Can Parent Plus Loans Be Discharged In Bankruptcy

Parent PLUS Loans can be discharged in both Chapter 7 bankruptcy and Chapter 13 bankruptcy like other types of federal and private student loans. But you first have to file a lawsuit in your bankruptcy case called an adversary proceeding. In the adversary complaint, you’ll have to show the bankruptcy judge that repaying the loans would cause an undue hardship to you and your dependents. Meeting the undue hardship standard for student loan discharge is challenging.

Most bankruptcy courts use the Brunner Test to determine if you’ve met the standard. The Brunner Test reviews three criteria:

You can read more about the student loan bankruptcy process here.

Parent Plus Loan Transfer To Student: Is It Possible

Many opportunities are accessible to PLUS loans made to students, while only a few involve Parent PLUS loans made to parents. Hence, parents might think about Parent PLUS Loan transfer to students to become eligible for other forgiveness options. Unfortunately, such a transfer is not possible. When you get a loan made to you instead of the child, you take full responsibility, and there is no way to get rid of this debt obligation.

When Parent Plus Loans Are A Good Idea

Simply put, Parent PLUS Loans can be very useful and a great optionwhen used intelligently and with planning. Parent PLUS Loans can cover any remaining college expenses when no other funds are available. This makes them perfect for students whose scholarships, family contributions, savings, and other sources of aid dont make ends meet.

You May Like: Semper Fi Auto Repair Las Vegas

Newssearch Your School: Put Your College Through A Financial Stress Test

Unlike student loans, with Parent Plus, its difficult to get a payment plan based on a familys income. That means that if a parent loses a job or suffers a significant pay cut they may be stuck with monthly bills that they cannot afford.

More than 1 in 8 parents will default on the loans, according to the most recent government estimates. Nonetheless, colleges and universities continue to offer parents the loans, and Congress allows them to borrow, even when administrators can see from a familys financial records that they have little possibility of repaying them.

For more of NBC News’ in-depth reporting,

Last spring, in the face of the coronavirus pandemic-induced economic meltdown, the federal government allowed students and parents with college loans to temporarily stop making payments without accruing interest. But that reprieve is scheduled to end on Dec. 31. Neither President Donald Trump nor President-elect Joe Biden has addressed the possibility of extending the deadline.

Policy experts only expect the situation to get worse for Plus borrowers during the pandemic. Millions of Americans have lost their jobs or have had their hours cut this year, and states face gaping budget holes, which in the past have led to huge cuts to higher education. The result has been spiking tuition, which in turn has led to increased student loans.

There is currently no limit on the amount parents can borrow, as long as the money is used for college-related expenses.

Federal Direct Plus Loan

Parents may apply for the Federal Parent Loan for Undergraduate Students , to help pay for their dependent undergraduate students education expenses. This loan is not need based and requires a credit review. A parent must apply each year after completing the FAFSA to receive this loan. This loan also includes a fixed interest rate. Because PLUS loans are administered directly by the federal government, parents must complete the following steps.

