Sme Recovery Loan Scheme

The Governments SME Recovery Loan Scheme is designed to support the economic recovery and provide continued assistance to SMEs dealing with the economic impacts of the coronavirus pandemic.

In recognition of the continued economic impacts of the Coronavirus Pandemic, the Government announced on 13 December 2021 that it proposed to amend the Scheme Rules to expand the SME Recovery Loan Scheme to provide support to SMEs adversely economically affected by the Coronavirus Pandemic. The Amended Scheme Rules were notified on 15 December 2021 and will come into effect on the 2022 Scheme Expansion date .

The Scheme is enhancing lenders abilities to provide cheaper credit to otherwise viable SMEs for additional funding to get through the Coronavirus pandemic, recover and invest for the future. The Government will work with lenders to ensure eligible firms have access to finance to maintain and grow their businesses.

The SME Recovery Loan Scheme builds on earlier loan schemes introduced during COVID-19.

Under the existing SME Recovery Loan Scheme, loans are available from 1 April 2021 until 31 December 2021 with a Government guarantee of 80 per cent. Under the 2022 Scheme expansion, loans are available from 1 January 2022 until 30 June 2022, with a Government guarantee of 50 per cent.

SME Recovery Loan Scheme – Reporting Standard

ArmidaleWollondilly

- ANZ

A Guide To The 5 Types Of Government Funding

One of the biggest culprits of funding fatigue or burnout is entrepreneurs approaching the wrong funder or applying for funding that they simply do not qualify for.

To help entrepreneurs to avoid the runaround Alice Leah, operations manager at Finfind, an online aggregator of lenders and funding solution offering access to finance for small businesses, offers a guide to government funding and grants.

Understanding Different Types Of Mortgage Loans

There are several types of loans, each available to help borrowers in different ways, based on their financial goals and qualifications. Mortgage loans differ in many ways, including:

- The minimum credit score required.

- The minimum down payment required.

- The length of the loan term.

- The mortgage rates charged.

- Whether the loan conforms to government-backed guidelines.

The homes property classification whether its a primary home, secondary residence or investment property can affect the type of loan you choose to get. For example, primary residences may have lower interest rates and down payment requirements and fewer restrictions than second homes and investment properties. To help you have more financial flexibility with these higher-risk properties, you may opt for a loan that offers the lowest down payment requirement or longer term, if possible.

Read Also: Government Jobs In Las Vegas Nv

The Bottom Line: Which Of The Different Types Of Mortgages Is Right For You

The variety of loans available makes financing a house a little more custom fit for your needs and goals. Its important to learn about each one, its pros and cons and its qualifications, to make an educated decision on which is best for you. Speaking to a licensed mortgage expert can help. If youve done your research and youre ready to start your home buying journey, apply for a mortgage today with Rocket Mortgage.

