Are Treasury Bills A Good Investment

As with all things, whether or not investing in T-bills is a good thing depends on your goals and risk appetite. What makes T-bills unique are their safety and ability to appreciate in times of crisis.

But if you are interested in generating income out of your portfolio you should probably look elsewhere. As we mentioned, you are not paid interest while holding T-bills, unlike with most bonds. Instead, you are paid the interest at the end of the term. Secondly, as per the U.S. Treasury website, the highest interest rate on a T-bill is around 0.10%. Either way you slice it, you are not going to be living in retirement off of Treasury bills.

However, for the longer-term T-notes and T-bonds, interest is paid every six months. But again, these pay rather low-interest rates . And these tie up your money for a very long time. Who knows what interest rates will do in the future?

One thing you can depend on is safety. As mentioned before, U.S. Government bonds are the benchmark for safety in the bond world, and the Treasury bill is its crown jewel. This is a major reason international investors also buy T-bills.

Treasury Bond Risks Vs Returns

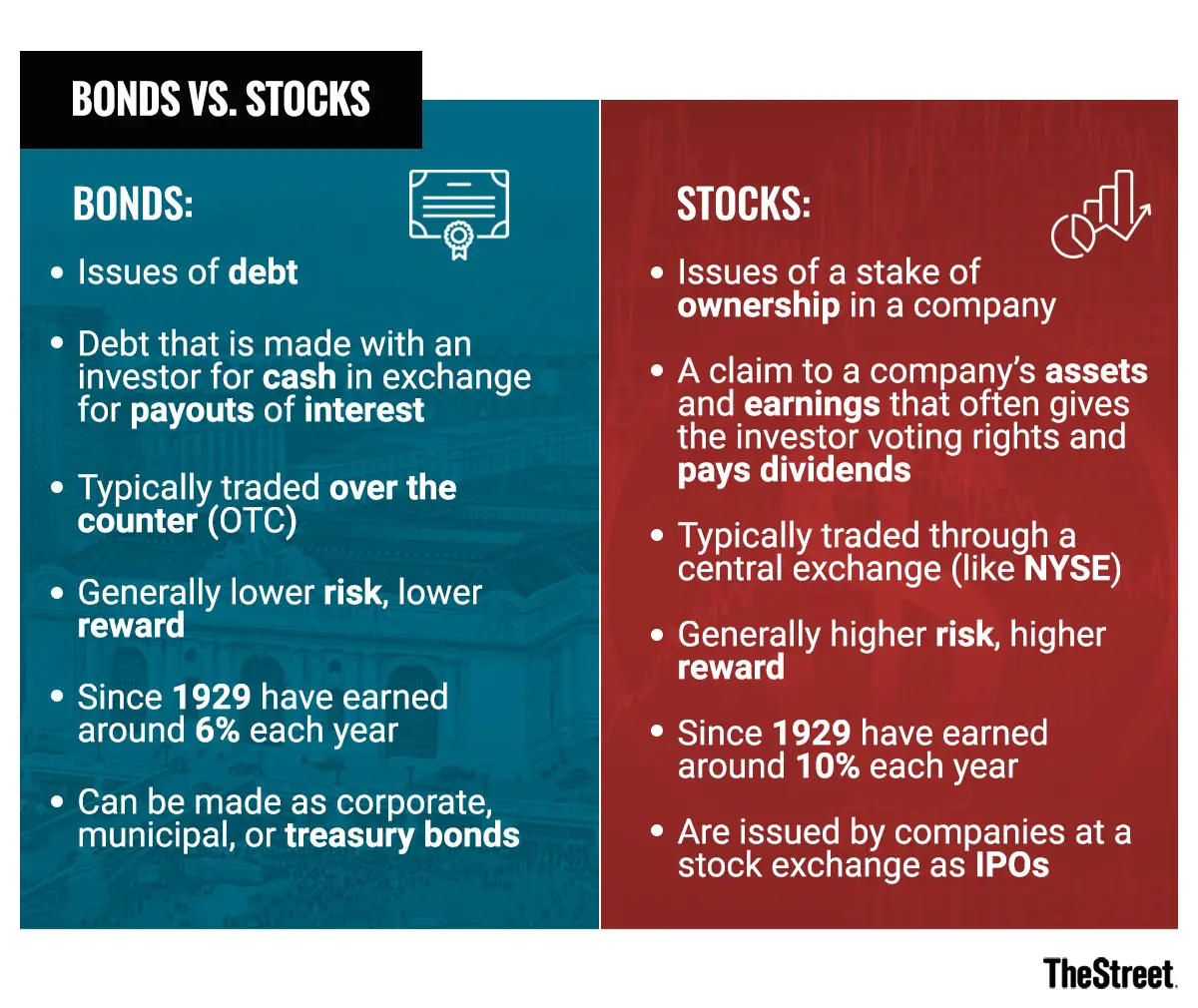

With investing, usually the higher the risk, the higher the return. This applies here: Bonds usually have less risk versus stocks, which means they usually generate lower returns versus stocks. Because Treasury bonds are typically safer than other bonds, that also means investors will likely see lower returns.