Read Also: State Jobs Kansas City

What Is A Direct Plus Loan

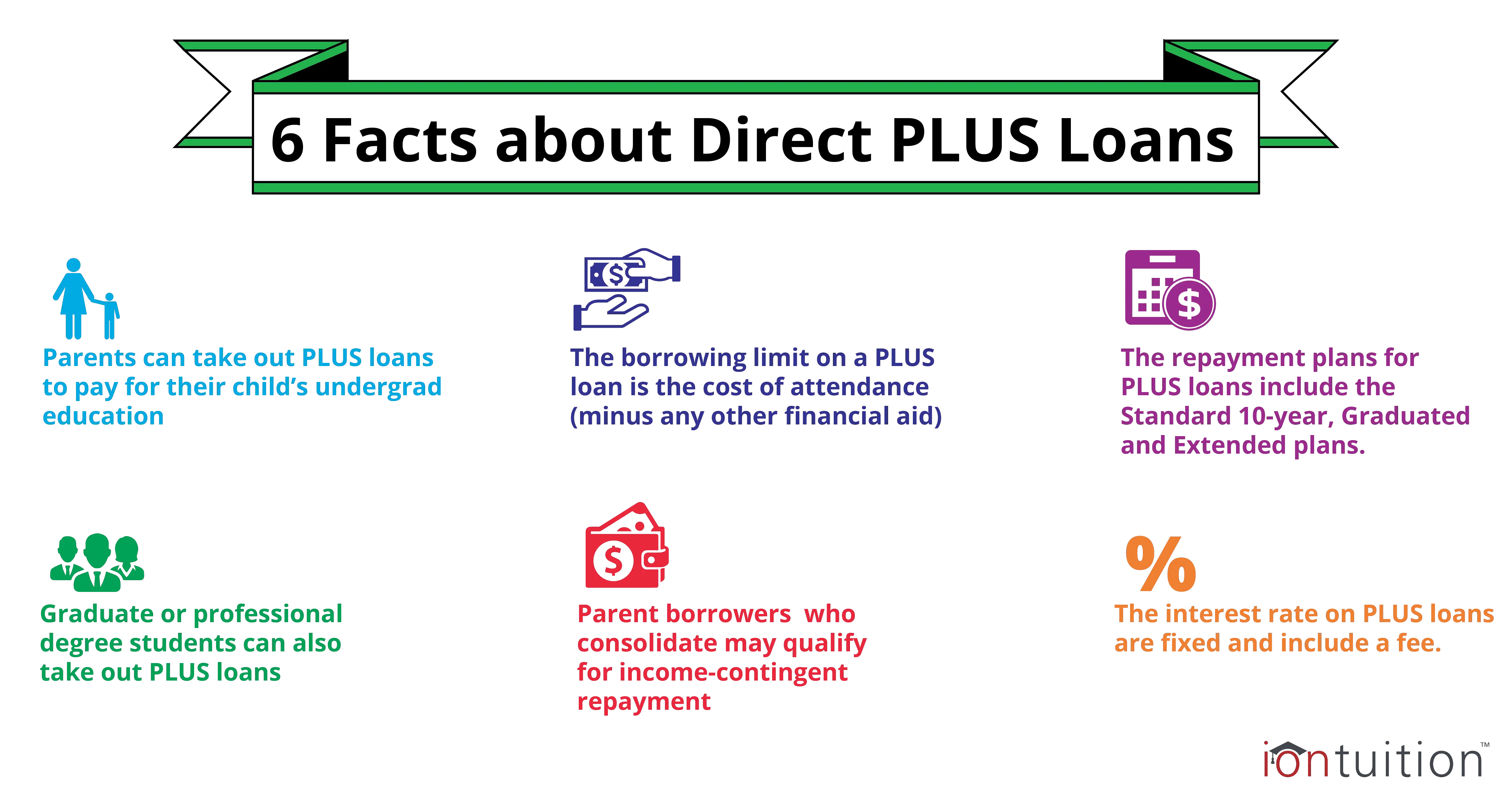

Direct PLUS loans are federal loans that graduate or professional degree students or parents of dependent undergraduate students can use to help pay for education expenses.

Direct PLUS loans have a fixed interest rate and are not subsidized, which means that interest accrues while the student is enrolled in school. You will be charged a fee to process a Direct PLUS Loan, called an origination fee. An origination fee is deducted from the loan disbursement before you or the school receives the funds. A credit check is performed on applicants to qualify for a Direct PLUS Loan.

There are two types of Direct PLUS loans: the Grad PLUS loan and the Parent PLUS loan.

Grad PLUS loans allow graduate and professional students to borrow money to pay for their own education. Graduate students can borrow Grad PLUS loans to cover any costs not already covered by other financial aid or grants, up to the full cost of attendance.

To qualify for a Grad PLUS loan you must meet three criteria:

Parent PLUS loans allow parents of dependent students to borrow money to cover any costs not already covered by the student’s financial aid package, up to the full cost of attendance. The program does not set a cumulative limit to how much parents may borrow. Parent PLUS loans are the financial responsibility of the parents, not the student and cannot be transferred to the student upon the students completion of school.

To qualify for a Parent PLUS loan, you must meet three criteria:

Repayment Plans And Forgiveness

You can expect to have 10 to 25 years to repay your Parent PLUS Loan without penalty, depending on the type of repayment plan you choose. Direct Loans offer multiple repayment plans that can help ease the burden of high monthly payments. If you find yourself unable to repay your loan, contact your service provider right away. You may be able to request a lower monthly payment, a period of deferment, or forbearance. Parent PLUS loans are currently eligible only for standard, extended, graduated, and income contingent repayment plans. They are not eligible for IBR, PAYE, or REPAYE programs at this time.

Your Parent PLUS Loan may also be eligible for thePublic Service Loan Forgiveness program and end of term forgiveness through the Income Contingent Repayment program . You could also qualify for Permanent Disability Discharge with a Parent Plus Loan.