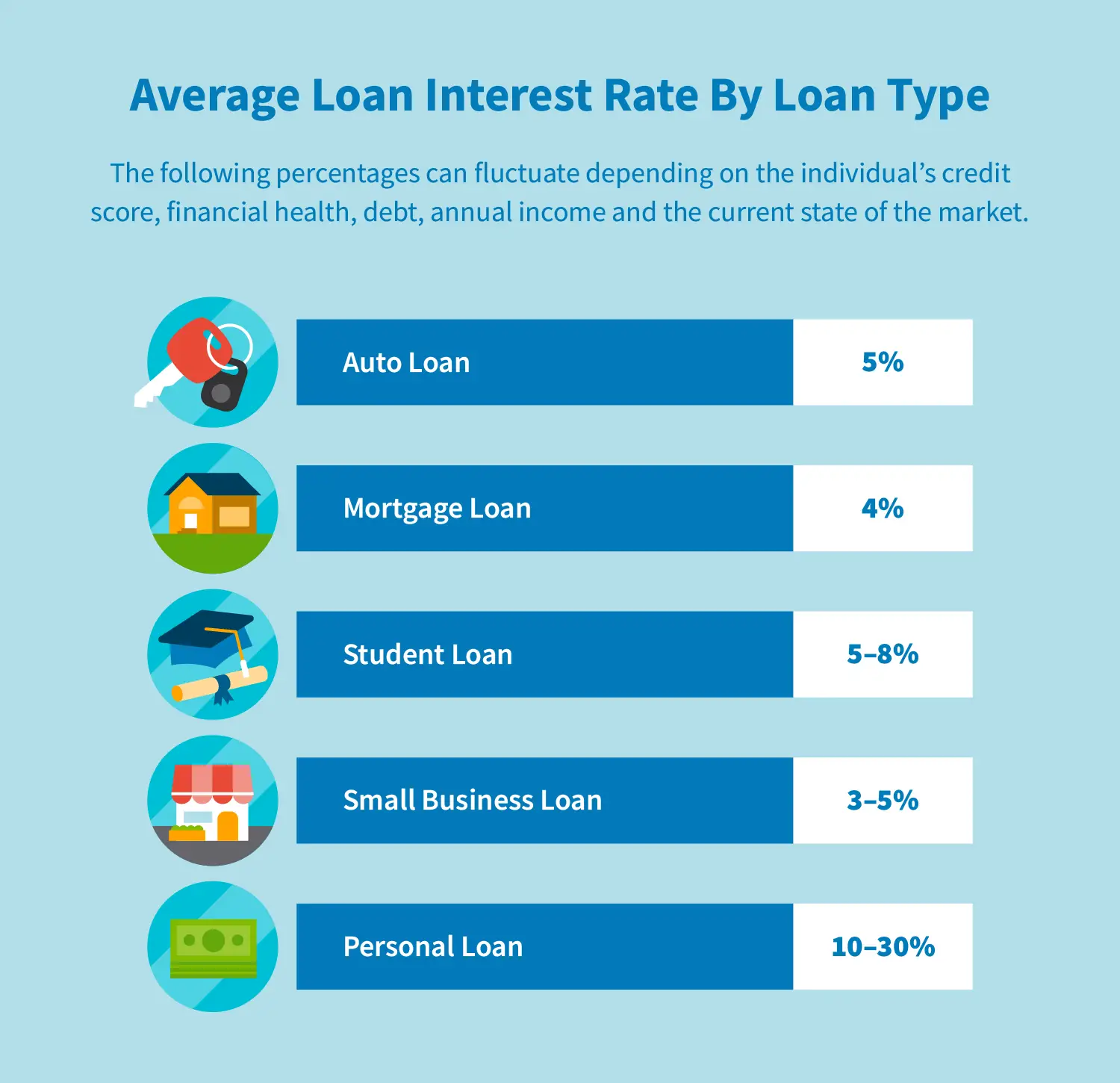

What Type Of Loan Has The Lowest Interest Rate

Even among loans of the same type, loan interest rates can vary based on several factors, such as the lender issuing the loan, the creditworthiness of the borrower, the loan term and whether the loan is secured or unsecured. In general, though, shorter-term or unsecured loans have higher interest rates than longer-term or secured loans.

Your credit score and debt-to-income ratio can affect the interest rates you’re offeredgetting low interest rates usually requires good to excellent credit.

- Mortgages usually have the lowest interest rates because they are secured and repaid over a long period. As of September 30, 2021, the average mortgage rate on a 30-year fixed-rate mortgage was 3.01%.

- Interest rates for federal student loans first disbursed on or after July 1, 2021, and before July 1, 2022, range from 3.73% to 6.28% private student loan interest rates range from 1.04% to 12.99%.

- For a 48-month auto loan, the average interest rate was 5.28% as of May 2021.

- The average APR on a two-year personal loan was 9.58% as of May 2021.

In comparison, the average credit card APR was 16.3% as of May 2021.

You May Like: Grant For Dental Implants For Seniors

Housing And Urban Development Loans

The largest part of the government loan pie is for financing home loans. This category has the largest number of loan programs, including loans for buying homes, making homes energy efficient, interest rate reduction, and paying for home repair and improvements. Common loan programs include:

The government can also fund the education of aspiring students for unique research or courses available only at foreign locations. Additional conditions, like working in public service upon graduation, may be attached to loans for foreign programs.

Education loans are considered to be the riskiest category for lenders and sponsors, as such loans are heavily dependent on individuals and may not be backed by physical collateral .

