Illinois Employer Tax Information

To sign up for online payroll through Square in Illinois, you must be registered as an employer with the Illinois Department of Revenue and Department of Employment Security , and provide us with your Illinois Unemployment Account Number and Unemployment Insurance Contribution Rate.

You May Like: Can You Get Free Health Insurance If You Are Unemployed

Is Employee Identification Number Needed

In most cases, small businesses are not required to have an Employee Identification Number. If, for example, somebody is running their business as a sole proprietorship and they have no other employees, they’re most likely not going to need an EIN. If, however, the business in question has more than one employee or they have chosen to structure themselves as either a corporation or a partnership, they’re going to need to apply for an Employee Identification Number.

Some other things that might trigger the need for an Employee Identification Number might include:

- Filing a tobacco tax return

- Filing a firearms tax return

- Setting a Keogh plan up through the business in question

If you’re a business owner and you’re not sure if you need to file for an EIN, it is probably in your best interest to contact an attorney with knowledge and experience in this area to examine your specific situation and help you determine if this is something you’ll need to do. It’s not a good idea to proceed without knowing for sure whether or not you’re going to need an EIN.

Minnesota Taxpayer Identification Number

A business needs to obtain a Minnesota tax identification number if it is required to file information returns for income tax purposes, has employees, makes taxable sales, or owes use tax on its purchases. Most businesses need a Minnesota tax identification number. However, a sole proprietorship or single member limited liability company which does not have any of these tax obligations does not need a Minnesota tax identification number. See the Minnesota Department of Revenue Minnesota Sales and Use Tax Business Guide.

You may apply for a Minnesota Tax ID number with the Minnesota Department of Revenue online at Business Registration, by phone at 651-282-5225 or 800-657-3605, or by filing a paper form Application for Business Registration .

To apply online, youll need your federal employer ID number , if applicable business name or if applicable, Certificate of Assumed Name business owner’s Social Security Number contact phone number and email address the North American Industry Classification Code and business begin date. You will need your federal employer ID number , if applicable the legal name or sole proprietor name and business address the business name if applicable NAICS names and social security numbers of the sole proprietor, officers, partners or representatives and address and name of a contact person. If you do not have Internet access, call 651-282-5225 or 800-657-3605 to speak to a business registration representative.

Also Check: Government Suburban

Confirming A Gst/hst Account Number

Businesses cannot charge HST/GST unless the business is registered. The HSt/GST Account number is supposed to be displayed on all invoices rendered by the business. If you have some concerns that the business you are dealing with is charging HST/GST without being registered there is a way of finding out if the business is registered. Refer to this page for how to look up a business and determine if they are registered:

What Accounts Can Be Opened Under The Federal Business Number

Accounts can then be opened up under this Business Number for GST/HST, Payroll, Import/Export and Income Tax.

Each GST/HST, Payroll, Import/Export and Income Tax account can have more than one account for different businesses. Refer to the following Revenue Canada Agency Guide for more information about all of the accounts: The Business Number and Your Canada Revenue Agency Program Accounts.

Also Check: Government Grants For Free Dentures

The Following Organizations Are Required By Law To Possess An Ein:

- Non-profits

- Businesses

- Government agencies at the state and local level

You can use the EIN to research information about different businesses. It is sometimes possible to perform a federal ID tax lookup for free, but there are also paid services that can be used. Businesses will use their FTIN to correctly file documents with the federal government. Employees can find their employer’s EIN by referencing their W2 forms.

Apply By Telephone International Applicants

International applicants may call 6 a.m. to 11 p.m. Monday through Friday to obtain their EIN. The person making the call must be authorized to receive the EIN and answer questions concerning the Form SS-4 PDF, Application for Employer Identification Number. Complete the Third Party Designee section only if you want to authorize the named individual to receive the entitys EIN and answer questions about the completion of Form SS-4. The designees authority terminates at the time the EIN is assigned and released to the designee. You must complete the signature area for the authorization to be valid.

