State Programs That Help With Mortgage Payments

However, if you are a disabled person and need help with your mortgage payments, then you can get help from the states as well. Yes, different states have different programs to help their people. Those programs also include mortgage grants for disabled people. They offer the mortgage assistance program to disabled buyers and make sure that get the house for living and without any issue. However, their mortgage assistance programs for disabled people will differ from state to state.

Lets take an example to understand this, the Pennsylvania Housing Finance Agency provides home loans to disabled people. They offer housing assistance to them with the competitive interest rates from the Keystone Home Loan and Keystone Government Loan. Although, the buyers who are qualified for their assistance program will get help to make their homes accessible.

Like this, Michigan State Housing Development Authority provides down payment assistance for disabled people that is up to $12,000. They provide this facility to them from the Home Choice Down payment assistance program. Even from this program, only those people can get advantage who has a disabled individual in their family.

Even, if you are a disabled person and need help for a mortgage grant or housing assistance then you can get help from your states housing finance agency or the housing development authority. You can get help to know about the available programs that will be helpful for you to buy a home or pay for it.

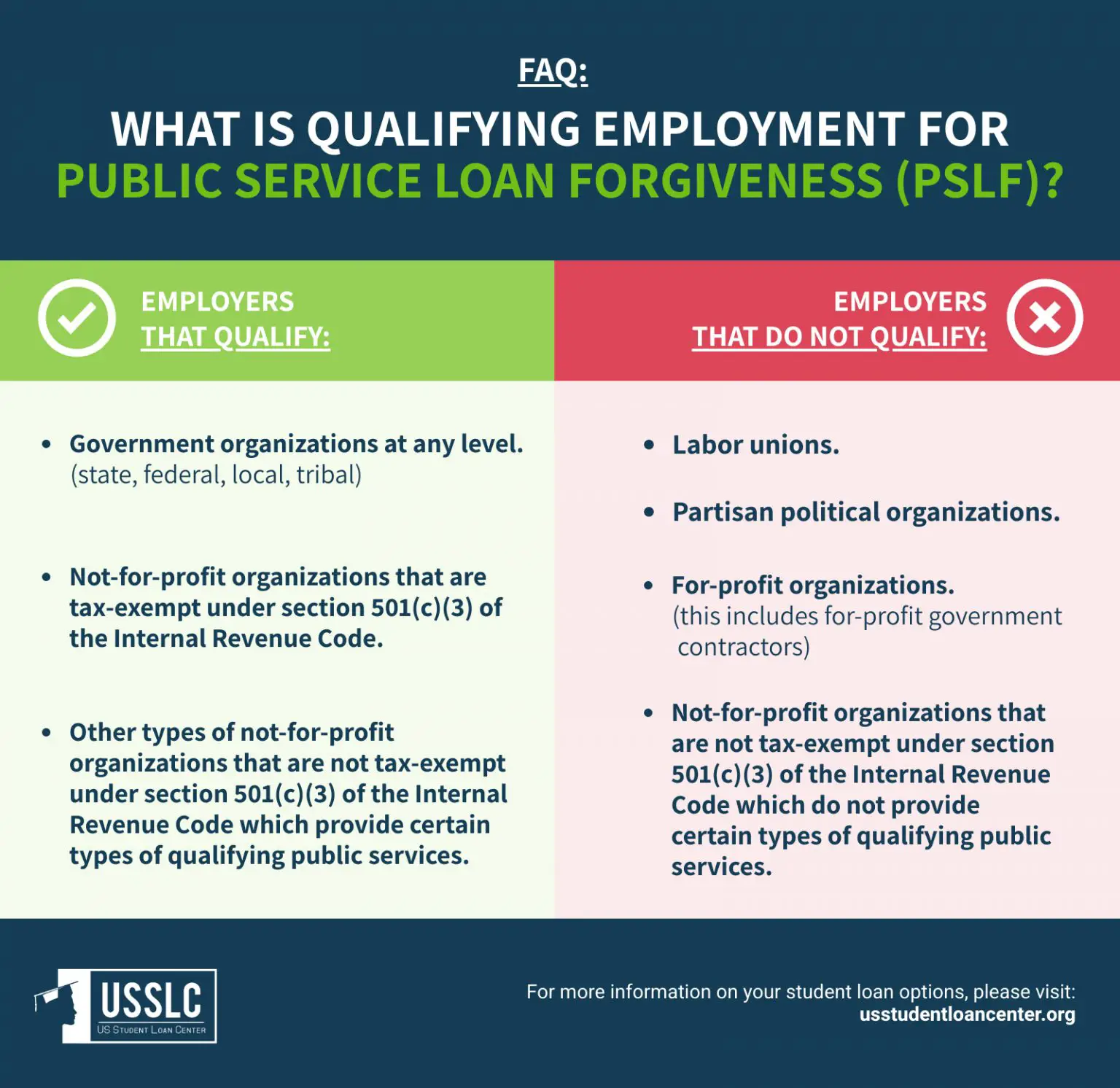

Department Of Housing And Urban Development

The U.S. Department of Housing and Urban Development has a foreclosure prevention department, working with homeowners and lenders to address issues facing struggling borrowers. As part of HUD’s services, the Special Forbearance program gives unemployed homeowners a suspension of their mortgage payments for 12 months, with an extension possible for another 12. There is also an emergency loan program.

For homeowners underwater on mortgages, meaning the loan is valued higher than the home’s value, HUD offers a Principal Reduction Alternative program and a Treasury/FHA Second Lien program. Both of these programs require borrowers to be current on all mortgage payments. A HUD counselor works with homeowners, assisting in the negotiation with lenders to reduce principal and overall debt associated with the home.

Other modification programs exist, but many programs have expired or are expiring. These include Home Affordable Modification Program and Home Affordable Refinance Program , which are being replaced with more comprehensive modification programs. While these don’t pay for the house per se, they make staying in the house more affordable. Talk to a local HUD counselor for current options.

How To Request Homeowner Assistance Funds

Homeowner assistance funds are in the process of being distributed to states for redistribution to homeowners. The U.S. Department of the Treasury has provided guidance for states to use in developing their individual HAF plans.

You will request funds from your state after your states HAF plan has been approved and its system is up and running. Meanwhile, the National Council of State Housing Agencies Homeowner Assistance Fund webpage features a map showing the status of each states HAF to date.

