Id2 Overseas Private Investment Corporation

OPIC is the U.S. Governments development finance institution. It mobilizes private capital to help solve critical development challenges and in doing so, advances U.S. foreign policy and national security objectives. Because OPIC works with the U.S. private sector, it helps U.S. businesses gain footholds in emerging markets, catalyzing revenues, jobs and growth opportunities both at home and abroad. OPIC achieves its mission by providing investors with financing, guarantees, political risk insurance, and support for private equity investment funds.

I.D.2.a. Small and Medium Enterprise Financing Program

|

Description |

For companies with annual revenues less than $400 million, this program provides medium- to long-term funding through direct loans and loan guarantees to eligible investment projects in developing countries and emerging markets. |

|

Links & Contact Info |

Information Officer: 202-336-8799 or |

|

Notes |

The Expanding Horizons workshop is OPICs premier outreach event. Learn more about OPIC’s upcoming workshops and seminars. |

What Credit Score Do You Need For An Sba Loan

The Small Business Association does not specify a minimum credit score required to secure an SBA loan. However, SBA loans are provided by lenders who may have minimum score requirements. Typically, this minimum is about 620. However, the higher your score, the more likely you are to receive approval.

Traditional Banks: Best For Established Businesses

Traditional lenders offer some of the lowest rates and highest credit limits. Plus, many of them offer a choice of both unsecured and secured business lines of credit.

So why are they so far down on our list? Simple: big banks have much higher application criteria than most online lenders.

For example, almost all banks require your business to be at least two years old, and some insist on more than that. For example, to get a Wells Fargo business line of credit, your business has to be at least three years old.

And while the alternative lenders above look for credit scores ranging from the low to mid-500s, most traditional lenders accept only credit scores over 700. Put simply, banks typically offer lines of credit to only their most creditworthy borrowers.

If your business can meet those kinds of qualifications, by all means, get your business line of credit from a traditional bank. Youll probably get a stellar deal, especially if you do your business banking at the same financial institution. But for many small businesses, alternative lenders are the way to goeven if they cost a little more.

Recommended Reading: Irs Tax Exempt And Government Entities Division

Is My Business Eligible

Banks and credit unions are responsible for issuing CSBFP loans, and they determine your ultimate eligibility for a loan. However, Canadian government guidelines set out the following minimum requirements:

- Your business must operate, or be planning to operate, in Canada

- Your business needs less than $10 million in gross revenue in the year you apply

- You must be a for-profit business farms, charities and religious organisations are not eligible

- The loan mus be used to purchase and improve eligible business assets

If these requirements are met, you and the lender can negotiate a loan amount up to $1,000,000 and the other terms of that loan.

What Is The Easiest Business Loan To Get

The easier business loan to get is one that is secured. This means the loan is backed by collateral, and the lender gets that collateral if the business owner defaults on the loan. The collateral pledged usually includes property, inventory, equipment, savings accounts, blanket liens, and personal guarantees.

You May Like: Government Jobs St Paul Mn

How Hard Is It To Get A Small Business Loan

Getting a small business loan may prove more challenging than other financing options like business credit cards. Although qualification requirements vary by lender, most lenders typically look at the business owners personal credit score and the business annual revenue. Many lenders require a minimum personal credit score of 600 to 660 and annual revenue between $100,000 and $250,000.

We recommend confirming the qualification requirements with your preferred lender before applying.

Business Credit Cards Vs Business Line Of Credit

Business credit cards are best suited for frequent everyday business expenses. Credit cards are often structured with lower credit limits and high fees than business lines of credit. However, credit cards are also the most liquid form of credit a business can use, making them ideal for daily expenditures. For example, if you’re looking for a financing option to buy office supplies on a regular basis or take out clients week to week, credit cards are the right option. Business lines of credit are best used for larger ongoing expenses like marketing campaigns and other long-term projects or bridging cash flow gaps.

Recommended Reading: Government Grants For Minority Owned Businesses

United Way Of Gordon County Thanks Its 2022 Donors

- From United Way of Gordon County

United Way of Gordon County would like to thank those individual donors, as well as campaign, small business circle, and event sponsors who have donated throughout the last year.

As we look back on what has been an amazing 2022, we wanted to take some time and simply say thank you. We are so grateful to all of our donors, workplace campaign businesses, community partners, Small Business Circle members, event sponsors, and all who donated their money, time, talents, resources, and more to help impact lives in Gordon County.

United Way of Gordon County has now served this community for 35 years and we are blown away by the compassion, generosity, and devotion the people here have for making a difference and giving back. We will continue to do our part as we move into 2023 and we hope you will join us on this journey and help us reach every single person in Gordon County next year.

