When Your Bankruptcy Will End

You will be freed from bankruptcy after 12 months. This ends the bankruptcy restrictions and releases you from most of the debts you had when the bankruptcy order was made.

Youll normally be discharged automatically, even if:

- no payments have been made to your creditors

- youre still paying an IPA or IPO

- some assets havent been sold yet

Assets you had during bankruptcy can still be used to pay your debts once your bankruptcy has ended.

Your bankruptcy can be extended for longer than 12 months if you do not co-operate with your trustee. Check your discharge date using the Individual Insolvency Register on our website. If your discharge status is suspended indefinitely you need to contact the official receiver for an update.

Government Fines In Bankruptcy

Filed under: bankruptcy

Many people ask if they can discharge government fines in bankruptcy. Things like federal, state, and municipal fines can be eliminated in some instances. In nearly every case that a government entity imposes a fine as a punishment for thing such as the following are not dischargeable in bankruptcy and must be paid:

- DUI related fines

- Fines for contempt of court

- Criminal restitution

- Fines for building code violations

If the government fine you are seeking to discharged doesnt fall under this list then you may be able to have the debt discharged depending on which type of bankruptcy your file. For example, while Chapter 7 bankruptcy will not discharge them, Chapter 13 bankruptcy can be used to discharge:

- Debts from nondischargable tax debt

- Lawsuit Judgments against you

- Debts from care accidents

Additionally, these fines and penalties can be discharged in bankruptcy depending on what state you file bankruptcy in: Bail Bond Forfeitures, Income Tax Penalties Older than 3 years, and some unpaid tolls for roads or bridges.

Recent Posts

What Practices Are Off Limits For Debt Collectors

A debt collector may not:

- Contact you at inconvenient times, for example, before 8 AM or after 9 PM, unless you agree to it.

- Communicate with you at work if you tell the debt collector your employer disapproves.

- Contact you after you send a letter to the collector telling them to stop, except to notify you if the creditor or collector plans to take a specific action.

- Communicate with your friends, relatives, employer, or others except to find out where you live or work.

- Harass you with repeated phone calls, profane language, or threats to harm you.

- Make any false claim or statement that you will be arrested.

- Threaten to have money deducted from your paycheck or to sue you, unless the collection agency or creditor intends to do so and it is legal.

Also Check: How Do You Apply For Government Jobs

Advantages Of Chapter 13

Chapter 13 offers individuals a number of advantages over liquidation under chapter 7. Perhaps most significantly, chapter 13 offers individuals an opportunity to save their homes from foreclosure. By filing under this chapter, individuals can stop foreclosure proceedings and may cure delinquent mortgage payments over time. Nevertheless, they must still make all mortgage payments that come due during the chapter 13 plan on time. Another advantage of chapter 13 is that it allows individuals to reschedule secured debts and extend them over the life of the chapter 13 plan. Doing this may lower the payments. Chapter 13 also has a special provision that protects third parties who are liable with the debtor on “consumer debts.” This provision may protect co-signers. Finally, chapter 13 acts like a consolidation loan under which the individual makes the plan payments to a chapter 13 trustee who then distributes payments to creditors. Individuals will have no direct contact with creditors while under chapter 13 protection.

What About Security Clearance

Both government and private sector jobs sometimes require security clearances. In most cases, if you file for bankruptcy, you wont lose clearance. However, for some employees with very high clearance, it could become an issue. The best thing to do is to speak with your companys human resources staff, and inquire about department policy regarding security clearance.