Read Also: Government Grant For New Business Start Up

What Does It Cover

For qualified homeowners who are past due on mortgage and housing-related payments by at least 30 days, the fund offers:

- Housing payment assistance for primary residence in North Carolina .

- Assistance for mortgage reinstatement to catch up on late payments or other housing-related costs due to a period of forbearance, delinquency or default.

- Assistance covering other housing-related costs such as homeowners insurance, flood insurance, mortgage insurance, homeowners association dues/fees or delinquent property taxes to prevent foreclosure.

There is no cost required to participate in the NC Homeowner Assistance Fund.

Residential Rehabilitation Assistance Program For Homeowners

This housing grant provides funding to low-income persons who own and occupy substandard housing so that they can have a comfortable home that meets the minimum federal health and safety standards. This means repairs to heating, structural, electrical, plumbing and fire safety. To qualify for this housing grant you will need to show that you live in low-income housing and that you dont have the financial means to pay for your homes necessary repairs. Eligible applicants could receive anywhere from $16,000 to $24,000.

You May Like: Safelink Free Replacement Phone

Also Check: Health Insurance For Retired Government Employees

Aging And Disability Resource Center

Most of the time, disabled or elderly people feel a burden on them or they lost to look for ways that can help them to pay for their mortgage payments. When they are not able to pay for their mortgage payments they feel overburdened and did not understand which source will be helpful for them. Thus to give free advice to those individuals, many states have aging and disability resource centers. These centers provide the guidance and resources that can help them. Such as home repairs, disability and old age modifications, utility bills assistance, and mortgage assistance programs. They will tell you how you can get help for these and from these and lessen your burden. With the help of them, you can reduce the risk of foreclosure and also get help to use the sources that help you to pay for the mortgage payments. Thus you can visit your states aging and disability resource center and get help in the various ways to get rid of your burden.

Mortgage Stimulus Programs Faq

Is there a mortgage relief program in 2022?

The Homeowner Assistance Fund is still helping homeowners in 2022 who need mortgage relief. Under the American Rescue Plan, the HAF was funded with at least $50 million for each state to assist homeowners in danger of foreclosure or housing instability. Talk to your loan servicer about HAF eligibility.

Is there a GSE rescue package?

There is not currently a GSE rescue package for homeowners. However, Fannie Mae and Freddie Mac both have options to help homeowners who are struggling with their mortgage payments. To find out whether you qualify for mortgage assistance, reach out to your mortgage loan servicer. Thats the company to which you make your payments.