You May Like: Entry Level Government Jobs San Diego

When Should You Use A Parent Plus Loan

Parent PLUS Loans should only be used to cover gaps in paying for college expenses, and only as a last choice. After grants, scholarships, work-study, out-of-pocket savings, and family contributions, you may still need loans to make up the difference. But before you take out a Parent PLUS Loan, your child should take out loans in their own name to cover as much of their college education as they can. If you are ineligible for a Parent PLUS Loan, your child may be able to obtain an increased subsidized loan.

Can A Parent Plus Loan Be Forgiven

Parent PLUS loan forgiveness can be accessible through the Public Service Loan Forgiveness program. This program is one of the best options to get forgiveness by providing public service. Alternatively, you can choose to repay the debt through an Income-Contingent plan which will bring forgiveness in 25 years. We will discuss the details of the mentioned opportunity in the next sections.

Besides this program, discharge can happen. Student loan discharge options eliminate the debt, in most cases fully, due to external reasons that the borrowers do not control. For example, if a parent or the student dies, the school closes, the family declares bankruptcy, or the parent becomes disabled, discharge can be possible.

Don’t Miss: Dental Implant Grant

Government Loans For Us Students

PLEASE NOTE: Online education: On March 27, 2020, the CARES Act was signed into U.S. law. This law allows the Department of Education to waive the distance education prohibition for foreign institutions. Consequently, for Fall 2021 and/or Winter 2022, you are allowed to have your US federal loans even if you are required to take any Dalhousie course offered fully or partially online.

Students who are citizens or permanent residents of the US may apply for Stafford and PLUS loans through the William D. Ford Federal Direct Loan Program. This program includes Stafford and PLUS loans only. Students attending foreign schools are not eligible for grants from the US government. Students must be registered in a degree program. Students in online or correspondence programs are not eligible.Please note: The following programs are not eligible for funding through the William D. Ford Federal Direct Loan program: all nursing programs Doctor of Medicine Bachelor of Agriculture, International Food Business diploma programs certificate programs or special student/qualifying non-degree programs. Programs offered fully or partially through distance education.

Interest Rate And Fees

Interest is money paid to the lender in exchange for borrowing money. Interest is calculated as a percentage of the unpaid principal amount borrowed. The interest rate varies depending on the loan type and the first disbursement date of the loan. Please to view the current interest rates, or to view historical Federal Direct Loan interest rate information.

Most federal student loans have loan fees that are a percentage of the total loan amount. The loan fee is deducted proportionately from each loan disbursement you receive. This means the money you receive will be less than the amount you actually borrow. You’re responsible for repaying the entire amount you borrowed and not just the amount you received.

Please to view the current loan fees for Federal Direct PLUS Loans.

Also Check: Jobs For History Majors In Government

Can I Transfer A Parent Plus Loan To My Child

While the government doesnt allow you to simply transfer a Parent PLUS loan to your son or daughter, it can still be done through a private lender, if your kid qualifies. Theyll need a strong credit score, a history of on-time loan payments and solid income. If you go this route, they should apply for their own refinanced loan and include your Parent PLUS loan in the application.

The question is, should you? In most cases, we do not recommend transferring a loan to your child. Remember, this is your loan. Even though it was to help them with college, your child doesnt have a moral obligation to pay it. However, if you and your child agreed beforehand that they would eventually pay it back, go ahead and transfer it. Otherwise, its better to just tackle the debt yourself. Dont burden your child with a loan you took out, no matter what it was originally for.

Some families also choose to work together to pay them off faster. In this case, theres no need to officially transfer it.

Direct Plus Vs Parent Plus Loans

PLUS Loans are available to both graduate/professional students and the parents of dependent undergraduate students.

Both cases are instances of direct loans, meaning they are issued directly by the federal government. A Parent PLUS Loan is the name given to these Direct PLUS Loans when they are taken out by parents on behalf of their undergraduate students. When theyre borrowed by professional or graduate students, these direct loans are referred to as Direct PLUS Loans, even though they dont involve a parent.

Direct PLUS Taken out by graduate and professional students without a cosigner.

Parent PLUS Taken out by the parents of dependent undergraduate students.

Also Check: Safelink Free Phone Replacement

What Happens If You Dont Pay A Parent Plus Loan

A Parent PLUS Loan will enter default after 270 days of nonpayment. At that point, you could be facing wage garnishment, or having Social Security payments or tax refunds withheld to cover the debt.