Read Also: Which Government Bonds Are Tax Free

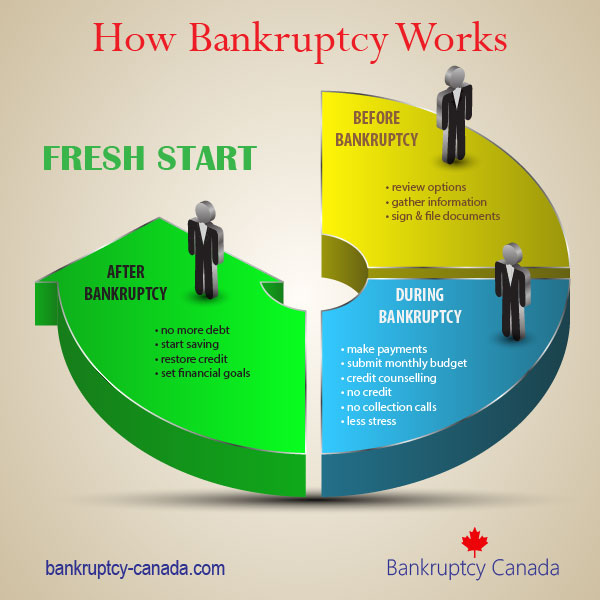

Bankruptcy: How It Works Types & Consequences

Bankruptcy is a legal process overseen by federal bankruptcy courts. It’s designed to help individuals and businesses eliminate all or part of their debt or to help them repay a portion of what they owe.

Bankruptcy may help you get relief from your debt, but it’s important to understand that declaring bankruptcy has a serious, long-term effect on your credit. Bankruptcy will remain on your credit report for 7-10 years, affecting your ability to open credit card accounts and get approved for loans with favorable rates.

Sometimes You’ll Owe Less On A Nondischargeable Debt After Chapter 7

If you can’t protect an asset with a bankruptcy exemption and the bankruptcy trustee sells it, it’s likely that it won’t be a complete loss. In many cases, the trustee will use the proceeds to pay down your nondischargeable debt. Why? Bankruptcy’s priority payment system requires paying priority debts before others, and many priority debts are also nondischargeable.

The system ensures payment of essential debts, such as nondischargeable support obligations and taxes, before less important commitments like credit card balances and student loan debt. So if you owe back taxes to the IRSa nondischargeable debtand the trustee sells your nonexempt RV, the trustee will likely apply the proceeds to your tax debt, and you’ll owe less after your case ends.

Example. Carter couldn’t make the monthly payment on his credit card balance of $25,000. He also owed $2,000 in child support arrearages and $1,500 from the prior year’s taxes. Needing a fresh start, he filed for Chapter 7 bankruptcy, even though he couldn’t protect his skeet shooting guns worth $10,000. The trustee sold the guns and, following payment priority rules, paid the child support and tax arrearages in full before applying the balance toward the credit card debt. Because the remaining credit card balance qualified for a discharge, Carter was free of debt at the end of his case.

Recommended Reading: Government Grants For Cattle Farmers

Donald Trump Proves What’s Wrong With Bankruptcy Laws In America

Robert B. Reich is Chancellorâs Professor of Public Policy at the University of California at Berkeley, and author of the forthcoming Saving Capitalism: For the Many, Not the Few.

On the opening day of Trump Plaza in Atlantic City in 1984, Donald Trump stood in a dark topcoat on the casino floor celebrating his new investment as the âfinest building in the city and possibly the nation.â Thirty years later, the Trump Plaza folded, leaving some 1,000 employees without jobs. Trump, meanwhile, was on Twitter claiming he had ânothing to do with Atlantic City,â and praising himself for his âgreat timingâ in getting out of the investment.

In America, people with lots of money can easily avoid the consequences of bad bets and big losses by cashing out at the first sign of trouble. Bankruptcy laws protect them. But workers who move to a place like Atlantic City for a job, invest in a home there, and build their skills have no such protection. Jobs vanish, skills are suddenly irrelevant and home values plummet. Theyâre stuck with the mess. Bankruptcy was designed so people could start over. But these days, the only ones starting over are big corporations, wealthy moguls and Wall Street bankers, who have had enough political clout to shape bankruptcy laws to their needs.

How Chapter 13 Works

A chapter 13 case begins by filing a petition with the bankruptcy court serving the area where the debtor has a domicile or residence. Unless the court orders otherwise, the debtor must also file with the court: schedules of assets and liabilities a schedule of current income and expenditures a schedule of executory contracts and unexpired leases and a statement of financial affairs. Fed. R. Bankr. P. 1007. The debtor must also file a certificate of credit counseling and a copy of any debt repayment plan developed through credit counseling evidence of payment from employers, if any, received 60 days before filing a statement of monthly net income and any anticipated increase in income or expenses after filing and a record of any interest the debtor has in federal or state qualified education or tuition accounts. 11 U.S.C. § 521. The debtor must provide the chapter 13 case trustee with a copy of the tax return or transcripts for the most recent tax year as well as tax returns filed during the case . Id. A husband and wife may file a joint petition or individual petitions. 11 U.S.C. § 302.

