Annuities Are They Insured By The Fdic

Shawn Plummer

CEO, The Annuity Expert

The FDIC is an independent agency of the United States government that protects depositors against loss in case of financial institution failure. One question you may be asking yourself is if annuities are insured by the FDIC. They are not, but there are other ways to protect your assets and make sure they stay safe should something happen to your company or bank.

Protections Can Vary By Annuity Type

Annuities come in all shapes and sizes. Fixed annuities pay out a defined percentage agreed upon in the contract. Conversely, the returns of variable annuities come on the basis of the performance of investments. A customer can also choose whether they receive payouts immediately after delivering a lump sum or defer their payments until a later date . As a result, protections may vary depending on the type of annuity a customer owns.

Its important to contact your states guaranty association to determine how exposed you may be in this situation. The National Organization of Life and Health Insurance Guaranty Associations lists contact information for every individual state organization on its website.

While federal protections that bank deposits enjoy do not extend to annuities, the Securities Investor Protection Corporation does protect variable annuities purchased through private brokerage firms. SIPC, a federally-mandated nonprofit organization, will cover up to $250,000 in variable annuities in the event the brokerage firm that sold the contract becomes insolvent. However, the SIPC does not protect fixed annuities or any loss in value that a variable annuity experiences as a result of its underlying investments.

What Is Fdic Insurance

The FDIC is a government agency that insures deposits made to banks and savings associations. It was established in 1933 as a response to the banking crisis of the Great Depression. The FDIC protects customers deposits of up to $250,000 per depositor per bank.

The FDIC insures deposits in the form of checking and savings accounts, CDs, money market accounts and certain other accounts. It does not insure investments made in stocks, bonds, mutual funds or other securities.

Don’t Miss: How To Do A Government Resume

What Is A Federal Annuity

A federal annuity, also known as a FERS annuity, is a retirement plan the government offers. It is a form of insurance, and it is designed to provide you with payments after you retire. The annuity is funded by your contributions, as well as the contributions of your employer. When you retire, you will begin to receive payments from the annuity, which will continue for the rest of your life.

Who Decides Exactly What I Invest In

You choose the investment options in which you will invest from among those offered in your contract. The insurance company issuing the annuity develops relationships with one or more professional money managers, who decide which specific stocks and bonds will be a part of each investment option. Most variable annuities offer you several different money management firms and multiple investment options within one alternative.

Recommended Reading: Government Assistance For Family Caregivers

What Happens When A Life Insurance Company Fails

Failures and bankruptcies are uncommon. According to the National Organization of Life and Health Insurance Guaranty Associations , no life insurance companies have filed for bankruptcy since the 2008 financial crisis.

But if a failure or bankruptcy does occur, then safeguards are in place to protect consumers. These include:

- Statutory reserves

- Guaranty association membership

Life insurance companies are required by state law to maintain capital reserves to pay out policyholder death benefits in the event that the business fails. The amount thats required to be held back can vary from state to state, but these reserves, along with other company assets, can be used to fulfill claims if the company goes bankrupt.

Reinsurance is another strategy that allows insurance companies to mitigate the risk of potential losses if a business failure occurs. Essentially, life insurance companies purchase insurance policies from other insurers, which allows them to spread out risk. So if one company goes under, for example, then the other companies can take up the reins to ensure that any claims or death benefits are paid.

Guaranty associations, such as the NOLHGA, are another form of protection against losses. If a member life insurance company goes out of business, then the membership association can step in and guarantee payment of benefits. The amount that the association will pay may be capped at certain limits, depending on state law, and membership is typically mandatory.

Are All Bank Accounts Insured By The Fdic

When you open a bank account, you expect the money you deposit to be safe. However, these accounts don’t work as a personal vault, which means your money doesn’t just sit around waiting for you to make a withdrawal when you need access to it. Banks usually keep a certain amount of cash on hand but the majority is loaned out to others.

When banks can’t keep up with the demand for withdrawals, they may have to turn people away. When more want their money and can’t get it, they end up losing confidence, resulting in panic. This, in turn, can trigger a domino effect, leading to a failure in the banking system, which the United States experienced during the Great Depression.

In order to keep public confidence, the federal government created the Federal Deposit Insurance Corporation in 1933. This short article outlines the basics of FDIC insurance, along with what’s covered and what isn’t covered.

Also Check: Government Grants For Green Technology

What Should I Do If I Have A Complaint

If you have a problem or a concern with a deposit or investment, try to resolve your complaint directly with an officer of the bank or firm before involving an outside agency. If you are unable to resolve the matter with the financial institution, use the following guidelines to determine where to direct your complaint.

- If your complaint is against a salesperson who represents a third-party investment firm

A Plan For Your Future

If youre seeking to secure your financial future beyond your working years, you have many options for saving and investing your money. But when it comes to long-term planning, certain investments let you save on a tax-deferred basis.

Combine tax deferral with the long-term growth potential inherent in stock and bond investments and you have an alternative that can help you build the retirement assets youll need a variable annuity.

