Who Is Eligible

The program applies only to Direct loan borrowers, but it covers all types of Direct loans, including Stafford, PLUS and consolidation loans.

Parent PLUS borrowers are eligible based on their own employment, not on the employment of the student on whose behalf they borrowed.

Borrowers with other federal government loans can consolidate with Direct Loans in order to obtain this benefit.If you already have a FFEL consolidation loan, you are allowed to reconsolidate with Direct Loans to start qualifying. Be careful if you want to consolidate your Direct loans. If you make qualifying payments on a Direct loan and then consolidate that loan, youll lose credit for the PSLF payments.

In order to qualify, you must not be in default and you must have made 120 monthly payments on your loans AFTER October 1, 2007. Payments can be made through any one or combination of eligible repayment plans, including income-driven repayment, ten year standard plan payments, or graduated or extended payments of not less than the monthly amount that would be due under a ten year standard plan.

You must be employed in a public service job at the time of the forgiveness and must have been employed in a public service job during the period in which you made each of the 120 payments.

What You Can Do

These dire consequences can be avoided, but you need to act before your loan is in default. Several federal programs are designed to help, and they are open to all who have federal student loans, such as Stafford or Grad Plus loans, although not to parents who borrowed for their children.

Three similar programs, called Income-Based Repayment , Pay As You Earn , and Revised Pay As You Earn , reduce loan payments to an affordable level based on the applicants income and family size. The government may even contribute part of the interest on the loan and will forgive any remaining debt after you make your payments over a period of years.

The balance is indeed forgiven, but only after 20 to 25 years of payments. The payments may be reduced to zero, but only while the indebted person has a very low income.

As of Aug. 23, 2022, under the Biden administration, the United States Department of Education approved $32 billion in student loan debt relief for over 1.6 million borrowers, a significant number of whom were victims of for-profit college fraud.

The Public Service Loan Forgiveness Program is designed specifically for people who work in public service jobs, either for the government or a nonprofit organization. People who participate may be eligible for federal debt forgiveness after 10 years on the job and 10 years of payments.

Do Student Loans Go Away After Seven Years

Yes, typically after seven years, defaulted student loans are removed from your credit report, like all defaulted loans. This primarily applies to private student loans. Note that this is not a reason to not pay your student loans as you still owe the debt and if the debt is transferred, it may show up on your credit report again.

You May Like: Government Jobs In Boston Mass

Under The Pslf Waiver Relief Is Not Dependent On Current Employment

While the employment requirements for PSLF remain largely unaltered under the waiver, the Department did enact one important change. Under the original PSLF rules, borrowers were required to maintain qualifying employment until their loans were actually forgiven. But under the Limited PSLF Waiver, this is not the case. According to the Department, Under normal PSLF Program rules you must be employed at a qualifying employer when you receive forgiveness. However, that requirement is waived until Oct. 31, 2022, as a result of this limited-time opportunity.

Use Chipper For The Best Path To Forgiveness

Finding your path to student loan forgiveness is easier than ever before. Chipper helps members find better Income-Driven Repayment plans every day. Once enrolled in an eligible repayment plan, we can help you explore your forgiveness options and understand your path towards forgiveness. and get on track with your student loans.

Also Check: Public Relations Jobs In Government

How To Apply For Nclrp

The application is lengthy and requires documentation from your employer as well as additional supporting information. Because it can be a bit complicated, its recommended that you first familiarize yourself with the Application and Program Guidance document before you begin your application.

In general, you may be ready to apply for the forgiveness program if you meet the following criteria:

- Youre an LPN, APRN, or nurse faculty member.

- You earned your degree from an accredited nursing school in a U.S. state or territory.

- You work full-time in a CSF in a high-need area or accredited nursing school.

Its also worth noting that the forgiveness is given out depending on your financial need, so there may be applicants who receive higher amounts based on their needs.

Student Loan Repayment Assistance Programs For Other Careers

Most state LRAPs award loan assistance to professionals in exchange for two years of service. The most common occupations are doctors, nurses, teachers and lawyers, but some other career paths qualify, too.

Several LRAPs for doctors, for instance, help out pharmacists and veterinarians. Other programs, like the Alfond Leaders Program in Maine, award people in STEM careers.

Even if youre not a doctor, nurse, teacher and lawyer, check your states offerings to find out if it has a loan repayment assistance program for you.

Read Also: Do I Qualify For Any Government Assistance

Millions In Student Loan Benefits Paid Annually

According to federal statistics, in calendar year 2013, the latest annual period for which data was available, 31 federal agencies provided 7,314 employees with a total of more than $52.9 million in student loan repayment benefits. The average annual benefit was $7,233.

This is wonderful news for recent college grads in the job market, those who are already working for the government, as well as individuals thinking about going back to school or making a job/career switch. Essentially, these federal and independent agencies use student loan benefits as a recruitment and retention tool.

Best of all, a very broad array of workers can qualify to have their student loans repaid, including accountants, analysts, civil service members, psychologists, pharmacists, engineers, scientists, lawyers, nurses, administrative professionals, human resources specialists and more.