You May Like: Free Dental Implants Grants

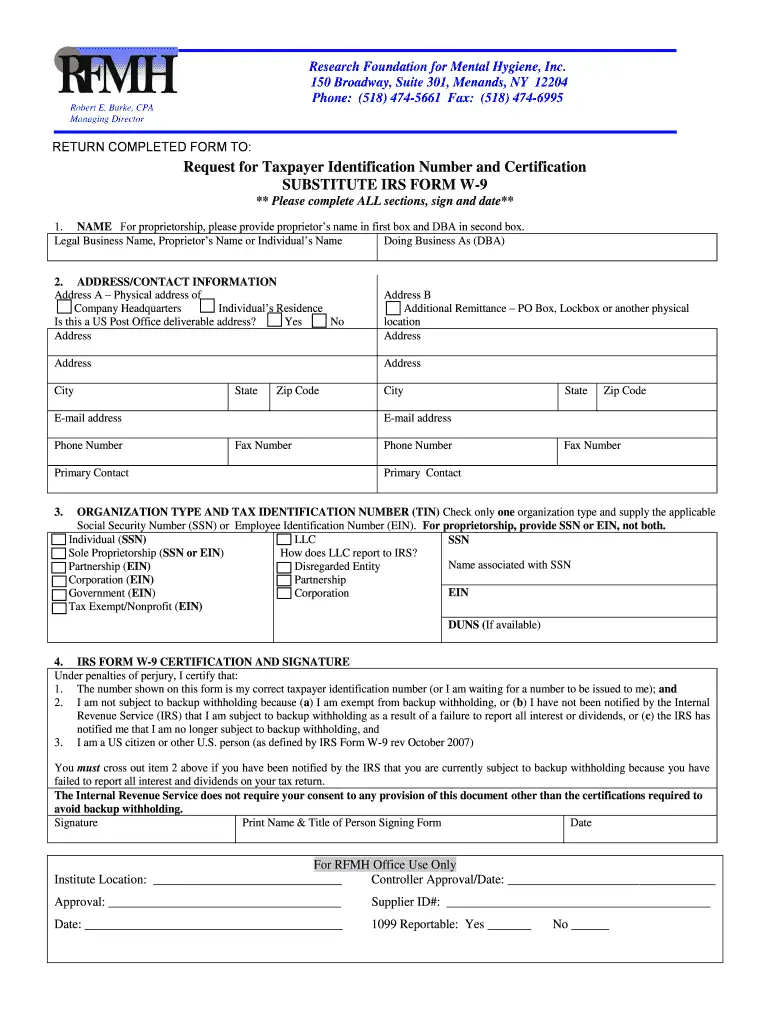

What Is A Tax Identification Number / Tin

A tax or taxpayer identification number, also known as a TIN for short, is a number issued to individuals and organizations to track tax obligations and payments they make to the Internal Revenue Service . It is issued by the federal government. A TIN can be assigned by the Social Security Administration for individuals, or by the IRS for businesses and other organizations.

Estate Of Deceased Individual Tax Id

In order to represent an estate that operates as a business after an owners death, you need to file for a federal tax ID number. There might be other things required of you as you attempt to settle an estate. IRS-EIN-TAX-ID takes the burden off you and helps you fill out, and submit, the necessary paperwork for your EIN number.

Don’t Miss: Middle Class Mortgage Stimulus Program

What Happens If I Lose My Federal Tax Id Number

Once you receive your number, take a moment to write it down. You will need easy access to this number throughout your businesss life so its important you dont actually lose it!

If you do lose it or forget it, however, you can call 829-4933 and choose EIN from the list of options. Find out more about recovering a federal tax ID number here .

What Is The Irs Form 1099

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. The amount reported is based upon the actual payment dates, not the week covered by the payment or the date the claimant requested the payment. The amount on the 1099-G may include the total of benefits from more than one claim.

Also Check: Dental Grants For Individuals

Tax Identification Number Lookup

Starting your company with a federal tax identification number is a critical first step. In order to apply for a company bank account or loan, a company requires a federal tax ID number in order to apply for a company bank account or loan. The accountable party is the person who controls or controls the company’s assets and has the most authority over company decisions. Your federal tax ID number will appear after you submit your online application with all of the required information After you submit your online application with all the required information, you will be given your federal tax ID number. Once you have your EIN, speak with your local business banker to find how a company bank account can help get you off the right foot and what financing options are available to you. Every business is also required to obtain a Miami-Dade Local Business Tax Receipt. What it is: An Adoption Taxpayer Identification Number, or ATIN, is a temporary, nine-digit tax ID number that the IRS gives to individuals who are in the process of adopting a child. If the adopting parents’ Social Security number for the child does not appear in time to file their tax return, the IRS gives the number.