When financial advisors talk about asset allocation within a portfolio, it means investment dollars are spread among three main asset classes, or groups of similar investments. Stocks generally provide the greatest long-term growth potential but are the most volatile. Bonds can generate income and compared to stocks, usually have more modest returns and can help balance out volatility. Cash has the least risk and lowest return to buffer volatility or cover unexpected expenses.

The Difference Between Treasury Bonds And Treasury Notes

Treasury bonds are part of a larger federal government family of Treasury securities, comprised of Treasury bonds, Treasury notes and Treasury bills.

Treasury notes and Treasury bonds are essentially the same type of instrument and only differ in original maturities, explains Robert R. Johnson, professor of finance at the Heider College of Business, at Creighton University. Technically, the government only issues Treasury bonds in original 20-to-30-year maturities and it issues Treasury notes in original maturities ranging as short as two years and no longer than 10 years.

Purchasers of Treasury bonds and notes receive an interest payment every six months, Johnson notes.

Treasury bills , the short-term debt of the government, differ from both Treasury bonds and Treasury notes.

T-bills are issued with original maturities of four, eight, 13, 26, and 52 weeks, Johnson says. They dont pay interest and are issued on a discount basis . With T-bills, the investor receives a higher amount when the bill matures than they paid to acquire it.

Also Check: Government Jobs In La Plata Md

What Are The Risks Associated With Investing In Bonds

As with any investment, buying bonds also entails risks:

- Interest rate risk: When interest rates rise, bond prices fall, and the bonds that you currently hold can lose value. Interest rate movements are the major cause of price volatility in bond markets.

- Inflation risk: Inflation is the rate at which the price of goods and services rises over time. If the rate of inflation outpaces the fixed amount of income a bond provides, the investor loses purchasing power.

- Credit risk is the possibility that an issuer could default on its debt obligation.

- Liquidity risk: Liquidity risk is the possibility that an investor might wish to sell a bond but is unable to find a buyer.

- Stocks tend to earn more money than bonds. In the period 1928-2010, stocks averaged a return of 11.3% bonds returned on average 5.28%.

- Bonds freeze your investment for a fixed period of time. For example, if you buy a 10-year-bond, you cant redeem it for 10 years. This creates the potential for your initial investment to lose value. Stocks, on the other hand, can be sold at any time.

You can manage these risks by diversifying your investments within your portfolio.

Bonds With Call Or Put Option

The distinguishing feature of this type of bonds is the issuer enjoys the right to buy-back such bonds or the investor can exercise its right to sell them to such issuer. This transaction shall only take place on a date of interest disbursal.

Participating entities, i.e. the government and investor can only exercise their rights after the lapse of 5 years from its issuance date. This type of bonds might come with either

- Put option only

In any case, the government can buy back its bonds at face value. Similarly, investors can sell such bonds to the issuer at face value. This ensures the preservation of the corpus invested in case of any downturn of the stock market.

Recommended Reading: How Much Does Government Freight Pay

How I Bond Interest Rates Work

I bond rates shift twice a year based on inflation.

There are two parts to the rate: a fixed rate, which stays the same after purchase, and a variable rate, which shifts twice per year based on inflation.

The Department of the Treasury announces new rates every May and November, and you can estimate the next variable rate about two weeks before from the consumer price index reports released in April and October.

The estimates offer a brief period to know roughly what you’ll earn for one year, which is how long you’ll lose access to the funds after buying.

Investors can still lock in the 9.62% annual interest for six months as long as they complete the purchase by Oct. 28. Six months after your purchase date, you’ll earn an estimated 6.48% for another six months.

“It’s nice to know what interest rates you will get when you’re committing to a 12-month lockup,” said Jeremy Keil, a certified financial planner with Keil Financial Partners in Milwaukee.

While it’s too early to estimate rates for May 2023, buying I bonds before the end of October means you’ll receive the May and November rates for six months each.

“That’s an option if someone wants the best of both worlds,” said Ken Tumin, founder and editor of DepositAccounts.com, who tracks I bonds, among other assets.

