What Are Small Business Loans

Running a business comes with never-ending expendituresyou may need to buy new equipment, improve your office space, obtain a new license, or you may need money only to cover day-to-day operations.

If you do not have enough money on the books to cover these expenses, you will need to look for funding elsewhere, and that is where small business loans come in. These loans serve to help struggling or incoming companies press on with their business despite not having enough money.

In return, loans come with set termsa business owner agrees to pay the money back with interest and a strict repayment schedule. This is why it is important you do your research and find the best loan for your business plan.

If you are struggling to do that by yourself, do not worryyou can register for DoNotPay and let our app conduct the search via our Find Online Business Loan Lender product.

Another aspect of small business loans you should consider is their type. Loans differ based on:

What Is A Grant From The Government

A grant is one of the ways the government funds ideas and projects to provide public services and stimulate the economy. Grants support critical recovery initiatives, innovative research, and many other programs. You can find a list of projects supported by grants in the Catalog of Federal Domestic Assistance . You can also learn about the federal grant process and search for government grants at Grants.gov.

Requirements For Small Business Loans

The requirements for small business loans can vary by lender. But in general, lenders may review the following information to approve you for a loan:

- Personal credit. You may be able to qualify for a business loan with a credit score as low as 500. However, a good score of at least 670 could give you a better shot at getting approved for a competitive rate.

- Time in business. Lenders typically require that you be in business for at least six months to two years to qualify for a loan.

- Business checking accounts. Lenders may require that you have a business checking account with several months of transactions to show cash flow.

- Business revenue. Most lenders require that you have between $100,000 to $250,000 annual business revenue to qualify.

Read Also: Government Benefits For Single Moms

We’ve Compiled All The Information Startups Need To Find Loans From The Federal Government

When it comes to small business loans, you have two options: private and government loans. While private lenders may be reluctant to take a risk on a new business or startup, government business loans were created specifically to boost small business in the United States.

As a result, you might find that itâs easier to secure a small business loan from the government than it is to secure one from a private lender.

Most government business loans are managed through the Small Business Association , which partners with lending institutions that actually distribute the money.

Because the loan is backed by the government â meaning if you default, the government pays of the balance â banks and credit unions are more likely to take a risk by issuing this type of loan than other types of loans.

Types Of Government Small

Federal government small-business loans

- SBA 7 loans. The 7 program is the primary type of SBA loan, with $36.5 billion in loans issued in fiscal year 2021, according to the Congressional Research Service. You can receive up to $5 million in funding for day-to-day expenses like payroll, as well as longer-term business costs like equipment financing. Funds are available as term loans or an SBA line of credit.

- SBA Express loans. A variation of the 7 program, Express loans come with a smaller funding maximum, $500,000, but offer quicker processing. If you need a fast business loan, you may be able to get approved for an SBA Express loan within a few days, whereas a 7 loan application may take weeks or months to process.

- SBA CDC/504 loans. These SBA loans also offer funding of up to $5 million however, CDC/504 loans have strict usage rules compared with other government small-business loans. Their primary use is financing construction or real estate projects. Unlike 7 loans, you cant use an SBA CDC/504 loan for working capital or refinancing debt.

- SBA Microloans. The SBA offers microloans of up to $50,000 through nonprofit community organizations. Microlenders often focus on assisting traditionally underserved populations, including minority business owners and women business owners, and may have looser eligibility requirements than other government-backed business loans. SBA Microloans can be good options for newer businesses or those with bad credit.

You May Like: Big Data Simplifies Data Governance Issues Especially For Global Firms

Federal Covid Relief For Small Businesses Arrived Quickly But With Risks To Loan Programs

Many of the more than 30 million small businesses in the U.S. experienced decreased revenue or closure as a result of the pandemic. In response to these economic strains, the Small Business Administration quickly issued low-interest loans to small businesses affected by COVID-19 through 2 loan programs. These loans helped businesses and employees, but were vulnerable to fraud and other losses.

In todays WatchBlog post, we look at how these 2 loan programs worked, their benefits, and challenges SBA faced in administering them.

Economic Injury Disaster Loan Program

The Economic Injury Disaster Loan Program provides grants and low-interest loans to help borrowers pay for operating expenses. Prior to the pandemic, EIDL had been used to support small businesses in communities affected by disasters like hurricanes or wildfires. Between March 2020 and May 2021, the program provided about $230 billion in loans and grants to small businesses and nonprofits affected by the COVID-19 pandemic.