In 2013, there were a total of 85 government or quasi-government agencies that either provided help repaying student loans, or had established programs or were in the process of creating programs to offer student loan repayment assistance.

Here is a list of the federal government agencies and independent agencies that will repay your student loans.

Should I Refinance My Student Loans

The simple answer is . . . maybe. Refinancing your student loans could be the right thing for you, but it depends on your specific situation. Here are the only times when we recommend refinancing your student loans:

- When its 100% free to make the change

- When you can keep a fixed rate or swap a variable rate with a fixed rate

- When you dont have to sign up for a longer repayment period

- When your new interest rate ends up being lower than your current interest rate

Refinancing your student loans could help you gain some major traction to pay off that debt for good. Thats something that can actually help you make progress in the right directionnot just kick the can farther down the road like the government is doing here.

See if refinancing your student loans is the right thing for youit costs you nothing to apply, and it only takes about 10 minutes. Get your new rate today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Dont Miss: Entry Level Government Jobs San Diego

Also Check: How To Apply For A Free Government Cell Phone

Government Grants For Dependent Expenses

There are lots of works and responsibilities that a person has to handle in their house. But because of their low income, they cant able to handle all the expenses and one and more important thing is the child care for them. Also, the government gives priority to child care and makes sure that they will able to handle these essential duties. Because several families did not have any income source or homeless and because of this they are unable to take care of their child. They also dont afford to fulfill their basic needs because of their low income.

These are the families which are not able to handle the expense of anyone extra thing even it is cheap. Thats why with the grants and schemes these families will get extra assistance with the financial help, so they can get out to pay off debt. For this, many states have the authority that they can provide specific help to those families. With their grant and scheme, they help them to pay off a debt to those people who need it. So, with the use of the grant, they can support their child and also care for them.

Now, you see that there are different classes for the grants and one can take advantage of those grants. But only on one condition that they will be eligible for the grant. And for this, they have to first check the eligibility criteria, and then they have to move their step forward in the direction of applying for the grant.

What Is The Nurse Corps Loan Repayment Program

The Nurse Corps Loan Repayment Program is for registered nurses who work in underserved communities at critical shortage facilities. Applications are accepted once a year to those interested in applying.

The NCLRP supports registered nurses, advanced practice registered nurses, and nurse faculty by paying up to 85% of their unpaid nursing education debt.

Individuals who work at a qualified facility can get 60% of their student loans paid off over two years of employment. Borrowers have the option of getting an additional 25% of their loans paid off by the Nurse Corps program for a third year.

In exchange, accepted applicants must work at least two years at a critical shortage facility or other appropriate locations in the United States.

Also Check: Office 365 Government G3 Pricing

Other Ways To Pay Off Nursing Student Loans

If you decide that the student loan forgiveness program is not right for you, or if youd like to explore other options, some of the other ways to pay off nursing student loan debt include:

- Income-driven repayment plans: These plans are most appropriate for nurses whose debt is higher in comparison to their income, because their loan payments will be lower and based on their income. Using this plan, if you make payments on your federal IDR loans for 20 to 25 years, your remaining debt can be forgiven.

- Travel nursing: Travel nursing can also be an option to help you pay back your student loan debt faster. Although travel nursing agencies may not offer specific student loan forgiveness, many offer different types of bonuses, as well as stipends that can help boost your pay. You could even work part-time travel nursing jobs in your local area in addition to a regular RN job to get additional income, if needed.

- Refinancing your student loans: In some situations, it may also make financial sense to refinance your student loans to consolidate or lock in a lower interest rate from a private lender. Keep in mind that if you choose to refinance any federal student loans, however, they will become private loans, so you wont be eligible for any federal loan forgiveness programs on the balance.

How Many Companies Offer Student Loan Repayment

According to a recent study by the Employee Benefit Research Institute, 17% of employers with 500 or more employees offered student loan repayment assistance in 2021, up from 16% in 2020.

Here are some of the most common ways that employers offer student loan repayment assistance:

-Employer match: an employer matches a portion of an employees student loan payments. For example, if an employer offers a 50% match, they will match 50% of an employees monthly student loan payments up to $500 per month.

-Student loan repayment program: this is one lump sum payment toward your student loans at the end of your employment with the company. For example, if you work for a company for five years and then leave after earning $100K in salary over that time period, they may pay off $50K of your student loans as a parting gift.

