We Return Unused Funds To The Agencies

We, the Bureau of the Fiscal Service, issue payments on behalf of many federal agencies.

When the Treasury center that issued the payment learns that the payment can’t be delivered or isn’t cashed in the allotted time or is returned for another reason, we cancel the payment and return the money to the relevant agency.

If you are missing a payment, you must go to the agency to have them tell us to issue it again.

If A Claim Has More Than One Owner

If there is more than one claimant, all claimants information needs to be provided, including their signatures and other documentation to support their identity and balance entitlement.

- An unclaimed balance held by two or more names joined by or, may be claimed in its entirety by any of the balance holders or by the estates of any deceased balance holders, if applicable.

- An unclaimed balance held by two or more names joined by and, will be split equally between the living holders and the estates of any deceased balance holders, if applicable.

In either case, when a claim is made on behalf of a deceased balance holder, the claimant must be an authorized representative of the deceased balance holder.

Why Would A State Be Holding Onto My Property Anyway

After a specific “dormancy period” — usually one to three years — businesses will send money and property to state-run unclaimed property offices when they can’t locate the owner. The state will then hold these items until their owner claims them.

The property can be money in a savings or checking account, stocks, annuities, life insurance policies or the contents of safe deposit boxes, among many possible items. New York state currently has a whopping $17.5 billion in unclaimed property, and the state comptroller office says it pays out $1.5 million per day.

Get the So Money by CNET newsletter

Also Check: Difference Between Governance And Compliance

If You’ve Freelanced For Years 1099

Here’s some good news — receiving a 1099-K can take some of the manual work out of filing your self-employment taxes. Previously, self-employed individuals would receive 1099-MISC or 1099-NEC tax forms from each individual client they worked for, when they earned more than $600.

Now, you may still receive individual 1099-NEC forms if you were paid through direct deposit, check or cash, but your 1099-K will include payments from all clients who paid you through that particular payment app. So, if you had five clients in 2022, and one paid via direct deposit, while the other four paid you through PayPal, you should receive two tax forms, instead of five. You’d get one 1099-NEC for the direct-deposit client and one 1099-K from PayPal for the other four clients’ payments.

This can save you from spending your time tracking down paperwork and adding up third-party payments.

Erc Free Money From The Us Government

The second stimulus bill enacted into law on December 27, 2020, and the American Rescue Plan Act of 2021 enacted into law on March 11, 2021, included significant enhancements to the Employee Retention Credit . The ERC allows qualified employers to receive significant dollars back from the United States government. This money is in addition to the PPP money that employer may have received. This is free money if you qualify that does not have to be paid back. Time is of the essence to see if you qualify since we do not know how long the US government will fund this program.

Also Check: Government Jobs In Corpus Christi Tx

Consult Tax Debt Relief Professionals Who Can Figure It Out For You

The last option may be the easiest and most hands-free answer to the question, How much do I owe the IRS? No need for an online portal, a phone call, or a form in the mail. Instead, you can have someone do that leg work for you.

Tax debt professionals can work with the IRS on your behalf to find out exactly how much your tax liability is. All youll need to do is give them the information they need and kick back while they deal with the IRS for you. And once they find out how much you owe, they can offer you customized solutions.