To keep up with everything United Way, please follow us on social media @uwgordoncounty and sign up for our newsletter on our website at gordoncountyunitedway.org.

Our office will be closed from Dec. 22nd, until Jan. 3rd. You can reach us at and we will respond to all emails upon our return. Thank you Gordon County for a great year. Have a very Merry Christmas and a Happy New Year!

Is A Line Of Credit Right For My Business

As a business owner, there are often times when working capital is tight. Without ample liquidity to cover business expenses like payroll, inventory, rent, and utilities it can be difficult to maintain operations. As one of the most flexible financing options, lines of credit are great for ensuring that you have the necessary working capital to meet your business needs and have access to emergency funds if needed.

For many businesses, a line of credit is the go-to solution for stabilizing cash flows as borrowers can secure access to funds and then draw at a later time when additional working capital is needed. Its also a great option for those who need to remain adaptable. After all, small business owners often have a limited window of time to seize the opportunity when it arises. A line of credit allows you to quickly access the funding you need to pursue the initiative.

Because you only pay for what you use, lines of credit are also great emergency funds. That said, a line of credit would not be the right option in certain scenarios, such as trying to open a startup. This is because the total cost of capital is typically lower with a term loan.

You May Like: Easy Government Contracts To Win

What Is The Commercial Interest Rate In Canada

The commercial interest rate in Canada is based on the banks prime rate, which fluctuates according to Bank of Canada policy. In general, business loans and mortgages are more expensive than personal loans and mortgages.

In the case of CSBFP loans, the maximum rate is set at 3% above prime for floating rate loans, 3% above the lenders single family residential mortgage rate for fixed rate loans, and 5% above prime for lines of credit.

How To Use A Line Of Credit

When you apply for a business loan, youre given money for a specific purpose . But since lines of credit are a form of revolving credit that are not tied to one specific purpose, you can use them for all sorts of needs, such as:

- Purchasing equipment or inventory

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Lendio is our favorite source for business lines of credit. So why does it deserve the top spot? Easybecause its not a lender, but a lending marketplace.

Heres what that means: you apply to Lendio with a brief online application. Lendio then takes your application and matches you with lenders you qualify for. You then compare offers and choose the one that works best for you. And Lendio works with several of the other lenders on this list, so your application on Lendios lending platform gives you a shot at most of our favorite lines of credit.

Lendios marketplace approach lets it offer large lines of credit and competitive rates. So for most businesses looking for a line of credit, Lendio should be your first stop.

Data as of 12/6/22. Offers and availability may vary by location and are subject to change.

Bluevines business line of credit can compete with the big banks while offering the convenience of an online lender.

Even so, if you want low rates on your business line of credit, Bluevine is the place to start.

Also Check: Government Program To Buy House

Best Line Of Credit: Lendio

Lendio

If you need flexible financing, consider a small business line of credit with Lendio. Youre not obligated to use all of the funds, and you wont pay for the funds you dont use. Many people consider a line of credit like a safety netits there if you need it.

-

Only pay interest on the funds you use

-

Application takes just 15 minutes

-

Must have $50,000 or more in annual revenue

-

Funding takes one to two weeks

-

Loan terms of only one to two years

Lendio is a small business lending marketplace launched in 2011 that matches businesses with 75+ different lenders to secure the funding they need. Because Lendio doesnt originate the loan, you receive multiple offers and can pick the one that best matches your needs. This is the best line of credit option for small business owners with bad credit because you only need a 560 credit score and you have no obligation to use all of your funds. Plus, you pay nothing on those unused funds.

Line of credit applications take 15 minutes and are a great option for businesses at least six months of age with $50,000 in annual revenue. Business owners must have a credit score of 560 and be willing to wait up to two weeks to receive funding. Loan terms offered are one to two years.

Your repayment amount and frequency depend on the final lender you choose. However, the longer youve been in business and the higher your credit score, the lower your payments will be.

Small Business Line Of Credit

Access to moneywhenever you need it. Manage seasonal cash flow, expand inventory, or grab hold of a new opportunity.

- Apply for a specific line of credit amount2

- Borrow up to your available credit limit.

- Access funds by transferring money to your checking account or by writing checks.

- Interest accrues only on the outstanding balance.

- Use as revolving line of credit and re-borrow over time up to the maximum credit limit.

- Cover seasonal or revolving cash flow.

- Access working capital where and when you need it.

- Access a larger line of credit if secured by collateral.