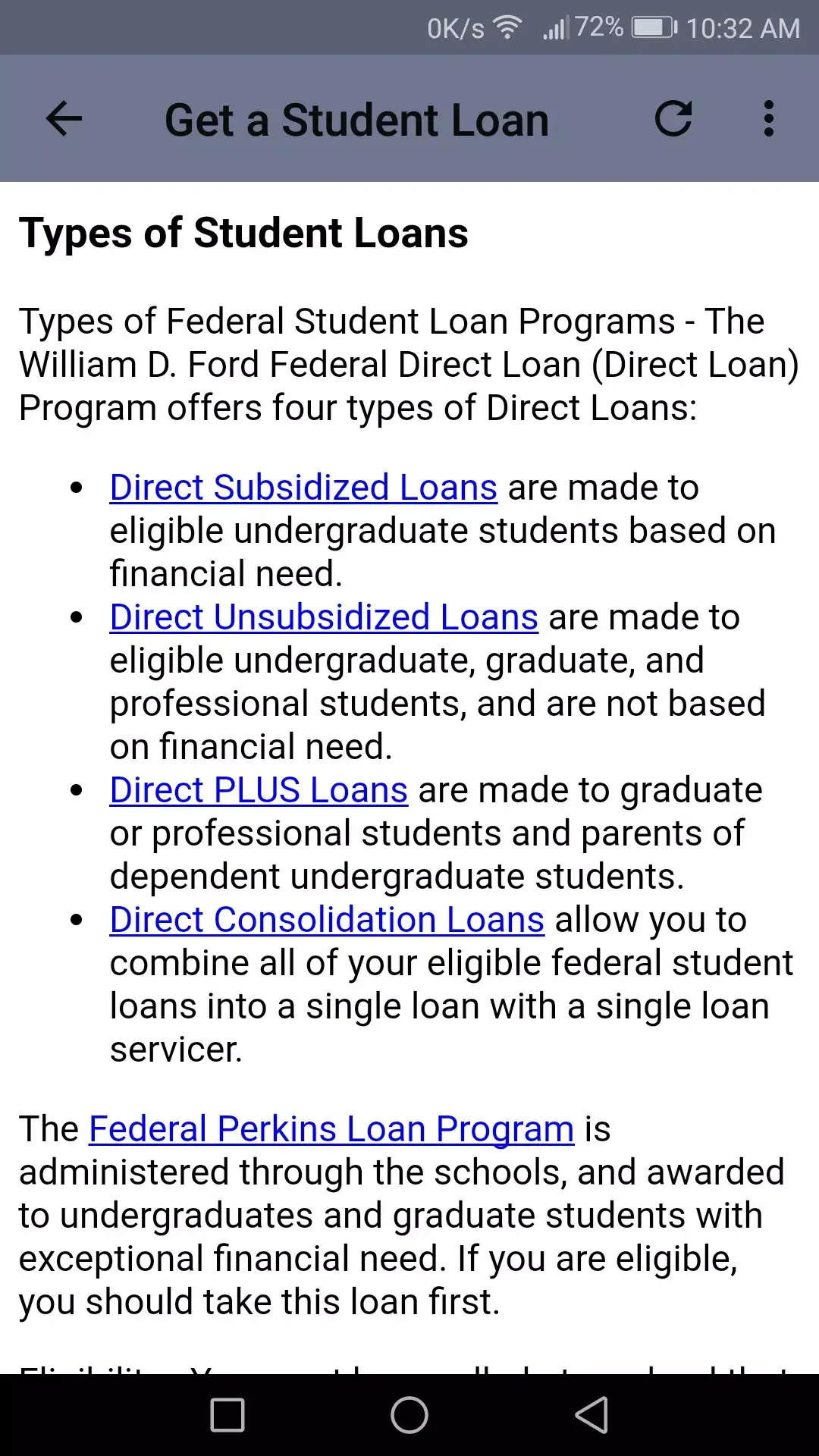

Comparing Federal Loans Vs Private Loans

The great majority of student loans are made through the William D. Ford Federal Direct Loan Program, but when students need more help to complete their college education, they turn to private lenders, such as banks or credit unions.

The major difference between federal student loans and private student loans is the cost and the use of credit scores in determining eligibility.

Undergraduate students applying for federal loans will not have to go through a credit check. Graduate students seeking federal loans must go through a credit check and could be denied loans if there is adverse information in their credit history.

Other differences between public and private student loans include:

8 Minute Read

Don’t Miss: Federal Jobs Kansas City

Business And Industrial Loans

No country or community can flourish with a stagnant marketplace. Innovation, entrepreneurship, employment, and healthy competition are important to the overall development of a nation’s economy. The loan programs offered in the business and industrial loan category aim to encourage these aspects of development. Business loans are available for small, mid-sized, and large businesses and industries for various periods of time.