Discover The Potential Advantages Of Fixed

Fixed-income investments may be right for you if you want to experience these benefits as part of a diversified portfolio.

- Preserve wealth while fixed-income prices may fluctuate, you can rely on receiving the full-face amount when your investment matures, subject to credit risk

- Diversify your portfolio diversifying your investments across asset classes may result in less risk exposure for your overall portfolio

- Generate income fixed-income investments may provide a steady stream of monthly, quarterly, or semi-annual income to help supplement your income or help fund your retirement

- Manage interest rate risk creating a ladder through staggered maturities can potentially help you manage interest rate risk in both rising and falling environments and experience less exposure to interest rate volatility

Recommended Reading: Government Dental Grants For Seniors

Recommended Reading: Data Governance In Google Cloud Platform

Brokerage Firm Role And Compensation

In the majority of bond transactions, a brokerage firm acts as principal, selling you a bond it already owns. When a brokerage firm sells you a bond in a principal capacity, it may increase or mark up the price you pay over the price the firm paid to acquire the bond.

Similarly, if you sell a bond, the firm may offer you a price that includes a markdown from the price at which it believes it can sell the bond. The markup or markdown is the brokerage firm’s compensation.

If the firm acts as agent, meaning it acts on your behalf to buy or sell a bond, you may be charged a commission, which will appear on your trading confirmation.

What Are The Best Bonds To Buy

Knowing the best bonds to buy largely depends on the investor’s risk tolerance, time horizon, and long-term financial goals. Some investors might invest in bond funds, which contain a basket of debt instruments, such as exchange-traded funds. Investors who want safety and tax savings might opt for Treasury securities and municipal bonds, which are issued by local state governments. Corporate bonds can provide a higher return or yield, but the financial viability of the issuer should be considered.

Don’t Miss: Native American Money From Government

Buying And Selling Treasury Bonds

A Treasury note is sold by the Treasury Department via an online auction. Once the note has been purchased by an investor, there are two options. The investor can hold the bond until maturity, in which case the initial amount invested would be paid back when the bond matures. If the investor holds the bond to maturity, the amount that was invested is guaranteed to be paid back by the U.S. government.

The investor also has the option of selling the bond before it matures. The bond would be sold through a broker in the secondary marketcalled the bond market. However, investors should be aware that their initial investment is not guaranteed if the bond is sold early through the bond market. In other words, they may receive a lower amount than what they had initially invested.

What Are The Types Of Government Bonds

The terminology surrounding bonds can make things appear much more complicated than they actually are. Thats because each country that issues bonds uses different terms for them.

In the US, bonds are referred to as Treasuries. They come in three broad categories, according to their maturity:

- Treasury bills expire in less than one year

- Treasury notes expire in one to ten years

- Treasury bonds expire in more than ten years

Government bonds from the UK, India and other Commonwealth countries, for example, are referred to as gilts. The maturity of each gilt is listed in the name, so a UK government bond that matures in two years is called a two-year gilt.

Other countries will use different names for their bonds so if you want to trade bonds from governments outside of the US or UK, its a good idea to research each market individually.

Also Check: Government Help For Single Moms

What Are Tips Bonds

Treasury Inflation Protected Securities, commonly abbreviated as simply TIPS, are U.S. Treasury securities designed specifically to compensate investors for inflation.

Though the bonds will carry a fixed interest rate, the principal value of the securities will increase with inflation. The opposite is also true the value will decrease in a deflationary environment. However, the securities will pay full face value if they are held to maturity, even in a deflationary market. Youre guaranteed to receive the greater of the adjusted principal value or the original value of the security.

TIPS are issued by the Treasury in denominations $100. Terms come in three tiers, five, 10 and 30 years. Interest on the securities is paid every six months.

While the interest and principal increases are subject to federal income tax, both are exempt from state and local income tax. This gives them at least a slight tax benefit, especially in high tax states.

And since TIPS are issued by the United States Treasury Department, they have the highest safety rating possible.

You May Like: Best Investment Companies For Beginners

Do I Have To Be A Us Citizen To Invest In A Us Government Bond

No. Your ability to purchase US government bonds may be affected by your home government’s laws and regulations, but generally, non-US citizens are allowed to buy US government bonds. You will need either a Social Security number or an Individual Taxpayer Identification Number. Similarly, U.S. citizens can also typically invest in government bonds from other countries.