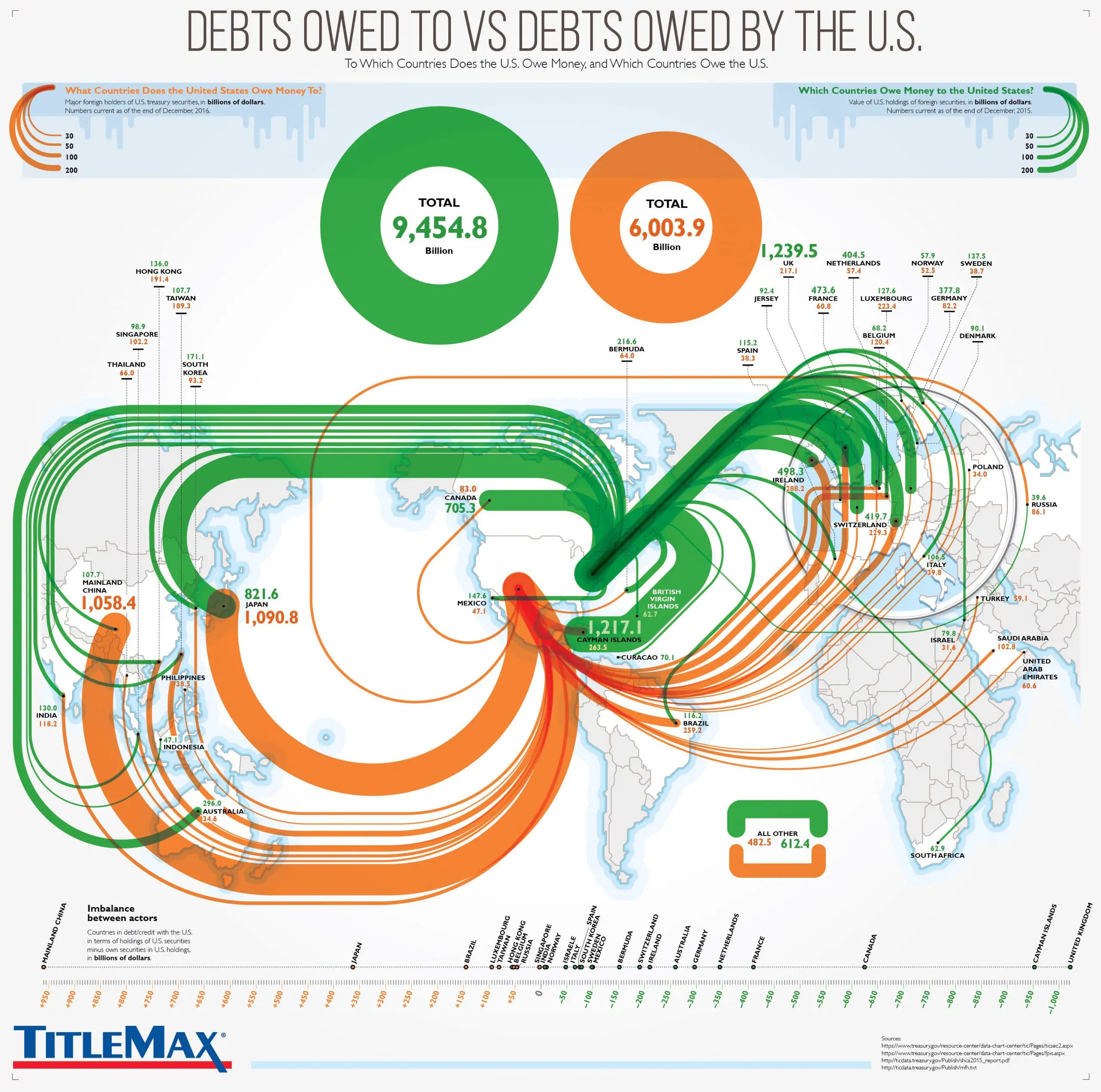

Us Debt: How Big Is It And Who Owns It

US federal debt is still a record high. This week it passed a milestone: the fourth straight year the deficit has passed the $1tn mark. As of today, the national debt stands at $16,066,241,407,385.80 .

Its an issue thats sure to come up in the first presidential debate this Wednesday.

So, how does the US borrow money? Treasury bonds are how the US and all governments for that matter borrow hard cash: they issue government securities, which other countries and institutions buy. So, the US national debt is owned mostly in the US but the $5.4tn foreign-owned debt is owned predominantly by Asian economies.

Under President Obamas first term, that figure has gone up from $3tn, a rise of 74.1%. Under George W Bush, it went up too by 85% over the whole two terms and 64% in his second term alone.

Holders of US Treasury bonds, $bn

The US Treasury releases the figures on this every quarter we have made them more useable. So, who has the most?

It reflects a US national debt which has grown starkly, from $7.8tn in 2005 to busting through the US debt ceiling of $14.294tn last year according to these day by day figures.

The full data is below. What can you do with it?

You May Like: Grant For Dental Implants For Seniors

Read Also: Government Contract Purchase Order Financing

How States Return Your Unclaimed Money Back To You

After reading about the different types of unclaimed money and the fact that there is such a thing as unclaimed money, you are probably thinking how can I receive this unclaimed money?

Each state identifies what is the most suitable and efficient method to receive the claim form of your unclaimed money. There are some states that accept online claim forms, while others accept mail forms. However, returning your unclaimed money is all the same. You will receive a check for your troubles.

Also Check: Government Contractors In Hampton Roads

Where Does Unclaimed Money Come From

The government is holding onto unclaimed money that comes from a variety of sources. Usually, unclaimed money becomes unclaimed when its lost in the mail. A check is sent out from an old insurance payment or a utility deposit and the money never ends up reaching the intended recipient. In these cases, the money is sent back to the company or government account where it originated before its sent to the government unclaimed money account that is in place for situations just like these.

