Ive Recently Moved Outside The United States What Does That Mean For Me

Regardless of where you move, the following applies:

Fidelity does not provide discretionary asset management services to customers who reside outside the United States. If you move outside the United States, your discretionary asset management relationships will be terminated, and certain mutual funds held in those accounts may be liquidated as part of that termination.

The services provided by our representatives are limited to those that are ministerial or administrative in nature. Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition.

Customers residing outside the United States will not be allowed to open new 529 Savings Plan Accounts or Health Savings Accounts , or to continue to contribute to existing 529s or HSAs.

Customers residing outside the United States will not be allowed to purchase shares of mutual funds.

There are additional restrictions that may apply, depending on the country where you now reside. Customers in certain countries may be limited to selling their existing holdings and withdrawing the proceeds from their accounts. They will not be able to make deposits in their accounts, or buy any additional securities. In most other countries, the restrictions will be less onerous, but customers may still experience certain limitations .

Money Market Funds In The Current Environment

Money market funds offered negligible yields in the low-rate environment that persisted over the past several years. Now that interest rates are rising, seven-day yield figures have been revived.

Still, inflation is rising at an even greater rapid clip. According to the Bureau of Labor Statistics Consumer Price Index , inflation stood at 8.6% in May 2022, its highest since 1981. Even though money market funds are paying more, inflation erodes real returnson all investments, not just money market funds.

In an inflationary market, its important to be mindful of how your investment returns are affected. A money market fund is a great option if you want to park cash for a relatively short termif youre holding cash for a large purchase like a house, just be aware of the impact of inflation. Remember, its always a good idea to discuss your plans with a financial advisor.

Best Money Market Funds Methodology

The best money market funds offer a combination of positive yield, low risk and a low expense ratio. To make our selection, we combed through the list of money market mutual funds at MutualFunds.com and identified nine with the highest yields, lowest expenses and a minimum investment balance of $1,000,000 or lower.

Note that the seven-day yield is an industry standard for side-by-side comparisons of money market funds. It takes into account fund distributions plus appreciation, minus average fees over a seven-day period, and assumes that this average continues over an entire year.

When you are selecting a money market fund, make sure you can meet the minimum investment balance. In addition, its important to understand the investments held by each fund. Carefully research your options before making a decision.

And keep in mind that when it comes to investing, past performance is no guarantee of future results.

Recommended Reading: Free Internet Through The Government

Read Also: Masters In Government And Politics

Weigh Your Comfort With Risk

Assessing your comfort with risk is important because its unlikely youll reach your long-term goals if you abandon your strategy during the inevitable short-term market decline. Determining and periodically revisiting your comfort level with risk can help you avoid some emotional investing mistakes, such as chasing performance.

Growth investments, such as stocks or stock mutual funds, may experience more market volatility than more income-oriented investments, such as bonds or bond mutual funds, but can provide opportunities for higher returns. Appropriate diversification across quality, long-term investments can help align the risk of your portfolio with your comfort level. Finding that right balance can help you stay on the path toward your investment strategy. Typically, your financial advisor will ask you to complete a questionnaire that can gauge how you might react to risk in different situations. If youre building an investment portfolio with your partner or spouse, this is an important topic to discuss with each other.

Types Of Money Market Funds

The types of debt securities held by money market mutual funds are required by federal regulation to be very short in maturity and high in credit quality. All money market funds comply with industry-standard regulatory requirements regarding the quality, maturity, liquidity, and diversification of the funds investments. Investments can include short-term U.S. Treasury securities, federal agency notes, Eurodollar deposits, repurchase agreements, certificates of deposit, corporate commercial paper, and obligations of states, cities, or other types of municipal agenciesdepending on the focus of the fund.

| Fund type | |

|---|---|

| known as tax-exempt) | |

| National municipal | Normally at least 80% of the funds assets are invested in municipal securities whose interest is exempt from federal income tax. |

| State municipal | Normally at least 80% of the funds assets are invested in municipal securities whose interest is exempt from federal and state personal income taxes. |

* A repurchase agreement is an agreement to buy a security at one price and a simultaneous agreement to sell it back at an agreed-upon price.

