Solar Panel Incentives And Rebates In Canada

Solar Panel Incentives and Rebates in Canada

Solar power is a cost-effective renewable energy source that only continues to grow in popularity.

Solar power systems not only reduce your ongoing energy costs, but they can also be cheaper to install than you might think. Solar incentives in Canada could help you save thousands of dollars off the cost of your solar installation through solar financing and subsidies.

Making the switch to solar power offers many long-term benefits for the environment, as well as ongoing cost savings. Solar panels are low maintenance, and the initial solar setup is the primary investment.

Solar panel installation does come with upfront hardware and installation costs which can be daunting. Luckily, the Canadian government and provinces offer some incentives so homeowners can reduce the initial cost of installing solar power systems.

There are several solar panel incentives available in Canada to encourage residents to switch to solar power. Weâll break down how solar financial incentives work in Canada and how to find them.

How do solar incentives work in Canada?

Canada-Wide Programs

Canadians can benefit from ongoing electricity savings and up-front financial rewards when switching to solar power. Incentives differ across Canadian provinces because some provincial governments have not yet committed to carbon pollution pricing systems.

Solar incentives in Canada by Province

Alberta Incentives

Getting The Work Done

Once your voucher has been issued, you can begin the work.

Your installer may ask you for a deposit. It cannot be larger than your expected contribution to the cost of measures under the quote they have provided you.

If you have applied under the low-income scheme, your installer can only ask you for a deposit when the total cost of the work exceeds the £10,000 grant. In this case, only the excess amount will be eligible for a deposit.

Is The Green Homes Grant Still Available

The short-lived Green Homes Grant offered homeowners up to £10,000 to make energy-efficient improvements. Solar thermal panels were included as a primary measure, but the scheme was scrapped in March 2021.

A local authority-delivered scheme has continued to provide funding for solar PV panels. Its open to households with an EPC rating of D, E, F or G and a combined annual income of below £30,000.

Recommended Reading: How Much Power Produced By Solar Panels

Also Check: How To Claim Lost Money From The Government

Alberta Solar Power Rebates

These rebates are current as of November 2020. Kuby Energy will complete all paperwork required for any incentive that may be applicable to your solar power system.

Edmonton Solar Rebate – The City of Edmonton recently announced a rebate for residential solar installations for $0.40/W up to $4,000. This rebate is in addition to the provincially-funded residential and commercial solar program.

Micro Generation – Micro generators in Alberta are subject to the Micro Generation Regulation guidelines. Homes and businesses with solar installations which are < 5MW , will have their solar energy consumption vs usage monitored and credited to you on your monthly power bill. Any excess solar energy is rolled over to the next month and can be sold at the end of the year at the same rate which you bought it for . For more details read the full micro-generation regulation.

Get Energy Solar Club – This membership allows one to have a higher energy rate during months when solar generation exceeds home consumption. This creates a much higher microgeneration credit. During the winter months, when consumption exceeds solar generations one can change back to the standard rate

Banff Solar Incentive – Residents of Banff, AB are eligible for a solar power incentive. This program will allow selected applicants to qualify for a seven year agreement with the town of Banff. Successful applicants will be selected through a lottery based system. Read more on the Banff solar power incentive program.

Government And Private Funding We Need Both For The Energy Transition

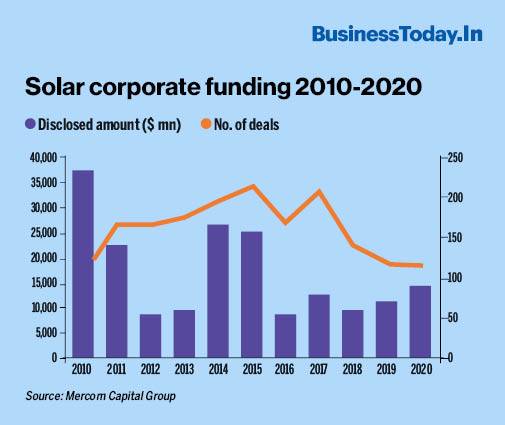

These days, companies and governments alike are making commitments to net zero emissions. While commitments are good, making progress requires investment. That means putting money on deploying existing technology in the near term, while continuing to fund innovation to deliver cost-effective approaches in the future. The current picture looks promising, but there is always a chance the momentum will lag.

Deploying Clean Technology

Despite COVID-19 and the economic downturn, clean energy investment did surprisingly well in the United States last year. U.S. companies, households and the government spent $85.3 billion on deployment of low-carbon technology in 2020, according to Bloomberg New Energy Finance . Although there was an overall decline from 2019, investment in electric transportation and residential heat pumps saw an uptick. Green bonds, which are primarily asset-linked, grew by 13% to a record $305 billion globally, after a slowdown in the first half of the year.

The federal government plays a significant role in the deployment of clean energy, mainly through policies like tax incentives, rebates and technical assistance. The U.S. Energy Act of 2020 which was part of the Consolidated Appropriations Act, 2021, extended existing taxes incentives for solar and wind, a new emphasis on 45Q carbon capture incentives and a new offshore wind credit.