Variable annuities offer a remarkable combination of tax-advantaged growth opportunities and protection including:

- Tax deferral. You pay no current income tax on earnings or other taxable amounts until you make a withdrawal. At that time, its important to be aware that withdrawals of taxable amounts are subject to income tax and, if taken prior to age 59 ½, a 10% federal tax penalty may apply.1

- Potential for long-term growth of your money. Youre able to invest in professionally managed investment portfolios.

- Valuable guarantees. These include protection for beneficiaries and choices for income you cannot outlive.

The questions and answers that follow will help you understand more about the valuable role variable annuities can play in your retirement planning.

You May Like: Free Government Phone New Hampshire

Are Annuities Really Guaranteed

Annuities, like most financial instruments, are not without risk. Annuity payouts are based on the annuitant’s life expectancy. Because we have no way of knowing how long any individual will live, buying an annuity means accepting the risk that you won’t necessarily reap all the potential benefits from your purchase.

Federal Regulation Of Variable Annuities: Sec And Finra

Unlike fixed annuities, variable annuities are considered securities and are regulated by the SEC and FINRA. Variable annuities principal is placed in investment portfolios. The performance of the investments in the portfolios dictates the interest rates.

According to the SEC, indexed annuities, which have payout rates linked to the performance of an index such as the S& P 500, may or may not be securities. But most of them are not registered with the SEC.

Sales of variable annuities are a leading source of investor complaints to FINRA. The authority attributes the volume of complaints about variable annuities to their complexity and the confusion surrounding them, which can lead to what regulators deem questionable sales practices.

A FINRA rule governing variable annuities establishes standards for people who sell these products. Before recommending them, the representative must make reasonable efforts to determine the customers age, annual income, investment experience, investment objectives, investment time horizon, existing assets, and risk tolerance. In addition, the representative must have a reasonable basis to believe the customer would benefit from the annuity.

The SEC recommends that if you have a complaint about sales practices related to variable annuities, contact the FINRA District Office near where you live. The organization provides a list of FINRA District Offices on its website.

Read Also: What Is A Data Governance Model

What Products Are Not Insured

There are a number of non-deposit investment products that are not insured by the FDIC, even if they were purchased from an insured bank. These include:

- Stock investments

- Safe deposit boxes or their contents

- U.S. Treasury bills, bonds or notes*

*These investments are backed by the full faith and credit of the U.S. government.

These products may be offered to you in a financial institution’s lobby, through the mail, over the phone, or online. The value of stocks, bonds, and other securities fluctuates with market conditions no one can guarantee that youll make money from your investments, and they may lose value. Each consumer should take into consideration their own financial goals, risk tolerance, and other factors when making the decision to purchase or invest in a non-deposit product.

Most often, the people selling these products are not employees or your bank, but employees of third-party securities broker/dealers or insurance companies. Whether they are making a presentation, providing you with investment advice concerning a non-deposit product, or opening an investment account for you, these sales representatives must make certain disclosures to you orally and/or in writing so you know for certain whether the product is covered by FDIC insurance. Keep an eye out for statements like:

Model Law For Disclosure

The NAIC Annuity Disclosure Model Regulation requires the disclosure of certain information about annuity contracts. This is designed to protect consumers and encourage education of the public. In general, states require annuity contracts and forms to be filed and approved by the insurance commissioner or by the Interstate Insurance Product Regulation Commission to which more than 40 states belong.

In addition to regulating annuities, each state has a guaranty association that insures annuities and other insurance products in the event the issuing insurance company becomes insolvent. Each states guaranty association has its own limits, but all of them insure at least $100,000 per customer, per company.

You May Like: Enterprise Health Information Management And Data Governance

How Do You Find A Good Life Insurance Company

Finding the right life insurance company can go a long way toward minimizing your need for these protections. That means finding a licensed insurer thats financially healthy and is able to pay out claims or death benefits for the foreseeable future.

There are some useful tools that you can use to find the best life insurance companies. The first is AM Best, a company that issues ratings for life insurance, annuities, and other financial products. AM Best ratings are assigned using a letter grade, similar to how a report card works. A rating of A+ or A++, for example, means that the companys financial health is superior, while a D rating indicates that an insurer may not be equipped to pay out claims if it comes under financial strain.

You can also review other industry ratings, such as those issued by S& P Global or Moodys, to get a better sense of a life insurance companys financial strengths and weaknesses. Beyond that, you can take a closer look at the companys financials by viewing its annual report or quarterly earnings report if those are made public. These reports can tell you a companys cumulative assets and liabilities, how much its earning, and what its turning in profits.

From there, you can also look at online reviews from established websites, consumer reviews, and Better Business Bureau ratings. Together, these tools can help you narrow down the list of life insurance companies that youre interested in doing business with.

Relative Levels Of Safety Vs Risk

Lets face it: when it comes to absolute safety of money, having the United States Government backing your money is unquestionably the safest place for it at this time on planet earth. It is also well-known that it is almost **guaranteed to grow at minimal rates and likely not keep pace with rising costs or the effects of true inflation. Government backed financial vehicles include FDIC insured banking instruments such as CDs, savings, money markets, checking, etc it also includes Treasury Notes, TIPs, T-Bills, Series E & I bonds, etc..The second safest place in the world to keep your money is likely to be highly regulated insurance companies offering annuities and life insurance. Please note that the emphasis here is on fixed and not variable annuities# or variable life products which place the insured client at risk for principal instead of the insurer assuming the risk.

