Alberta Seniors Benefit Program

This is a monthly benefit paid to low-income seniors in order to supplement their OAS/GIS pension. Currently, single seniors with a total annual income of $29,285 or less, and couples who have a combined annual income of $47,545 or less are eligible for the benefit.

A single senior can qualify for up to a maximum amount of $11,771 per year and for a senior couple, it is up to a maximum of $15,202.

For more information on Albertas Seniors Benefit program, contact them at 1-877-644-9992 or 780-644-9992.

Government Programs For Older People That You May Not Know About

Pamela Rodriguez is a Certified Financial Planner®, Series 7 and 66 license holder, with 10 years of experience in Financial Planning and Retirement Planning. She is the founder and CEO of Fulfilled Finances LLC, the Social Security Presenter for AARP, and the Treasurer for the Financial Planning Association of NorCal.

When most people think about government help with retirement, they think about Social Security and Medicare. This isn’t necessarily surprising, since nine out of 10 retirees receive Social Security benefits, and virtually all retired Americans age 65 or older are enrolled in Medicare.

Other government programs are also available, but many older citizens do not participate for a variety of reasons, including lack of knowledge about available programs and the complexity of the application process. Read on to learn about what’s available, who qualifies, and how to obtain help along with information about how the coronavirus pandemic has impacted many of these programs.

Newfoundland And Labrador Seniors Benefit

- Whether single or as a couple, seniors with family net income of up to $29,402 are eligible to receive the maximum benefit of $1,444. The amount of the benefit will be phased out at a rate of 11.66% as net income increases between $29,402 and $41,786.

- In order to qualify for this benefit, the person must be 64 years of age or over by December 31st of the taxation year.

While fully funded by the Government of Newfoundland and Labrador, these benefits are administered by the Canada Revenue Agency and will be paid with the federal GST Credit. To learn more about the federal administration of provincial credits, please visit the CRA webpage: .

For more information please contact:

Also Check: What Is The Mortgage Stimulus Program For The Middle Class

If You Have Not Yet Applied For The Old Age Security Pension

If you were born on or before June 30, 1947 and are eligible for the Old Age Security pension, it is important that you submit your application for the Old Age Security pension no later than May 31, 2022.

If you apply for the Old Age Security pension after May 31, 2022, you will not be eligible for the one-time payment.

Federal Benefits And Programs For Seniors

Service Canada

The federal government is most responsible for income security programs for seniors. They manage two major public pension programs through Service Canada:

- Old Age Security , based on years of living in Canada, and

- Canada Pension Plan , based on years of work in Canada and the amount paid into the plan.

OAS benefits represent about 14% of pre-retirement earnings for someone earning at the average wage, while CPP provides about 25%. It is generally considered that retirement income should replace about 60% to 70% of pre-retirement earnings for retirees to maintain their standard of living in retirement.

More information on the various income security programs can be found at Service Canada. We also provide more information below. You can find your nearest Service Canada Office by clicking here: Find your nearest Service Canada office

Seniors Canada

Information about most federal government programs for seniors can be found below, and at Seniors Canada.

Find information you need on community organizations, retirement residences, medical offices, etc.

Read Also: Free Government Phones In Las Vegas

Supplemental Nutrition Assistance Program

The SNAP program, formerly known as Food Stamps, is a federal government program to help needy persons of any age pay for food. To qualify for benefits, households must meet strict resource and income limits. However, households in which all members receive SSI or TANF benefits are automatically assumed to meet the asset and income requirements for SNAP eligibility, and no further eligibility analysis is necessary.

Households with members who are elderly or disabled are allowed to have up to $3,000 in countable assets, such as cash or money in savings, checking and investment accounts.

The value of the primary residence is excluded from countable assets, as is the value of pension and retirement accounts. The fair market value of a vehicle up to $4,650 is always excluded from countable assets by federal rules, however states have the option to exclude an even higher amount.

In addition to asset limits, recipients must also meet income limits. Households with an elderly or disabled member must have anet monthly income below a certain level in order to qualify for SNAP assistance.