Investing in Innovation

Figure 1. Innovation from Concept to Maturity

Sustaining the Momentum

About the Author

Don’t Miss: Free Small Business Government Grant Application

Other Solar Incentives And Tax Credits Still Available

The 2017 Legislature extended Xcel Energys Solar*Rewards Program for three years and increased its funding to $15 million in 2018, $10 million in 2019 and 2020, and $5 million in 2021. Like Made in Minnesota, the Solar*Rewards Program provides recipients with 10 years of annual incentive payments based on the solar energy systems annual production. Solar*Rewards is available to Xcel customers on a first-come, first-served basis.

Minnesota Power offers solar incentives to qualified customers through its SolarSense program. Otter Tail Power offers a Publicly Owned Property Solar program that provides cash incentives to publicly owned facilities that install non-residential solar photovoltaic systems.

Other utilities may also offer incentives for new solar energy systems.

Solar Panel Grants And Schemes In Scotland

Solar Panel Grants and Schemes are now available in Scotland under the latest government schemes.You could now get totally free solar panels enabling your home to produce its own hot water and generate its own electricity. The electricity that you produced can be used by yourself or sell surplus electricity to the national grid. This will help to reduce your fuel bills and cut carbon emissions..

- Grants and Schemes for Solar Panels

Apply now, get a choice of solar panels, you can choose an approved installer or we can arrange installation directly for you by a fully qualified and registered installer in your area.

Don’t Miss: Short Term Government Bonds Rates

Solar Finance And Solar Panel Loans

If you cant afford the total upfront cost of a brand new solar PV system, there are ways to source the cash.

Some companies offer homeowners low-interest loans and reasonable repayment plans to help them make the switch to solar. For example, check out the options currently offered by Pegasus Finance and EvoEnergy.

You can also get a loan from your bank to cover solar panel installation costs. Most banks offer personal loans specifically for home improvements, which could be used for renewable energy developments.

Am I Eligible To Claim The Federal Solar Tax Credit

You might be eligible for this tax credit if you meet all of the following criteria:

- Your solar PV system was installed between January 1, 2017, and December 31, 2034.

- The solar PV system is located at a residence of yours in the United States.

- You purchased an interest in an off-site community solar project, if the electricity generated is credited against, and does not exceed, your homes electricity consumption. Note: A private letter ruling may not be relied on as precedent by other taxpayers.

- You own the solar PV system .

- The solar PV system is new or being used for the first time. The credit can only be claimed on the original installation of the solar equipment.

Recommended Reading: Sell My Car To Government

Homeowners Guide To The Federal Tax Credit For Solar Photovoltaics

This webpage was updated September 2022.

Disclaimer: This guide provides an overview of the federal investment tax credit for residential solar photovoltaics . It does not constitute professional tax advice or other professional financial guidance. And it should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.

Will The Solar Panels Be Installed Totally Free

There are different schemes available, in some cases they may be totally free.Schemes are available for all householders including tenants and landlords. Apply now or contact us for more information.

Please note you do not necessarily need to be receiving benefits or be over a certain age to qualify.

Read Also: How To Start A Sole Proprietorship In Ny

Read Also: Fidelity Government Money Market Vs Treasury Money Market

What Solar Panel Funding Is Available In The Uk

Promoting the use of renewable energy sources has been on the UK governments agenda for many years now. The EUs Renewable Energy Directive set out for all member countries to reach a 32% renewables target before 2030. The UK has been working towards that goal, as the focus is to move in this direction by introducing more schemes and incentives in the renewable energy sector.

This tendency was accompanied by a decrease in the cost of solar panels, so new buyers do not need to worry. Though there aren’t any grants in the traditional sense, there are opportunities for solar panel funding in the UK. Currently, the only scheme open to new applications is the Smart Export Guarantee .

Overall, there are six notable incentives for solar panels in the UK that will be covered in this guide:

Solar Grants in the UK| UK Solar Grants |

|---|

| Fully free solar panel system |

Available solar panel grants in the UK as of September 2022

What Government Grants Are Available For Solar Panels In Uk 2022

Did you know that the government offers grants to help people install solar panels? In this informative guide, well tell you everything you need to know about solar panel grants in the UK. Well cover eligibility requirements, how to apply for a grant, and what you can use the grant money for. So if youre interested in going solar, keep reading!

Read Also: Myrtle Beach Hotels With Government Discounts

Municipalities And Counties With Programs

Clean Energy Improvement Program is available in multiple municipalities across Alberta. This program allows home owners to access financing for energy efficiency and renewable energy upgrades, and repay through the propertys regular tax bill. The repayment stays with the home, rather than moving with you. To see if your municipality is participating go to myceip.ca.

Government Grants For Solar Panels

Solar panels are a great source of renewable energy that meets the demand for energy at home and in industry. Solar panels generate electricity that is useable and clean energy and limit the dependency on the grid. Renewable energy is going to be a much-needed option not just for homeowners and business entities but it is one of the top priorities for every government. In the United States of America, renewable energy is considered one of the most important issues to ensure dependency on energy and a better greener future for the next generation. For this, renewable energy is getting priority, and investment in the clean energy sector is booming.