Also Check: Is There A Government Mortgage Relief Program

Are All Of Fidelitys Products And Services Available To Customers Residing Outside Of The United States

No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. While the questions below provide a general overview of those limits, because so much is dependent on the particulars of your specific situation, we suggest you call us at 800-343-3548 to learn about how they apply to you. If you are calling us from outside the United States, please visit Fidelity Phone Numbers, For Customers Traveling Abroad to see a list of available international phone numbers available.

Surprisingly High Inflation Can Be A Challenge

Some inflation is normaland even good because it means the economy is growing. But inflation doesnât always behave the way itâs expected to. If itâs higher than expected or stays at an elevated level for a longer time than markets expect, managing investments can get tricky.

âSurprisingly high inflation can be a challenge for investment portfolios for 2 reasons: First, both bonds and stocks typically perform less well in a more inflationary environment. Second, stock-bond correlations tend to rise when inflation is higher. So bonds may provide less diversification benefits in that kind of environment,â Hofschire says.

Stock-bond diversification highest when inflation is tame

Past performance is no guarantee of future results.

Don’t Miss: Environmental Social And Corporate Governance Esg

What Do The Different Account Values Mean

| Balance |

|---|

Total account value

| Total account value | The total market value of all positions in the account, including core, minus any outstanding debit balances and any amount required to cover short options positions that are in-the-money | Real-time |