On March 27, 2020, President Trump signed into law a $2 trillion emergency stimulus package called the CARES Act. As part of the new legislation, the Small Business Administration established the Paycheck Protection Program, a $350 billion loan program. It’s available to businesses with 500 or fewer employees to help cover healthcare costs, payroll, rent, utilities, and other costs. The SBA also expanded some of its existing programs, including the Economic Injury Disaster Loan Program. The funding was later extended when President Biden signed the American Rescue Plan Act into law in March of 2021.

Funding can be used to buy land, facilities, equipment, machinery, and repairs for any business-specific needs. Other unique variants in these government loan programs include offering management assistance to qualifying small start-ups with high growth potential, among others.

There Are Lenient Credit Requirements

Not everyone has a perfect credit score, thats why government-insured loans can be fitting for those individuals who may have less-than-desirable credit scores. A conventional loan typically requires a credit score above 620. But FHA and VA loans are available for homebuyers with credit scores of at least 580.

Don’t Miss: Dental Implant Assistance Programs

What Is The Home Stimulus Program

Better known as the Homeowners Assistance Fund , this program is part of the American Rescue Plan for providing relief to Americans amid the COVID-19 pandemic. The purpose of the HAF is to prevent Americans from losing their homes, utilities or insurance during a time of economic hardship. More information about the HAF can be found on the U.S. Treasury website.

Lower Rates And Flexible Repayment Plans

For those without top credit scores, federal loans generally offer low interest rates in part because they are considered a safer bet to be repaid. With others, like a subsidized Stafford loan, the government even pays the interest charges while the student is in college.

In addition, federal student loans may offer flexible repayment plans and the option to defer repayment until after graduation. Home loans through state and local governments may waive fees and offer tax incentives to draw people to a specific place.

Tip

Federal loans aren’t always the cheapest option. You might pay less interest with a private lender for a student loan, for example, if you’re a graduate student with an excellent credit score.

You May Like: What Is Of306

An Alternative: Quick Business Loans From Lendingkart

While all these schemes display the commitment of the past and present Indian governments to develop the nations economy, there is much that needs to be done to make the schemes effective. For example, the refinancing and subsidy model used by the government takes away the quick factor from unsecured business loans touted by the schemes.

Since these loans are essentially funded by government-sponsored banks, the turnaround time is in weeks or even months, which is detrimental for a small business owner looking for quick business finance. Even the most ambitious of all these schemes, the 59 Minutes Loan for MSMEs, takes up to 2 weeks in reality.

On the other hand, MSME finance by non-banking financial companies like Lendingkart is approved and disbursed within 72 hours. This is done by combining business analytics and online technologies for loan approval and disbursal instead of relying on paperwork and age-old processing techniques. For instance, Lendingkart offers business loans online through its website or mobile app.

Simply log in to apply for a business loan, get a same-day approval, accept the quote and upload your documents digitally for verification. The entire process hardly takes 10-minutes of your time and the verification is completed within 3 working days by Lendingkart. So, you have the funds ready for use within a quarter of the time it takes a government scheme to disburse a loan.

What To Do If You Can’t Get A Government Loan

There are many alternatives available to those unable to qualify for a government loan. For example:

- Mortgage loans: If you can’t get an FHA loan, you might qualify for a Fannie Mae HomeReady mortgage or a Freddie Mac Home Possible mortgage, both of which offer a down payment as low as 3%. Or, you can apply for other conventional mortgages from banks, credit unions and other lenders.

- Student loans: Still searching for a student loan after not qualifying for a government loan? You might look into a student loan from a bank, an online lender or another private lender.

- Small business loans: Did you strike out with a business loan from the SBA? Other sources of business financing include banks, credit unions, online lenders, crowdfunding platforms, credit cards, and even family and friends.

Don’t Miss: Congress Mortgage Stimulus For The Middle Class

Bank Credit Facilitation Scheme

Features:

- The loans under this scheme are facilitated by the National Small Industries Corporation which has signed a Memorandum of Understanding with banks to offer loans to meet the credit requirements of SME units.

- The facilitation is carried out by offering MSME units the option to pick between private and public sector banks.

- The loans are available in the form of working capital and term loans.

- Through this scheme, the NSIC will also help SME units to get loans at affordable rates, help with the documentation process, and other necessary services related to the loan.

Home Equity And Refinance Loans

A refinance loan replaces your existing mortgage with a new one. Home refinance loans are useful to homeowners who want to lower their monthly mortgage payments, reduce their interest rate or switch from an adjustable-rate to a fixed-rate loan. A cash-out home refinance loan allows you to borrow more than you have remaining on your principal balance and use the extra cash however you want.

