Federal Student Loan Benefits

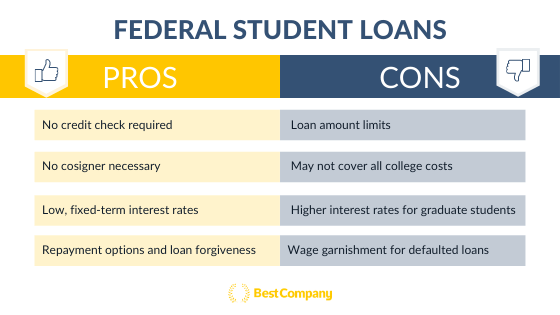

- You have flexibility. Though any student loanfederal or privateis a legal agreement and must be paid back with interest, federal student loans generally offer more flexible options than private student loans. For example, with federal student loans, the borrower can change their repayment options even after the loan has been disbursed .

- You can make payments based on your salary. Some federal student loans allow for income-driven repayment plans, which cap payments based on the borrowers income and family size.

- You dont need a strong credit history to get federal student loans. Unlike with private student loans, most federal student loans dont require the borrower to have a strong credit history. This can be especially helpful for recent high school graduates who plan on attending college but havent had enough time to build up credit of their own.

- You dont need a cosigner. With most federal student loans, other than Direct PLUS Loans, the borrowers credit is not considered, so its not necessary to apply with a cosigner.

If You’re A Muslim Student

Muslim students in England are set to be able to get alternative student finance acceptable under sharia, although there is no news on when this will be made available. We’ll update the guide as soon as we know more.

Had lessons online as a result of coronavirus? We’ve had lots of people asking whether they can get a partial refund of their tuition fees if their courses are have been carried out online . Unfortunately, you shouldn’t hold out too much hope of getting a refund, but Martin has done a 10-minute explainer video which hopefully can help.

How Much Money Does The Fafsa Give You

The amount of financial aid you may receive from the FAFSA is highly dependent on you and your parents’ financial situation. Grants, work-study programs, and student loan amounts all vary based on the school you are attending and the information you submit in the FAFSA.

Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site.

If you are applying for colleges or are already in school, then you probably know that you need to fill out the Free Application for Federal Student Aid .

Its the gateway to all federal financial aid, including grants and federal student loans. By filling it out, colleges know what your financial situation is and can create a financial aid package that helps cover the costs of college.

Your financial need is determined by several factors, including the information you enter into the application about your financial situation and that of your parents if youre a dependent student.

Its important to be accurate because those numbers determine how much you can get from the FAFSA.

Read Also: Grants For Homeschooling Parents

What Does The Shutdown Mean For Current Students

Students who took out Federal Direct student loans for the 2019 spring semester are in the clear, as their loan amount will be honored.

FAFSA submissions will also still be processed and reviewed, but students who need to include a tax transcript or register for selective service prior to applying might hit a bump in the road with a large portion of IRS employees furloughed.

The Department of Education was already funded through separate legislation, so operations should continue for now, and the agency will be able to answer any questions.

If you are an Earnest client and experiencing a financial hardship as a result of the government shutdown, please reach out to our Client Happiness Team.

This article was written by Carolyn Pairitz Morris, Senior Editor at Earnest.

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

Read Also: Rtc Bus Driver Salary Las Vegas

How Much Can I Borrow

There are limits on the amount of subsidized and unsubsidized loans that you may receive each academic year as well as limits on the total amount you may receive for undergraduate and graduate study .

The amount you can borrow may vary depending on what year you are in school and whether you are a dependent or independent student. For example, dependent undergraduate students may borrow up to $3,500 per year in Direct Subsidized Loans and $2,000 per year in Direct Unsubsidized Loans, for an annual limit of $5,500.

Parents and graduate students who are eligible for PLUS loans can borrow an amount up to the cost of attendance at the school the student attends minus any other financial aid the student receives.

If you are a dependent student whose parents are ineligible for a Direct PLUS Loan, you may be able to borrow more than the limit on Direct Unsubsidized Loans. Check with your colleges financial aid office for more information.