Read Also: American Government In Christian Perspective

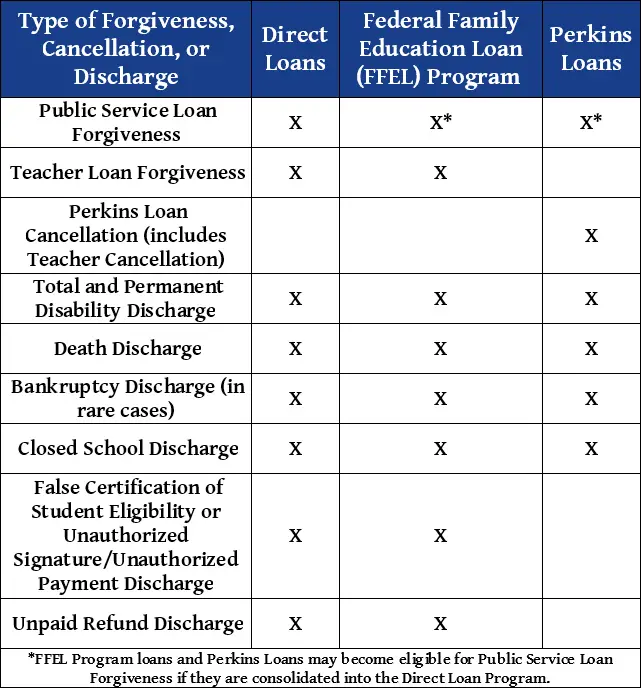

Perkins Loan Cancellation Options

Perkins loans operate very differently that most student loans. These loans are offered and administered by where you attended school. They also have a lot more loan forgiveness options than other loan types.

Perkins loans have unique requirements for loan cancellation based on the field you work in. Schools award these Federal loans to high-need students attending or planning to attend college. Make sure you fill out the FAFSA each year and check your financial aid award to see if you qualify.

Depending on the profession , Perkins loan borrowers can have up to 100% of their loan cancelled over the course of 5 years .

Heres how it works:

- 15% of their principal balance and accrued interest can be cancelled after their first and second year of qualifying service.

- 20% of their principal balance and accrued interest can be cancelled after their third and fourth year.

- 30% of their principal balance and accrued interest can be cancelled after their fifth year.

Perkins loans also offer concurrent deferment if you are performing qualifying service.

Combining that postponement with these cancellation options means you could potentially never have to make payments on these loans. Thatâs a fantastic deal!

The professions eligible for cancellation and the requirements are listed below.

Nurse or Medical Technician: You must be a full-time nurse or medical technician. You may receive up to 100% student loan forgiveness. Check out our full guide to student loan forgiveness for nurses.

Grants To Pay Off Student Loans For Single Mothers

This one is a bit difficultthere arent a lot of student loan forgiveness programs specifically for single mothers.

However, if youre a single mom who needs student loan debt relief, any of the above may be an option depending on your career, the state you live in, and other circumstances.

Which leads us toâ¦

Don’t Miss: List Of Government Contracts For Bid

I Couldve Made More Money By Investing

My student loans had various interest rates ranging from around 4% to just over 6%. During the years I was repaying my debt, these were the yearly returns for the Dow Jones:

In all but one of those years, the returns I couldve received from investing in an index fund that tracks the performance of the Dow would have exceeded the savings I made by paying off my loans.

I was so focused on paying off my debt that I even waited to start investing for retirement which meant I missed out on tax breaks for investing in an IRA. So my opportunity cost was even higher.

Careers That Will Help Pay Off Your Student Loan Debt

The amount of student loan debt in America is a staggering number. Its estimated that Americans carry at least a trillion dollars in student loan debt. Yes, some colleges have a much higher tuition than others, but at least two thirds of college graduates are carrying some type of student loan debt. Couple that with a limping economy, and the job horizon for many first entering the work force, can be depressing. But there is hope! Some good careers will actually help you pay your student loans. In fact, some public service jobs will even pay your loans completely.

Check out our student loan calculator.

You May Like: Student Loan Forgiveness By Government

Student Loan Repayment Help For Federal Employees

Many federal jobs qualify for student loan debt repayment help up to $10,000 per year. Under 5 U.S.C. 5379, agencies may repay the student loans of federal employees in order to attract or keep highly qualified individuals. These repayments may not amount to more than $60,000 in total.

Selection of employees to receive assistance with repaying student loans must be in accordance with merit principles. This authority is not an entitlement. As with any incentive, it is used at the discretion of the agency. If an agency chooses to use it, the agency will need to develop a plan that describes how it will be implemented within that agency.

People interested in participating in this program must contact the agency in which they work or wish to work for details.

Note: The Veterans Affairs Department operates several student debt repayment programs for its own employees with different terms. See www.vacareers.va.gov/Benefits/EducationSupport.

Rent Your Pad To Raise Cash

Even if your home is relatively modest, someone will likely leap at the chance to call it their own for a weekend at the right price, of course. If you can arrange to stay elsewhere for a while, , you can make a sizeable amount of cash on popular platforms like Airbnb.

According to the companys numbers, hosts average $924 a month in earnings not bad for a gig that doesnt require much work in the traditional sense of the word. Of course, your pads Airbnb potential hinges on the desirability of your hometown as a destination. California, a state that attracts visitors in droves, saw its hosts earn $1 billion in 2016, but theres no guarantee your hometown will fetch high nightly prices.

Additionally, many of the nations largest cities are attempting to regulate Airbnb and its competitors, and you could run afoul of your landlords rules as well. Even if youre tempted to rent your place under the radar, weigh the possibility of acrimony with your neighbors. When guests get rowdy while youre away, theyre the ones wholl know.

Read Also: Government Grants For Stroke Victims