Home equity loans and home equity lines of credit are types of second mortgages, which add another payment to your existing mortgage.

Here are the major types of home refinance loans and second mortgages:

- Rate-and-term refinance: With a rate-and-term refinance, you get a new mortgage with a different interest rate and/or term length. The result might be a lower monthly mortgage payment or paying less in interest.

- Cash-out refinance: In a cash-out refinance, you get a new mortgage for an amount thats higher than your principal balance you can use the extra cash for any purpose.

- Home equity loan: A home equity loan, a type of second mortgage, allows homeowners to borrow against the equity in their home and pay the money back over time.

- Home equity line of credit : With this type of second mortgage, your bank sets up a revolving line of credit like with a credit card and you can borrow up to a limit thats based on your home equity. You pay back only what you borrow.

For more information, read about the differences between reverse mortgages, home equity loans and HELOC.

Read Also: Dental Grants For Low Income Adults

Msme Loan In 59 Minutes

This scheme, also known as PSB Loan in 59 minutes, launched by the Government of India in which introduced a quick business loan portal for the individuals who need to expand their existing business.

Under this scheme, MSMEs can get loan amounts from INR 1 lakh to INR 5 crores in less than 59 minutes at an interest rate of 8.50% from public and private sector banks and NBFCs . MSME/PSB Loans in 59 minutes provides you with the required financial resources in the stipulated time and pretty quickly.

Which business/enterprise is eligible for his loan scheme? So there are some factors which determine the eligibility of business:

There are other benefits to this scheme as well

Government Loan Schemes For Small Scale Businesses

| Name of the Scheme | |||

|---|---|---|---|

| At the discretion of SIDBI | Rs.10 lakh onwards | Up to 10 years including 3 years moratorium | |

| Pradhan Mantri Mudra Yojana | Varies from bank to bank | Up to Rs.10 lakh | Varies from bank to bank |

| Varies from bank to bank | Varies from bank to bank | 5 years to 7 years | |

| Stand-Up India Scheme | Up to base rate + 3% + tenor premium | Rs.10 lakh to Rs.1 crore | 7 years |

| MSME Loans in 59 minutes | 8.5% onwards | Rs.1 lakh to Rs.5 crore | As per the bank |

You May Like: Free Government Flip Phones

How Much Money Should I Put Down

If you have a large chunk of cash just sitting around, then putting 20% down will save you any mortgage insurance premiums and will make you a more qualified buyer, getting you the best rates. With current mortgage rates as low as they are, any cash over 20% down could most likely perform better in a retirement savings vehicle like an IRA, 401, or HSA and give you immediate tax savings.

You Can Strengthen Your Finances

Purchasing a home through a government-insured loan can open a lot of financial doors for borrowers. As a homeowner, youll start building equity and credit which will help your financial portfolio moving forward. For many people, the lack of assets and credit history is a recurring obstacle that stands in the way of important purchases like buying a car, qualifying for other loans and more.

Most government insured loans have a limit to the amount that you can borrow.

Upon first thought, you may consider this to be a negative factor, however, these limits are calculated based off of a percentage of your total income, taking your debt-to-income ratio into consideration. This can be helpful because it ensures youre purchasing a home within your financial means. Such structure not only helps make homeownership a reality, but it sets you up for continued financial success and growth that you can afford.

Read Also: What Is Congress Mortgage Stimulus Program For The Middle Class

Types Of Credit Options

The two major categories for consumer credit are open-end and closed-end credit. Open-end credit, better known as revolving credit, can be used repeatedly for purchases that will be paid back monthly. Paying the full amount due every month is not required, but interest will be added to any unpaid balance.

The most common form of revolving credit is credit cards, but home equity lines of credit also fall in this category.

Credit card holders incur interest charges when the monthly balance is not paid in full. The interest rates on credit cards average 16%, but can be as high as 30% or more, depending on the consumers payment history and credit score. Loans for bad credit may be hard to find, but lower interest rates are available through nonprofit debt management programs, and credit scores are not a factor.

Closed-end credit is used to finance a specific purpose for a specific period of time. They also are called installment loans because consumers are required to follow a regular payment schedule that includes interest charges, until the principal is paid off.

The interest rate for installment loans varies by lender and is tied closely to the consumers . The best interest rates go to borrowers with credit scores of 740 and higher. Interest rates go up as credit scores go down.

The lending institution can seize the consumers property as compensation if the consumer defaults on the loan.