The household’s net income is calculated by subtracting certain deductions from the gross monthly income. These deductions include:

– 20% of earned income

– Standard deduction of $147 for household sizes of 1-3, and $155 for a household of 4.

– Dependent care deduction when necessary to enable a family member to work, attend school, or receive training.

– Court-ordered child support payments.

Usda Housing Repair Program

This United States Department of Agriculture program, also known as the Section 504 Home Repair program, sponsors grants and low-interest loans to repair or improve your home. You must be at least 62 years old and meet the program’s low-income requirements. Grants do not have to be paid back, but loans do.

Also Check: Las Vegas Federal Jobs

Yukon Seniors Income Supplement

This is a monthly benefit to low-income seniors who receive OAS/GIS benefits and are 65 years of age or older. The current maximum monthly benefit is $253.25 per month.

For more info on Yukons Seniors Income Supplement program, call 867-667-5674 or 1-800-661-0408 ext. 5674.

Veterans Affairs Canada Services And Benefits

Veterans Affairs Canada provides a variety of services and benefits for eligible Veterans, their families and caregivers, both at home and in community facilities. These include disability benefits, financial assistance for low-income Veterans and their families, health care, respite care, palliative care, special equipment, and support for home adaptations for Veterans with special needs. VAC can also help bring together services offered by the community and the province to meet the needs of Veterans, and their families and caregivers. For more information, call Veterans Affairs Canada or visit their web site.

Don’t Miss: Entry Level Government Jobs San Antonio Tx

A Free Service From The National Council On Aging

BenefitsCheckUp is safe to use because its a free service from the National Council on Aging , a leading nonprofit service and advocacy organization.

Since 1950, the NCOA has been working to improve the lives of Americans aged 60+, especially those who are struggling.

They provide community programs and services, online help, and advocacy.

NCOA also builds public awareness, influences federal legislation, and creates national programs to make life better for older adults.

Senior Community Service Employment Program

This Department of Labor program helps seniors obtain long-term employment through the learning of new skills such as computer programming and through paid community service at public facilities including schools, hospitals, daycare centers, and senior centers. The idea is that, through this subsidized on-the-job training, you will eventually gain unsubsidized employment.

You May Like: State Jobs In Las Vegas Nv

Application Process For Free Government Money

Free government money or grants are available from different departments of the government. It is important to know the right processes to get started. Where you are going to apply you read through their terms and conditions to make sure you can get assistance instantly. But there are some steps to go through for the application process.

British Columbia Seniors Supplement Program

This is a monthly benefit paid to low-income seniors who are recipients of OAS/GIS, or who receive an Allowance. The amount received is based on how much you already get in federal benefits.

Currently, you could get up to a maximum of $99.30 , $220.50 , or $99.83 .

If you need more information regarding British Columbias Senior Supplement Program, contact them at 1-866-866-0800 or email at .

You May Like: Government Jobs In Las Vegas Nv

Where To Look For Help

As noted above, one of the main reasons older people don’t take advantage of government assistance is a lack of knowledge. There are resources to help you find government assistance programs for which you qualify.

BenefitsCheckUp from the National Council On Aging , is one such tool. Use this service to find out which of more than 2,500 public and private benefits programs may apply to you. There are programs for prescription drugs, nutrition, help with utility bills, income assistance, healthcare, and much more.

The Eldercare Locator service, sponsored by the U.S. Administration on Aging, helps you locate agencies near where you live that provide a variety of services to older Americans. Services include meals, transportation, home-based care, and other caregiver support services. If you prefer, you can call Eldercare Locator at 1-800-677-1116.

Prepare And Check Application

Surely an application is a process to ask for any assistance in writing. When someone seeks assistance such as free money, no verbal means of application is accepted. It should be one type of document that can be conserved and forward for approval.

You just need to go through an application process, and you should prepare your application with authentic information. Some organizations may direct you to go online application. In this case, you should visit their website and may find an application field. In this field, you have to provide information to complete the application process. More importantly, information should be accurate and authentic. You may hire any professional expert who deals with this issue. But dont forget to check and double-check the application form.