The government of the United States of America ensures funding to the different departments for a transition to cleaner energy through solar energy. There are different grants and assistance programs under these departments for energy saving assistance. So low-income people and homeowners can go with renewable energy for a better and greener tomorrow. The homeowners who dont afford to go for renewable energy may apply for government grants for solar panels, free roof repair, home repair grants, and grants for replacing windows. When you want to get solar panels but dont afford them, you may get grants for solar panels. So we are going to discuss some government grants programs for getting solar panels.

Don’t Miss: Are You Owed Money By The Government

Solar Grants: Funding Communities

In an effort to incentivize the growth of solar power, various departments within the federal government offer grants to make the transition more affordable. No typical residential solar energy grants are given directly at the federal level instead, the departments provide grants to low-income and rural areas alongside farms, tribes, schools, and nonprofit organizations.

With the average lifespan of a solar panel reaching beyond 20 years and electric bills being dramatically reduced or eliminated altogether, these grants offer cost-saving measures for those who need them most.

Solar Loans: The Fhas Powersaver Program

There are a number of home equity loans available to help offset the cost of outfitting a house with solar panels. These loans essentially work as equity loans, creating a lien against the house and reducing its equity. Because of how the loans are structured, homeowners can likely save more on their electric bills than they will have to pay in loan payments, making them a very good deal :

-

Interest rates range from 3.5 to 7.5 percent

-

Terms are typically 7 to 20 years

-

Interest may be tax-deductible

Some of the most common types of solar energy loans are:

-

Address: 2831 G Street #200

City: Sacramento

State: CA

Zip: 95816

This type of loan is for smaller projects such as insulation, air and duct sealing, water heating, and upgrading or replacing heating and cooling equipment. This is an unsecured consumer loanno home appraisal is required.

- Energy Upgrade Loan

State: WA

Zip: 98624

This type of loan is for smaller projects such as insulation, air and duct sealing, water heating, and upgrading or replacing heating and cooling equipment. This is an unsecured consumer loanno home appraisal is required.

- Energy Upgrade Loan

State: VA

Zip: 22901

This type of loan is for smaller projects such as insulation, air and duct sealing, water heating, and upgrading or replacing heating and cooling equipment. This is an unsecured consumer loanno home appraisal is required.

Read Also: Can I Get A Government Grant To Start A Business

Green Retrofit Solar Panel Grants

Grants for solar panel installations are a great deal for low-income homeowners who are looking to improve their homes with solar panels. A program sponsored by HUD is offered through the department. A low-income homeowner receives grants under this program, which is run by the Office of Affordable Housing Preservation.

In order to reduce dependence on the grid, they will be able to save energy by installing solar panels. As part of the Housing Recovery Act, $250 million is budgeted to provide grants to the people. A condition is that the grant recipient must use the grant within two years of receiving it.

Saskatchewan Solar Power Incentives

Net Metering – Solar power systems in Saskatchewan are eligible for a net metering credit similar to Alberta. Solar panels in Saskatchewan will generate a credit on your monthly power bill for excess energy sold back to the grid.

Additional energy incentive rebates and programs are offered within Saskatchewan not pertaining to solar panel installations.

You May Like: Government Programs For Troubled Youth

Community Solar Panel Grants

Community solar panel projects are growing in size and in popularity as communities can earn money through investing in large scale solar projects. There are also a number of solar panel grants designed to help communities install solar and other renewables but most are available locally through local or regional groups.

Rural Community Energy Fund The RCEF is a community fund of 15 million set up to provide assistance to feasible community renewable projects. The programme is specifically designed for rural communities and offers up to £150,000 in grant money to projects which offer economic and social benefits to the community.

Also Check: How To Clean Solid Hardwood Floors

Smart Export Guarantee: Government Support For The Export Of Renewable Energy

From 1 January 2020, the Department for Business, Energy and Industrial Strategy introduced the Smart Export Guarantee , to fill the void left by FITs. In fact, the technology included by this incentive is the same as under the FIT scheme. But the two initiatives are very different. The new scheme is focused only on remuneration forrenewable energy exported to the National Grid. The new mechanism ensures small-scale generators, such as citizens with a PV system, are paid at least a minimum fee for energy fed into the Grid.

With FITs, tariffs were fixed as they were decided and paid by the Government now, under the SEG, any energy company with at least 150,000 customers must offer a tariff, but each is free to set the rate. Smaller suppliers can offer a fee on a voluntary basis. The only limitation imposed by the Government is that offers must always be greater than £0.

The economic savings associated with solar PV remain, of course. Customers with PV panels will still have the opportunity to lower their electricity bill by self-consuming the energy generated on-site. However, without the generation tariff there is no real opportunity to quickly offset the initial investment. For instance, according to the Energy Saving Trust, if you live in London, your overall saving drops from £375 £515 to £300 £390 depending on when you spend time at home. So the payback you can get from SEG increases.

Why a magazine

Read Also: Document Management System For Government