Is there really a mortgage relief program?

Even though the Covid pandemic is waning, many homeowners can still take advantage of Covid-era relief programs. If you have a conforming mortgage or a government-backed mortgage, its not too late to request an initial loan forbearance and pause your payments if youre going through a temporary financial hardship. Ask your loan servicer about forbearance options.

Is there a government mortgage relief program?

The CARES Act and subsequent American Rescue Plan have provided mortgage relief during the Covid-19 pandemic. These programs do not refinance your mortgage but let you postpone repayment while keeping your loan active. The CARES Act also created a temporary moratorium on foreclosures and renter evictions.

Read Also: What Hotels Give The Best Government Discount

Charities That Help With Mortgage Payments Programs

Numerous people are facing difficulties in their life and have to struggle with the financial crisis. The main problem creates for they are not able to pay for the mortgage payments and are at the risk of foreclosure. In that situation, they feel stressed and did not think about what they have to do now. In that condition, they can look for the different local and national non-profit organizations that can help them.

Prepare Yourself And Your Family

- Make sure your state ID or drivers license is current and available. Shelters and assistance programs may have strict ID requirements.

- If possible, store your belongings. Shelters have limits on how much you may bring.

- Arrange for your mail to be delivered somewhere or talk to your local post office. Many have special services for people who are homeless. You may be able to get a free PO box or receive general delivery service.

- Pack a bag for yourself and each member of your family.

- Keep important documents and needed medications with you.