Also Check: Semper Fi Auto Repair Las Vegas

Complete The Application Package

Complete the Seniors Financial Assistance application:

- Download and print the Seniors Financial Assistance application form

Optional income forms are available to help you complete your application:

- Income estimate form the use of this form is limited to the Alberta Seniors Benefit program. Complete the form if you have experienced a decrease in income compared to your most recent tax return and are applying to the program for the first time or have previously applied but have never received benefits. For more information, see How Your Benefit is Determined First time exception section above).

- Income information form complete this form if you have not filed your income tax return for the previous calendar year.

Optional forms are available to help you complete your application:

PO Box 3100Edmonton, Alberta T5J 4W3

If you need help completing an application, call the Alberta Supports Contact Centre toll-free at .

Benefits Programs For Seniors With Pets

For seniors, owning a pet can provide a level of companionship that is essential to health and wellbeing. But owning a pet is costly, and some owners may find themselves worrying about how to get help with vet bills, pet food costs, and vaccinations. Thankfully, there are plenty of organizations that provide financial help for seniors with pets.

Read Also: City Jobs Las Vegas Nevada

Government Programs For The Elderly

Use government programs to bridge the gap between your expenses and income. There are senior specific government programs available at the local, state, and federal levels.

Three of your major expenses after retirement will be housing, food and healthcare.

Here are just some of the programs available to seniors nationwide that can help cut those costs.

Federal Programs And Retirement Income Benefits For Seniors

Following the initial introduction of The Annuities Act in 1908, Canada has come a long way when it comes to retirement benefits.

On the federal level, we now have the Old Age Security pension and the Canada Pension Plan /Quebec Pension Plan .

The OAS and CPP are often referred to as Pillar 1 and Pillar 2 of Canadas retirement income system respectively. In the light of a seniors total income in retirement, the OAS and CPP are expected to cover approximately 40% of their retirement income.

Lets look at what these benefits offer:

Recommended Reading: Access Wireless Replacement Phone

Ontarios Soldiers Aid Commission

The Ontarios Soldiers Aid Commission provides assistance to Canadian veterans in need who served overseas and their dependants living in Ontario. The assistance is provided on a one-time basis to resolve a specific problem when all other resources have been exhausted. It does not support ongoing needs related to income deficiencies.

Funds may be granted to assist with buying:

- health-related items, like hearing aids, glasses, prescription drugs or dental needs

- home-related items, like rent, repairs, moving costs, furniture, repair/replacement of roof and furnace

- specialized equipment, like assistive devices, wheelchairs and prosthetics

- personal items, like clothing and specialized support services

Get information and apply for benevolent funds, including Ontarios Soldiers Aid Commission, by contacting your local Royal Canadian Legion or Veterans Affairs Canada office.

What Medicaid Covers For Medicare Enrollees

Medicare has four basic forms of coverage:

- Part A: Pays for hospitalization costs

- Part B: Pays for physician services, lab and x-ray services, durable medical equipment, and outpatient and other services

- Part C: Medicare Advantage Plan offered by private companies approved by Medicare

- Part D: Assists with the cost of prescription drugs

Medicare enrollees who have limited income and resources may get help paying for their premiums and out-of-pocket medical expenses from Medicaid . Medicaid also covers additional services beyond those provided under Medicare, including nursing facility care beyond the 100-day limit or skilled nursing facility care that Medicare covers, prescription drugs, eyeglasses, and hearing aids. Services covered by both programs are first paid by Medicare with Medicaid filling in the difference up to the state’s payment limit.

Read Also: Entry Level Government Jobs For College Graduates

Commodity Supplemental Food Program

The USDA Commodity Supplemental Food Program differs from the Child and Adult Care Food Program in that it provides foods instead of meals. To be eligible, you must be at least 60 years old and qualify as low-income, according to guidelines in the state where you live. Program guidelines and application information are available on the CSFP website.

Seniors To Receive Up To $500 In A One

Seniors who qualify for Old Age Security will be eligible for an automatic one-time, tax-free payment of $300, and those eligible for the Guaranteed Income Supplement will get an extra $200. Read more: More information to be added.

There are three kinds of benefits available from the Canada Pension Plan:

- Retirement pension

- Survivor benefits which includes a one-time death benefit , the Survivor pension and the Childrens Benefit.