* Please keep in mind that all text is machine-generated, we do not bear any responsibility, and you should always get advice from professionals before taking any actions.

Find Out If Your Business Needs A Tax Id Number To Operate In Canada

The tax ID number is part of the 15-character program account number assigned to your business by the Canada Revenue Agency . The program account number consists of three parts:

- Nine-digit Business Number that identifies your business

- Two-letter identifier for the program type

- Four-digit reference number for the program account

An account number would look like this: 123456789 RT0001

Think of your Business Number as your business tax ID number because that’s why it exists. The CRA assigns your company a Business Number when you first register for any one of the four major program accounts you will need to operate your business:

The nine-digit tax ID number is the same across program accounts the numbers for the program ID and account number will change based on which of the four it’s referring to. You can apply for the number through The Canada Revenue Agency’s Business Registration Online service.

Note that in Quebec, the Business Number does not include your GST/HST accounts. You must register for a separate GST/HST account with Revenu Québec. Its General Information Concerning the QST and the GST/HST provides further clarification.

Several other tax accounts, such as Excise Tax, require a tax ID number/Business Number if they apply to you.

You May Like: Dispensary Silver City Nm

Is A Tin Number The Same As An Ein

An employer identification number is a type of tax identification number . An EIN is used by employers to open a business bank account, apply for a business loan, for business licenses and permits, and for reporting and paying federal payroll taxes.

Your business needs an EIN if you:

-

Have employees

-

Operate your business as a corporation or partnership

-

File employment, excise, or alcohol, tobacco and firearms tax returns

-

Withhold taxes on income paid to a resident alien

-

Have a Keogh plan

Church Controlled Organization Tax Id

Church-controlled organizations arent exempt from needing federal ID numbers. If your church-controlled organization hasnt applied for its federal tax ID number yet, IRS-EIN-TAX-ID can help. On your behalf, we file the appropriate paperwork and get your tax ID number back to you quickly. Our filing process is secure and we work 24/7 saving you time and making filing convenient for you.

Also Check: Dental Grants For Implants

Completing Your Gst/hst Return

The government sends out these returns automatically and if you do not receive yours you will need to call them and request new copies. These are not returns that can be located online. These returns are specifically created by Revenue Canada for your business and have certain dates already filled in.

You should keep in mind that even though a business needs to charge GST on products and services and you will remit that amount to Revenue Canada Agency, you will also be allowed to subtract any amounts of GST that you have paid for services and products paid for with respect to your business. In the first year of business, if you have more expenses than profits, you may be able to obtain a refund of GST since you may pay more GST than you actually claimed. It works like this:

GST Charged on Products and Services that were sold through the business

Minus

GST Paid for Products and Services for the business.

Total

If it turns out you paid more GST than you actually charged your customers you will be entitled to a refund.

Goods and Services Taxable

If you are a GST/HST registrant and you provide goods and services that are taxable at various amounts, you have to charge either GST or HST as the case may be for your province or territory. The Canada Revenue Agency does provide a summary of the GST/HST Rates. Refer to the following guides for more information about registering for a GST/HST Account:

How To Get A Federal Tax Identification For A New Business In Florida

One of the fastest ways to get an EIN for your business is to call the Internal Revenue Service and apply by phone. Call 800-829-4933. You can call Monday through Friday, 7 a.m. to 7 p.m. If youre calling from outside of the U.S., use the non-toll-free international number: 267-941-1099.

You can complete Form SS-4 to apply for your EIN. Once you fill it out, fax it to 859-669-5760. Provide a return number if you can otherwise, it may take up to two weeks for the IRS to process your application.

Another way to apply is by mail. Complete Form SS-4 and mail it to the Internal Revenue Service, Cincinnati, OH 45999, ATTN: EIN Operation. International applicants should mark it ATTN: EIN International Operation.

You can also apply online on the IRS website. Its as quick as a phone application. To apply online, the business owner must have a valid individual TIN or Social Security Number.