Loan

Read Also: How To Become An Agent For The Government

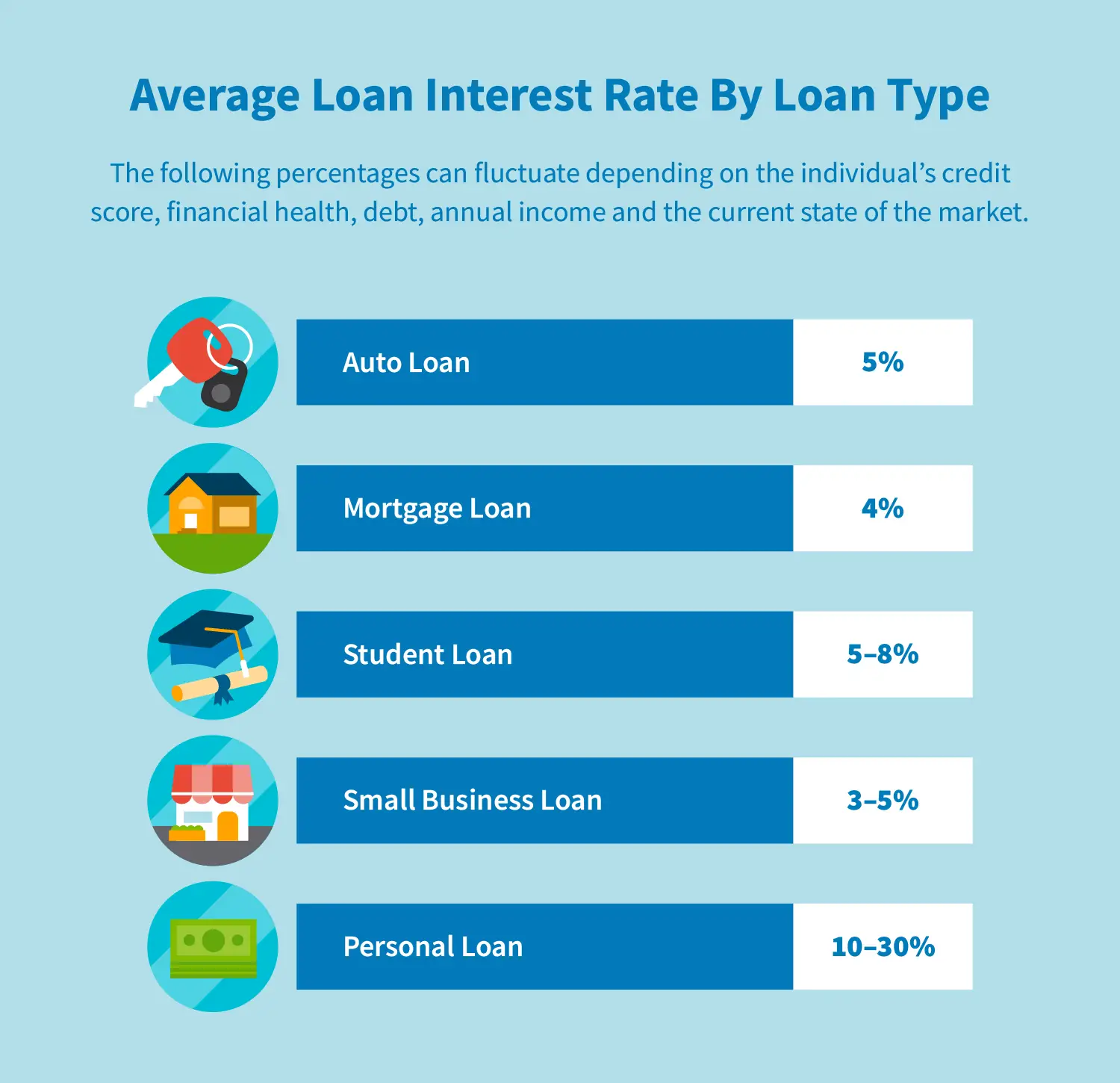

What Are The Interest Rates

For term loans, the interest rates are determined by your financial institution and may be floating or fixed.

- Floating: The maximum chargeable is the lenders prime lending rate plus 3%.

- Fixed: The maximum chargeable is the lenders single family residential mortgage rate for the term of the loan plus 3%.

For lines of credit, the maximum chargeable is the lenders prime lending rate plus 5%.

Sample Rates From Selected Lenders

Are you curious about how much some of the most popular lenders charge? Youll see several offerings below, but these might not be the perfect fit for your needs. To ensure that you get the best deal possible, shop among several lenders, including small banks and credit unions in your area.

Remember that the lowest advertised rates are only available for borrowers with the best finances, and that definition can vary from lender to lender.