The best way to avoid those troubles is to steer clear of debt completely. The next best approach is to pay it all off as fast as possible.

Exceptions To The Standard Budget:

Living in Residence:

Students living in residence may have higher living and food costs than associated with the standard student budget. For those students living in residence with a meal plan we will increase your monthly living costs accordingly. You may need to notify our office to confirm your living arrangement.

Additional Housing Allowance:

Students who pay more in rent and utility costs can request a budget increase provided documentation to validate these costs is submitted. Additionally, the student may be asked to present a reason why less costly housing is not an option. Determined on a case by case basis.

Transportation

Students may request exceptional expenses related to the maintenance of their vehicle. Routine maintenance is not considered in this review. Please contact Student Financial Aid to discuss this directly for a review.

Medical and Dental Expenses:

US Students are insured under the University Health Insurance Plan: . These plans do not cover all related Medical expenses. In cases where UHIP does not cover the full cost of a medically required treatment these costs may be considered. Cosmetic or elective procedures will not be considered.

Computer Purchase

A standard budget exists for computer related expenses . Printers, software etc, may be considered additional costs for the budget. Appropriate documentation must be submitted and reviewed as reasonable.

License and Professional Fee Expenses:

Read Also: Congress Mortgage Stimulus Middle Class

Parent Plus Loan Eligibility

Parent PLUS Loans are available only to the parents of dependent undergraduate students. The parents of independent undergraduate students are not eligible for the Parent PLUS Loan.

If a dependent students parents are divorced, both parents can take out separate Parent PLUS Loans with separate Master Promissory Notes . But the combined Parent PLUS Loans cannot exceed your students cost of attendance minus other financial aid received.

Applying For A Direct Loan

Also Check: Gov Jobs San Antonio

Applying For A Plus Loan

Parents, graduate and professional students who are applying for a PLUS loan must submit the Free Application for Federal Student Aid and sign a master promissory note.

To qualify, however, the student must be enrolled at least half-time and be eligible for federal student aid. Both the parent borrower and the student must be US citizens, nationals or eligible noncitizens. Neither the student nor the parent borrower can have a federal government judgment lien on his or her property. The parent cannot owe an overpayment on a federal education grant or be in default on a previous federal education loan unless he or she has made satisfactory arrangements to repay the grant overpayment or loan. The student is required to be registered with Selective Service, but the parents are not. Colleges are required to determine eligibility for both the dependent student and the parent before certifying a Parent PLUS loan. Besides obtaining the students complete financial aid history, the school may also have supplemental forms for the parent to complete, such as signing a statement of educational purpose.

How To Apply For A Parent Plus Loancopy Link To Copied To Clipboard

Federal Direct Parent PLUS Loans are available to the parents or stepparents of dependent undergraduate CCA students. Direct PLUS Loans are financed directly by the U.S. government, so you do not need to choose a lender.

Instructions listed here are intended for those parents who wish to borrow through the Federal Direct Parent PLUS Loan program on behalf of their children who are CCA students in 202122.

To Receive a Parent PLUS Loan

- Complete a Parent PLUS Master Promissory Note . You can complete and sign the Parent PLUS Loan MPN online.

Select Complete Master Promissory Note option on menu.

The Parent PLUS MPN is usually a multiyear promissory note. The MPN is good for ten years unless you use an endorser , in which case the MPN is good for that loan only.

You must complete and sign a Parent PLUS MPN to receive your loan funds which you can do so online.

How much to apply for

If you need assistance determining the overall amount needed to request in a Parent PLUS loan, please contact our Student Accounts office.

Important Notes

Related Pages

Also Check: Peachtree City Job Seekers

I Cant Pay My Parent Plus Loan What Now

Life happens, and no one plans on not being able to pay their student loans â but it happens. If you can’t pay your Parent PLUS Loan, here are 8 options to consider:

The federal government doesn’t offer a loan program that would allow you to move the liability for a Parent PLUS Loan to a spouse or to the student. However, some private lenders will allow a parent to transfer a Parent PLUS Loan to a child through refinancing.

Parent PLUS Loans are not eligible for IBR, PAYE, or REPAYE forgiveness programs. But they are eligible for ICR.

Parent PLUS Loans can be forgiven if the parent borrower suffers a total disability that renders them unable to repay the loan.

If possible, you should always avoid going into default. Federal student loans can garnish your wages or tax refund to get the repayment theyâre owed.

For weekly student loan tips and tricks, life-changing info, and great resources, . Iâll only send you stuff that you should know as a borrower.