What Is Credit Score & Credit Report

The credit report is created using a borrowers credit history with detailed information of his/her prior borrowings and how loans/credit cards have been handled in the past. Apart from credit history, credit report also contains a list of banks/NBFCs that have made an enquiry for the consumers credit report.

The formula used for generating credit score is proprietary and it varies from one credit bureau to another, so the credit score of the same individual also varies from one CIC to another. Credit score is one of the key factors considered by lenders when approving a loan or credit card application. The closer an applicants score is to 900, greater are the chances of being approved for new credit cards and/or loans.

Ask The Experts: The Best Credit Reports In Life Are Free

Fortunately, its pretty easy to get a free credit report these days. But we could all stand to make some improvements in terms of how often we check and what we do with the information. So WalletHub convened a panel of personal finance experts for some tips and insights. Below, you can see who they are, what we asked them and how they recommend getting more from your free credit reports.

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

Also Check: Rtc Jobs Las Vegas

What Do Credit Scores Mean

Because there are so many credit scoring models in existence, you likely have multiple scores. If you pull your score from one site or product, it will likely be slightly different from one you find through another product.

So don’t get hung up on one particular score or even the exact number. Instead, pay attention to what range you fall in. Most websites and card issuers will offer some context behind the score in addition to the number.

That information will typically include where you stand and whether your score is poor, fair, good, very good or exceptional. You will also likely find information about why your score is what it is. Your score range can help you understand how lenders view your creditworthiness and what types of credit products you’re likely to be approved for.

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

Don’t Miss: Government Contractors Charleston Sc

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Read Also: Government Grant For Dental Implants

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.

If the information is wrong, you can try to fix it. If the information is right but not so good you can try to improve your credit history.

What Happens After A Debt Collector Contacts You

Within five days after a debt collector first contacts you, the collector must send you a written notice that tells you the name of the creditor, how much you owe, and what action to take if you believe you do not owe the money. If you owe the money or part of it, contact the creditor to arrange for payment. If you believe you do not owe the money, contact the creditor in writing and send a copy to the collection agency informing them with a letter not to contact you.

Don’t Miss: Free Touch Screen Government Phones Georgia

Order Your Free Credit Report

Consumers can get free copies of their credit report each year. The Fair Credit Reporting Act requires each of the three nationwide consumer reporting agencies Equifax, Experian, and TransUnion to provide you with a free copy of your credit report, at your request, once every 12 months.

At least once a year, review each one of your three credit reports to:

- ensure that the information is accurate and up-to-date before you apply for a loan, lease a car, get a credit card, buy insurance, or apply for a job.

- help guard against identity theft. If identity thieves use your information to open new account in your name, those unpaid accounts get reported on your credit.

To order your FREE reports:

How To Obtain Your Free Credit Reports

The three major credit reporting agencies in the U.S. teamed up to provide where you can order your free credit reports: www.annualcreditreport.com.

Once there, answer a series of questions to verify your identity, and select which reports to view. You can also call 877-322-8228 to request a copy of your credit reports by phone.

You May Like: Safelink Wireless Las Vegas

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

How Do I Build A Good Credit History

A credit reporting agency needs a track record of how youve managed credit before it can calculate a credit score. Typically, six months’ worth of activity will provide enough information to generate a score. Your score is dynamic and may rise or fall over time, based on how consistently and promptly you pay your bills. Establishing a good credit history takes time. Each creditor has different.requirements for issuing credit. If you are declined credit, contact the lender to determine the reasons why.

Also Check: Government Jobs Vegas

What Is A Credit Score

A credit score is a numeric figure that represents your credit risk at a particular point in time. The credit-reporting agencies, Equifax and TransUnion, use a scale from 300 to 900. The higher your score, the lower the risk for the lender, so it’s easier to get approved for a new loan.

Factors that influence your credit score include:

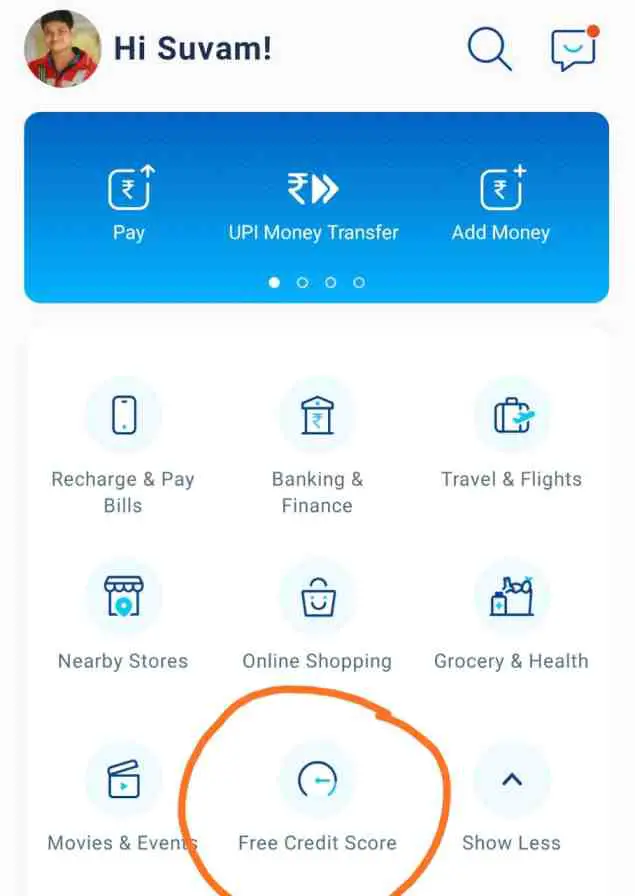

Taking Advantage Of Free Credit Scores

Note that free credit scores you receive online may differ from the credit scores lenders pull to review your application. Lenders usually use a credit score specific to their industry, while online consumer credit scores are generic and for educational purposes only. Lenders also may use credit scores from one or all three credit bureaus.

