Pros And Cons Of Consolidation

With a few exceptions, you only get one chance to consolidate your government loans. You should consider the pros and cons of consolidation before starting the process. Among other potential down sides, you may lose important rights by consolidating. If you still want to consolidate, you dont have to include all of your eligible loans. The Department gives this example: If you have both Direct Loans and other types of federal student loans, and you have been making payments toward public service loan forgiveness on your Direct Loans, you should not consolidate your Direct Loans along with your other loans. Leaving out your Direct Loans will preserve the benefits on those loans.

Can I Cancel My Student Loans

Federal student loans may be canceled under the following circumstances:

- Your college closed down while you were a student there or within 90 days after you withdrew.

- Your school owed you or your lender a refund after you withdrew but never provided it.

- The loan was a result of identity theft.

- The student borrower dies.

You May Like: One Main Financial Bill Payment

Make Sure The Default Is Correct

The very first thing to do is make sure your lender didnt put your loans into default by mistake.

Youll likely know whether youve been missing your student loan payments. If you know youre on-time with your payments or arent past-due enough for default, reach out to your loan servicer to fix the mistake.

Also Check: Hotels Government Camp Oregon

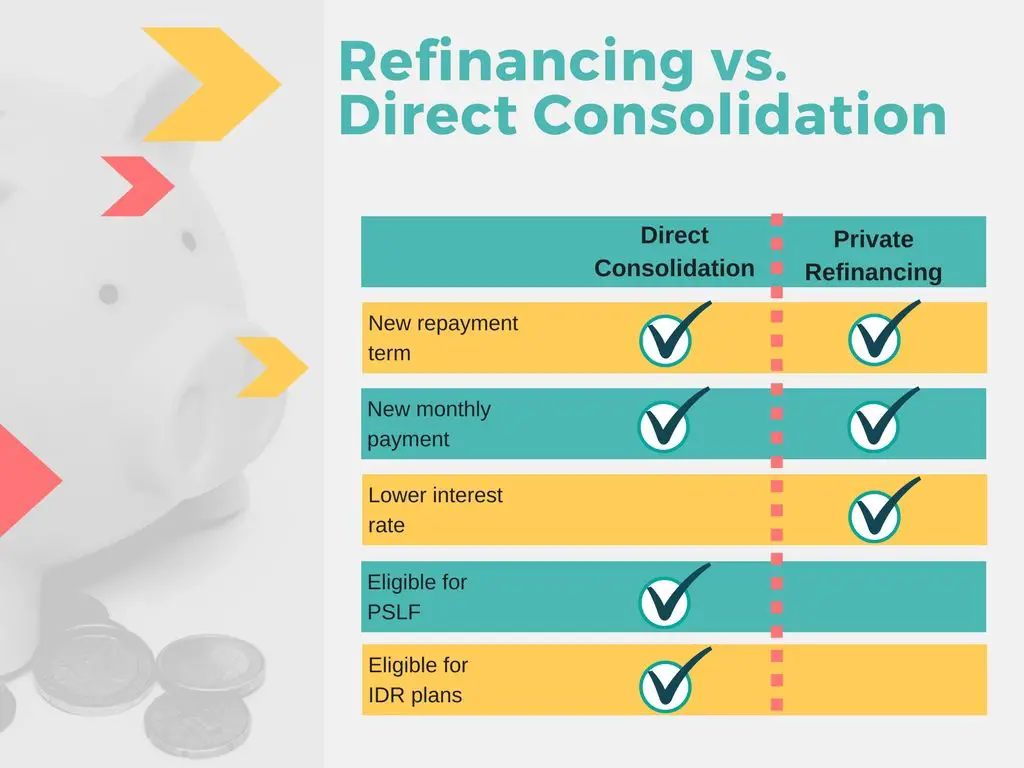

Should I Consolidate My Federal And Private Student Loans Together

You cant consolidate private student loans with the U.S. Department of Education. So, if youre interested in a federal Direct Consolidation Loan, youll only be able to consolidate your federal loans.