In order to complete the Official Bankruptcy Forms that make up the petition, statement of financial affairs, and schedules, the debtor must compile the following information:

Recommended Reading: What Is A Government Issued Birth Certificate

Suspended Income Tax Payments

HMRC will apply a nil tax code when youre bankrupt. This tells your employer not to take any further income tax from your wages for the rest of the tax year . The extra money in your pay that results from this can be claimed by the trustee to form part or all of an IPA or IPO. If the IPA or IPO is wholly paid out of this extra income, it will stop when you start paying tax again.

The NT will not tell your employer youre bankrupt as an NT can be applied for a number of reasons.

What Is The Role Of The Us Securities & Exchange Commission In Chapter 11 Bankruptcies

Generally, the SEC’s role is limited. The SEC will:

- review the disclosure document to determine if the company is telling investors and creditors the important information they need to know and

- ensure that stockholders are represented by an official committee, if appropriate.

Although the SEC does not negotiate the economic terms of reorganization plans, we may take a position on important legal issues that will affect the rights of public investors in other bankruptcy cases as well. For example, the SEC may step in if we believe that the company’s officers and directors are using the bankruptcy laws to shield themselves from lawsuits for securities fraud.

Read Also: How To Medically Retire From Federal Government

What Happens To Your Information

Any previous name included in the bankruptcy petition will appear on the bankruptcy order, and in the:

- notice of your bankruptcy, which is permanently recorded in the Gazette but excluded from search engine results one year and three months after publication

- Individual Insolvency Register which will be removed within three months of your discharge

Georgia Attorney Explains Bankruptcy Costs

Although bankruptcy is a legal remedy for people who cant keep up with debt payments, there are costs involved in obtaining this protection. Depending on the complexity of your case, there may be court fees, legal fees and other expenses totaling a few hundred to a few thousand dollars. At Jeff Field & Associates, we can help determine ways to make bankruptcy an affordable option for you.

Read Also: How To Be A Government Contractor

What Happens To Your Debts In Bankruptcy

The main reason people file for bankruptcy is to get rid of, or get control of, their debts. How debts are treated in bankruptcy depends on whether you file for Chapter 7 or Chapter 13.

Although most debts will be discharged in Chapter 7 bankruptcy, not all are. And in Chapter 13 bankruptcy, you must pay some debts in full through your repayment plan. Others are paid in part, and the remainder discharged at the end of your case.

Below you’ll find articles explaining how your debts are treated in Chapter 7 and Chapter 13 bankruptcy as well as information about what happens to particular debts — such as credit card debt, medical debt, mortgages, car loans, taxes, child support, and student loans.

Debts You Have To Pay In Bankruptcy

Most unsecured debts, such as utility and credit card bills, are included in the bankruptcy. You dont have to make payments for these once you have declared bankruptcy until you become bankrupt. However, you still must pay the secured debt during bankruptcy. This can include car loans and mortgages. If you cant make the payments for your secured debts, you will have to surrender the secured items.

Read Also: T Mobile Discounts For Government Employees

The Individual Insolvency Register On Annulment

Once notice of the annulment is received your bankruptcy will be removed from the Individual Insolvency Register after:

- 28 days if the bankruptcy order should not have been made

- 3 months if the debts were paid in full or an IVA has been agreed

If an IVA has been agreed, details of this will appear on the register.

The Chapter 13 Hardship Discharge

After confirmation of a plan, circumstances may arise that prevent the debtor from completing the plan. In such situations, the debtor may ask the court to grant a “hardship discharge.” 11 U.S.C. § 1328. Generally, such a discharge is available only if: the debtor’s failure to complete plan payments is due to circumstances beyond the debtor’s control and through no fault of the debtor creditors have received at least as much as they would have received in a chapter 7 liquidation case and modification of the plan is not possible. Injury or illness that precludes employment sufficient to fund even a modified plan may serve as the basis for a hardship discharge. The hardship discharge is more limited than the discharge described above and does not apply to any debts that are nondischargeable in a chapter 7 case. 11 U.S.C. § 523.