You May Like: An Effective Information Governance System Should Include All Except

Do I Use My Name Or The Deceased Persons Name In A Life Insurance Policy Search

Records relating to life insurance policies vary slightly to that of banks and companies as the policy owner may be different from the life insured. When you do a name search, both of these names are searched. For example, if you search for Robert Smith, any life policy which has Robert Smith as either the owner of the policy or the life insured will be displayed.

Dont Miss: Government Employee Discounts Universal Studios Orlando

Moneyare You Owed Money Heres How To Find Out Without Getting Scammed

First, go to your states unclaimed property website to check if youre owed funds. If youve moved around a lot, you can try sites like missingmoney.com or unclaimed.org, which may be able to search multiple state databases at once. The search uses your name and your city to check for any funds. Remember to try a maiden name or a middle initial if those apply to you.

There are several different places where you might be able to find more funds:

- If you have an Federal Housing Administration-insured mortgage, you may be eligible for a refund through the Department of Housing and Urban Development. Take a look at the HUD website.

- If you expected a tax refund and never received it, it may have been sent to the wrong address or bank account. Additionally, if you didnt file your taxes but should have received money back, you can check the IRS website to claim your missing refund.

- Still hanging on to some savings bonds you never cashed in? If youre missing the paper copy, you can request a savings bond reissue here.

- If your government-insured bank or credit union was liquidated, the Federal Deposit Insurance Corp. or National Credit Union Administration will refund any deposits you had not claimed. For banks, search the FDIC for credit unions, search the NCUA.

Don’t Miss: Government Jobs In Manhattan Ks

Search To Find Unclaimed Money

Finding out if you are entitled to any unclaimed money really isnt that difficult to do. The truth is that anyone can go online to each state and agency holding funds and search by name to see if they have any unclaimed property out there that belongs to them.

There is complexity because any state you have ever lived in could be holding your money or any agency you have ever done business with could be holding money. And their search tools are often clunky. That is why Inlife Claims has aggregated data across multiple states and has a more intuitive and powerful search engine to help you find unclaimed money. Nonetheless, finding out that you have unclaimed money is the easy part, but retrieving any unclaimed money gets a little more in-depth though.

If You Earn $600 Or More With Paypal Venmo Or Cash App The Irs Is Going To Know

Money sent to friends and family won’t be taxed, but income received through third-party apps will be.

Did you start a side hustle or work for yourself this year? If you did and earned money through digital apps like PayPal, Cash App, Zelle or Venmo, the IRS is going to know about it. That means you’ll need to make sure you’re reporting the correct amount of self-employment income — down to the penny — when filing your tax return.

Self-employed individuals are always required to report their earnings when filing their tax returns, but a new regulation for 2022 requires digital payment apps to report your earnings over $600 directly to the IRS via tax form 1099-K. You’ll then receive a copy of your 1099-K in late January or February.

What exactly does this new rule mean for your taxes? We’ll walk you through what’s changed and debunk a few myths along the way.

Read Also: Us Government Loans And Grants

The Irs Isn’t Taxing Money You Send To Family And Friends

Rumors have circulated that the IRS was cracking down on money sent through third-party payment apps to family and friends, but that isn’t true. Personal transactions involving gifts, favors or reimbursements are not considered taxable. Some examples of nontaxable transactions include:

- Money received from a family member as a holiday or birthday gift

- Money received from a friend covering their portion of a restaurant bill

- Money received from your roommate or partner for their share of the rent and utilities

Payments that will be reported on your 1099-K must be flagged as payments for goods or services from the vendor. When you select “sending money to family or friends” it won’t show up on your tax form. So that money from your roommate for her half of the restaurant bill is safe.

If you do receive a 1099-K for money that was sent from a family member or friend, reach out to the payment processing company to get this transaction corrected.

How Much Is Returned

In fiscal year 2020, the Unclaimed Property Division of the State Treasurer Office processed 17,600 individual claims totaling more than $4.7 million. This represented cash only it excluded distributions for mutual funds and other securities. Below you will find historical data detailing the number of claimants paid annually, the amount of unclaimed property returned to Vermonters annually, and the amount of unclaimed property annually turned over to the Treasurers Office.

Also Check: Free Government Phones Milwaukee Wi

Moneyscammers Want To Steal Your Stimulus Check Here’s What You Should Know

Claiming the money is straightforward. You just need to prove that the money is yours, and your state will cut you a check. Each state has its own rules about how to prove your identity and claim that money, so make sure you read any rules on the site.