Fundera is an online service that connects small businesses to a variety of lenders. Rates for credit lines range from 7% to 25%, with rates near the lower end if you have good credit.

Don’t Miss: What Is Fidelity Government Money Market

What Should I Do Once My Business Line Of Credit Becomes Active

- Pay attention to what you use your line of credit for. You should use your line of credit for expenses that will generate a quick return. In a perfect world, you’d pay off your balance immediately after you use your credit to avoid fees. Usually, the bulk of fees will come from usage or interest fees on the credit that you use, so you shouldn’t feel pressured to use it.

- Understand your repayment plan. Lines of credit typically have repayment schedules that are more regular than most businesses may be used to.

- Make on-time payments. If you want to continue operating with your line of credit, good standing with your lender is crucial. Don’t be late on payments otherwise, you may face late fees and increased interest rates or the lender may liquidate your collateral to recoup its loss. On the flip side, if you always make your payments on time and use your credit enough to show that you’re a reliable customer, you may get your credit line increased and fees reduced.

What’s Required To Obtain A Small Business Line Of Credit

Be sure to research the specifics of any lenders business line of credit requirements. For example, many banks will require a business to have been under current ownership for some fixed amount of time.

Rates for a business line of credit tend to be lower than those for a business credit card, which can charge more than 20% APR for purchases and even more than that for cash advances.

Don’t Miss: Government Agencies That Protect The Environment

How To Apply For A Small Business Line Of Credit

Much like any other type of business funding, a lender will want to see proof that your business has been doing well and is capable of turning a profit. You may be asked to provide things such as:

- Past bank statements and business tax returns

- Your resumé and resumés for any business partners or other essential employees

- Business plan and your business history

- Revenue projections

- A copy of your drivers license

Lenders who offer business lines of credit will also want to know that you would only be using it for purposes that would help your business grow and continue to turn a profit, not for things like paying off past losses.

Are There Fees Involved In Csbfp Loans

The following registration fees are associated with CSBFP loans:

- For term loans, a 2% registration fee is calculated based on the total amount loaned under the program.

- For lines of credit, a 2% registration fee is based on the total amount od credit that has been authorized.

Registration fees must be paid by the borrower to the lender, and they may be financed.

Also Check: Motels In Government Camp Oregon

The Most Popular Small Business Government Loans

The SBA has different credit programs depending on the size of the loan and the needs of each business. These are the most popular government loans or SBA loans:

Loan Program 7

Its one of the Governments most popular small business loans. And for a reason: loans in the program can sum up to $5 million. Also, terms are up to 10 years, and its flexible as to how the funds can be used.

You can use the money from a 7 loan if you need to:

- Buy a business or a franchise.

- Buy equipment, real estate, or use the money as working capital.

- Refinance existing debts.

The interest rates are very competitive, with a maximum limit of 4.75% on the base rate. It takes between 2 to 4 weeks to be approved for one of these loans.

With all these benefits, its not surprising that the 7 loan program is the favorite choice for small business owners.

CDC / 504 Loan Program

CDC / 504 government loans are mainly used to invest in business expansion. This program offers long-term loans at a fixed rate to finance assets such as equipment or real estate.

These loans are made through Certified Development Companies , which are non-profit intermediaries that work with the SBA, banks, and companies seeking financing.

With this loan program, you can access funds of up to $5 million. Its the most suitable for those looking to buy or remodel a building or purchase machinery.

CDC / 504 loans are financed as follows: 50% by the bank, 40% by the Development Companies or CDC, and 10% by the business.

Camino Financial: A Fast And Reliable Alternative

As you can see, getting a small business government loan can be difficult. If you meet the SBA requirements and have the time and patience to do the paperwork, this may be a good option to finance your venture. But if you have a business opportunity that can not wait and you need fast financing, there are other reliable alternatives to make your business dreams come true.

Traditional banks and the SBA are not the only ones that can help you fulfill your dreams as an entrepreneur. At Camino Financial, we can help you finance your venture with our two loan programs: small business loans and microloans: you can get from $5,000 to $400,000 for your business needs.

There are many advantages to our business loan compared to others available in the market:

- You can pay at any time without receiving additional penalties or fees.

- You dont need collateral.

- You receive an instant prequalification that doesnt affect your .

- Your loan can be financed as subordinated debt over an existing one.

- You dont need an SSN, only an Individual Tax Identification Number

- You can receive the capital in as fast as 2 days.

If you want to receive a quote for one of our loans, simply submit an online application. It will only take you a few minutes, and youll prequalify instantly.

Also Check: Free Government Phone And Service