Why Consider A Federal Student Loan

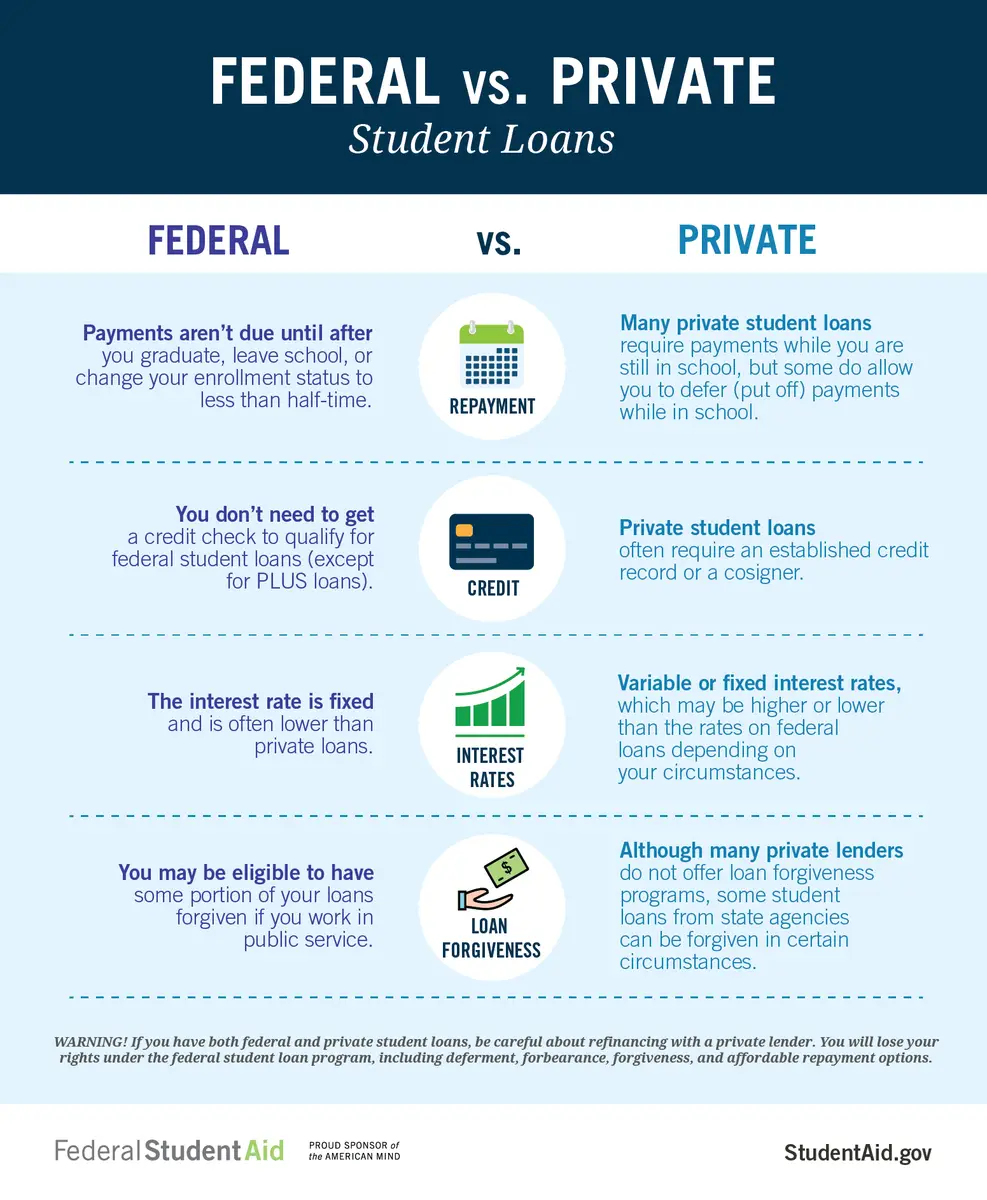

College loans provided by the U.S. Department of Educations federal student loan program, known as the William D. Ford Federal Direct Loan Program, generally have lower interest rates and more flexible repayment terms than private loans.

If you demonstrate financial need, you may qualify for a Direct subsidized loan. The advantage of subsidized loans is that the government pays the interest on the loan while you are in college. If you are unable to demonstrate financial need, you may still be eligible for an unsubsidized federal student loan. With a Direct unsubsidized loan, you are responsible for paying the interest even while youre in school.