You can apply for an EIN free of charge, although some websites offer to process your application for anywhere between $75 to $150. The quickest ways to get your EIN is by phone or online. Faxing can take four days , and mailing can take up to four weeks.

As soon as you form your new business, apply for your EIN. Its a requirement, and its free to do. With several options for applying, choose the one you are most comfortable with or find most convenient.

Hire the top business lawyers and save up to 60% on legal fees

Read Also: How Do I File My Unemployment Taxes

Also Check: City Of Hot Springs Jobs

Taxes On Unemployment Benefits

All benefits are considered gross income for federal income tax purposes. This includes benefits paid under the federal CARES Act, Federal Pandemic Unemployment Compensation , state Extended Benefits , Trade Adjustment Assistance , Pandemic Unemployment Assistance , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance . DES reports these benefits to the Internal Revenue Service for the calendar year in which the benefits were paid.

You may choose to have federal income tax withheld from your unemployment benefit payments at the rate of 10% of your gross weekly benefit rate , plus the allowance for dependents .

The amount deducted for state income tax will be 10% of the amount deducted for federal taxes, which is currently calculated as 1% of the gross weekly benefit amount. Please Note: State income tax cannot be withheld from the $300 additional weekly benefit in Lost Wages Assistance and the $600 additional weekly FPUC benefit for regular UI claims. Claimants who received FPUC and/or LWA in regular UI will be responsible for paying any tax due on those amounts when filing state income taxes for calendar year 2020.

After selecting your tax withholding on the initial Unemployment Insurance application, you can change your withholding preferences by completing the Voluntary Election for Federal/State Income Tax Withholding form . After completing the form, submit it to DES by mail or fax.

Itin Holders Pay Taxes

- ITINs let more people pay into the system, which builds the tax base. According to the IRS, in 2015, 4.4 million ITIN filers paid over $5.5 billion in payroll and Medicare taxes and $23.6 billion in total taxes.

- ITIN holders are not eligible for all of the tax benefits and public benefits that U.S. citizens and other taxpayers can receive. For example, an ITIN holder is not eligible for Social Security benefits or the Earned Income Tax Credit . However, if that person becomes eligible for Social Security in the future , the earnings reported with an ITIN may be counted toward the amount he or she is eligible to receive.

- Some ITIN holders are eligible for the Child Tax Credit . According to federal legislation passed in March 2021, the CTC may be worth up to $3,600 for each child under 6 and up to $3,000 for each child age 6 to 17, depending upon the applicants income. Because ITIN holders are eligible for the CTC, the IRS estimated in 2014 that up to 4 million U.S.-citizen children of ITIN holders benefit from the tax credit. If a child does not have a SSN, he or she is not eligible for the tax credit.

Read Also: Assurance Wireless Las Vegas Nv

Types Of Tax Id Numbers

A TIN is a generic term and refers to several different kinds of identifying numbers, which include:

- A social security number issued to an individual

- An Individual Taxpayer Identification Number , issued to non-U.S. citizens currently residing, and often working, in the U.S.

- An Employer Identification Number issued to businesses and non-profit organizations

- An Adoption Taxpayer Identification Number , for children in the process of being adopted from outside the U.S.