You May Like: Loans For Federal Government Workers

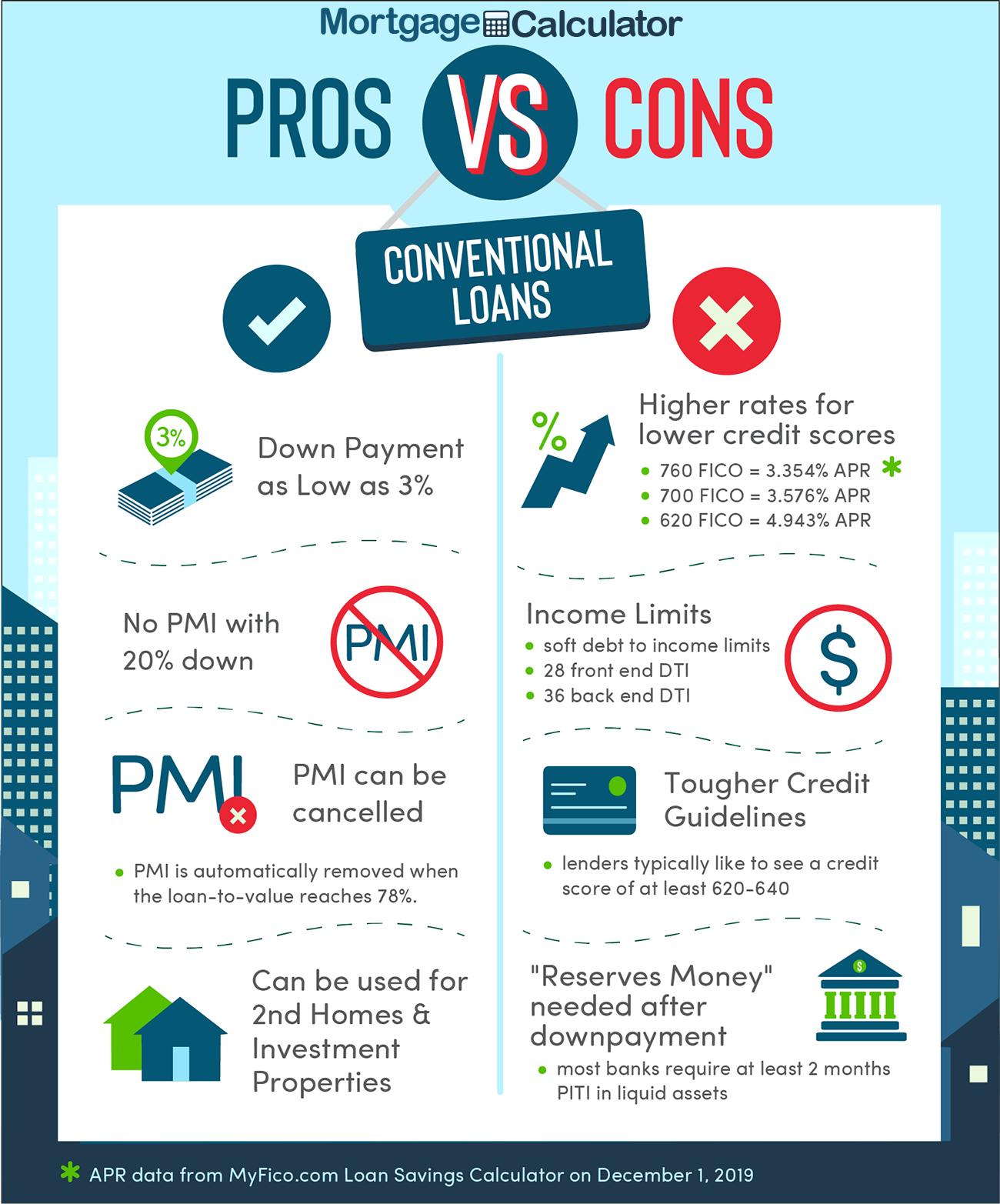

Shop Around For A Consolidation Loan

Some companies offer consolidation loans with interest rates that are higher than the debts you are trying to consolidate. Shop around to find the lowest rate and weigh your options. Although its not the biggest factor, applying for loans with different lenders within a short period of time may lower your credit score.

Financial institutions may offer you different interest rates depending on the type of product you choose. Shopping around might help you find the best loan for your budget.

Illinois Down Payment Assistance Programs

The Illinois Housing Development Authority has three down payment assistance loan options:

- Up to $6,000 Forgivable Unless you sell or refinance your home within the first 10 years, this DPA assistance loans balance would be forgiven. You could get 4% of the homes purchase price up to $6,000

- Up to $7,500 DeferredThis 0% loan would need to be repaid when you sell or refinance the home. You could borrow 5% of the homes price up to $7,500

- Up to $10,000 Repayable Youd make monthly payments on this DPA loan for 10 years. You could borrow 10% of the homes purchase price up to $10,000

To get any of these loans, youll have to put up $1,000 or 1% of the purchase price yourself. And you must be buying an existing home newbuilds are excluded.

The authority also has a special program for firstgeneration homebuyers. Its called Opening Doors, and it provides a $6,000 assistance loan thats forgiven after five years.

You May Like: Goverment Jobs In Nevada

Read Also: Government Assistance Child Care Texas

What To Do If You Cant Pay Your Mortgage

The first thing to do if you cant pay your mortgage is probably the last thing you want to do: Let your mortgage lender know the situation, whether its loss of income, divorce, a health emergency or other changes in your circumstances.

It is best to stay ahead of the changing situation with your lender, who can be your best resource and ally in a crisis. Explain the circumstances, the steps youre taking to restore your financial status, and your intent to come through the crisis and resume monthly mortgage payments.

One of those steps is the next call you should make, to a Housing and Urban Development -approved housing counselor. This is easier than it sounds, as the Consumer Financial Protection Bureau provides an online Find a Counselor tool.

You can prepare for that process by learning about the kinds of options a counselor will discuss:

- Mortgage Loan Modifications

Use Your Grace Period

The mortgage lenders will give you the limit of two weeks in the grace period to make your payments. In that period, if you make all the payments, then it will not be considered as a late payment or you will be get rid of all of the late fines and late fee penalties. However, it may come under the late payments. You have to make sure that you will use this grace period to arrange the money to pay for the mortgage payments. For this, you can contact your friends, family members, and others knew who will help you to pay for the payments. Apart from them, you can look to reassess your monthly budget, or can look for some short-term loans. So you can pay the mortgage payments and then pay the loan amount according to their conditions.

Recommended Reading: Government Home Assistance For The Elderly

Governor Hochul Announces First

Funding Will Help Low- and Moderate-Income Homeowners Impacted by the Pandemic Stay in Their Homes

To Learn More, Residents Can Visit the HAF Website or Contact the New York State Homeowners Assistance Fund Call Center at 1-844-77-NYHAF

Applications Accepted Beginning Monday, Jan. 3, 2022

Governor Kathy Hochul today announced that New York State is the first state in the nation to receive U.S. Department of the Treasury’s approval to launch its Homeowner Assistance Fund, a program that will provide up to $539 million to help eligible homeowners avert mortgage delinquency, default, foreclosure, and displacement. Applications will be accepted beginning Monday, Jan. 3, 2022.