Read Also: City Of Las Vegas Government Jobs

Reasons Why It Probably Wont Happen

The biggest hurdle to eliminating student debt is the high cost of college tuition.

If the student loans are forgiven, many future college students may think that their student loans will also be forgiven eventually. This could lead to some irresponsible borrowing and further escalate the runaway cost of college. For a blank slate on student debt, fixing the high cost of college will have to come first or at the same time.

Many lenders make a great deal of money on student loans. Many corporations that run for-profit colleges make a ton of money on student loans. Schools continue to operate because of student loans. These stakeholders have deep pockets and the financial ability to influence Congress. They will likely be against sweeping changes to higher education.

Similarly, many of the student loan refinance companies would be opposed to student loan forgiveness especially if only federal loans are forgiven.

These companies make money by targeting federal borrowers who are likely to repay their debt. Even though the federal government treats borrowers the same regardless of credit score, the refinance companies do not. They can offer lower interest rates to the low-risk customers to steal the governments top borrowers and make a profit. This is the reason why refinance interest rates are usually several percent less than federal loan interest rates.

Recent Student Loan Forgiveness Developments

The U.S. Department of Education and the Justice Department are reviewing whether the President has the legal authority to cancel up to $50,000 in federal student loan debt through executive action. There is no timetable on when these reports will be issued. There may be delays because Congress has not yet confirmed key policy advisors in both departments.

The White Houses Domestic Policy Council will consider how student loan forgiveness should be targeted, regardless of whether it is implemented through executive action or legislation.

Borrowers should beware of student loan scams that promise debt forgiveness, in exchange for a fee. When student loan forgiveness is implemented, it will most likely be automatic and free. The U.S. Department of Education will publish an update on the StudentAid.gov web site.

The U.S. Department of Education has recently taken a few steps toward providing student debt relief for which they have clear legal authority:

Recommended Reading: Government Jobs In Las Vegas Nevada

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Can The United States Afford To Forgive All Student Loans

Plenty of people will say the answer is a definite no, but it could be done.

As one Ocasio-Cortez tweet notes, it is a question of priority and we could afford the comparatively more expensive tax cuts.

Cost of the GOP Tax Scam for the rich:~$1.8-2.3 Trillion

Cost of forgiving all student loans in America:~$1.5 Trillion

Clearly where theres a will, theres a way.

When people say that there isnt enough to do these things, what they mean is they dont *want* to do them.

Alexandria Ocasio-Cortez

The true cost of student loan forgiveness is hard to determine.

A key part of the motivation behind the move would be the boost that it would provide the US economy. Like the tax cuts, the idea is that by putting more money in the pockets of many Americans, they have more money to spend and the economy grows. The growth results in more tax income for the federal government.

During the most recent round of tax cuts, many Republicans argued that they would pay for themselves. Many economists disagreed. It will be years before we can put a true cost to the cuts.

Similarly, we wouldnt even know the true cost of student loan forgiveness until long after it happened. Even then, it would be hard to say how much it cost and how much it helped.

Don’t Miss: City Of Las Vegas Government Jobs

What Is A Government Shutdown

As you might have guessed, this means that the federal government is no longer operating at full capacity. As of December 22nd, 2018, the funding of several agencies ended, and a new budget has yet to be approved.

This means we are in a partial shutdown, as some agencies remain open. Until the budget is approved, the unfunded agencies will not be able to pay employees and might be operating with a limited staff, or not operating at all. The earnings of contractors for government agencies could also be affected.

How Does The Shutdown Affect Borrowers

You dont have to be a government employee to feel the effects of the shutdown. A large section of the IRS workforce has been furloughed, meaning we might go into tax season with a short-staffed IRS.

The IRS will continue to accept returns and tax payments, and has announced it will bring back staff to issue refunds despite the shutdown. Still, those who rely on a tax refund should review their budget and start to make a plan in case refunds are delayed.

Federal student loan borrowers who are applying for, or re-certifying for, income-driven repayment plans will need to provide income tax information as well. The automated tool that transfers income information from the IRS to the Department of Education is operational at this time, but you can always use alternative documentation such as a pay stub or letter from your employer if there was an issue in the future.