You should be able to claim this money for free and on your own. If someone is asking you to pay a fee for it, proceed with caution. If you do need to go through a third-party service, make sure that you dont pay upfront and dont pay more than 10% to 20% in fees.

Emily Pandise is a producer and reporter for NBC News, covering business, tech and media since 2017. In her early 20s, she realized she had no idea how to manage her money. She set out to change her financial habits, and she did. Now, she wants to help others do the same. You can find her on Twitter and Instagram @emilypandise.

Search For Unclaimed Money In Your State

Businesses send money to state-run unclaimed property offices when they cant locate the owner. The unclaimed funds held by the state are often from bank accounts, insurance policies, or your state government.

- Search for unclaimed money using a multi-state database. Perform your search using your name, especially if youve moved to another state.

- Verify how to claim your money. Each state has its own rules about how you prove that youre the owner and claim the money.

Read Also: Us Government Jobs San Antonio

Start Your Search Now

Revenue NSW is committed to protecting your personal information from unauthorised access, misuse, and disclosure.

We have recently undertaken a review of our unclaimed money search function and have made improvements for the protection of your personal information.

You can search and claim for unclaimed money belonging to you. Its free.

When you access the unclaimed money search facilities, you must only use the information for its intended purpose and in line with privacy legislation governing the use of information.

We do not ask people to pay any fees to search and claim any unclaimed money held with us and encourage you to submit a claim yourself.

You May Like: Government Phone Replacement

How To Find Lost Money

A forgotten savings account or a lost paycheck can be a lifeline for many people during this time. Luckily, there are credible websites that can help you search for these windfalls of cash.

To start, visit NAUPAs website Unclaimed.org, a national network collecting records from all 50 states. From there, you can find links to each states official unclaimed property program. These are all vetted government resources, so its important you go through NAUPA-provided websites versus a general search engine.

When you click on a state, you will be directed to its official website. To search for your unclaimed money, use both your current and maiden name if you legally changed your last name. You may want to try different search inquires as well, such as using the first initial of your first name plus your full last name.

Because unclaimed property is reported to the state where the company or organization is located, its common to have lost money in more than one place, especially if you have moved between states. To search multiple states at once, NAUPA recommends using MissingMoney.com, a free website they endorse. Make sure to check every state where you have lived and done business.

Some other government sources with searchable databases include:

- The IRS website for any undeliverable tax refunds

- The Pension Benefit Guaranty Corporation for unclaimed pension money

- The U.S. Treasury Hunt for unclaimed savings bonds, registered Treasury notes or registered Treasury bonds

Recommended Reading: How To Write A Resume For A Government Position

Average Amount Of Unclaimed Funds

For most people who are owed funds, the amount tends to be in the hundreds in terms of dollars. However, there are instances when a person is due a large amount of money. In New York state, for instance, if the $13 billion in unclaimed funds was doled out equally to citizens, every man, woman and child in the state would be given more than $600. In California, the average claim is around $277.But much larger claims are possible.

According to SmartAssett, a company specializing in personal finance technology, certain states lead the way in terms of unclaimed property. These include New York, Massachusetts, Maine, Maryland, Rhode Island, Connecticut, Virginia, Nevada, Arizona and California. The most populous states have the most unclaimed money. This is to be expected, given the higher number of residents.

You May Like: Free Government Funding For Home Repairs

California Judge Rejects Water Deal For Major Farm Supplier

Kathleen Ronayne

FILE In this June 25, 2013, photo, workers move irrigation pipes from a field in the Westlands Water District near Five Points, Calif. A California judge has rejected a controversial contract between the federal government and the Westlands Water District, the nations largest agricultural water supplier, ruling the district failed to provide key information about the deal to permanently lock in its water access.

SACRAMENTO, Calif. A California judge has rejected a federal contract granting permanent access to U.S. government-controlled water for the nations largest agricultural water supplier, saying it lacked details on costs and appropriate public notice.

Environmentalists had blasted the contract with Westlands Water District as a sweetheart arrangement designed to benefit corporate agricultural interests over environmental needs and taxpayers. It was crafted during the Trump administration under then-Interior Secretary David Bernhardt, a former lobbyist for Westlands, a public entity based in Fresno that supplies water to private farmers.

This was an effort to basically steal public resources and put them into private pockets, said Stephan Volker, an attorney for the Winnemem Wintu Tribe, the North Coast Rivers Alliance and several other groups.

The argument really is: Are we going to allocate that much water to Westlands Water District without conditions? she said.

Recommended Reading: Grants For Teeth Implants

Recommended Reading: Government Programs To Help With Debt