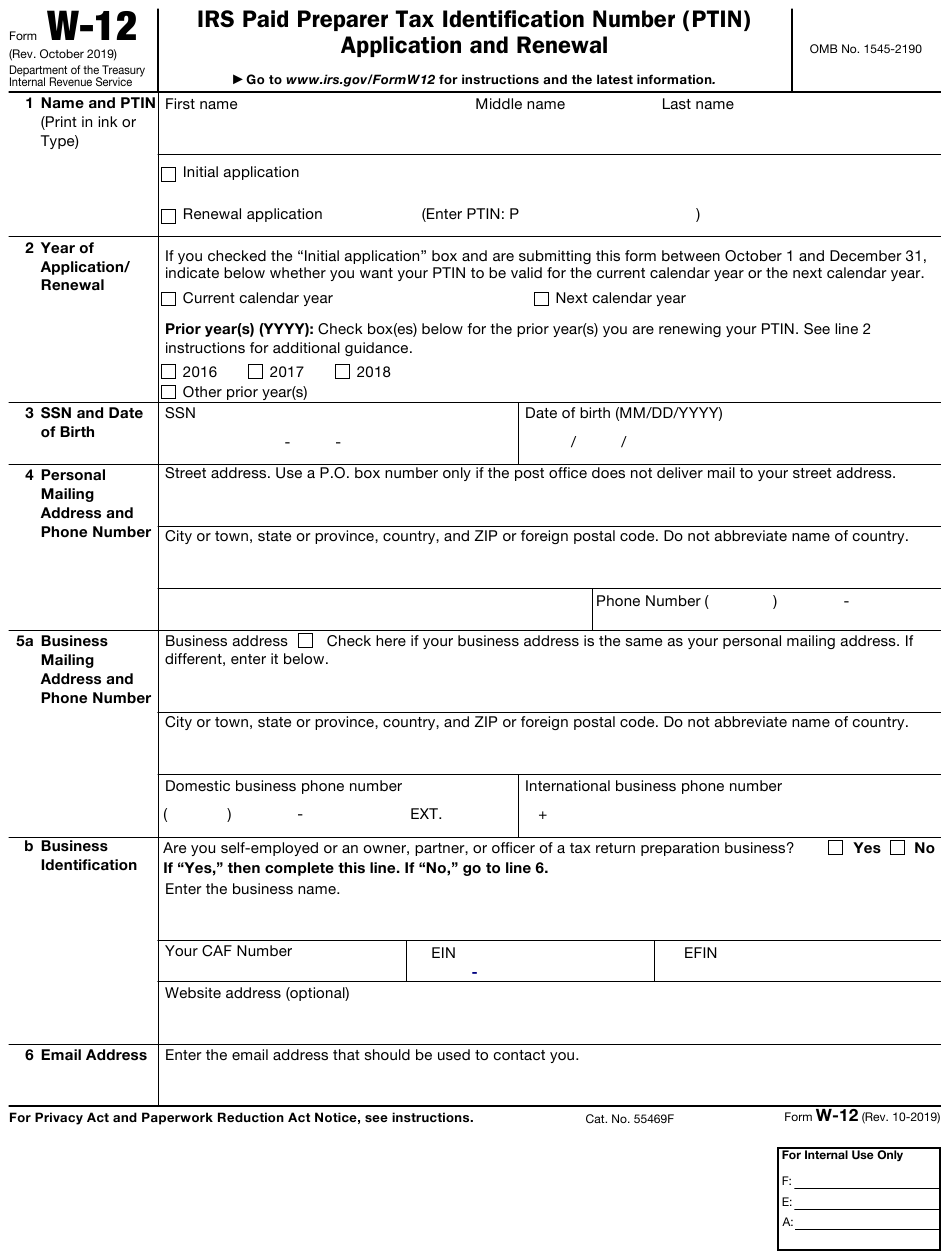

- A Preparer Taxpayer Identification Number, to identify accountants and firms involved with tax document preparation

Small businesses require a TIN, in the form of an Employer Identification Number, in order to issue payroll and make tax payments. To apply for an EIN, the IRS requires you to complete a Form SS-4.

A TIN is required on all tax documents, such as quarterly or estimated payments and annual filings.

Is A New Tax Id Number Needed When A Business Is Already Operating

Sometimes you need to replace your tax ID number.

- If you’ve lost your EIN as opposed to applying for a new one, you can call the Business & Specialty unit of the Internal Revenue Service at 800-829-4933 for help.

- If the structure of your business changes, you may need a new EIN.

- In the case of a bankruptcy filing, it’s best to get a new EIN.

What Is the Electronic Data Gathering, Analysis, and Retrieval system ?

If you’re searching for the EIN of a publicly traded company or a nonprofit organization, there are free directories that can help. You can search by business name, ZIP code, tax ID, and other data. You can try searching for just the first few letters of the business name because the name that the organization is commonly called may not be the legal name.

Try EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, for publicly traded companies. It’s maintained by the Securities and Exchange Commission . The EIN is also listed on 8-K, 10K, or 10-Q reports. If you’re looking for the EIN of a nonprofit organization, try Melissa Data, and search by ZIP code of the corporate office and not a local site.

If you must call the business to ask for the EIN, try the Accounting Department or Human Resources as they are the ones most likely to have that on file.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

Recommended Reading: Are There Grants For Seniors To Get Dental Implants