Approved EIDL Per 1,000 Small Businesses by County, March 2020-February 2021

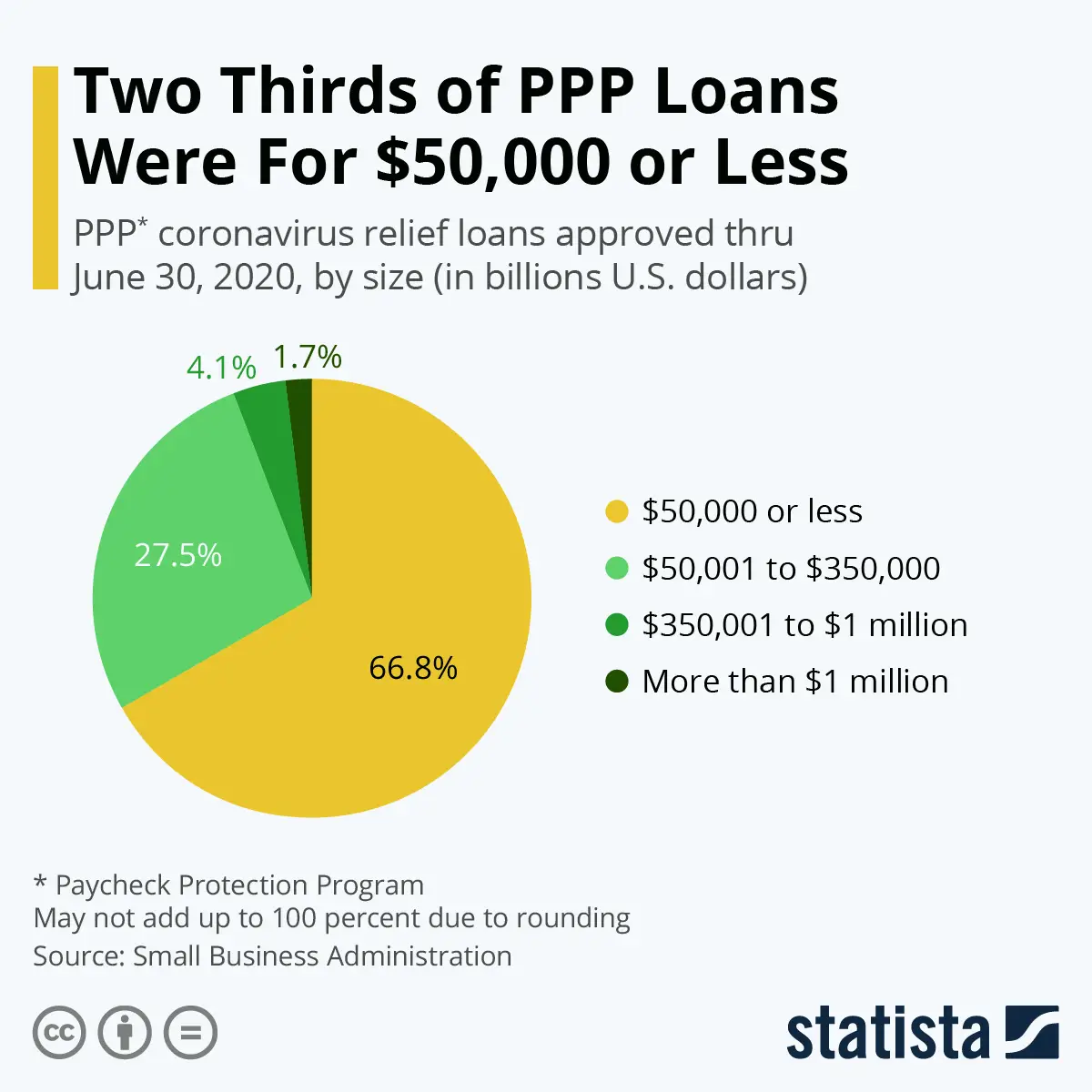

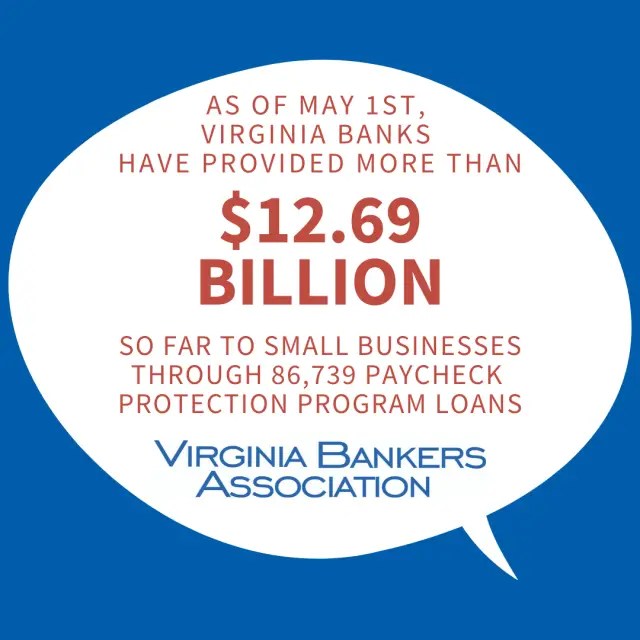

Paycheck Protection Program

The Paycheck Protection Program was a new program designed specifically to respond to the pandemic by providing low-interest loans, made by approved lenders, to small businesses that could be used for payroll and other eligible expenses, such as rent and utility payments.