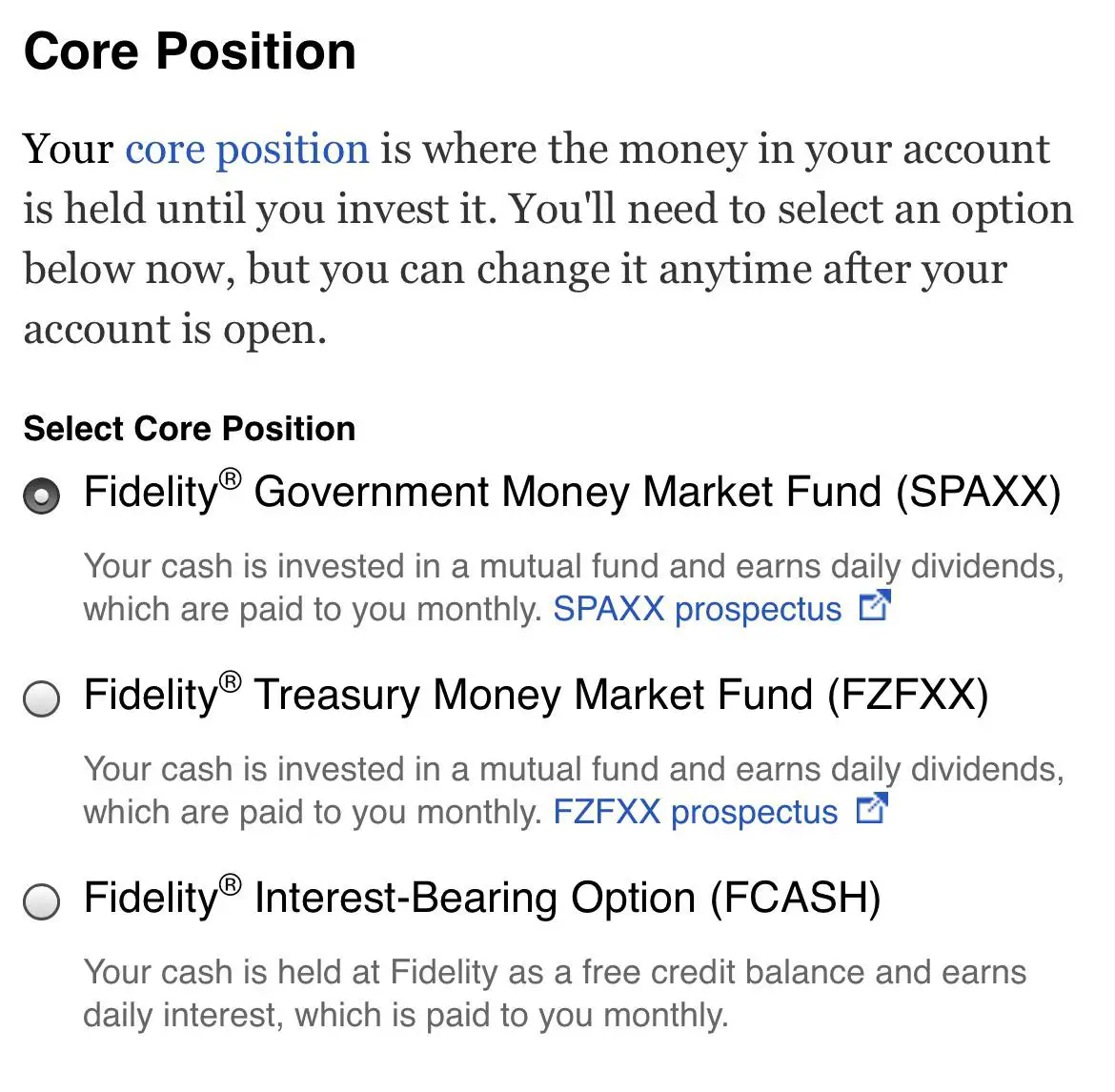

| Cash | Account settlement position for trade activity and money movement. Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core. | Overnight |

| Cash credit/cash debit | A cash credit is an amount that will be credited to the core at trade settlement. A cash debit is an amount that will be debited to the core at trade settlement. | Intraday |

| Held in cash | The total market value of all long cash account positions. This figure is reduced by the value of any in-the-money covered options and does not include cash in the core position. | Real-time |

Cash available to withdraw

| Cash available to withdraw | Amount collected and available for immediate withdrawal. This balance includes both core and other Fidelity money market funds held in the account. This balance does not include deposits that have not cleared. Sell orders are reflected in this balance on settlement date and buy orders are reflected on trade date. | Intraday |

| Cash | Account settlement position for trade activity and money movement. Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core. | Overnight |

Donât Miss: Real Estate Capital Investment Companies

How Is My Account Protected

Protecting your account assetsFidelitys brokerage businesses are members of the Securities Investor Protection Corporation , and brokerage accounts maintained with Fidelity are covered by SIPC, which protects brokerage accounts of each customer when a brokerage firm is closed due to bankruptcy or other financial difficulties and customer assets are missing from accounts.

SIPC protects brokerage accounts of each customer up to $500,000 in securities, including a limit of $250,000 on claims for cash awaiting reinvestment. Money market funds held in a brokerage account are considered securities.

In addition to SIPC protection, Fidelity, through NFS, provides its brokerage customers with additional excess of SIPC coverage from Lloyds of London together with Axis Specialty Europe Ltd. and Munich Reinsurance Co. The excess of SIPC coverage would only be used when SIPC coverage is exhausted. As with SIPC, excess of SIPC protection does not cover investment losses in customer accounts due to market fluctuation. It also does not cover other claims for losses incurred while broker-dealers remain in business. Total aggregate excess of SIPC coverage available through Fidelitys excess of SIPC policy is $1 billion.

Furthermore, we also offer protection for your assets in the case of unauthorized activity in your account. For more information, please see our Customer Protection Guarantee.