These are the views of AnnuityGuys.com, which does not give tax or legal advice. All information is believed to be from reliable sources however, we make no representation as to its completeness or accuracy. The publisher is not engaged in rendering legal, accounting or other professional services. If other expert assistance is needed, the reader/site visitor is advised to engage the services of a competent planner/educator/professional. Please consult a financial advisor for further information.

Don’t Miss: Government Programs To Help Low Income Families

What Kinds Of Annuities Are There

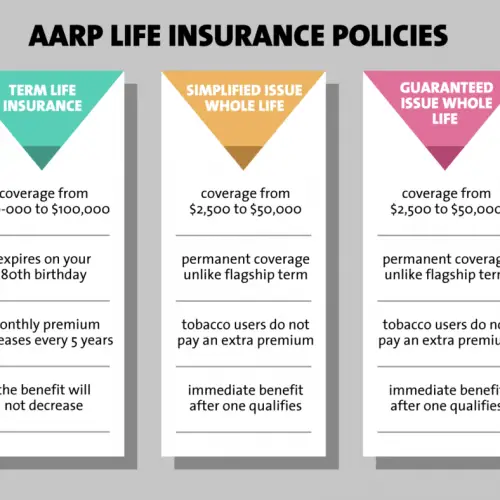

There are three basic types of annuities, fixed, variable and indexed. Here is how they work:

- Fixed annuity. The insurance company promises you a minimum rate of interest and a fixed amount of periodic payments. Fixed annuities are regulated by state insurance commissioners. Please check with your state insurance commission about the risks and benefits of fixed annuities and to confirm that your insurance broker is registered to sell insurance in your state.

- Variable annuity. The insurance company allows you to direct your annuity payments to different investment options, usually mutual funds. Your payout will vary depending on how much you put in, the rate of return on your investments, and expenses. The SEC regulates variable annuities.

- Indexed annuity. This annuity combines features of securities and insurance products. The insurance company credits you with a return that is based on a stock market index, such as the Standard & Poors 500 Index. Indexed annuities are regulated by state insurance commissioners.

When You Need The Most Growth Potential

With a variable annuity, the contract value fluctuates based on the ups and downs the market may experience. This is in contrast to a fixed annuity, which provides a guaranteed interest rate, regardless of what may happen in the market.

When you purchase a variable annuity, you can choose from a selection of investments called subaccounts, which include stocks, bonds and money markets. Your financial professional can tell you more about how subaccounts work. You can also tailor your contract to meet more of your needs by optional riders at an additional cost.

Recommended Reading: Government Contract Jobs Charleston Sc

What Is The Difference In Taxation For Taxable And Tax

When you invest in a currently taxable investment, like a mutual fund, any dividends or interest you earn during the year are taxable, even if you reinvest the dividends. Mutual funds can earn money for an investor in several ways, which can be taxed at different rates. Capital gains may be taxed at a capital gains tax rate that is lower than the income tax rate dividends and interest are generally taxed at income tax rates.

Many investors may not realize that if you sell an investment that has had any gains, or if the mutual fund money manager sells a security that results in a distribution to you, you may owe capital gains taxes.

Variable annuities are insurance alternatives whose gains accumulate tax-deferred and are taxed as ordinary income when withdrawn. When you invest in a variable annuity, any growth is credited to your account but is not taxed until you take distributions, at or near retirement.

In a variable annuity, when you make a withdrawal, youll owe income taxes at your then current tax rate on any portion of the withdrawal that is considered earnings. For tax purposes, interest is always considered to be withdrawn first, so unless you begin to exhaust principal, you may owe taxes on the full amount of your withdrawal. In addition, because the IRS set up tax-deferral rules in order to encourage Americans to save for retirement, if you make a withdrawal before age 59 1/2, youre likely to owe a 10% federal tax penalty on the amount withdrawn.

Updates To Suitability Standard

The NAICs Suitability in Annuity Transactions Model Regulation governs when a sales representative can recommend purchasing an annuity. The regulation, according to the association, is designed to ensure the insurance needs and financial objectives of consumers are appropriately met at the time of the transaction.

The NAIC began work on updating the suitability regulation following the demise of a federal rule that would have applied stricter standards to professionals who sell and recommend annuities. That U.S. Labor Department rule, known as the fiduciary rule, would have required such professionals to act as fiduciaries to their customers. In other words, it would have required them to put their customers interests before their own.

The rule was overturned by the courts before it was enacted, prompting the Securities and Exchange Commission and state regulators to examine other ways to impose stricter standards on annuity transactions.

The result of the NAICs Annuity Suitability Working Group was an update to ensure that any recommendations made to consumers by agents were in the best interest of the consumer. Agents also could not put their own financial interests ahead of that of the consumer when making a recommendation to them.

According to the NAIC, 27 states had adopted these model revisions as of 2022.

Read Also: Government Free Money For Seniors