What challenges did SBA face in administering EIDL and PPP?

National Small Industries Corporation Subsidy

The NSIC is a Government enterprise under the MSMEs, and it is ISO certified. One of its primary functions is to aid the growth of MSMEs by providing services including finance, technology, market, and other services across the country. The NSIC has initiated two schemes in order to promote the growth of MSMEs, which are:

- The scheme supports in the development of any business by devising schemes such as Consortia and Tender Marketing. Such a scheme is crucial as the MSMEs must be aided in order for them to grow in the current competitive market.

- The NSIC provides for financial aid to procure raw materials, for activities in relation to marketing and for financing with banks through syndication to MSMEs.

The benefit of this scheme is that it offers the small-scale industries access to tenders without them having to bear any costs, and the MSMEs also do not have to pay the security deposits for availing of financial aid under this scheme.

Don’t Miss: Government Housing Loans For Single Moms

The Top Four Places To Look For Small Business Grants

Here Are 5 Government Small Business Loans

Sort by

| Best for Government small-business loans | $5,000,000 |

| Best for Fast government small-business loans | $500,000 |

| Best for Government small-business loans for bad credit | $50,000 |

| Best for Government loans to start a business | $50,000 |

| Best for Government small-business loans for real estate financing | $5,000,000 |

Our pick for

Government small-business loans

SBA 7 loans are the most common government small-business loan, offering financing for equipment, working capital, refinancing debt or other business purposes.

Don’t Miss: Government Enhanced Relief Mortgage Program

What Documents Do You Need To Apply For A Sba Loan

Regardless of the type of the SBA small business loan you decide is the best fit for your startup, youâre going to need to present the following documents and information to your lending institution. Itâs a good idea to get all of this together before you approach the bank, so that youâre ready to go before you start the long process of applying and qualifying for a SBA small business loan.

Youâll need:

- A description of how you plan to use the loan.

- How long youâve been in the business.

- The size of your startup.

- Your personal credit report.

- Personal and business tax returns.

- Other financial documents.

For more information on each type of documentation, check out our SBA Small Business Startup Loans: A Comprehensive guide.

Sba Guaranteed Loan Purchase Program

The SBA Guaranteed Loan Purchase Program provides low interest rate loans to North Dakota businesses with bank financing which includes a loan guarantee from the US Small Business Administration. BND can participate in a SBA guaranteed loan by purchasing the guaranteed portion of the promissory note. The purchase is conditioned upon the borrower receiving the benefit of the lower interest rate on the purchased portion of the note.

Interest rate and fees

Interest rate: The interest rate may be fixed or variable. Click here for BNDs Guaranteed Loan Purchase Program Rates. A reasonable service fee may be added to BNDs net rate options. If the loan term exceeds five years, only the first five years can be set at the fixed rate option. Thereafter, the loan will change to the variable rate.

Fees: The SBA may require an ongoing guarantee fee. If so, these fees should be added to the interest rate options. BND will charge a $250 set-up fee.

Lending criteria

Application by a lead lender is required for BNDs participation. Additional documentation will be required when submitting the request. The lead lender is responsible for servicing the loan.

Financial information about the borrower is not required by BND. However the borrower will need to meet the requirements of the lead lender and SBA.

Repayment terms are contingent upon the agreement set between the borrower and SBA. Typical maximum terms are:

Recommended Reading: What Is The Free Government Cell Phone

Doordash Restaurant Disaster Relief Fund

Everyone knew that because of the covid-19 pandemic many businesses have to face losses. Not only because of Covid-19 but because of many other disasters as well businesses and restaurants had to face many problems and they have to be closed for months. Natural disasters such as floods, fires, hurricanes, and lots more disasters affect the lives of people in the United States and they have to face lots of problems that affected their life badly.

According to Doordash, when any disaster happened, then because of this restaurant and the small businesses had to face a loss of an average of $3,000 every day, they have to remain close for a month at least. For the businesses that are affected by natural disasters, the Doordash works in partnership with Hello Alice, so that they can help those small businesses. For helping them, and the capital they need to match with that, Doordash offers the fund of $10,000 to the affected small businesses.