Recommended Reading: Fidelity Roth Ira Automatic Investment

Read Also: Government Business Loans For Veterans

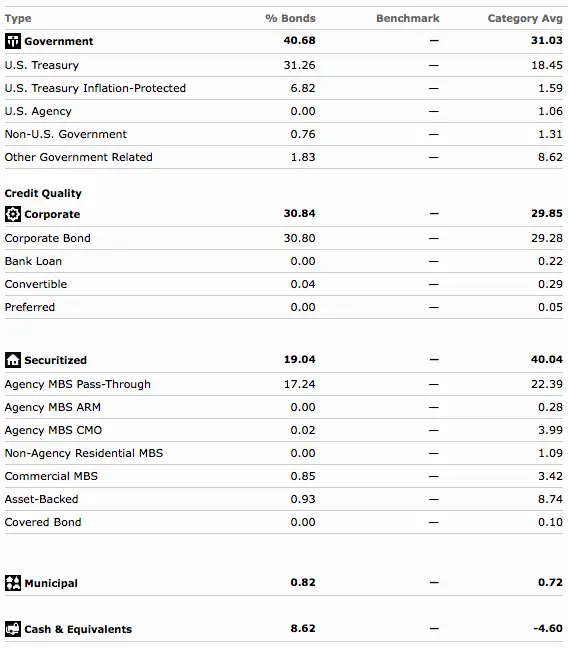

Vanguard Federal Money Market Fund

Vanguard launched the Vanguard Federal Money Market Fund in 1981. Total AUM as of May 2021 is $193.8 billion. This fund has the same investment aims of providing capital preservation and current income through investing in high-quality, short-term U.S. government securities.

Vanguard bills this fund as one of the most conservative offerings in this category, making it an ideal choice for conservative seeking risk avoidance and capital preservation.

As of May 2021, the funds top allocation was to U.S. Treasury Bills at 75.4%, followed by U.S. Government Obligations at 23.6% and Repurchase Agreements at 1.0%. The average maturity of the portfolio holdings was 55 days. The expense ratio for the Vanguard Federal Money Market Fund is 0.11% the dividend yield is 0.02%, and the one-year total return is 0.45%.

Also Check: Congress Mortgage Stimulus For Middle Class

American Century Capital Preservation Fund

The American Century Investments Capital Preservation Fund Investor Class was launched by American Century in 1972, and has over $2.22 billion in total assets under management , as of June 2021. The fund is primarily known for maximizing safety and liquidity. The fund aims to achieve the highest possible yield return consistent with its asset mix, which consists of Treasury bills, bonds, and notes. The fund ordinarily invests solely in short-term U.S. Treasury money market securities. The weighted average maturity of its portfolio holdings is 58.55 days.

The gross annual expense ratio for the Capital Preservation Fund was 0.48% as of May 2021. Its one-year total return as of December 2020 was 0.01%. This mutual fund is appropriate for investors whose current investment goals align with those of the strategy and who seek a pure-play government money market fund that invests exclusively in U.S. Treasury securities.

Also Check: Government Subsidies For Small Business

Agree On The Optimal Portfolio Mix

There are risk and return expectations associated with each investment you choose. If an investment portfolio is made up primarily of fixed-income investments, it will likely have lower risk and lower return expectations. If an investment portfolio is more focused on equities, it will likely have higher risk and higher return expectations.

Investing is all about balance. For your portfolio, we recommend choosing an appropriate mix between equity and fixed-income investments based on your unique situation, starting with your comfort with risk, time horizon and financial goal. Considering additional factors such as your retirement income needs, existing savings and whether you want to leave a legacy can also help you decide the most appropriate allocation to stocks and bonds.

Evaluating how the risk and return characteristics of our portfolio objectives align with your situation can help you through this step in the process. This illustration can help you visualize the risk-return tradeoff as you move across portfolio objectives:

Their Holdings May Include Debt Issued By The Likes Of Bear Stearns Freddie Mac And Some Other Less

In stressful times, you may hear advisers and strategists recommend that investors raise their allocations to cash. There are two reasons for doing so. First, cash, which is presumably risk free, protects your portfolio from losses. Second, raising cash builds reserves you can use to buy stocks, junk bonds or other assets at lower prices once the backdrop brightens.

But just what is cash? And is it as safe as it appears to be?

In finance, cash is more than the green paper you carry in your wallet. The financial worlds definition of cash sometimes its referred to as cash equivalents is any investment with a fixed value that is easy to buy and sell.

This includes Lincolns and Hamiltons as well as savings and checking deposits and shares of money-market mutual funds. Short-term certificates of deposit and U.S. Treasury bills also count. The bedrock assumption is that if you invest $1 in any of these forms, your investment is worth $1 anytime, no questions asked.

