Getting Free Credit Reports Under The Fcra

The three major credit bureaus have set up a central website and a mailing address where you can order your free annual report.

You may get your free reports at the same time or one at a time – the law allows you to order one free copy of your report from each of the credit bureaus every 12 months.

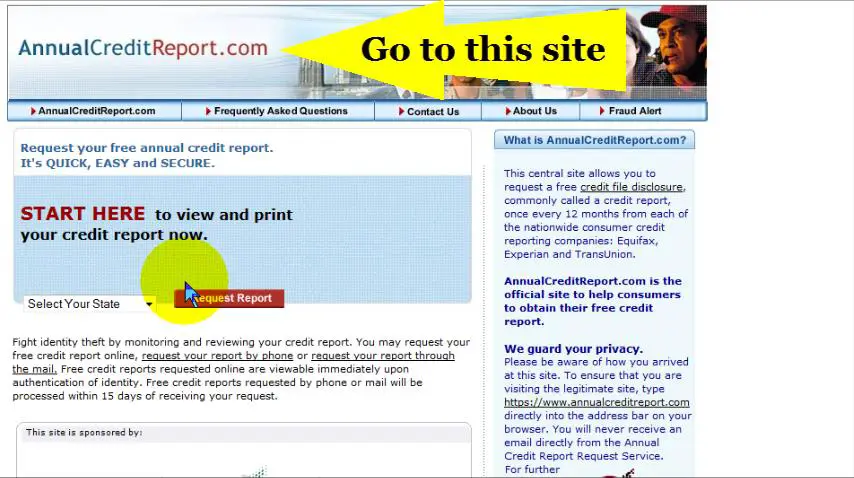

To get your free reports, visit AnnualCreditReport.com. You can also complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281.

Free Annual Credit Report

Review your credit report often to make sure the information is accurate. If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.

Contacting The Credit Agencies Directly

If you prefer, you can call the major credit agencies directly and request a credit report at no charge. However, the FCRA-mandated Annual Free Credit Reports are only available through the website and phone number above. In other words, you might have to pay if you contact a directly.

The only way to get your annual free credit report is to use AnnualCreditReport.com or the phone number above. If you go any other route, you may have to pay or subscribe to a private service.

If you need additional credit reports , numerous companies try to sell subscription services or paid reports. That said, you might not need those services.

Contact the credit bureaus:

Don’t Miss: Grants For Dental Implants For Seniors

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Don’t Miss: Middle Class Mortgage Stimulus Program

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

You May Like: Highest Paying Jobs For History Majors

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free credit report if

- you get a notice saying that your application for credit, employment, insurance, or other benefit has been denied or another unfavorable action has been taken against you, based on information in your credit report. Thats known as an adverse action notice. You must ask for your report within 60 days of getting the notice. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

If you fall into one of these categories, contact a credit bureau by using the below.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Also Check: Government Jobs In Las Vegas Area

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Recommended Reading: Free Budget Phone

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Read Also: Good Jobs For History Majors

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Check Your Credit Reports Regularly For Free

Accounts listed on your credit report that you do not recognize may indicate that you have become a victim of identity theft. The next section contains specific information related to credit reports, credit scores and identity theft.

What is a Credit Report and How is it Used?A credit report contains detailed information about a person’s credit history, including credit accounts and loans, bankruptcies and late payments and recent inquiries. Credit reports are compiled by three major companies known as credit reporting agencies.

Typically, when a consumer applies for credit, the prospective lender obtains the applicant’s credit report to help determine creditworthiness. The information in a credit report is one of several factors that help lenders determine whether to offer credit, and on what terms, such as interest rate, annual percentage rate, grace period and other contractual obligations of the credit card or loan. This information is also used to generate a credit score, which is explained in greater detail below.

Requesting FREE Credit ReportsConsumers are entitled to one free credit report every twelve months from each of the three major credit reporting agencies. The official website from which consumers can request their free annual credit report is www.annualcreditreport.com.

Read Also: Best Entry Level Government Jobs

Brochures On Identity Theft

A brochure from the Federal Trade Commission entitled Stop Think and Click highlights seven practices for safe computing. The brochure also focuses on a web site called onguardonline.gov, which provides practical tips from the federal government and the technology industry to help you be on guard against internet fraud. Here are links to the top five web sites consumers can use to fight identity theft.

How To Get A Free Annual Credit Report From The Government

The Fair Credit Reporting Act entitles all Americans to a free credit report every 12 months. You can make this request via the official government-run website. The credit report contains information from the three major US credit reporting bureaus

This will take you to a page outlining the three-step process required to request your credit report.

This begins the three-step process.

Recommended Reading: What Is The Mortgage Stimulus Program For The Middle Class

Why Are Your Credit Score And Report So Important

Your credit report is like your financial report card, and your credit score is like your final grade. In Canada, banks and lenders review your credit when you apply for financial products. Your credit report can also be pulled by car dealerships, insurers, cell phone companies, landlords, and future employers to determine your ability to manage debt and meet financial obligations. Because of this, it’s important to know your credit.

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

Also Check: Peachtree City Job Seekers

Review And Download Your Reports For Each Credit Bureau

The final two steps will be repeated for each credit bureau from which you’ve requested a credit report. At the end of each bureau’s steps, you will have the option to download a PDF of your credit report. I recommend either printing a hard copy or encrypting the downloaded file to prevent cyber-thieves from gaining access to this sensitive information.During the verification process, you will be asked questions about past loans, credit lines, etc. in order to verify your identity.

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Read Also: Missouri State Jobs In Kansas City

Order Your Free Credit Report

Consumers can get free copies of their credit report each year. The Fair Credit Reporting Act requires each of the three nationwide consumer reporting agencies Equifax, Experian, and TransUnion to provide you with a free copy of your credit report, at your request, once every 12 months.

At least once a year, review each one of your three credit reports to:

- ensure that the information is accurate and up-to-date before you apply for a loan, lease a car, get a credit card, buy insurance, or apply for a job.

- help guard against identity theft. If identity thieves use your information to open new account in your name, those unpaid accounts get reported on your credit.

To order your FREE reports:

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

You May Like: Congress Middle Class Mortgage Relief

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

You May Like: Government Jobs Vegas