Don’t Miss: Government Jobs In Huntsville Al

Speak With Our Bankruptcy Lawyers In Phoenix & Scottsdale

Canterbury Law Group should be your first choice for any bankruptcy evaluation. Our experienced professionals will work with you to obtain the best possible outcome. You can on the firm to represent you well so you can move on with your life. Call today for an initial consultation. We can assist with all types of bankruptcies including Business Bankruptcy, Chapter 7 Bankruptcy, , Chapter 5 Claims, Chapter 13 Bankruptcy, Business Restructuring, Chapter 11 Bankruptcy, and more.

*This information is not intended to be legal advice. Please contact Canterbury Law Group today to learn more about your personal legal needs.

The Chapter 7 Discharge

A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor. Because a chapter 7 discharge is subject to many exceptions, debtors should consult competent legal counsel before filing to discuss the scope of the discharge. Generally, excluding cases that are dismissed or converted, individual debtors receive a discharge in more than 99 percent of chapter 7 cases. In most cases, unless a party in interest files a complaint objecting to the discharge or a motion to extend the time to object, the bankruptcy court will issue a discharge order relatively early in the case generally, 60 to 90 days after the date first set for the meeting of creditors. Fed. R. Bankr. P. 4004.

The grounds for denying an individual debtor a discharge in a chapter 7 case are narrow and are construed against the moving party. Among other reasons, the court may deny the debtor a discharge if it finds that the debtor: failed to keep or produce adequate books or financial records failed to explain satisfactorily any loss of assets committed a bankruptcy crime such as perjury failed to obey a lawful order of the bankruptcy court fraudulently transferred, concealed, or destroyed property that would have become property of the estate or failed to complete an approved instructional course concerning financial management. 11 U.S.C. § 727 Fed. R. Bankr. P. 4005.

Also Check: Can You Refinance Government Student Loans

The Gall To Look Like Heroes

More than seven months into the war, its hard to overstate the impact Starlink has had in Ukraine. The government in Kyiv, Ukrainian troops as well and NGOs and civilians have relied on the nimble, compact and easy-to-use units created by SpaceX. Its not only used for voice and electronic communication but to help fly drones and send back video to correct artillery fire.

CNN has seen it used at numerous Ukrainian bases.

Starlink has been absolutely essential because the Russians have targeted the Ukrainian communications infrastructure, said Dimitri Alperovitch, co-founder of the Silverado Policy Accelerator, a think tank. Without that theyd be really operating in the blind in many cases.

Though Musk has received widespread acclaim and thanks for responding to requests for Starlink service to Ukraine right as the war was starting, in reality, the vast majority of the 20,000 terminals have received full or partial funding from outside sources, including the US government, the UK and Poland, according to the SpaceX letter to the Pentagon.

SpaceXs request that the US military foot the bill has rankled top brass at the Pentagon, with one senior defense official telling CNN that SpaceX has the gall to look like heroes while having others pay so much and now presenting them with a bill for tens of millions per month.

What Debts Cannot Be Discharged In Bankruptcy

The following debts cannot be discharged in either a Chapter 7 or a Chapter 13 bankruptcy case. If you file Chapter 7, you will still owe these debts after your case is over. If you file Chapter 13, these debts will either be paid in full during your plan, or the balance will remain at the end of your case.

Nondischargeable debts include:

- Unlisted debts, unless the creditor had knowledge of your bankruptcy filing.

- Recent income tax debt and other tax debt.

- Fines imposed for violating the law.

- Student loans, unless you can show that it will cause a hardship for you to repay them.

- Debts you owe under a divorce decree or settlement.

In a Chapter 7 and 13 case, a creditor may object, and a judge may agree, to theseadditional debts being discharged:

- Debts incurred by embezzlement, fraud, or larceny.

- Certain credit purchases made within 90 days or cash advances made within 70 days of filing.

- Restitution or damages awarded in a civil action for willful or malicious injury to a person.

Don’t Miss: Government And Nonprofit Accounting Textbook