However, you can consolidate both federal and private student loans together into one loan if you refinance with a private lender. You may also get the added benefit of a lower interest rate and reduced monthly payments.

But because youre refinancing with a private lender, you will lose access to any federal benefit programs you may have had access to on your federal loans, like income-driven repayment and loan forgiveness. Consider carefully whether you plan to take advantage of these programs before you refinance.

Understanding The Difference Between Consolidation And Refinancing

Its important to understand how a consolidation differs from refinancing. When you consolidate your federal loans, your new interest rate will be a weighted average of all the rates on the loans being consolidated. That federal consolidation is done by the government and your loan servicer.

When refinancing and consolidating with a private lender, your new rate will be based on your creditworthiness at the time of your application and, if applicable, your cosigners credit history.

If your financial situation has improved since you took out the loan, you could see a lower interest rate which will likely save you money in interest over the life of the loan. If you are not offered a lower rate than what you already have, you should avoid refinancing as you will probably end up paying more in the long term.

Read Also: City Of Los Lunas Jobs

What Is Student Loan Debt Consolidation

Consolidation refers to the process of rolling multiple debts into a single, simplified repayment schedule. In this case, you combine your school loans into one repayment option that work for your budget. There are several ways to consolidate student debt, depending on the types of loans you have, your budget and your credit.

Which Are Eligible Loans For Private Consolidation

You can refinance and consolidate both federal and private student loans. This includes all types of federal loans, including Direct Loans, Stafford Loans, Parent PLUS Loans, as well as private loans.

Its important to note that when you refinance and consolidate, you can decide in your loan application which loans you want to refinance and which, if any, youre happy to keep at their current terms. Some people may want to refinance all their loans, and for others it may make sense to only refinance some of them.

When you refinance federal loans and private loans into one new private loan you will no longer be eligible to use repayment options included in the governments income-based repayment programs or forgiveness programs like public service loan forgiveness.

To decide, you should look at the loan repayment terms for each of your current loansand whether refinancing can help you do better. You can get an estimated rate from Earnest in just two minutes.

Don’t Miss: Free Grants For Dental Implants

Should You Consolidate Your Student Loans

Ultimately, only you can answer this question.

If you are overwhelmed by the sheer volume of federal student loans that you have, need to lower your monthly payment, want to convert variable-rate loans into fixed-rate loans, or need to avoid defaulting on your loans, then consolidation can help you achieve this.

If, however, you have made significant progress toward student loan forgiveness, you might want to reconsider consolidation, as this will reset the clock toward forgiveness.

Meanwhile, if you would like to lower your interest rates and are okay with the idea of giving up the benefits that come with federal student loans, you might want to consider refinancing your student loans with a private borrower instead.

Are There Any Fees To Consolidate

No, there are no fees to consolidate federal student and parent loans, including the Direct Loan and Federal PLUS loan. However, if a borrower was receiving a loan discount or borrower benefit from a FFEL program lender, the borrower may lose that benefit upon consolidation since the discounts are not provided by the promissory note.

You May Like: Peachtree City Job Seekers

Are There Any Early Payment/repayment Fees Or Penalties

No, there are no early repayment penalties for a federal consolidation loan. To make extra payments, the borrower may specify Extra payment to principal on any prepayment.

Borrowers who are planning on making extra payments on their loans may wish to avoid consolidation. When a borrowers loans are kept separate, the borrower can target the loans with the highest interest rates for accelerated repayment, saving money. Consolidation replaces these loans with a single loan with a single interest rate, eliminating the possibility of prepaying specific loans.

How To Consolidate Student Loans For Pslf

You can apply for a Direct Consolidation for free by submitting a consolidation loan application to the student loan servicer responsible for handling the program for public servants: FedLoan Servicing.

Follow these three steps to consolidate your student loans to qualify for Public Service Loan Forgiveness.

The consolidation process takes about six weeks to complete. You can submit the PSLF form before or after getting the new loan.