One can apply for this grant, to get help from Doordash. One can apply for this grant, before its deadline. The applications are open for this fund and one can apply for this fund before the end of January. This grant helps the small businesses and helps them to get back to their normal state.

Do Sba Loans Actually Work

Next, you need to decide if these are the right choice for you. If youre an entrepreneur looking for the best way to fund your growing business, you might be wondering if an SBA loan will help you get where you want to be.

Do SBA loans work? Have they helped others? For many businesses, the answer is yes.

We went right to the source for more information and exchanged emails with the SBA Office of Communications and Bill Manger, associate administrator for the SBAs Office of Capital Access. Manger relayed a few impressive true SBA loan success stories:

-

Chobani Yogurt, which had a valuation as high as $5 billion in 2016, used a 504 loan to start the company, according to Manger.

-

Vidalia Denim Mills, a denim manufacturing company located in northern Louisiana, recently got a $25 million loan from the United States Department of Agriculture and a $5 million loan from the SBA to grow their operations. The company will be exporting its denim and employing more than 300 full-time workers thanks to its product and the partnership between the USDA and SBA, Manger says.

-

Laundry City, a laundry pickup and delivery service based in Baltimore, benefited from a $3.5 million SBA 504 loan. The loan allowed to company to grow and increase the number of its employees, Manger explains.

Don’t Miss: California Government Tort Claim Form

Black Founder Startup Grant

The Black Founder Startup Grant Program is from the SoGal Foundation and various other sponsors. They all offer help to Black multiracial women and nonbinary entrepreneurs, with the grant amount of up to $10,000. The business owners who are planning to investor financing on the scale, and are legally registered business owners, for those business owners this grant is open. However, the assistance is given to businesses on a rolling basis and tries to help every needy business to grow up.

Do You Fellowship Program

Do You Fellowship Program is offered by the Digitalundivided Company. This company invested in 2020, to more than 1,500 Black and Latinx women entrepreneurs. They help them during the Covid-19 pandemic when they face a financial crisis on the big level. Again, this year they come with their Do You Fellowship Program to help them Black and Latinx women entrepreneurs. They offer their help to those 10 women entrepreneurs by offering them $5,000 for their business. Additionally, they offer them various mentorship opportunities as well.

So, if any women entrepreneur wants to get help from this program then they can apply for their application. However, their applications are not open still, but the digitalundivided says to add your name to their email list. So that when the applications are opened then you will know about that sooner and can apply for the program to get funds for your business.

You May Like: Government Of Canada Travel Restrictions

Id2 Overseas Private Investment Corporation

OPIC is the U.S. Governments development finance institution. It mobilizes private capital to help solve critical development challenges and in doing so, advances U.S. foreign policy and national security objectives. Because OPIC works with the U.S. private sector, it helps U.S. businesses gain footholds in emerging markets, catalyzing revenues, jobs and growth opportunities both at home and abroad. OPIC achieves its mission by providing investors with financing, guarantees, political risk insurance, and support for private equity investment funds.

I.D.2.a. Small and Medium Enterprise Financing Program

|

Description |

For companies with annual revenues less than $400 million, this program provides medium- to long-term funding through direct loans and loan guarantees to eligible investment projects in developing countries and emerging markets. |

|

Links & Contact Info |

Operating Your Business During Coronavirus

As a small business owner, youre likely thinking about how you can continue to safely operate your business during the coronavirus pandemic. Learn more about how to adapt your business to protect your staff and customers, as well as how to proactively engage with your customers to make them aware of the changes to your small business.

How to Reopen Your Small Business Post-Coronavirus Lockdowns

Also Check: Government Helps You Buy House

The Cons Of Small Business Grants

Unfortunately, there are a number of cons associated with small business grants.

Because grants are essentially free money, there are many hidden âcostsâ associated with themâincluding your time. Typically, grant applications require a lot of paperwork. In addition to the application, you and your small business will also have to provide additional documentation such as demographics of your market, your product or service and your specific reasons for applying for the grant.

In your application, you will be required to show specifically and with great attention to detail how you will use the grant funds, should they be awarded to you. This may involve charts, graphs, budget numbers, market demographics, and projection sheets that will paint a picture of your intentions. This is time-consuming and often requires many hours of research, planning and organizing. Since grants are essentially free money, the issuer may require you to show how your small or online business will use the grantmoney to benefit the society at large.

After all the time you spend on the application process, be prepared to wait even longer for the response. It takes weeks and sometimes months to find out if youâve been approved or not for a smallbusiness grant. This can be very frustrating, especially if you, as the small business owner, are in need of the funds quickly.