Potential Opportunities Beyond The Biggest Stocks

At the end of September, the five largest companies by market cap accounted for roughly 22% of the S& P 500 Index and 38% of the Russell 1000 Growth Index.2 This high level of concentration means that large-cap growth investors relative performance often hinges on making the right call on a handful of the largest stocks: Apple, Microsoft, Amazon.com, Tesla, and Alphabet .

We remain very thoughtful about our positioning in the established tech giants. Key considerations include:

- How effectively they are investing in growth initiatives,

- The levers they could pull to create value, and

- The extent to which they are returning capital to shareholders.

These entrenched businesses have advantages of scale, but constant due diligence is required to evaluate whether they can overcome the law of large numbers. Achieving a robust rate of earnings or cash flow growth becomes more challenging off a large base.

Albeit painful in the near term, the difficult economic environment should expand the opportunity set by creating some coiled springs, or names where the mismatch between valuation and potential growth may create a compelling risk/reward profile.

In managing the strategy, we are always on the lookout for companies that we believe are responding to the difficult environment in ways that can create value over a longer time frame.

T. Rowe Price Beyond the Numbers

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

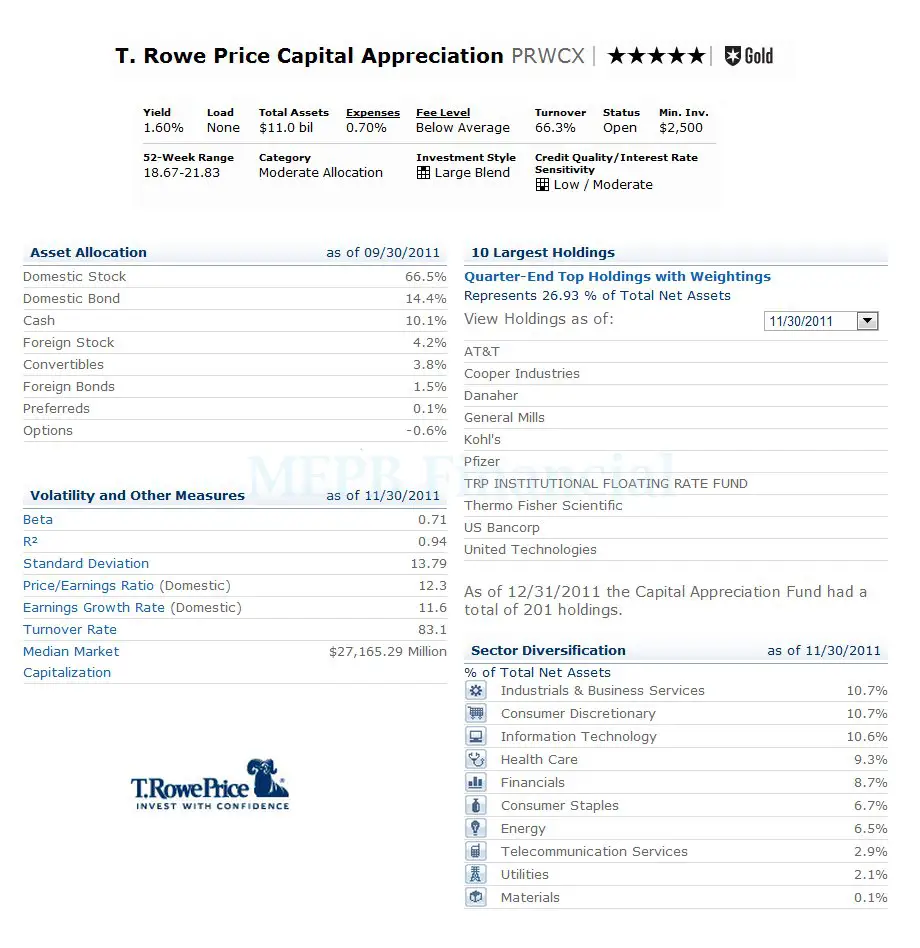

Top T Rowe Price Funds As Of 8/31/22

Fund Name, Ticker, Overall Rating,

TheStreet Ratings’mutual fund rating model compiles and examines financial data on a monthly basis to gauge a mutual fund’s risk-adjusted return compared to its competitors.

The 10 T. Rowe Price mutual funds are ranked highest by TheStreet Ratings’ methodology.

Best Mutual Funds For 2022

Recommended Reading: Government Drones At Night 2021

Breaking Down The Breakdown In Stocks

Bulk of weakness has come from valuation compression

As of December 31, 2021, to September 30, 2022.Past performance is not a reliable indicator of future performance.*Uses next 12 months data for earnings. Earnings estimates are used because the stock market tends to be forward-looking in nature.Source: T. Rowe Price analysis using data and analytics provided by FactSet Research Systems, Inc.All Rights Reserved. Actual outcomes may differ materially from estimates.

Depending on the duration and magnitude of the Feds rate-hiking program, the price portion of the price-to-earnings multiple could remain under pressure.

On the positive side, this leg of the level-finding process seems to be farther along. Growth stocks could return to favor when inflation appears to be trending lower and the Fed might slow the pace of rate increases.

Growth stocks could return to favor when inflation appears to be trending lower and the Fed could slow the pace of rate increases.