- CPP-D disability benefit which includes benefits for disabled contributors and for their dependent children

Our focus will be on the CPP retirement pension, which provides income to working Canadians after they retire. The amount of CPP pension income they receive depends on the amount they paid into the fund from their wages over the years they worked in Canada. An older adult can receive CPP pension if they have contributed and:

- they are 60-64 years old and have stopped working or have a low income, or

- they are 65 years or older.

If they start collecting at 60 yrs. their rate then remains the same after they turn 65. If they work past 65, they can be receiving CPP benefits at the same time. They can also choose to continue paying premiums into CPP up until age 70 this will increase the amount they receive in retirement benefits.

CPP Child Rearing Drop-Out Protection

CPP Survivor Benefits

Also Check: Grants For Teeth Implants

What Are Grants For The Senior

There are a lot of grants program for senior citizens who can live better after getting this grant. In the united states of America, these grants are also known as federal assistance grants, capital assistance programs for the elderly, the foster grandparent program, the nutrition services incentives programs, USDA repairs programs, and educational grants that are highly designed for the senior and elderly.

Senior Farmers’ Market Nutrition Program

This USDA program issues coupon booklets to older people with low incomes that can be used to pay for fresh fruit, vegetables, and other foods at local farmers’ markets and outdoor stands. These coupons are not usable for nonperishable foods and are available on a first-come, first-served basis. Not all farmers’ markets accept them, so it’s wise to check in advance.

You May Like: State Jobs Las Vegas Nv

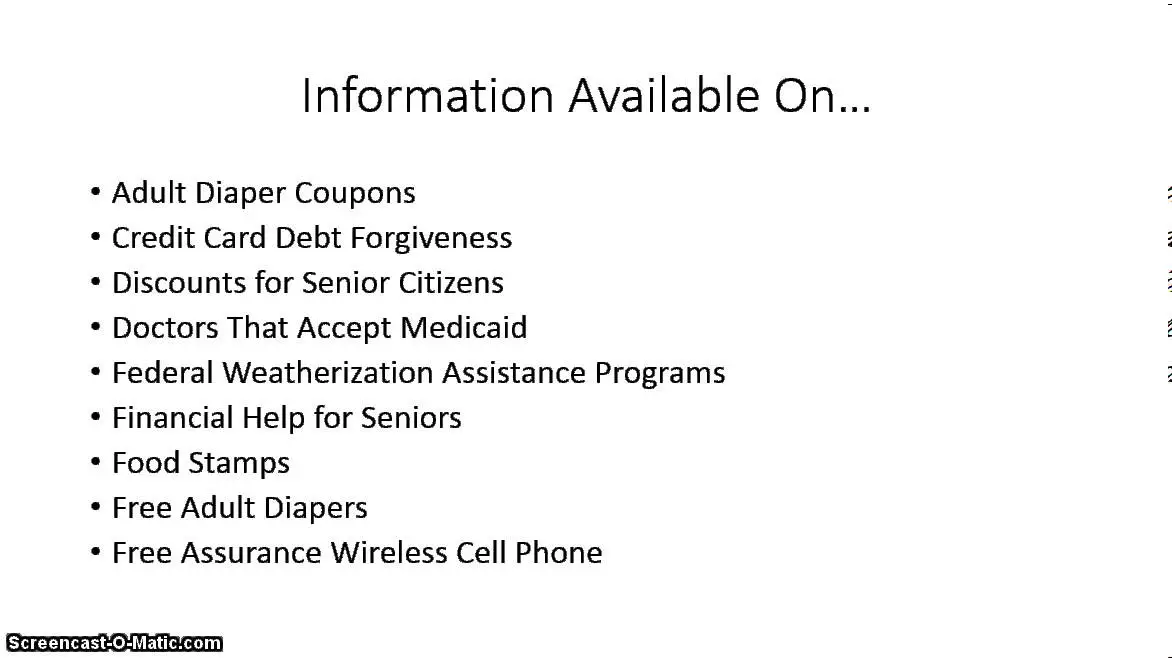

Top 10 Government Resources For Seniors And Caregivers