But financial engineers have also invented all sorts of other cash equivalents. These are short-term interest-earning investments that are designed to maintain a stable value thats behind the comparison to cash but that are not necessarily liquid and not guaranteed by the government.

Also Check: Government Cleaning Jobs In Dc

Money Market Fund Advantages

Money market funds invest in the short-term debt of the United States government: This means treasury bills, which mature much sooner than treasury bonds. The short-term nature of this investment allows the fund to adjust to rising interest rates. When the fund gets its money back from short-term investments, the money manager can quickly reinvest the money in T-bills that pay higher interest. Your money remains relatively safe because the investment is backed by the U.S. Treasury, and your income goes up as interest rates rise.

Recommended Reading: Best Real Estate Investment Analysis Software

Us Reform: Sec Rule Amendments Released July 24 2014

The Securities and Exchange Commission issued final rules that are designed to address money funds susceptibility to heavy redemptions in times of stress, improve their ability to manage and mitigate potential contagion from such redemptions, and increase the transparency of their risks, while preserving, as much as possible, their benefits.

There are several key components:

Floating NAV required of institutional non-government money funds

The SEC is removing the valuation exemption that permitted these funds to maintain a stable NAV, i.e., they will have to transact sales and redemptions as a market value-based or floating NAV, rounded to the fourth decimal place .

Fees and gates

The SEC is giving money fund boards of directors the discretion whether to impose a liquidity fee if a funds weekly liquidity level falls below the required regulatory threshold, and/or to suspend redemptions temporarily, i.e., to gate funds, under the same circumstances. These amendments will require all non-government money funds to impose a liquidity fee if the funds weekly liquidity level falls below a designated threshold, unless the funds board determines that imposing such a fee is not in the best interests of the fund.

Other provisions

You May Like: Socially Responsible Investing Robo Advisor

Recommended Reading: Government Grants For Business Owners

Canso Investment Counsel Ltd

From Auckland, to London, to Ottawa, central banks raised overnight rates in a race to restore price stability and their own credibility. Stocks, bonds, crypto, real estate if you owned it, it went down. If you borrowed against it, your banker wants to speak with you.

Canso offers segregated and pooled investment management services to institutional investors.

Dividendsand Capital Gain Distributions

Each fund earns interest, dividends, and other income from its investments, and distributes this income to shareholders asdividends. Each fund may also realize capital gains from its investments, and distributes these gains , if any, to shareholders ascapital gain distributions.

Distributions from a money market fund consist primarily of dividends. A money market fund normally declares dividends daily and paysthem monthly.

Dividends declared for each fund are based on estimates of income for the fund. Actual income may differ from estimates, and differences,if any, will be included in the calculation of subsequent dividends.

You may request to have dividends redeemed from an account closed during the month paid when the account is closed. A fund reserves theright to limit this service.

Don’t Miss: How To Qualify For Government Housing

Government And Treasury Money Funds

- 7-day yield as of 03/04/20224

- Minimum Initial Investment

- Schwab Government Money Fund Investor Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab Government Money Fund Ultra Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab Treasury Obligations Money Fund Investor Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab Treasury Obligations Money Fund Ultra Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab U.S. Treasury Money Fund Investor Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab U.S. Treasury Money Fund Ultra Shares

- 7-day yield as of 03/04/20224 0.01%

You May Like: Cash Out Refinance To Invest

Which Is Better: Money Market Fund Or Savings Account

A savings account with a financial institution is the safest, most liquid option for holding cash. Thats because the FDIC insures savings account deposits for up to $250,000, and funds are instantly available at the ATM or counter.

That said, money market funds are also very low risk given that they invest in cash and securities guaranteed by the US government, such as Treasury bills, Treasury notes and repurchase agreements based on government-backed obligations.

Both accounts are extremely liquid, although some funds impose liquidity fees on redemption and certain limitations on redemption periods.

Don’t Miss: Cash Government Check Without Bank Account