Learn More: Is Student Loan Consolidation a Good Idea?

Also Check: Dental Implant Assistance Programs

How To Get Approved For Consolidating Your Student Loans

Students who have graduated, left school or dropped below half-time enrollment are eligible to consolidate their federal student loans. There are no credit requirements for federal student loan consolidation. However, there are several other requirements that limit who can apply for a direct consolidation loan:

- The loans you want to consolidate must already be in repayment or in the grace period, which lasts six months after you graduate, leave school or drop below half-time enrollmentdepending on the type of loan.

- In general, if you already consolidated a loan, you cant consolidate it again without also consolidating another eligible loan.

- The loans you want to consolidate cannot be in default unless you make three consecutive monthly payments on the loan prior to consolidation or agree to repay your new direct consolidation loan under one of several income-related repayment plans.

- Likewise, consolidating a defaulted loan thats being collected through wage garnishmentor in accordance with a court orderisnt permitted unless the garnishment order is lifted or the judgment vacated.

In contrast, private student loan refinancing has approval requirements similar to traditional loans. To qualify, lenders typically require a credit score in the upper 600s, a debt-to-income ratio under 50% and a demonstrated ability to repay the loan.

Consolidating Student Loan Debt: Private Vs Federal School Loans

When youre talking about consolidation, student loans fall into two categories:

For the purposes of consolidation, it doesnt matter if you have subsidized or unsubsidized federal loans both consolidate in the same way. However, if you use federal loan consolidation options, those only apply to your government-backed debt. In other words, you cant use federal consolidation and repayment plans for private student loans.

Its also important to note that a Federal Direct Consolidation Loan doesnt consolidate debt in the traditional sense. It generally will not reduce the interest rate applied to your debt. Instead, it makes sure as many of your loans as possible are eligible for federal repayment plans and loan forgiveness.

Consolidating federal student loan debt is a two-part process.

If you work in public service as a teacher, nurse, or first responder, using this method of consolidation ensure you are eligible for Public Service Loan Forgiveness.

Don’t Miss: Where To Buy Gold Bars In Las Vegas

A Debt Consolidation Loan

A debt consolidation loan is provided by a bank or financing company and gives you a lump sum with which you can repay your existing student debts.

Then, you simply repay the loan directly to the lender.

This may be a good option for student debt consolidation if you have a better credit score now than you did when you got your initial student loans.

You may be able to get a lower interest rate with a debt consolidation loan, which will decrease the total amount you repay, as well as your monthly payments.

However, its important to note that this method of student debt consolidation will not typically work if you have government student loans.

Most banks are not willing to lend you money to repay government loans.

In addition, you may lose tax-deductible benefits when you consolidate your debt, and you may not qualify if you do not have enough assets to pledge as collateral.

What Are The Benefits Of Federal Consolidation Loans

- Reduces the monthly loan payment by as much as half, helping the borrowers cash flow

- Simplifies the borrowers finances, replacing multiple loan payments with only one payment a month

- Provides flexible repayment options with more affordable monthly payments

Federal consolidation loans allow borrowers to combine several federal student loans into one loan to streamline loan repayment.

The monthly payment amount may decrease because repayment can be spread over a longer time period. Because there are no penalties for prepaying the loan in full or in part, borrowers may make larger monthly payments or extra payments if they wish. Borrowers may also change repayment plans at least once a year.

Although student and parent borrowers are each eligible to consolidate their loans, they may not consolidate their loans together. Married borrowers may no longer consolidate their loans together.

Also Check: State Jobs In Las Vegas Nv

How Does Student Loan Consolidation Work

There are two types of student loan consolidation: private and federal. Both private and federal consolidation let you combine all your loans into one. But federal consolidation is only for federal loans and a private consolidation loan can combine both federal and private loans.

-

Federal: Federal consolidation is offered through the federal government in the form of the Federal Direct Consolidation Loan Program. It willcombine all your federal loansinto one so you dont have to worry about multiple loans or servicers. You can also get a lower monthly payment if you want to lengthen your repayment period. The interest rate on a Direct Consolidation Loan is the weighted average of the rates on your existing loans, so you generally wont save any money with federal consolidation, but it does help you simplify your payments.

