports Every Year

Reviewing your credit reports is a crucial part of avoiding errors and preventing identity theft. Those reports contain the raw information that goes into your credit scores, and bad information can lead to lower .

Fortunately, its free to see whats in your credit reports. The federal Fair Credit Reporting Act requires that U.S. consumers be entitled to a free credit report each year.

In the past, it was harder to get that information for free. You had to purchase reports or qualify based on certain activities based on the credit report . Some states required that residents periodically be entitled to a free report, but federal law makes it official nationwide.

You May Like: Debt Consolidation Programs Government Approved

Have Your Personal Information Ready

In order to request a credit report, you will have to provide several pieces of personal information, specifically your full name, date of birth, mailing address, Social Security number , and your previous mailing address. Additional information may be required to process your request, in which case the consumer credit reporting company you requested your credit report from will contact you by mail. As this information is used to identify you for the request process, omission of any information when filing by mail may delay your request.

Although most of this information should be known to you, some details may be harder to recall. While you can simply pause when filling out a mailing request form or an online application, failing to have all of this information on hand while making a request by phone could result in a slower application process or having to start over at a later time.

When requesting your credit report online, you will be asked several security questions about your finances that only you should be capable of answering . As these questions will vary from person to person, it can be difficult to adequately prepare for them. Note that, should you request your credit report by mail or phone, you may not be required to answer any security questions.

How To Get Your Free Report

Read Also: How Do You Apply For Government Grants

How Do I Get My Free Credit Report

Reading time: 3 minutes

- You can receive Equifax credit reports with a free myEquifax account.

- You can access free credit reports from each of the nationwide credit bureaus at annualcreditreport.com.

- You can request these free annual credit reports online, by phone, or by mail.

- In addition to receiving a free credit report, you can now also receive your credit report in Spanish from Equifax.com or by calling Equifax Customer Care.

If you want to check your credit reports there are several ways that we’ll discuss below.

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

-

Data from one or two credit bureaus

-

A recent history of your credit use

-

Additional information about building and protecting your credit

AnnualCreditReport.com is authorized by federal law and safe to use as long as you ensure you’re on the correct site.

Double-check the URL when you type it, to be sure you have not made a typo. Some other sites have similar-sounding names, so check that the URL matches and the site looks as expected.

Be aware that your credit reports are free, but credit bureaus also use the AnnualCreditReport.com site to sell credit scores and promote paid services, such as . However, monitoring doesnt keep your identity from being stolen it just alerts you after the fact. For best protection, use a

Just get your free credit report. Dont get suckered by the upsell, says Ed Mierzwinski, consumer program director for the U.S. Public Interest Research Group.

AnnualCreditReport.com

Also Check: Government Assistance To Buy A House

Check Your Credit Report

Because your credit score is so important in getting loans, credit, and housing, its important to check your credit reports regularly to make sure they are correct and complete. Checking your credit reports will also alert you to identity fraud because youll see if someone has opened accounts in your name or if late payments have been reported for purchases you didnt know about.

You can get one free copy of your credit report every 12 months from each of the three major credit reporting companies . All three credit reporting companies collect credit information, but different things may show up on the different credit reports. You can monitor your credit for free by getting free copies of your credit report. There are two common ways to do this:

In addition, you can get a free copy of your credit report:

To order a free credit report, go to Annual Credit Report or call 1-877-322-8228. You can also fill out the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Q: What Information Do I Need To Provide To Get My Free Report

A: You need to provide your name, address, Social Security number, and date of birth. If you have moved in the last two years, you may have to provide your previous address. To maintain the security of your file, each nationwide credit reporting company may ask you for some information that only you would know, like the amount of your monthly mortgage payment. Each company may ask you for different information because the information each has in your file may come from different sources.

Don’t Miss: Free Government Credit Counseling Services

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Viewing And Saving Your Credit Reports

The credit report itself is presented in an easy to use format, with links to each section of the credit report, including open accounts, potentially negative information and recent credit inquiries. This electronic format is far easier than the old method of requesting a copy of the credit report by mail, reading through the paper and painstakingly documenting errors by hand. You can easily spot any attempts at identity theft or other potential problems.

The online credit report also provides a dispute link so you can dispute any erroneous information found on the report. You can use this or you can submit disputes through regular mail and send them via certified mail. We have found both methods work equally well.

The web site has a FAQs section for asking how to questions about getting your credit report and using this free service more effectively. The FAQ link is located right at the top of the home page, making it visible to consumers wanting answers to their questions.

The site also includes a customer comment form consumers can use to contact the AnnualCreditReport.com organization. You may ask questions about the use of the site or your credit report using this form that are not already covered in the frequently asked questions section of the web site.

Don’t Miss: Government Funding For Single Mothers