Inflation and Fed policy should also shape the outlook for the economy and corporate earnings, which, in turn, could drive volatility. By increasing interest rates, the central bank seeks to tame inflation through higher borrowing costs, which can slow the economy by prompting consumers and businesses to curb spending and investment.

Not all companies will be affected equally by an economic slowdown. Growth stories that are less sensitive to the economy could become more appealing on a relative basis.

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for T. Rowe Price Gr’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of T. Rowe Price Gr’s whale trades within a strike price range from $60.0 to $125.0 in the last 30 days.

Recommended Reading: Federal Government Grant World Bank

Interest On Direct Us Government Securities

In most states, fund dividends from interest on direct U.S. government securities are exempt from state and local taxes. To determine this amount for each of your funds, multiply the “% of dividends from U.S. government securities” by the amount for that fund in Box 1a of your Form 1099-DIV.

Check the specific requirements for your state. For example, some states only allow exemptions on dividends for those funds holding a minimum percentage, usually 50%, of government securities at the end of each quarter. We indicate in Column 3, below, whether any of your investments meet this requirement.

Inflation And Rising Rates Pressure Valuations And Earnings

Inflation and rising interest rates tend to pressure asset prices by reducing the present value of future cash flows. Growth stocks have typically exhibited greater sensitivity to these factors because investors have demonstrated a willingness to look further into the future when evaluating a companys prospects. The strong runup in growth stocks during the pandemic may also have made them more vulnerable in a pullback.

Much of the pronounced weakness in growth stocks and the broader market has stemmed from valuation compression, as opposed to a deteriorating outlook for corporate earnings .

You May Like: Federal Government Employee Personal Loans

Growth Stocks Have Exhibited Strong Fundamentals

Cumulative change in key financial metrics

June 30, 2007, to September 30, 2022.Past performance is not a reliable indicator of future performance.*Per share free cash flow, earnings, and sales are 12-month forward estimates.Source: Financial data and analytics provider FactSet. Copyright 2022 FactSet. All Rights Reserved.

We believe that some of the powerful trends that have driven outsized growth remain intact and should have room to run, even if these stories may seem old hat to many investors.

Consider the shift from data centers that information technology departments build and administer internally to cloud-based infrastructure maintained by a third party. This migration started almost 15 years ago but remains at only 10% to 15% of the addressable market, by our estimates. The move to cloud-based platforms and infrastructure could be a multi-decade growth story.

Transitioning data centers and workloads to the cloud saves businesses money by lowering their IT costs. And these investments can also result in meaningful efficiency and productivity gains. The pandemic underscored this point, as employees shifted to remote work seamlessly. Access to low-cost computing power via subscriptions that can be scaled up or down also tends to encourage innovation. In our view, this potentially durable tailwind may benefit established companies, including Microsoft and Amazon.com.

International Equity Index Pool

Provides long-term capital growth by seeking to match the performance of the MSCI EAFE Index Net, a broadly diversified stock index designed to represent the performance of large- and mid-cap securities across developed markets, including countries in Europe, Australasia and the Far East, and excluding the U.S. and Canada.

Don’t Miss: What Government Programs Are Available For Single Mothers

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

State Intangible Property Tax

If you pay state intangible property tax on the value of your fund, you may be able to exclude a portion of such value attributable to the fund’s investments in U.S. government securities. To determine this amount, multiply the “% of fund held in U.S. government securities on December 31, 2021” by the total value of your shares at year end. Consult your tax advisor or your state tax office for more information.

Also Check: Vacation Rentals Near Government Camp Or

T Rowe Price Gr Unusual Options Activity

Someone with a lot of money to spend has taken a bearish stance on T. Rowe Price GrTROW.

And retail traders should know.

We noticed this today when the big position showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don’t know. But when something this big happens with TROW, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 25 options trades for T. Rowe Price Gr.

This isn’t normal.

The overall sentiment of these big-money traders is split between 28% bullish and 72%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $50,618, and 24, calls, for a total amount of $5,744,969..

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

- Gear advertisements and other marketing efforts towards your interests.

To learn more about how we handle and protect your data, visit our privacy center.

Recommended Reading: Government Loans For Small Business Startup

Money Market Funds Portfolio Holdings

View our money market funds’ portfolio holdings.

The chart below features the portfolio holdings for money market funds. Select the fund and time period to download the complete portfolio of investments. Note that monthly holdings are released five business days after the period ends and will remain available for six months.

From time to time, a report may include up to 5% of the value of a fund’s portfolio securities, without identifying the issuer, under the caption “Miscellaneous Securities.” This is done to prevent potential harm to the fund while it completes a buying or selling program in those securities.

The portfolio holdings for our other mutual funds are available here.

Money Market Portfolio Holdings by Quarter in 2020 and 2021| Fund Name |

|---|

| View PDF |

1 Retail Money Market Funds: You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Read Also: Free Government Phones In Virginia

Total Equity Market Index Pool

Seeks to match the performance of the entire U.S. stock market by investing substantially in a broad spectrum of small-, mid-, and large-cap stocks representative of the S& P Total Market Index.

Seeks to match the performance of the entire U.S. stock market by investing substantially in a broad spectrum of small-, mid-, and large-cap stocks representative of the S& P Total Market Index.

- 10% Mid-Cap Index Fund-I Class

- 10% Small Cap Index Fund-I Class