-

Private: Unlike federal consolidation, private student loan consolidation allows you to combine both private and federal loans into one. It also gives you the option to lower your monthly payment by extending your loan term . Or you could shorten your loan term or potentially lower your interest rate which could save you money over the life of your loan.

Consolidating Federal Student Loans More Than Once

You can consolidate your government student loans more than once only in either of these situations:

-

You have federal loans that werent included in a previous consolidation.

-

You previously consolidated loans under the Federal Family Education Loan Program, or FFELP, consolidation program.

If you have FFELP-consolidated loans, merging them under the Direct program can help you get out of default. Consolidation is also necessary if you have FFELP loans and want to enroll in Public Service Loan Forgiveness.

If you dont meet the qualifications to consolidate again but want to extend your term to get lower payments, consider other student loan repayment options. Contact your student loan servicer to discuss income-driven repayment, extended student loan repayment or forbearance.

Read Also: Best Entry Level Government Jobs

What Are The Pros And Cons Of Student Loan Consolidation

The number one advantage of student loan consolidation is a simplified loan payment. You also have the option to select a longer loan term that can reduce your loan payment. Depending on the loans you have, there may be some downsides to student loan consolidation. Perkins loans, for example, may be forgiven for teachers and other public servants. Consolidating them would eliminate access and enrollment to this loan forgiveness option. Additionally, any grace period or deferment you have with your current loan program also goes away if they are consolidated.

How To Combine Student Loans With Your Spouse

To use your spouse as a cosigner on your student loans, you should refinance them first.

It works like this. To apply for a loan, youll need to locate a lender who will accept a cosigner. Once you respond yes to whether you have a cosigner, youll provide their legal name, Social Security Number, birth date, and salary.

Upon completion of the refinance, your spouses credit record should show the loan as having been completed.

Don’t Miss: Government Jobs For History Majors

Can You Combine Student Loans With Your Spouse

Its impossible to combine your school loans with your spouse. Student loan spousal consolidation loans are no longer available from the federal government.

From 1993 through 2006, the U.S. Education Department offered spousal consolidation loans, often known as joint consolidation loans. It allowed two married federal loan borrowers to consolidate their debts into a single loan.

Your existing loans are paid off with a consolidation loan. Youre left with a single loan and a single payment to make each month. Its a technique that can make the repayment procedure go more smoothly.

You have one joint consolidation debt rather than many monthly payments.

In theory, the concept may seem appealing. However, this method of consolidating student loans has several drawbacks.

Refinancing Your Student Loans

Combining federal student loans and private loans through the refinancing process wont make sense for every person, but it can provide great benefits for some.

Now that you know its an option and understand how it works, youre hopefully in a better position to assess whether its the right option for you.

While refinancing your federal student loans will eliminate you from federal protections and benefits, its worth noting that some private lenders offer their own benefits and protections. At SoFi, for example, if you lose your job through no fault of your own, you may qualify to pause your payments. And SoFi can even help you find a new job through our career services program for members.

If youre interested in refinancing your student loans, you might want to consider evaluating a few different options, since requirementsas well as interest rates and loan termscan vary from lender to lender.

In addition to unemployment protection for qualifying members, when you refinance your student loans with SoFi there are no origination fees or prepayment penalties.

The application process can be completed easily online and youll have access to customer service seven days a week. You can find out if you prequalify, and at what rates, in just a few minutes.

Learn more about refinancing your student loans with SoFi.

SLR16109

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

You May Like: Goverment Jobs In Las Vegas

Make A Plan To Get Out Of Default

If the default isnt a mistake, its time to try to fix it.

For federal loans, youve got a few different options:

Keep in mind that options may look a bit different for private student loans. While you arent likely to have rehabilitation available to you, you can try to work with your lender to create a new repayment plan or negotiate to settle the debt.