Read Also: American National Government College Class

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Treasury securities vary based on the type of maturity:

How To Buy I Bonds

After inflation rose to a 40-year high in 2022, Series I savings bonds — better known as “I Bonds” — re-entered the mainstream conversation. In their latest release, I Bonds pay an annualized rate of 9.62%. Given persistent inflation, they will continue to pay competitive interest in the immediate future.

This article will review where and how to purchase I Bonds and answer a number of frequently asked questions.

Recommended Reading: Government Jobs That Pay Off Student Loans

How To Invest In Government Bonds In India

Now that you have understood what are G-Secs and the benefits they have to offer, lets understand how to buy Indian Government Bonds or the process to invest in Govt bonds.

You can invest in Government Bonds through brokers or through the exchange which may get tedious. Or, you can invest with IndiaBonds in 3 simple steps:

- The first step to invest in govt bonds is to sign up on IndiaBonds.com.

- As a second step, complete your KYC online in less than 5 mins without the need of any paperwork or uploads.

- Step three, Browse through the curated packs and click on Government Securities / State Development Bonds on the explore Page to view a variety of Government Bonds for investments

- Pick your choice of Government Bonds from our curated list of Bonds on our website.

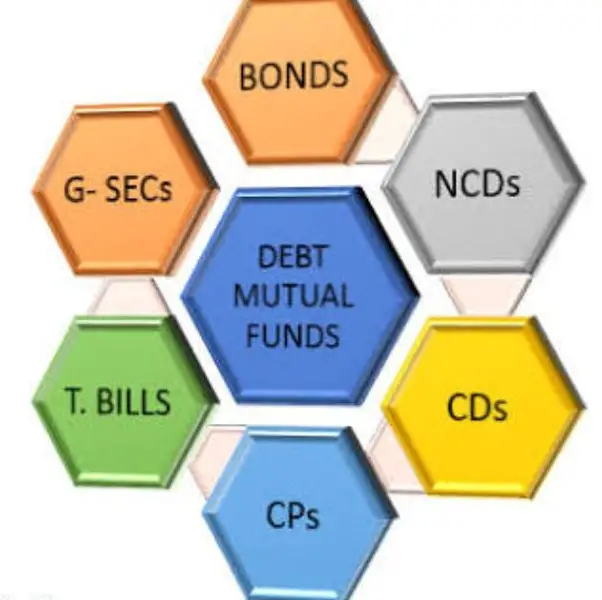

What Types Of Bonds Are There

Bonds also known as fixed income instruments are used by governments or companies to raise money by borrowing from investors. Bonds are typically issued to raise funds for specific projects. In return, the bond issuer promises to pay back the investment, with interest, over a certain period of time.

Certain types of bonds corporate and government bonds are rated by credit agencies to help determine the quality of those bonds. These ratings are used to help assess the likelihood that investors will be repaid. Typically, bond ratings are grouped into two major categories: investment grade and high yield .

The three major types of bonds are corporate, municipal, and Treasury bonds:

Dont Miss: How Much Money To Invest In Cryptocurrency

You May Like: Government Education Grants For Adults

What Are The Risks Of Government Bonds

You might hear investors say that a government bond is a risk-free investment. Since a government can always print more money to meet its debts, the theory goes, youll always get your money back when the bond matures.

In reality, the picture is more complicated. Firstly, governments arent always able to produce more capital. And even when they can, it doesnt prevent them from defaulting on loan payments. But aside from credit risk, there are a few other potential pitfalls to watch out for with government bonds: including risk from interest rates, inflation and currencies.

Municipal Bonds Vs Government Bonds

The international bond market is an attractive low-risk investment for long-term investors. In this case, the investor purchases treasury notes and earns interest on the money they loan to the government. Government bonds are popular as a safe-haven asset, among institutions, and they flock to them to avoid volatility in the stock markets and other risky investments.

However, the interest investors earn on government bonds is subject to capital gains tax. Therefore, they may not suit short-term investors that dont want to share a portion of their investment gains with the government.

Government bonds also have a relatively low yield, as they are attached to the Federal Funds Rate, which is currently a paltry 2.5-percent.

The Federal Reserve is set to reverse its current course of monetary policy, from a tightening phase to an easing environment where they cut rates. Therefore, you can expect yields on government bonds to decline over the next policy cycle, which could last 4-years or longer.

If you hold government bonds during this period, and the Fed cuts rates to zero, or negative territory, you could end up paying the government to loan them money and thats not an ideal investment strategy.

However, municipal bonds, or munis, are an attractive alternative to government bonds, and they carry a much higher interest rate.

These bonds are free of any capital gains taxes, and you get to keep all of the money you make on the investment.

Don’t Miss: Us Government I 9 Form