“Many New Yorkers are still recovering from the pandemic, and just like we did for renters, our state is now leading the way to provide much-needed economic relief to vulnerable homeowners across the state,” Governor Hochul said. “We know that the economic pain of the pandemic has been felt disproportionately in rural communities, communities of color, and immigrant communities, and this program is a demonstration of our commitment to placing the needs of New Yorkers in need at the heart of our work. We thank the Biden Administration and our entire congressional delegation for securing this critical lifeline, and New York is ready to support homeowners in need every step of the way.”

Avoid Taking On More Debt

If you spend more than your income, it will be difficult to become debt-free.

If you’re considering borrowing more money, understand how it would impact:

- your existing debt payments

- your ability to save for other goals

- your credit report and score

You’re at risk of no longer being able to manage your debt if:

- you’re already having trouble making your debt payments

- you’re close to your credit limit

- you would have trouble making higher payments if interest rates increased

Read Also: Government Jobs In Newnan Ga

Tip To Get Mortgage Assistance From Charities

However, if you are disabled and worried about repaying the mortgage then you can take the mortgage insurance for repaying the mortgage. This insurance is very helpful for you if you are disabled or became disabled and not in the condition to pay more mortgage amount. The mortgage insurance pays all the loan amount that you did not do.

But getting mortgage insurance may be unwise if you buy it only for preventing one thing such as disability. That means you have to take the mortgage insurance when you see that it will give you more benefits.

Local Churches And Charities

However, one can look for the local churches and charities in their nearby area as well. Because many churches offer financial help to needy people who come to church. They know about everyone but when someone suffering from a financial crisis and needs help to pay their mortgage payments, rent, and other bills, then they offer them help as well. Even they can help them with cash or can provide the vouchers that can help them to pay the amount. They provide financial aid only to those people who can do something in their life but at present need help with financial assistance.

Don’t Miss: Government Jobs In Pueblo Co

Is Selling Your Home An Option

If you have enough equity in your home and the real estate market is as hot as it has been the past few years selling your home might be the best way to avoid foreclosure.

Homeowners who have seen the value of their home rise the average home value went up an incredible 24% in 2021 but dont have the income to make monthly mortgage payments, should consider selling.

Check with local real estate agents to gauge the resale value of your home and whether selling your home will cover whats left of your mortgage and taxes.

If your home already is in foreclosure, make sure you advise the lender that you intend to sell and pay off the mortgage. Ask them to postpone the auction date so you have time to sell on your own.

Selling and downsizing would relieve the pressure of foreclosure and help you avoid the negative impact it would have on your credit score.

Federal Relief For Struggling Homeowners

Under the Homeowner Assistance Fund – part of the American Rescue Plan Act of 2021 – the U.S. Department of the Treasury is distributing more than $9.9 billion to eligible states, territories, and Tribes. Depending on availability and usage of funds, this mortgage assistance program is expected to be available through September 2025.

Also Check: Government Programs That Help With Rent

Work Out A Repayment Plan

When you lose your job, first you have to contact the lender. He may be agreed to make a new payment plan for you and provide you with some help to repay the loan amount. With your short-term crisis, the lender may be ready to accept the reduced or partial payments. The lender may help you with the new payment plan until you will stand on your feet again or find a new job. But for this, you have to tell your lender about your job situation.

Do You Qualify For A Lower Interest Rate

Refinancing can offer relief from high mortgage payments. By lowering your mortgage interest rate and/or extending your loan term, you can typically reduce your monthly payment and take some pressure off your budget.

To qualify for a refinance, youll need to meet some basic criteria. But these can be very flexible depending on the loan program.

Also Check: How To Get Free Grant Money From The Government

Veteran Mortgage Relief Options

One benefit of a VA loan is that the Department of Veterans Affairs can help you out if youre having trouble making mortgage payments.

Veteran mortgage assistance comes in two forms:

If youre underwater on a VA loan and need to refinance, you may be able to use the VA Streamline Refinance to do so. Like other Streamline programs, the IRRRL requires no income or employment check, and skips the home appraisal so your LTV wont matter.

If youre not sure whether a refinance is right for you, you might take advantage of the other VA relief program.

For VA loan holders as well as veterans with non-VA mortgages, the VA offers access to professional counselors who can help you if youre having trouble making your payment. These people help veterans figure out whether they should refinance, try to restructure their loan, or take another measure to prevent foreclosure.

Even better, the VAs loan technicians work with your lender on your behalf so you dont have to figure out all the logistics of a mortgage relief program yourself.