Are you applying for a new job? You might see a delay in the hiring process, as the E-Verify service by the Department of Homeland Security is no longer available due to the lapse in federal funding.

Recommended Reading: Government Grants To Start Trucking Business

Read The Agreement Carefully

This is one of the most important aspects to look after while taking the loan. We always suggest you go through the terms and conditions of the loan carefully and then move ahead with it. This is one factor we really stress upon, as you should always be clear with all the conditions mentioned in the loan agreement. If you have any doubts regarding anything then always consult the experts apart from the bank representative.

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn about COVID emergency relief for federal student loans that has been extended through September 30, 2021.

Recommended Reading: Government Jobs For History Majors

Types Of Federal Student Loans

There are three types of federal student loans:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans, of which there are two types: Grad PLUS Loans for graduate and professional students, as well as loans that can be issued to a student’s parents, also known as .

These loans are available through the Federal Direct Loan Program. Since federal loans offer different benefits than private student loans, you should always explore them first.

Learn more about the three types of federal student loans:

Student Loans: The Government Is Now Officially In The Banking Business

Ellen Brown is an attorney, Founder of the Public Banking Institute, and author of twelve books including the best-selling Web of Debt.

“We say in our platform that we believe that the right to coin money and issue money is a function of government… Those who are opposed to this proposition tell us that the issue of paper money is a function of the bank and that the government ought to go out of the banking business. I stand with Jefferson… and tell them, as he did, that the issue of money is a function of the government and that the banks should go out of the governing business.” — William Jennings Bryan, Democratic Convention, 1896

William Jennings Bryan would have been pleased. The government is now officially in the banking business. On , President Obama signed the reconciliation “fix” to the health care reform bill passed by Congress last week. Slipped into it was student loan legislation the President calls “one of the most significant investments in higher education since the G.I. Bill.” Under the Student Aid and Fiscal Responsibility Act , the federal government will lend directly to students, ending billions of dollars in wasteful subsidies to firms providing student loans. The bill will save an estimated $68 billion over 11 years.

A Failed Experiment in Corporate Socialism

The answer is no – not if the program is set up properly. In fact, it could be a significant source of income for the government.

Taking Back the Credit Power

Don’t Miss: Goverment Jobs In Las Vegas

Things To Remember While Taking An Education Loan For Abroad Studies

- Moratorium period: This is the time period during which the borrower need not make any repayment to the bank. This period varies from bank to bank and could last up to sometime after completion of the course.

- Loan Margin: Usually, banks do not provide the complete amount i.e. 100 percent money needed to fund the education. The majority of the public sector banks issue 90% of the total amount, the remaining 10% has to be arranged by the aspirant himself.

- Effect of Exchange Rate: Always calculate the amount which you will be receiving at the time of disbursement, as any change in the exchange rate can affect the amount you will be receiving.

How Much You Need To Repay

Verify your loan or line of credit contract to figure out the following:

- the total amount you owe

- the interest rate that will be applied to your debt

- how youll repay your debt

- how much youll pay

- how long it will take to pay back your debt

Contact the organization that provided your student loan or line of credit if you dont have the information listed above.

Recommended Reading: City Of Las Vegas Government Jobs

Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

Policy Goals For Helping Current Borrowers

Overall, the purpose of any policy proposal for current student loan borrowers has to be about reducing the negative effects of these debts. That said, each policy idea may attempt to address a different negative effect. For example, policies focused on interest rates target negative effects related to the size of monthly payments, which can help with faster repayment over time. Meanwhile, policies focused on immediate forgiveness are about reduction in the amount owed right away, while those with longer-term forgiveness may be about creating a safety net for those with perpetual struggles.

Regardless of which problem a given policy tries to solve, it is important that it consider four factors: equity, simplicity, striving for broad impact, and providing a sense of meaningful relief. Understanding how a given policy idea lines up against each of these goals can help policymakers ensure they optimize their solutions for the problems they want to address and in a manner that would be effective. More on each of these goals follows below.

Address equity

While the various challenges student loans present may be clear for certain individuals who are in different situations and financial circumstances, meaningful variations exist even for borrowers who otherwise have the same levels of educational attainment and/or income. This can be due to other factors such as the presence or absence of familial wealth or discrimination in housing or employment.

Ensure simplicity

Read Also: City Of Las Vegas Government Jobs