A credit score is a snapshot of your credit history at a specific point in time. Credit reports, which provide the information to generate your credit score, change frequently. Changes to your credit report since your last credit score pull can also explain why your credit score may be different.

A free credit score is a great way to stay on top of how your credit score is changing, but purchasing an industry FICO score will give you a better look at what a bank will see if you apply for a major credit card or loan.

Also Check: Dental Implant Grants For Low Income

How To Get A Free Annual Credit Report:

- Online: Visit AnnualCreditReport.com and click on Request Your Free Credit Reports, then fill out the request form, which will require your name, address, Social Security number, and date of birth. Then, choose which bureau you want a report from to view them online.

- : Call 1-877-322-8228 and press 1, then follow the prompts. You will need to provide the same information as the online method.

- : Print and fill out the Annual Credit Report Request Form. Then, mail it to Annual Credit Report Request Service / PO Box 105281 / Atlanta, GA 30348-5281.

If you get a report from AnnualCreditReport.com, its best not to check your Experian, Equifax and TransUnion reports all at the same time. Review one of them now, and save the others for later, spreading them out across the year. Pulling your reports in rotation will help you ensure that youre not missing anything for an extended period of time.

Just bear in mind that using only AnnualCreditReport.com would be a mistake, as it would normally blind you to credit-report changes for much of the year. Due to the COVID-19 pandemic, however, all three credit bureaus are offering free reports weekly on AnnualCreditReport.com through April 2021.

While WalletHub and AnnualCreditReport.com are the best options for getting a free credit report, there are plenty of other choices, too.

How Do You Check Your Credit Score

You can check your credit score from many sources, including Experian. Learning what your credit scores mean and what affects them can help you when you’re getting ready to apply for new credit.

Lenders use credit scores to decide how likely it is you will repay your debts on time. There are hundreds of credit scoring models in existence, though the FICO® Score is the most common. The higher your credit scores, the better offers you are likely to receive from lenders in the form of lower interest rates and other favorable terms.

Recommended Reading: Grants For Owner Operators

How To Check Your Credit Scores

There are a few ways to check your credit scores:

Check And Monitor Your Credit Reports And Credit Scores

Now that you know why your credit is so important, you can see why itâs a good idea to check and monitor your credit. But how do you do it?

How to Request Free Copies of Your Credit Reports

You can get a free copy of your credit report from each of the three major credit bureausâEquifax, Experian and TransUnionâby visiting AnnualCreditReport.com. Youâll need to provide your:

- Legal name.

- Social Security number.

- Current address.

If youâve moved in the past two years, you may need to include your previous address as well. There may be a limit on how often you can obtain your reportâcheck the site for details.

Once youâve provided the information above, youâll pick which credit reports you want before answering a few additional questions that help verify itâs really you. âThese questions are meant to be hard,â according to AnnualCreditReport.com. âYou may even need your records to answer them. They are used to ensure that nobody but you can get your credit information.â

How to Check Your Credit Scores for FreeâWithout Hurting Your Credit

Keep in mind that your credit scores donât actually appear on your credit reports. So what do you do if you want to check your scores?

Depending on your lender, you may be able to find your scores by checking your statement or by logging in to your account online. You can also get your scores directly from the credit bureaus and credit-scoring companiesâbut you might have to pay for them.

Related Content

Read Also: Federal Jobs Las Vegas

What Can Lower Your Credit Score

While checking your own credit score won’t change it, there are plenty of other things that can affect your credit score negatively. Here’s a quick breakdown of each factor that influences your FICO® Score:

Because there are so many variables that go into calculating your credit score, it’s impossible to determine exactly how much damage a negative item may cause to your score. But if you notice your credit score drop and are wondering why, look at these areas to find the likely reason.

No Impact On An Individual’s Credit History

PSPC’s inquiry is similar to that commonly done by private sector companies when screening employees. Credit checks conducted for the purpose of security screenings are masked, meaning there is no negative effect on an individual’s credit bureau file and a PSPC credit history request will not include the applicant’s credit score.

PSPC is committed to protecting the privacy of personal information.

The credit check results are kept confidential on the PSPC applicant’s security screening file. PSPC stores personnel information in accordance with the terms and conditions of the provision of the federal Directive on Privacy Practices.

An applicant’s credit history report information is never shared with the applicant’s company security officer or alternate. PSPC contacts the applicant directly whenever there is a need to validate financial information.

However, PSPC may share, through government approved secure means, an individual’s credit history report information with another Government of Canada department or agency in cases when an applicant’s reliability status or security clearance needs to be transferred.

You May Like: City Jobs Las Vegas Nevada